SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET FORECAST 2025-2032

SCOPE OF THE REPORT

Singapore Reverse Osmosis Components Market by Component (Cartridge Prefilters, Ancillary Components, RO Membrane Modules, RO Pumps, Pressure Vessels/Housings) Market by Operating Pressure (10-100 PSI, 101-400 PSI, 401 PSI and Above) Market by Application (Municipal Water Purification, Brackish and Seawater Desalination, Wastewater Treatment, Other Applications) Market by End-User (Industrial, Municipal, Agriculture)

REPORTS » ENVIRONMENT » WATER TREATMENT » SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET FORECAST 2025-2032

MARKET OVERVIEW

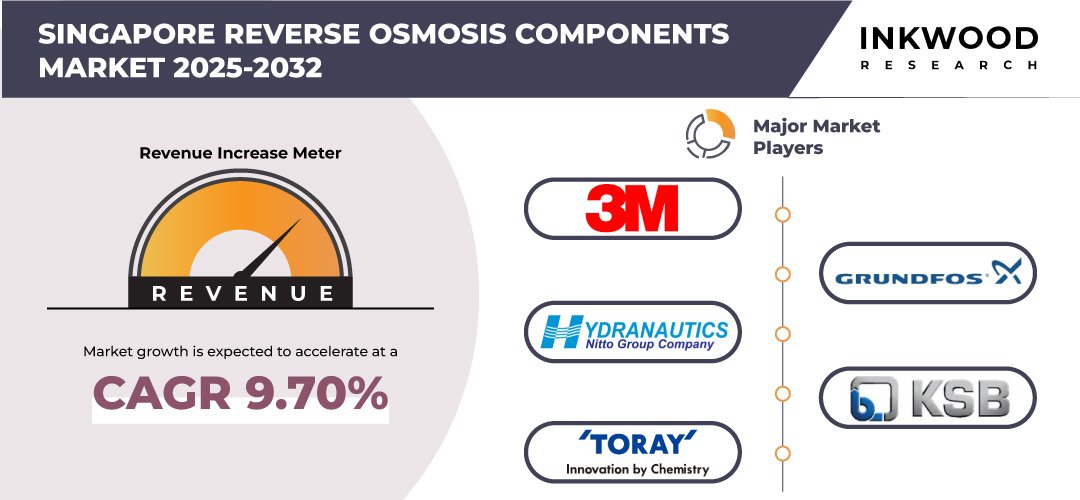

The Singapore reverse osmosis components market is projected to rise with a CAGR of 9.70% over the forecast years of 2025 to 2032. The base year regarded for the studied market is 2024, and the forecasting years are from 2025 to 2032.

The Singapore reverse osmosis components market is experiencing strong growth, driven by factors such as escalating water scarcity, rapid urbanization, and the nation’s commitment to sustainable water management. Singapore’s advanced infrastructure and its focus on leveraging innovative technologies to improve water quality are key drivers of the growing adoption of reverse osmosis systems. The government’s proactive initiatives, such as the Singapore Water Story, highlight the nation’s commitment to water self-sufficiency, further stimulating demand for RO components.

A major contributor to market growth is the increasing implementation of desalination plants and water reuse systems. Desalination plays a crucial role in meeting Singapore’s water needs due to the country’s limited natural water resources. Reverse osmosis is central to these systems, requiring high-performance membranes, pumps, and filters capable of enduring demanding operational conditions. Additionally, the rising demand for ultrapure water in industries such as semiconductor manufacturing and pharmaceuticals is fueling investments in advanced RO technologies.

To Know More About This Report, Request a Free Sample Copy

Despite the market’s growth, manufacturers face several challenges, particularly in meeting stringent environmental and safety regulations. Singapore’s rigorous quality standards for water treatment equipment are essential for public health and ecological protection but result in higher costs for manufacturers. Competition from alternative water treatment technologies and the high maintenance requirements of RO systems present further obstacles.

However, opportunities in the market are expanding with the integration of smart technologies. The adoption of IoT-enabled RO systems, which enable real-time monitoring and predictive maintenance, is improving efficiency and reducing operational costs. Moreover, there is a growing trend toward energy-efficient and low-waste RO solutions, addressing concerns about high energy consumption and brine disposal.

The Singapore reverse osmosis components market segmentation includes the market by component, operating pressure, application, and end-user. The end-user segment is further differentiated into industrial, municipal, and agriculture.

The industrial sub-segment is a key driver of the Singapore reverse osmosis components market, fueled by the nation’s advanced manufacturing sector and technology-driven economy. Industries such as semiconductors, pharmaceuticals, petrochemicals, and food & beverage are major adopters of RO systems, driven by the need for ultrapure water in critical production processes. For example, Singapore’s electronics manufacturing sector, which constitutes a vital portion of its GDP, heavily relies on RO technologies to produce the high-purity water essential for semiconductor fabrication.

Strict regulations on industrial wastewater discharge, enforced by agencies like PUB (Singapore’s national water agency), have further accelerated the adoption of RO systems for water recycling and reuse. Industrial facilities are increasingly integrating reverse osmosis into their zero-liquid discharge (ZLD) strategies, minimizing water waste and reducing their environmental footprint.

