GLOBAL SWABS COLLECTION KIT MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

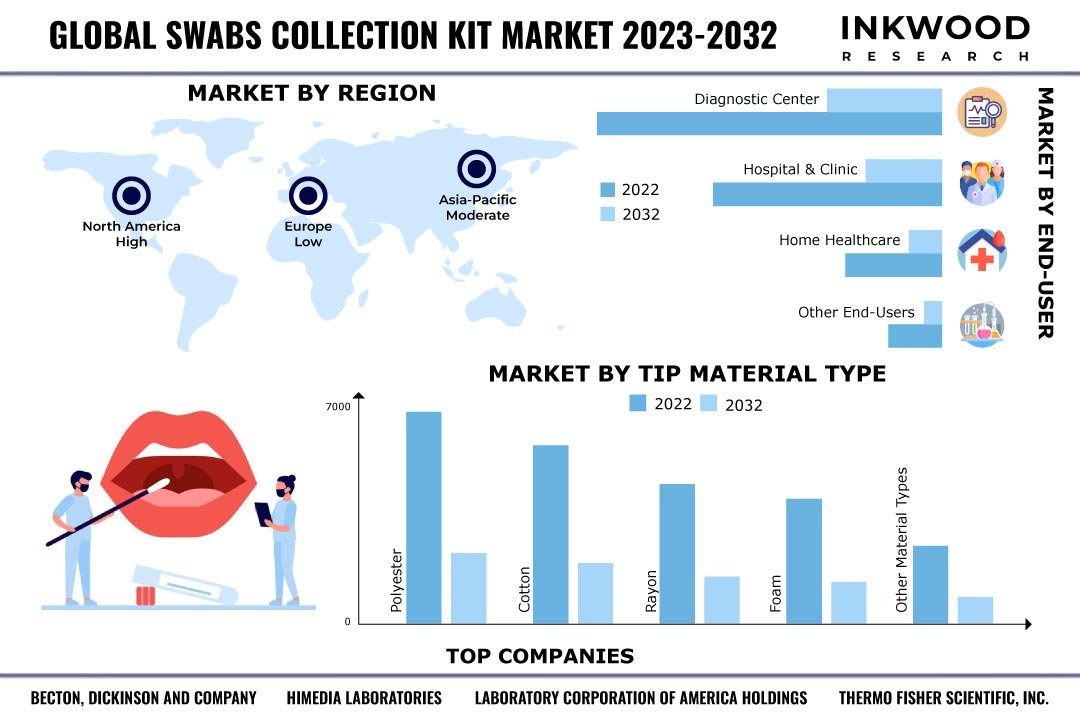

Global Swabs Collection Kit Market by Tip Material Type (Polyester, Cotton, Rayon, Foam, Other Tip Material Types) Market by Sample Type (Nasopharyngeal Swabs, Oropharyngeal Swabs, Other Sample Types) Market by End-user (Diagnostic Centers, Hospitals & Clinics, Home Healthcare, Other End-users) by Geography

REPORTS » HEALTHCARE » MEDICAL DEVICES » GLOBAL SWABS COLLECTION KIT MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global swabs collection kit market is expected to reach $7931.14 million by 2032, growing at a CAGR of 2.42% during the forecast period, 2023-2032.

Swab testing, also known as swab-based diagnostic testing, is a way of collecting samples from various body locations for diagnostic testing purposes using a swab. Swabs are small, sterile devices with cotton, synthetic fiber, or other material tip used to absorb and collect specimens.

Swab collection kits are packages or sets that contain numerous components required for collecting, transporting, and preserving biological samples using swabs. These kits are intended to make it easier to collect samples from certain parts of the body safely and consistently for diagnostic testing or research purposes.

Swab testing is frequently utilized for diagnosing various respiratory infections (for instance, COVID-19), sexually transmitted diseases, bacterial infections, viral infections, and genetic disorders. This method offers a non-invasive and straightforward approach to sample collection, making it easily accessible and suitable for large-scale testing during outbreaks or routine diagnostic screening.

