UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

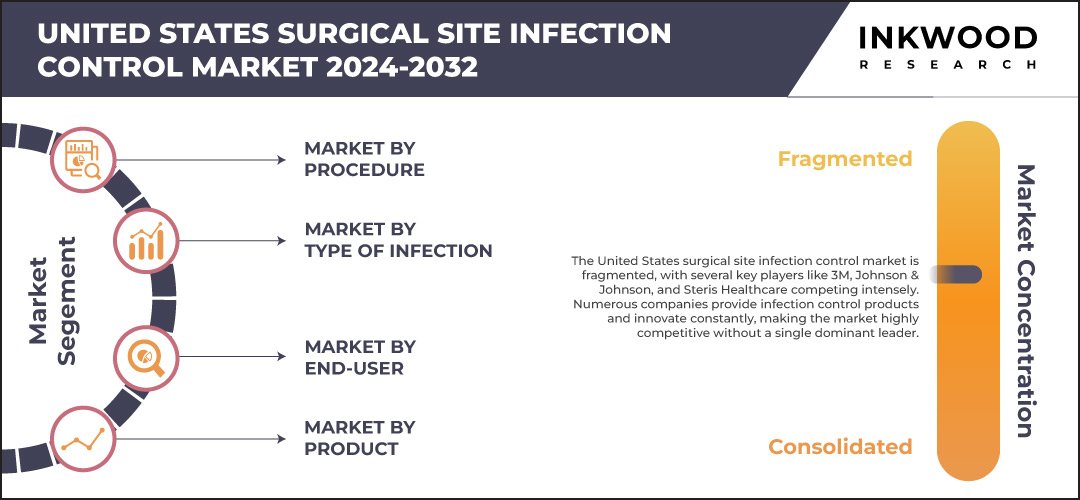

United States Surgical Site Infection Control Market by Procedure (Laparoscopy, Orthopedic Surgery, Cardiovascular, Obstetrics and Gynecology, Wound Closure, Plastic & Reconstructive Surgery, Thoracic Surgery, Microvascular, Urology, Neurosurgery, Other Procedures) Market by Type of Infection (Superficial Incisional SSI, Deep Incisional SSI, Organ or Space SSI) Market by End-user (Hospitals, Ambulatory Surgical Centers) Market by Product (Disinfectants, Manual Reprocessors Solutions, Surgical Drapes, Surgical Gloves, Skin Preparation Solutions, Surgical Irrigation, Surgical Scrubs, Hair Clippers, Medical Nonwovens, Other Products)

REPORTS » HEALTHCARE » MEDICAL DEVICES » UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET FORECAST 2024-2032

MARKET OVERVIEW

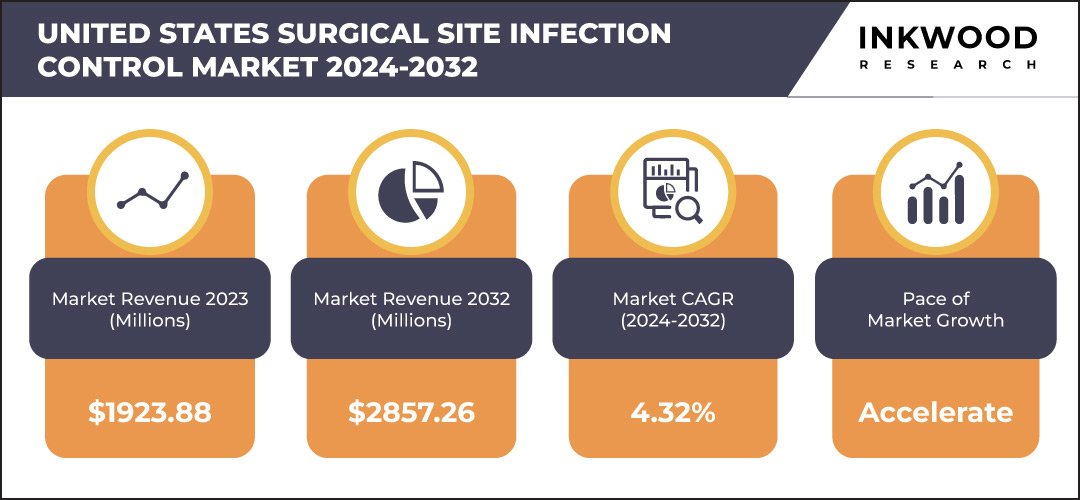

The United States surgical site infection control market is forecasted to grow with a CAGR of 4.32% during the projection period of 2024-2032. The United States surgical site infection (SSI) control market is a critical component of the broader infection control industry, driven by the high prevalence of surgical procedures and the increasing emphasis on patient safety. Surgical site infections are a major cause of morbidity, prolonged hospital stays, and healthcare costs, making their prevention a top priority for healthcare providers.

