GLOBAL RODENT CONTROL MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

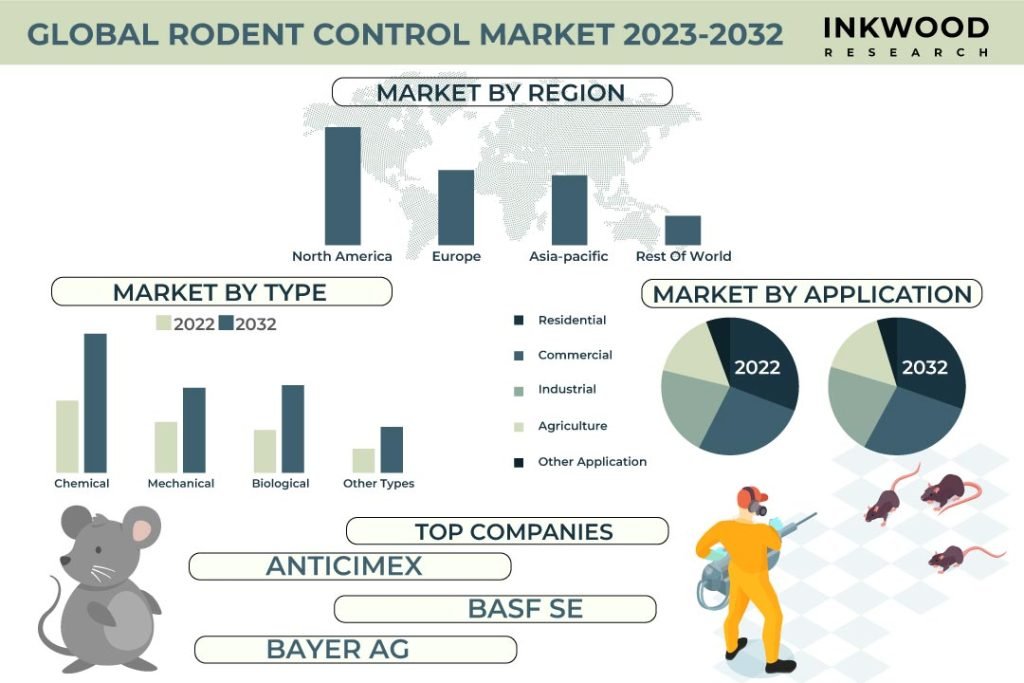

Global Rodent Control Market by Type (Chemical, Mechanical, Biological, Other Types) Market by Application (Residential, Commercial, Industrial, Agriculture, Other Applications) by Geography

REPORTS » CHEMICALS AND MATERIALS » SPECIALTY CHEMICALS » GLOBAL RODENT CONTROL MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global rodent control market was valued at $2844.99 million in 2022 and is expected to reach $5369.39 million by 2032, growing at a CAGR of 6.52% during the forecast period 2023-2032. The base year considered for the study is 2022, and the estimated period is between 2022 and 2032. The market study has also analyzed the impact of COVID-19 on the rodent control market qualitatively as well as quantitatively.

Rodent control encompasses a comprehensive array of strategies and practices designed to manage and prevent the proliferation of rodents, with a primary focus on mice and rats, across diverse settings such as residential households, commercial enterprises, and agricultural landscapes. Rodents can serve as vectors of disease, wreak havoc on infrastructure, and taint essential food stores.

A successful rodent control regimen typically calls for a multifaceted approach, incorporating elements like the sealing of entry points to obstruct their access, deploying traps and baits for targeted extermination, adhering to stringent sanitation protocols to eradicate potential food sources, and, in some cases, enlisting the expertise of professional pest control services. By diligently implementing these measures, rodent control not only fortifies human health and safeguards valuable property but also effectively mitigates the detrimental consequences associated with rampant rodent infestations.

Read our latest blog on the Rodent Control Market

GROWTH ENABLERS

Key growth enablers of the global rodent control market:

- Rising awareness about the health and economic risks associated with rodent infestation

- Surge in the incidences of pest–borne diseases

- The incidence of pest-borne diseases, such as Lyme disease and dengue fever, is increasing. This is driving the demand for rodent control services, as rodents are often vectors of these diseases.

- Rodents are a major public health and economic threat. They can carry and transmit a variety of diseases to humans, including leptospirosis, salmonellosis, and hantavirus pulmonary syndrome.

- Increasing urbanization and population growth

- A growing number of businesses are turning to rodent control solutions

GROWTH RESTRAINTS

Key growth restraining factors of the global rodent control market:

- Environmental concerns associated with rodenticide chemicals

- High cost of rodent control products and services

- Government restrictions affecting the rodent control market

- Government restrictions in the rodent control industry encompass a range of measures. Some administrations have imposed restrictions on the use of rodenticides, including bans on specific types or prerequisites for pest control companies to acquire special permits for usage.