Read our latest blog on the Swabs Collection Kit Market

GROWTH ENABLERS

Key enablers of the global swabs collection kit market growth are:

- Growing need for quick & accurate diagnosis of infectious diseases

- As the incidence of infectious diseases continues to rise, the demand for effective surveillance and timely diagnosis has become increasingly crucial. Swab collection kits provide a convenient and consistent method for gathering samples from various body locations.

- These kits play a pivotal role in epidemiological research with regard to comprehending the prevalence, distribution, and transmission patterns of infectious illnesses. In addition, researchers and public health professionals utilize swabs to collect samples from individuals in affected populations, enabling them to monitor disease progression and recommend appropriate public health measures.

- Furthermore, swab collection kits are used in routine screening programs such as human papillomavirus (HPV) testing and sexually transmitted infection (STI) testing. They facilitate the collection of samples for testing and early detection of infections.

- Surging demand for diagnostic testing

- Increasing healthcare investments

GROWTH RESTRAINTS

Key factors restraining the global swabs collection kit market growth are:

- Availability of alternatives

- Strict government regulations

- Inconclusive results due to operator error

- Insufficient swab collection practices, such as obtaining inadequate samples or mishandling swabs, could lead to inaccurate test results. Such incorrect or insufficient sampling may result in false negatives or false positives, compromising the reliability of diagnostic tests.

- Furthermore, technical issues during sample collection, handling, or laboratory processing may lead to inconclusive results. Errors or irregularities in the swab collection procedure, transportation, or processing protocols can significantly impact sample quality and the overall accuracy of test findings.

- Given the limitations of swab tests, alternative testing methods may be preferred. For instance, saliva testing is often considered less invasive and more comfortable than swab-based testing. As a result, it may be favored by some individuals seeking testing options.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Swabs Collection Kit Market | Top Market Trends

- Government backing for medical innovations has significantly influenced the market for swab collection kits, particularly in light of COVID-19. Governments worldwide have acknowledged the crucial role of testing in controlling the virus’s spread and mitigating its impact on public health and the economy. For instance, in April 2023, India’s Union Cabinet approved the National Medical Devices Policy, aimed at fostering the systematic expansion of the medical device sector to fulfill public health objectives of accessibility, affordability, quality, and innovation.

- At-home testing kits have experienced a significant surge in popularity, especially during the pandemic. Individuals now have the convenience of collecting their own samples in the comfort of their homes and have the option to either submit the samples to a laboratory for examination or conduct the test themselves using point-of-care devices. Comprehensive instructions are included with these at-home testing kits, guiding users on the proper collection of samples. The kit may contain nose swabs, saliva collection tubes, or other specific devices based on the type of test. In order to ensure precise sample collection, clear instructions, and video training are often provided.

- Swab collection kit technological advancements have been geared towards enhancing various aspects of the sample collection procedure, encompassing user convenience, patient comfort, sample quality, and overall testing efficiency. Swab collection kits now offer integrated viral transport media (VTM) or alternative liquid transfer methods, which effectively preserve the collected sample’s viability and stability during transportation to the testing laboratory, eliminating the necessity for separate vials or transport media.

MARKET SEGMENTATION

Market Segmentation – Tip Material Type, Sample Type, and End-User –

Market by Tip Material Type:

- Polyester

- Polyester is the largest revenue-generating tip material type.

- Polyester-tipped swab collection kits are specialist sample collection kits extensively utilized across various industries, including healthcare, diagnostics, forensics, and research.

- The use of polyester fibers in these kits proves highly advantageous due to their superior surface area, which enables more efficient absorption and retention of samples. This characteristic is particularly valuable when dealing with samples containing DNA, RNA, proteins, or other essential biological components.

- Furthermore, the chemical resistance of polyester fibers ensures seamless compatibility with an extensive range of collection and transport fluids. Additionally, these fibers withstand standard preservation and transportation techniques, guaranteeing the preservation of sample integrity throughout storage and transit.

- Cotton

- Rayon

- Foam

- Other Tip Material Types

Market by Sample Type:

- Nasopharyngeal Swabs

- Nasopharyngeal swabs are the fastest-growing sample type.

