GLOBAL THERMOPLASTIC ELASTOMERS MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

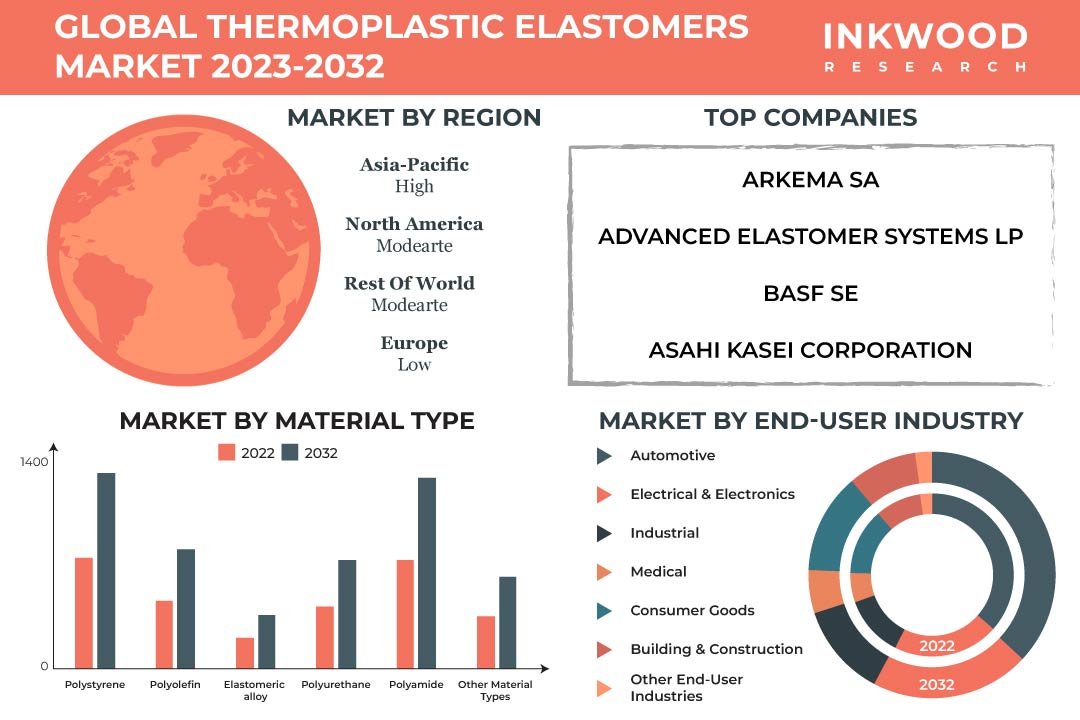

Global Thermoplastic Elastomers Market by Material Type (Polystyrene, Polyolefin, Elastomeric Alloy, Polyurethane, Polyamide, Other Material Types) Market by End-user (Automotive, Electrical & Electronics, Industrial, Medical, Consumer Goods, Building & Construction, Other End-users) by Geography

REPORTS » CHEMICALS AND MATERIALS » METALS & ALLOYS » GLOBAL THERMOPLASTIC ELASTOMERS MARKET FORECAST 2023-2032

MARKET OVERVIEW

In terms of revenue, the global thermoplastic elastomers market was valued at $xx million in 2022 and is expected to reach $48294.02 million by 2032, growing at a CAGR of 5.84% during the forecast period, 2023-2032.

The market study also evaluated in terms of volume, where the market volume stood at 6324.07 kilotons in 2022 and is expected to grow with a CAGR of 2.66% during the forecast period, 2023-2032. The market study has also analyzed the impact of COVID-19 on the thermoplastic plastic industry qualitatively as well as quantitatively.

The thermoplastic elastomer (TPE) is a rubber-like material with plastic-like characteristics. It is a true thermoplastic, eliminating the need for vulcanization or curing. TPEs can be processed using various plastic production tools, including blow molding, injection molding, and extrusion molding.

TPEs are especially suitable for secondary processes, such as welding and bonding to various materials. They are also ideal for more complex processes like over-molding and two-shot molding. Also, TPEs facilitate a simple bonding to a wide range of thermoplastic substrates and flexible design options for different parts.