Moreover, the growing development of industrial zones such as the Jurong Industrial Estate highlights the increasing demand for scalable RO solutions. With a strong emphasis on sustainability and resource efficiency in Singapore’s industrial operations, the adoption of advanced RO components is poised for continued growth, solidifying the industrial sector as a key end-user in this market.

Some of the top players operating in the Singapore reverse osmosis components market include Grundfos Holding A/S, Hydranautics (A Nitto Group Company), KSB SE & CO KGaA, Toray Industries Inc, etc.

Hydranautics, a Nitto Group Company headquartered in Oceanside, California, is a global leader in membrane technology. The company specializes in providing advanced water treatment solutions, including reverse osmosis (RO), nanofiltration (NF), ultrafiltration (UF), and microfiltration (MF) membranes. Serving a wide range of industries such as municipal, industrial, and commercial sectors, Hydranautics operates across regions including Asia-Pacific, North America, and Europe. In Singapore, the company’s RO components are extensively used in desalination plants, water reuse systems, and ultrapure water applications. Its product portfolio features high-performance membranes such as the ESPA, SWC, and CPA series, which are renowned for their energy efficiency, durability, and superior water purification performance.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2025-2032 |

| Base Year | 2024 |

| Market Historical Years | 2018-2023 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Component, Operating Pressure, Application, and End-User |

| Countries Analyzed | Singapore |

| Companies Analyzed | 3M, Grundfos Holding A/S, Hydranautics (A Nitto Group Company), KSB SE & CO KGaA, Parker Hannifin Corp, Pentair, Toray Industries Inc, Veolia, Xylem |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- INCREASING ADOPTION OF REVERSE OSMOSIS SYSTEMS IN INDUSTRIAL WATER RECYCLING PROJECTS TO ADDRESS URBAN WATER SCARCITY

- GOVERNMENT INITIATIVES LIKE PUB’S WATER SUSTAINABILITY STRATEGIES ARE DRIVING DEMAND FOR HIGH-EFFICIENCY RO COMPONENTS

- SINGAPORE’S ADVANCED INFRASTRUCTURE SUPPORTS RAPID DEPLOYMENT OF MODULAR REVERSE OSMOSIS SYSTEMS IN URBAN SETTINGS

- COLLABORATION WITH GLOBAL RO COMPONENT MANUFACTURERS IS STRENGTHENING SINGAPORE’S POSITION AS A REGIONAL WATER MANAGEMENT HUB

MARKET DYNAMICS

- KEY DRIVERS

- RISING DEMAND FOR FRESHWATER DUE TO POPULATION GROWTH AND URBANIZATION

- INCREASING ADOPTION OF RO SYSTEMS IN INDUSTRIAL WATER TREATMENT

- TECHNOLOGICAL ADVANCEMENTS ARE ENHANCING THE EFFICIENCY AND COST-EFFECTIVENESS OF RO COMPONENTS

- KEY RESTRAINTS

- HIGH ENERGY CONSUMPTION AND OPERATIONAL COSTS OF RO SYSTEMS

- CHALLENGES IN MEMBRANE FOULING AND SCALING ARE AFFECTING LONG-TERM PERFORMANCE

- ENVIRONMENTAL CONCERNS RELATED TO BRINE DISPOSAL FROM RO PROCESSES

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS – WATER TREATMENT SYSTEMS

- ESG FRAMEWORK ANALYSIS IN THE REVERSE OSMOSIS COMPONENTS MARKET

- KEY MARKET TRENDS

- INTEGRATION OF IOT AND SMART TECHNOLOGIES IN RO COMPONENTS FOR REAL-TIME MONITORING

- DEVELOPMENT OF ADVANCED MEMBRANES WITH HIGHER PERMEABILITY AND DURABILITY

- INCREASING USE OF RO TECHNOLOGY IN DESALINATION PROJECTS ACROSS ARID REGIONS

- SHIFT TOWARD SUSTAINABLE AND ENERGY-EFFICIENT RO SYSTEMS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIAL PROCUREMENT AND SUPPLY CHAIN

- COMPONENT MANUFACTURING

- SYSTEM INTEGRATION AND ASSEMBLY

- DISTRIBUTION AND LOGISTICS

- END-USER APPLICATIONS AND INSTALLATION

- AFTER-SALES SERVICES AND MAINTENANCE

- SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET REGULATORY FRAMEWORK AND COMPLIANCE BODIES

- PATENT ANALYSIS

MARKET BY COMPONENT

- CARTRIDGE PREFILTERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ANCILLARY COMPONENTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RO MEMBRANE MODULES

- THIN-FILM

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CELLULOSE ACETATE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- THIN-FILM

- RO PUMPS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PRESSURE VESSELS/HOUSINGS

- FRP

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- STEEL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PVC

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FRP

- CARTRIDGE PREFILTERS

MARKET BY OPERATING PRESSURE

- 10-100 PSI

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 101-400 PSI

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 401 PSI AND ABOVE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 10-100 PSI