- Nasopharyngeal swabs are specialized tools used for collecting samples from the nasopharynx, the upper region of the throat behind the nose. These swabs are specifically designed to capture respiratory specimens for diagnostic testing, with a focus on detecting respiratory viruses like SARS-CoV-2.

- During the COVID-19 pandemic, the demand for nasopharyngeal swabs surged, as they were the primary means of obtaining respiratory specimens for SARS-CoV-2 testing. Given the higher viral load in the nasopharynx, nasopharyngeal swabs played a crucial role in accurately identifying the virus. Moreover, beyond COVID-19 testing, these swabs are valuable for identifying other respiratory viruses, such as influenza, respiratory syncytial virus (RSV), and more.

- Oropharyngeal Swabs

- Other Sample Types

Market by End-User:

- Diagnostic Centers

- Hospitals & Clinics

- Home Healthcare

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- North America is the fastest-growing region in the global swabs collection kit market.

- Swab collection kits play a crucial role in COVID-19 testing as they gather respiratory specimens from individuals suspected of carrying the virus. As of July 2023, the World Health Organization (WHO) has reported 103 million COVID-19 cases in the United States.

- In response to the pandemic, the United States government has made substantial investments in expanding testing centers nationwide. This effort includes supporting the establishment of various testing facilities such as testing sites, mobile units, and other specialized centers. Additionally, the government has allocated funds towards research and development programs aimed at enhancing testing technology and procedures.

- Moreover, the National Healthcare Expenditure in the US reached $4.3 trillion in 2021, accounting for 18.3% of the GDP, as per the Centers for Medicare & Medicaid Services.

- Europe: The United Kingdom, France, Germany, Spain, Italy, Nordic Countries, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Philippines, Malaysia, Australia & New Zealand, and Rest of Asia-Pacific

MAJOR PLAYERS

The major players in the global swabs collection kit market are:

- Becton, Dickinson, and Company (BD)

- Lucence Diagnostics

- Puritan Medical Products

- Thermo Fisher Scientific

- Vircell SL

Key strategies adopted by some of these companies:

- November 2020: CoreMedica’s Mybiopassport.com portal announced the availability of the ‘COVID-19 and Immunity Profile.’ Mybiopassport is a one-of-a-kind tool in the individualized analysis of biological data on Pre-analytical with the simple collection of a few drops of blood anywhere, at any time, and by anyone.

- June 2021: Thermo Fisher Scientific revealed the availability of a new COVID-19 test with the CE-IVD designation. Thermo Fisher will offer a wider selection of high-precision assays to identify live SARS-CoV-2 infections with the TaqPath COVID-19 Fast PCR Combo Kit 2.0.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Tip Material Type, Sample Type, End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Becton, Dickinson and Company, BTNX Inc, Formlabs, Hardy Diagnostics, HiMedia Laboratories, Laboratory Corporation of America Holdings, Lucence Diagnostics, Puritan Medical Products, Thermo Fisher Scientific Inc, Vircell SL |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON SWABS COLLECTION KIT MARKET

- MAJOR MARKET FINDINGS

- PREVENTIVE CARE ENABLES EARLY DETECTION AND CONTAINMENT OF INFECTIOUS DISEASES

- NASOPHARYNGEAL SWABS ARE MORE EFFICIENT FOR INFECTIOUS DISEASES

- POINT-OF-CARE TESTING ENABLES RAPID & TIMELY DIAGNOSIS

-

MARKET DYNAMICS

- KEY DRIVERS

- GROWING NEED FOR QUICK & ACCURATE DIAGNOSIS OF INFECTIOUS DISEASES

- SURGING DEMAND FOR DIAGNOSTIC TESTING

- INCREASING HEALTHCARE INVESTMENTS

- KEY RESTRAINTS

- AVAILABILITY OF ALTERNATIVES

- STRICT GOVERNMENT REGULATIONS

- INCONCLUSIVE RESULTS DUE TO OPERATOR ERROR

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR ITALY

- GROWTH PROSPECT MAPPING FOR CHINA

- GROWTH PROSPECT MAPPING FOR LATIN AMERICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