Read our latest blog on the Thermoplastic Elastomers Market

GROWTH ENABLERS

Key enablers of the global thermoplastic elastomers market growth are:

- Growing demand from automotives

- Thermoplastic elastomer’s use as a substitute for thermoset elastomer

- Introduction of 3D printing

- The advent of 3D printing technology has brought about a transformative impact on the manufacturing sector, offering rapid prototyping, enhanced design flexibility, and unparalleled precision, surpassing traditional manufacturing techniques like injection molding and subtractive manufacturing.

- Within the realm of additive manufacturing, Thermoplastic Elastomers (TPEs) have risen in prominence as preferred filaments for various processes like Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM). This is attributed to their flexibility, seamless processing, remarkable durability, high chemical resistance, and robust layer bonding.

GROWTH RESTRAINTS

Key factors restraining the global thermoplastic elastomers market growth are:

- Price fluctuations in raw materials

- Reduced volume consumption due to lightweighting & miniaturization

- Lightweighting & miniaturization have emerged as key trends fueling the expansion of the TPE market across various end-use industries, including automotive, consumer goods, medical, and electronics sectors.

- However, these trends can also pose certain challenges as they demand significantly reduced volume consumption of TPEs. This reduction in usage is especially evident in the context of miniaturization in medical and electronic devices, which is expected to continue in the future.

- At the same time, the impact of this restraint is projected to be relatively low in the short term and moderate in the medium to long term during the forecast period.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Thermoplastic Elastomers Market | Top Trends

- Many countries have committed to lowering CO2 emissions, prompting tire manufacturers to adopt measures that reduce carbon dioxide output. These efforts include enhancing energy efficiency and recycling gas emissions. As a result, elastomer producers are experiencing a significant push to develop new elastomer products that aid in greenhouse gas reduction.

- Due to the scarcity of raw materials and fluctuating prices, businesses are under pressure to produce more recyclable goods. For instance, China has notably increased its production of recycled rubber in recent years. Currently, over 80% of the world’s recycled rubber comes solely from China.

MARKET SEGMENTATION

Market Segmentation – Material Type and End-User –

Market by Material Type:

- Polystyrene

- In 2022, polystyrene dominated the material type segment in terms of revenue share. This strong, rigid, and exceptionally transparent resin is produced through the polymerization of styrene, making it one of the most prevalent types of plastic materials.

- With a few exceptions, polystyrene is a non-biodegradable synthetic material. It can be readily dissolved by various aromatic hydrocarbon solvents and chlorinated solvents. It finds extensive use in the food service industry, where it serves the manufacturing of rigid trays, containers, disposable plates, bowls, and other related items.

- Polyolefin

- Elastomeric Alloy

- Polyurethane

- Polyamide

- Other Material Types

Market by End-User:

- Automotive

- Automotive is the fastest-growing end-user in the market. TPEs (Thermoplastic Elastomers) are witnessing rapid advancements due to the wide array of thermoplastic and elastic phase combinations available. The automotive industry, especially vehicle manufacturing, stands as the largest consumer, accounting for approximately 40% of global TPE product consumption.

- Thermoplastic elastomers find extensive applications in various automotive components, such as belts and hoses, roars, gaskets, sound management systems inside vehicles, floors, and instrument board skins.

- Furthermore, TPEs are employed in the production of tires (including base tires, side walls, and treads), wires, cables, and almost all external car parts. This growth is further driven by increased car production and higher polypropylene consumption per vehicle.

- To cater to interior applications like covering instrument panels, compound thermoplastic olefin (TPO) products are being promoted as a viable alternative to flexible PVC.

- Electrical & Electronics

- Industrial

- Medical

- Consumer Goods

- Building & Construction

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Taiwan, Australia & New Zealand, and Rest of Asia-Pacific

- Asia Pacific is the fastest-growing and dominating region in the global thermoplastic elastomer market in terms of revenue.

- This can be attributed to the region’s prominence as the primary consumer in the automotive industry and the significant demand for food in major economies like China, India, and Japan.