MARKET BY APPLICATION

- MUNICIPAL WATER PURIFICATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BRACKISH AND SEAWATER DESALINATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WASTEWATER TREATMENT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MUNICIPAL WATER PURIFICATION

MARKET BY END-USER

- INDUSTRIAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MUNICIPAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AGRICULTURE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- INDUSTRIAL

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- MARKET SHARE ANALYSIS OF TOP PLAYERS (IN %)

- COMPANY PROFILES

- 3M

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GRUNDFOS HOLDING A/S

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HYDRANAUTICS (A NITTO GROUP COMPANY)

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- KSB SE & CO KGAA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PARKER HANNIFIN CORP

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PENTAIR

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TORAY INDUSTRIES INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- VEOLIA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- XYLEM

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- 3M

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – REVERSE OSMOSIS COMPONENTS

TABLE 2: COUNTRY SNAPSHOT – SINGAPORE

TABLE 3: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET REGULATORY FRAMEWORK AND COMPLIANCE BODIES

TABLE 4: PATENT ANALYSIS

TABLE 5: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY COMPONENT, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 6: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY COMPONENT, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 7: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY RO MEMBRANE MODULES, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 8: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY RO MEMBRANE MODULES, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 9: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY PRESSURE VESSELS/HOUSINGS, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 10: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY PRESSURE VESSELS/HOUSINGS, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 11: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY OPERATING PRESSURE, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 12: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY OPERATING PRESSURE, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 13: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 14: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY APPLICATION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 15: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 16: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY END-USER, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 17: LIST OF MERGERS & ACQUISITIONS

TABLE 18: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 19: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 20: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: MAJOR MARKET FINDINGS

FIGURE 2: MARKET DYNAMICS

FIGURE 3: KEY MARKET TRENDS

FIGURE 4: PORTER’S FIVE FORCES ANALYSIS

FIGURE 5: GROWTH PROSPECT MAPPING

FIGURE 6: MARKET MATURITY ANALYSIS

FIGURE 7: MARKET CONCENTRATION ANALYSIS

FIGURE 8: VALUE CHAIN ANALYSIS

FIGURE 9: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2024

FIGURE 10: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY CARTRIDGE PREFILTERS, 2025-2032 (IN $ MILLION)

FIGURE 11: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY ANCILLARY COMPONENTS, 2025-2032 (IN $ MILLION)

FIGURE 12: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY RO MEMBRANE MODULES, 2025-2032 (IN $ MILLION)

FIGURE 13: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY RO MEMBRANE MODULES, IN 2024

FIGURE 14: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY THIN-FILM, 2025-2032 (IN $ MILLION)

FIGURE 15: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY CELLULOSE ACETATE, 2025-2032 (IN $ MILLION)

FIGURE 16: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY RO PUMPS, 2025-2032 (IN $ MILLION)

FIGURE 17: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY PRESSURE VESSELS/HOUSINGS, 2025-2032 (IN $ MILLION)

FIGURE 18: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY PRESSURE VESSELS/HOUSINGS, IN 2024

FIGURE 19: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY FRP, 2025-2032 (IN $ MILLION)

FIGURE 20: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY STEEL, 2025-2032 (IN $ MILLION)

FIGURE 21: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY PVC, 2025-2032 (IN $ MILLION)

FIGURE 22: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY OPERATING PRESSURE, IN 2024

FIGURE 23: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY 10-100 PSI, 2025-2032 (IN $ MILLION)

FIGURE 24: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY 101-400 PSI, 2025-2032 (IN $ MILLION)

FIGURE 25: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY 401 PSI AND ABOVE, 2025-2032 (IN $ MILLION)

FIGURE 26: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2024

FIGURE 27: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY MUNICIPAL WATER PURIFICATION, 2025-2032 (IN $ MILLION)

FIGURE 28: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY BRACKISH AND SEAWATER DESALINATION, 2025-2032 (IN $ MILLION)

FIGURE 29: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY WASTEWATER TREATMENT, 2025-2032 (IN $ MILLION)

FIGURE 30: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY OTHER APPLICATIONS, 2025-2032 (IN $ MILLION)

FIGURE 31: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2024

FIGURE 32: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY INDUSTRIAL, 2025-2032 (IN $ MILLION)

FIGURE 33: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY MUNICIPAL, 2025-2032 (IN $ MILLION)

FIGURE 34: SINGAPORE REVERSE OSMOSIS COMPONENTS MARKET, BY AGRICULTURE, 2025-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

UNITED STATES TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

GERMANY TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

CHINA TRADING CARD GAME (TCG) MARKET FORECAST 2025-2032

-

INDIA WIND ENERGY MARKET FORECAST 2025-2032

-

INDIA SOLAR ENERGY MARKET FORECAST 2025-2032

-

INDIA GREEN HYDROGEN MARKET FORECAST 2025-2032

-

INDIA GREEN BUILDING MATERIAL MARKET FORECAST 2025-2032

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032