-

MARKET BY TIP MATERIAL TYPE

- POLYESTER

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COTTON

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RAYON

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FOAM

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER TIP MATERIAL TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POLYESTER

-

MARKET BY SAMPLE TYPE

- NASOPHARYNGEAL SWABS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OROPHARYNGEAL SWABS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER SAMPLE TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NASOPHARYNGEAL SWABS

-

MARKET BY END-USER

- DIAGNOSTIC CENTERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOSPITALS & CLINICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOME HEALTHCARE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DIAGNOSTIC CENTERS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA SWABS COLLECTION KIT MARKET DRIVERS

- NORTH AMERICA SWABS COLLECTION KIT MARKET CHALLENGES

- NORTH AMERICA SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

- KEY PLAYERS OPERATING IN NORTH AMERICA SWABS COLLECTION KIT MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE SWABS COLLECTION KIT MARKET DRIVERS

- EUROPE SWABS COLLECTION KIT MARKET CHALLENGES

- EUROPE SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE SWABS COLLECTION KIT MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- NORDIC COUNTRIES

- NORDIC COUNTRIES SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC SWABS COLLECTION KIT MARKET DRIVERS

- ASIA-PACIFIC SWABS COLLECTION KIT MARKET CHALLENGES

- ASIA-PACIFIC SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC SWABS COLLECTION KIT MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- PHILIPPINES

- PHILIPPINES SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- MALAYSIA

- MALAYSIA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD SWABS COLLECTION KIT MARKET DRIVERS

- REST OF WORLD SWABS COLLECTION KIT MARKET CHALLENGES

- REST OF WORLD SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD SWABS COLLECTION KIT MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA SWABS COLLECTION KIT MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BECTON, DICKINSON AND COMPANY

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BTNX INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- FORMLABS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HARDY DIAGNOSTICS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HIMEDIA LABORATORIES

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- LUCENE DIAGNOSTICS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PURITAN MEDICAL PRODUCTS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- THERMO FISHER SCIENTIFIC INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- VIRCELL SL

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BECTON, DICKINSON AND COMPANY

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SWABS COLLECTION KIT

TABLE 2: GLOBAL SWABS COLLECTION KIT MARKET, BY TIP MATERIAL TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL SWABS COLLECTION KIT MARKET, BY TIP MATERIAL TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL POLYESTER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL POLYESTER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL COTTON MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL COTTON MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL RAYON MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL RAYON MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL FOAM MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL FOAM MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL OTHER TIP MATERIAL TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL OTHER TIP MATERIAL TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL SWABS COLLECTION KIT MARKET, BY SAMPLE TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL SWABS COLLECTION KIT MARKET, BY SAMPLE TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL NASOPHARYNGEAL SWABS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL NASOPHARYNGEAL SWABS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL OROPHARYNGEAL SWABS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL OROPHARYNGEAL SWABS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL OTHER SAMPLE TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL OTHER SAMPLE TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL SWABS COLLECTION KIT MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL SWABS COLLECTION KIT MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL DIAGNOSTIC CENTERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL DIAGNOSTIC CENTERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL HOSPITALS & CLINICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL HOSPITALS & CLINICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL HOME HEALTHCARE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL HOME HEALTHCARE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL SWABS COLLECTION KIT MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL SWABS COLLECTION KIT MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: NORTH AMERICA SWABS COLLECTION KIT MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: NORTH AMERICA SWABS COLLECTION KIT MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: NORTH AMERICA SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

TABLE 37: KEY PLAYERS OPERATING IN NORTH AMERICA SWABS COLLECTION KIT MARKET

TABLE 38: EUROPE SWABS COLLECTION KIT MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: EUROPE SWABS COLLECTION KIT MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 40: EUROPE SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

TABLE 41: KEY PLAYERS OPERATING IN EUROPE SWABS COLLECTION KIT MARKET

TABLE 42: ASIA-PACIFIC SWABS COLLECTION KIT MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: ASIA-PACIFIC SWABS COLLECTION KIT MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: ASIA- PACIFIC SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