- Moreover, Asia-Pacific has set a strategic goal to strengthen China’s position as a major global manufacturing hub.

- The region’s rapid urbanization is fueling expansion in the construction sector, leading to a projected rise in demand for TPE in the years ahead. Additionally, the Asia-Pacific region is witnessing a surge in demand for styrene butadiene due to the growing need for adhesives, driven by the flourishing packaging sector, attributed to the thriving e-commerce and e-retail industries.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

The major players in the global thermoplastic elastomers market are:

- Arkema SA

- BASF SE

- Covestro AG

- Dynasol Group

- The Dow Chemical Company

- LG Chem Ltd

- Asahi Kasei Corporation

Key strategies adopted by some of these companies:

- In May 2023, Arkema SA announced to acquire Polytec PT to strengthen its position in the batteries and electronics markets for long-term company development.

- In June 2023, BASF SE and Avient Corporation collaborated to develop a product named Ultrason, an advanced polymer useful in the electronics and medical fields.

- In May 2023, Covestro AG started a new production line for Thermoplastic Polyurethane which is useful in paints and coatings protection films.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million), Volume (Kiloton) |

| Segments Analyzed | Material Type, End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Arkema SA, Advanced Elastomer Systems LP, BASF SE, Asahi Kasei Corporation, Covestro AG, Dynasol Group, The Dow Chemical Company, Evonik Industries AG, LG Chem Ltd, Lubrizol Corporation, Kraton Corporation, LyondellBasell Industries, Avient Corporation, Huntsman Corporation |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19

- IMPACT OF RUSSIA-UKRAINE WAR

- MAJOR MARKET FINDINGS

- RISING GLOBAL TARIFFS

- IMPACT OF TIRE LABELING REGULATIONS

- THERMOPLASTIC ELASTOMERS CATER TO DIFFERENT FUNCTIONAL REQUIREMENTS

-

MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND FROM AUTOMOTIVES

- THERMOPLASTIC ELASTOMER’S USE AS A SUBSTITUTE FOR THERMOSET ELASTOMER

- INTRODUCTION OF 3D PRINTING

- KEY RESTRAINTS

- PRICE FLUCTUATIONS IN RAW MATERIALS

- REDUCED VOLUME CONSUMPTION DUE TO LIGHTWEIGHTING & MINIATURIZATION

- KEY DRIVERS

-

KEY ANALYTICS

- PARENT MARKET ANALYSIS

- KEY TECHNOLOGY TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS SUPPLIERS

- POLYMER COMPOUNDING

- END-USER

-

MARKET BY MATERIAL TYPE

- POLYSTYRENE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POLYOLEFIN

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ELASTOMERIC ALLOY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POLYURETHANE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POLYAMIDE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER MATERIAL TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POLYSTYRENE

-

MARKET BY END-USER

- AUTOMOTIVE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ELECTRICAL & ELECTRONICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- INDUSTRIAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MEDICAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CONSUMER GOODS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BUILDING & CONSTRUCTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AUTOMOTIVE

-

GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $MILLION & IN TERMS OF VOLUME: KILOTONS)

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET DRIVERS

- NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET CHALLENGES

- NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE THERMOPLASTIC ELASTOMERS MARKET DRIVERS

- EUROPE THERMOPLASTIC ELASTOMERS MARKET CHALLENGES

- EUROPE THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE THERMOPLASTIC ELASTOMERS MARKET

- COUNTRY ANALYSIS

- GERMANY

- GERMANY THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- UNITED KINGDOM THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- GERMANY

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET DRIVERS

- ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET CHALLENGES

- ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- TAIWAN

- TAIWAN THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET DRIVERS

- REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET CHALLENGES

- REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA THERMOPLASTIC ELASTOMERS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ADVANCED ELASTOMER SYSTEMS LP

- COMPANY OVERVIEW

- PRODUCTS LIST

- ARKEMA SA

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- ASAHI KASEI CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- AVIENT CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- BASF SE