In the United States, SSIs account for a significant percentage of hospital-acquired infections, prompting the adoption of rigorous infection control protocols. The market encompasses a wide range of products and services, including antiseptics, wound dressings, surgical drapes, sutures, and advanced technologies like antimicrobial-coated devices. Leading players in the market, such as Johnson & Johnson, Kimberly-Clark, Steris Corporation, and others, are focused on developing innovative solutions to minimize SSI risks and enhance surgical outcomes.

To Know More About This Report, Request a Free Sample Copy

The growth of the SSI control market in the United States is supported by several factors, including the increasing volume of surgical procedures, rising awareness about healthcare-associated infections (HAIs), and advancements in infection prevention technologies. Government initiatives, such as the implementation of stringent guidelines by the Centers for Disease Control and Prevention (CDC) and the introduction of value-based healthcare reimbursement models, further encourage healthcare facilities to prioritize infection control measures.

Additionally, the aging population, a higher prevalence of chronic conditions, and an increased focus on outpatient surgeries contribute to the demand for effective SSI control solutions. As healthcare providers continue to invest in advanced infection control products and technologies, the SSI control market is expected to experience steady growth in the coming years.

The United States Surgical Site Infection Control Market: 4.32% CAGR (2024-2032)

Need a custom report or have specific data requirements? Let us know!

Need a custom report or have specific data requirements? Let us know!

The United States surgical site infection control market segmentation includes procedure, type of infection, end-user, and product. The type of infection segment is further classified into superficial incisional SSI, deep incisional SSI, and organ or space SSI. The skin serves as a crucial barrier against infections; however, following surgery, the risk of developing a surgical site infection (SSI) ranges from approximately 1% to 3%. Deep incisional SSIs occur beneath the incision area, affecting the muscles and surrounding tissues.

According to a study published in the Surveillance of Surgical Site Infections in NHS Hospitals, 34.8% of inpatients who underwent hip prosthesis surgery were diagnosed with deep incisional SSIs. Similarly, 22.9% of patients who had knee prosthesis surgery and 47.2% of those who underwent repair of the femoral neck experienced deep incisional SSIs.

Furthermore, 30.5% of inpatients who had coronary artery bypass surgery were diagnosed with deep incisional SSIs. Notably, in hip and knee prosthesis surgeries, the proportion of deep incisional SSIs among inpatients and readmitted patients increased to 45.7% and 41.1%, respectively.

The key companies operating in the United States surgical site infection control market include Becton, Dickinson and Company (BD), Johnson & Johnson, Kimberly-Clark, etc.

Kimberly-Clark is an American multinational company specializing in the production of consumer products, primarily paper-based goods. The company offers a wide range of products across various categories, including facial tissues, feminine hygiene products, toilet paper, utility wipes, and scientific cleaning wipes. Headquartered in the United States, Kimberly-Clark employs approximately 43,000 people. Its business operations are organized into three key segments: personal care, consumer tissue, and K-C professional.

The personal care segment focuses on manufacturing and marketing products such as disposable diapers, training and youth pants, swim pants, baby wipes, feminine care items, and incontinence products. The consumer tissue segment produces and distributes facial and bathroom tissues, paper towels, and other related household products. The K-C professional segment provides a range of products, including wipers, tissue, towels, apparel, soaps, and sanitizers for professional and industrial use.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Procedure, Type of Infection, End-User, and Product |

| Countries Analyzed | The United States |

| Companies Analyzed | 3M Company, Ansell Ltd, Becton, Dickinson and Company (BD), Johnson & Johnson, Kimberly-Clark |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- HIGH EMPHASIS ON ENVIRONMENTAL HYGIENE BOOSTS THE SSI CONTROL MARKET

- DISPOSABLE AND SINGLE-USE PRODUCTS ARE SHAPING THE SURGICAL INFECTION CONTROL LANDSCAPE

MARKET DYNAMICS

- KEY DRIVERS

- SURGE IN GERIATRIC POPULATION

- INCREASED INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS

- IMPLEMENTATION OF REGULATORY GUIDELINES FOR THE PREVENTION OF HOSPITAL-ACQUIRED INFECTIONS

- KEY RESTRAINTS

- LACK OF AWARENESS ASSOCIATED WITH HOSPITAL-ACQUIRED INFECTIONS

- SURGING MEDICAL WASTE DUE TO THE USE OF MEDICAL DISPOSABLE ITEMS

- RISING USE OF OUTPATIENT TREATMENTS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- RISING RATE OF SURGICAL PROCEDURES