TABLE 45: KEY PLAYERS OPERATING IN ASIA-PACIFIC SWABS COLLECTION KIT MARKET

TABLE 46: REST OF WORLD SWABS COLLECTION KIT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: REST OF WORLD SWABS COLLECTION KIT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 48: REST OF WORLD SWABS COLLECTION KIT MARKET REGULATORY FRAMEWORK

TABLE 49: KEY PLAYERS OPERATING IN REST OF WORLD SWABS COLLECTION KIT MARKET

TABLE 50: LIST OF MERGERS & ACQUISITIONS

TABLE 51: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 52: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 53: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR ITALY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR LATIN AMERICA

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL SWABS COLLECTION KIT MARKET, GROWTH POTENTIAL, BY TIP MATERIAL TYPE, IN 2022

FIGURE 10: GLOBAL SWABS COLLECTION KIT MARKET, BY POLYESTER, 2023-2032 (IN $ MILLION)

FIGURE 11: GLOBAL SWABS COLLECTION KIT MARKET, BY COTTON, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL SWABS COLLECTION KIT MARKET, BY RAYON, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL SWABS COLLECTION KIT MARKET, BY FOAM, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL SWABS COLLECTION KIT MARKET, BY OTHER TIP MATERIAL TYPES, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL SWABS COLLECTION KIT MARKET, GROWTH POTENTIAL, BY SAMPLE TYPE, IN 2022

FIGURE 16: GLOBAL SWABS COLLECTION KIT MARKET, BY NASOPHARYNGEAL SWABS, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL SWABS COLLECTION KIT MARKET, BY OROPHARYNGEAL SWABS, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL SWABS COLLECTION KIT MARKET, BY OTHER SAMPLE TYPES, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL SWABS COLLECTION KIT MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 20: GLOBAL SWABS COLLECTION KIT MARKET, BY DIAGNOSTIC CENTERS, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL SWABS COLLECTION KIT MARKET, BY HOSPITALS & CLINICS, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL SWABS COLLECTION KIT MARKET, BY HOME HEALTHCARE, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL SWABS COLLECTION KIT MARKET, BY OTHER END-USERS, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL SWABS COLLECTION KIT MARKET, BY GEOGRAPHY, 2022 & 2032 (IN %)

FIGURE 25: NORTH AMERICA SWABS COLLECTION KIT MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 26: UNITED STATES SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: CANADA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: EUROPE SWABS COLLECTION KIT MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 29: UNITED KINGDOM SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: GERMANY SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: FRANCE SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: ITALY SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: SPAIN SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: NORDIC COUNTRIES SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: REST OF EUROPE SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: ASIA-PACIFIC SWABS COLLECTION KIT MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 37: CHINA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: JAPAN SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: INDIA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: SOUTH KOREA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: INDONESIA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: THAILAND SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: PHILIPPINES SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: MALAYSIA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: AUSTRALIA & NEW ZEALAND SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: REST OF ASIA-PACIFIC SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: REST OF WORLD SWABS COLLECTION KIT MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 48: LATIN AMERICA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FIGURE 49: MIDDLE EAST & AFRICA SWABS COLLECTION KIT MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

Swabs are generally considered non-invasive and cause minimal discomfort. However, depending on the area being swabbed and individual sensitivity, some swab collection procedures may result in slight discomfort or tickling sensations. Nevertheless, swabbing discomfort can be effectively minimized by employing proper techniques and handling with care.

No, swabs are strictly meant for single use. Their design is optimized for collecting a sample before proper disposal. Reusing swabs can lead to potential contamination, jeopardizing the integrity of the sample and yielding inaccurate test results. To maintain the specimen’s integrity, it is crucial to collect each sample using a new, sterile swab.

Depending on the local legislation, disposal options may vary. It is generally recommended that used swabs be disposed of in biohazard waste containers or securely sealed in plastic bags before following the appropriate local guidelines for proper disposal.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032