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- COVESTRO AG

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- DYNASOL GROUP

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- EVONIK INDUSTRIES AG

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- HUNTSMAN CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- KRATON CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- LG CHEM LTD

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- LUBRIZOL CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- LYONDELLBASELL INDUSTRIES

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- THE DOW CHEMICAL COMPANY

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- WANHUA CHEMICAL GROUP CO LTD

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- ADVANCED ELASTOMER SYSTEMS LP

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – THERMOPLASTIC ELASTOMERS

TABLE 2: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY MATERIAL TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY MATERIAL TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL POLYSTYRENE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL POLYSTYRENE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL POLYOLEFIN MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL POLYOLEFIN MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL ELASTOMERIC ALLOY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL ELASTOMERIC ALLOY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL POLYURETHANE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL POLYURETHANE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL POLYAMIDE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL POLYAMIDE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL OTHER MATERIAL TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL OTHER MATERIAL TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL ELECTRICAL & ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL ELECTRICAL & ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL INDUSTRIAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL INDUSTRIAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL MEDICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL MEDICAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL CONSUMER GOODS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL CONSUMER GOODS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN KILOTONS)

TABLE 35: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN KILOTONS)

TABLE 36: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOTONS)

TABLE 39: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN KILOTONS)

TABLE 40: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

TABLE 41: KEY PLAYERS OPERATING IN NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET

TABLE 42: EUROPE THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: EUROPE THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: EUROPE THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOTONS)

TABLE 45: EUROPE THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN KILOTONS)

TABLE 46: EUROPE THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

TABLE 47: KEY PLAYERS OPERATING IN EUROPE THERMOPLASTIC ELASTOMERS MARKET

TABLE 48: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 50: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOTONS)

TABLE 51: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN KILOTONS)

TABLE 52: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

TABLE 53: KEY PLAYERS OPERATING IN ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET

TABLE 54: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 56: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN KILOTONS)

TABLE 57: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN KILOTONS)

TABLE 58: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET REGULATORY FRAMEWORK

TABLE 59: KEY PLAYERS OPERATING IN REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET

TABLE 60: LIST OF MERGERS & ACQUISITIONS

TABLE 61: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 62: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 63: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY TECHNOLOGY TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, GROWTH POTENTIAL, BY MATERIAL TYPE, IN 2022

FIGURE 11: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY POLYSTYRENE, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY POLYOLEFIN, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY ELASTOMERIC ALLOY, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY POLYURETHANE, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY POLYAMIDE, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY OTHER MATERIAL TYPES, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 18: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY AUTOMOTIVE, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY ELECTRICAL & ELECTRONICS, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY INDUSTRIAL, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY MEDICAL, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY CONSUMER GOODS, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY BUILDING & CONSTRUCTION, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, BY OTHER END-USERS, 2023-2032 (IN $ MILLION)

FIGURE 25: GLOBAL THERMOPLASTIC ELASTOMERS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 26: NORTH AMERICA THERMOPLASTIC ELASTOMERS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 27: UNITED STATES THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: CANADA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: EUROPE THERMOPLASTIC ELASTOMERS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 30: GERMANY THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: UNITED KINGDOM THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: FRANCE THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: ITALY THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: SPAIN THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: REST OF EUROPE THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 37: CHINA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: INDIA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: JAPAN THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: SOUTH KOREA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: AUSTRALIA & NEW ZEALAND THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: INDONESIA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: TAIWAN THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: THAILAND THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: REST OF ASIA-PACIFIC THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: REST OF WORLD THERMOPLASTIC ELASTOMERS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 47: LATIN AMERICA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 48: MIDDLE EAST & AFRICA THERMOPLASTIC ELASTOMERS MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

China, India, the United States, Japan, and South Korea produce and consume the most TPE.

The pandemic’s effects on thermoplastic elastomers have varied according to the industry, including construction, automotive, medicine, and hygiene. Healthcare, personal care, and food packaging saw market expansion during the pandemic, whereas building & construction, industrial, and chemical market growth was hampered due to shutdowns.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032