- EXPANSION OF MINIMALLY INVASIVE AND OUTPATIENT SURGICAL PRACTICES

- ADVANCEMENTS IN TECHNOLOGY FOR PREVENTING SURGICAL SITE INFECTIONS

- PESTLE ANALYSIS

- POLITICAL

- ECONOMICAL

- SOCIAL

- TECHNOLOGICAL

- LEGAL

- ENVIRONMENTAL

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTIONS

- NEW ENTRANTS

- INDUSTRY RIVALRY

- MARKET CONCENTRATION ANALYSIS

- KEY MARKET TRENDS

MARKET BY PROCEDURE

- LAPAROSCOPY

- ORTHOPEDIC SURGERY

- CARDIOVASCULAR

- OBSTETRICS AND GYNECOLOGY

- WOUND CLOSURE

- PLASTIC & RECONSTRUCTIVE SURGERY

- THORACIC SURGERY

- MICROVASCULAR

- UROLOGY

- NEUROSURGERY

- OTHER PROCEDURES

MARKET BY TYPE OF INFECTION

- SUPERFICIAL INCISIONAL SSI

- DEEP INCISIONAL SSI

- ORGAN OR SPACE SSI

MARKET BY END-USER

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

MARKET BY PRODUCT

- DISINFECTANTS

- SKIN DISINFECTANTS

- HAND DISINFECTANTS

- MANUAL REPROCESSORS SOLUTIONS

- SURGICAL DRAPES

- SURGICAL GLOVES

- SKIN PREPARATION SOLUTIONS

- SURGICAL IRRIGATION

- SURGICAL SCRUBS

- HAIR CLIPPERS

- MEDICAL NONWOVENS

- OTHER PRODUCTS

- DISINFECTANTS

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- 3M COMPANY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ANSELL LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- BECTON, DICKINSON AND COMPANY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- JOHNSON & JOHNSON

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KIMBERLY-CLARK

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- 3M COMPANY

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SURGICAL SITE INFECTION CONTROL

TABLE 2: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY PROCEDURE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY PROCEDURE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY TYPE OF INFECTION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY TYPE OF INFECTION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY PRODUCT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: LIST OF MERGERS & ACQUISITIONS

TABLE 11: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 12: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: MARKET CONCENTRATION ANALYSIS

FIGURE 4: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY PROCEDURE, IN 2023

FIGURE 5: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY LAPAROSCOPY, 2024-2032 (IN $ MILLION)

FIGURE 6: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY ORTHOPEDIC SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 7: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY CARDIOVASCULAR, 2024-2032 (IN $ MILLION)

FIGURE 8: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY OBSTETRICS AND GYNECOLOGY, 2024-2032 (IN $ MILLION)

FIGURE 9: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY WOUND CLOSURE, 2024-2032 (IN $ MILLION)

FIGURE 10: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY PLASTIC & RECONSTRUCTIVE SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 11: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY THORACIC SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 12: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY MICROVASCULAR, 2024-2032 (IN $ MILLION)

FIGURE 13: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY UROLOGY, 2024-2032 (IN $ MILLION)

FIGURE 14: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY NEUROSURGERY, 2024-2032 (IN $ MILLION)

FIGURE 15: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY OTHER PROCEDURES, 2024-2032 (IN $ MILLION)

FIGURE 16: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY TYPE OF INFECTION, IN 2023

FIGURE 17: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SUPERFICIAL INCISIONAL SSI, 2024-2032 (IN $ MILLION)

FIGURE 18: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY DEEP INCISIONAL SSI, 2024-2032 (IN $ MILLION)

FIGURE 19: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY ORGAN OR SPACE SSI, 2024-2032 (IN $ MILLION)

FIGURE 20: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 21: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY HOSPITALS, 2024-2032 (IN $ MILLION)

FIGURE 22: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY AMBULATORY SURGICAL CENTERS, 2024-2032 (IN $ MILLION)

FIGURE 23: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2023

FIGURE 24: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 25: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY DISINFECTANTS, IN 2023

FIGURE 26: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SKIN DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 27: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY HAND DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 28: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY MANUAL REPROCESSORS SOLUTION, 2024-2032 (IN $ MILLION)

FIGURE 29: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL DRAPES, 2024-2032 (IN $ MILLION)

FIGURE 30: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL GLOVES, 2024-2032 (IN $ MILLION)

FIGURE 31: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SKIN PREPARATION SOLUTIONS, 2024-2032 (IN $ MILLION)

FIGURE 32: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL IRRIGATION, 2024-2032 (IN $ MILLION)

FIGURE 33: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL SCRUBS, 2024-2032 (IN $ MILLION)

FIGURE 34: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY HAIR CLIPPERS, 2024-2032 (IN $ MILLION)

FIGURE 35: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY MEDICAL NONWOVENS, 2024-2032 (IN $ MILLION)

FIGURE 36: UNITED STATES SURGICAL SITE INFECTION CONTROL MARKET, BY OTHER PRODUCTS, 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

UNITED STATES TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

GERMANY TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

CHINA TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

INDIA WIND ENERGY MARKET FORECAST 2025-2032

-

INDIA SOLAR ENERGY MARKET FORECAST 2025-2032

-

INDIA GREEN HYDROGEN MARKET FORECAST 2025-2032

-

INDIA GREEN BUILDING MATERIAL MARKET FORECAST 2025-2032

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032