- These limitations, while driven by environmental and health concerns, can pose challenges by increasing the complexity and cost of rodent control efforts for service providers.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Rodent Control Market | Top Trends

- Eco-friendly rodent control solutions are gaining popularity due to their numerous advantages over traditional methods. These eco-friendly approaches are not only safer for people, pets, and the environment, but they are often more effective and sustainable as well. A study conducted by the University of California, Davis found that eco-friendly rodent control methods are not only as effective as traditional methods but, in some instances, even more effective. This comprehensive research compared the effectiveness of various eco-friendly rodent control approaches, including trapping, natural repellents, and biological control, to conventional methods like rodenticides. The study’s results revealed that eco-friendly rodent control methods were just as proficient as traditional approaches in reducing rodent populations. In some cases, these eco-friendly methods outperformed traditional methods. For example, trapping was found to be more effective than rodenticides in reducing populations of Norway rats.

- The global rodent control market has witnessed a significant shift in how individuals and businesses approach pest management, with a growing trend towards DIY pest control. The DIY pest control for rodents comprises traps, repellents, and poisons, all readily accessible to homeowners without requiring specialized expertise. This trend empowers consumers by offering accessible, cost-effective, and user-friendly solutions to address rodent infestations. With a wide range of DIY products and resources available, individuals can do pest control by themselves. DIY pest control methods often provide cost savings compared to professional services, making it an attractive option for households and budget-conscious small businesses.

MARKET SEGMENTATION

Market Segmentation –Type and Application –

Market by Type:

- Chemical

- Chemical rodenticides is the largest revenue-generating type.

- Chemical rodenticides are purpose-designed substances formulated for the extermination of rodents. These compounds commonly derive from anticoagulants that impede blood clotting or neurotoxins targeting the nervous system.

- They are available in various forms, including baits, powders, liquids, and gels, and are accessible through over-the-counter purchase or consultation with pest control professionals.

- Mechanical

- Biological

- Other Types

Market by Application:

- Residential

- Commercial

- Commercial is estimated to be the fastest-growing application in the global rodent control market.

- Rodent control is of significant importance in the commercial sector, where businesses must contend with potential health risks, property damage, and regulatory compliance.

- Rodents can carry diseases that pose a direct threat to the health of employees and customers, with infections like salmonellosis, leptospirosis, and hantavirus pulmonary syndrome being a concern. Moreover, the potential contamination of food and water sources by rodents’ droppings and urine creates an added risk for businesses, particularly those in the food industry.

- Industrial

- Agriculture

- Other Applications

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- North America is set to be the largest market for rodent control during the forecast period.

- The North American food industry has strict regulations in place to ensure food safety. Rodents can contaminate food and spread diseases, so there is a high demand for rodent control services in the food & beverage sector.

- Governments in North America are increasingly implementing regulations related to rodent control. For example, many cities have regulations in place that require restaurants and other food establishments to have regular rodent inspections.

- There is a growing demand for sustainable rodent control solutions in North America that are safe for the environment and human health. This is leading to the development of new and innovative rodent control products and services.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Thailand, Indonesia, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global rodent control market:

- Anticimex

- Ecolab Inc

- Rollins Inc

- Rentokil Initial Plc

- BASF SE

Key strategies adopted by some of these companies:

- In April 2023, Rollins Inc completed the acquisition of Fox Pest Control, a pest management company.

- In May 2022, German chemical company Bayer announced the sale of its pest control division to private equity firm Cinven.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Type and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Bayer AG, BASF SE, Anticimex, Ecolab Inc, Neogen Corporation, Rentokil Initial Plc, Syngenta AG, Rollins Inc, Senestech Corporation, Terminix, Orkin Pest Control, Abell Pest Control, Plunketts Pest Control Inc, Mccloud Services, Pelgar International |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- INCREASING SHIFT TOWARDS INTEGRATED PEST MANAGEMENT (IPM)

- MANUFACTURERS NEED TO BE COMPLIANT WITH REGULATIONS

- RESIDENTIAL AND COMMERCIAL END-USERS DOMINATED THE RODENT CONTROL MARKET

MARKET DYNAMICS

- KEY DRIVERS

- RISING AWARENESS ABOUT THE HEALTH AND ECONOMIC RISKS ASSOCIATED WITH RODENT INFESTATION

- SURGE IN THE INCIDENCES OF PEST–BORNE DISEASES

- INCREASING URBANIZATION AND POPULATION GROWTH

- A GROWING NUMBER OF BUSINESSES ARE TURNING TO RODENT CONTROL SOLUTIONS

- KEY RESTRAINTS

- ENVIRONMENTAL CONCERNS ASSOCIATED WITH RODENTICIDE CHEMICALS

- HIGH COST OF RODENT CONTROL PRODUCTS AND SERVICES

- GOVERNMENT RESTRICTIONS AFFECTING THE RODENT CONTROL MARKET

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS: PEST CONTROL MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- KEY BUYING CRITERIA

- EFFECTIVENESS

- EASE OF USE

- SAFETY

- LONGEVITY

MARKET BY TYPE

- CHEMICAL

- MECHANICAL

- BIOLOGICAL

- OTHER TYPES

MARKET BY APPLICATION

- RESIDENTIAL

- COMMERCIAL

- INDUSTRIAL

- AGRICULTURE

- OTHER APPLICATIONS

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA RODENT CONTROL MARKET DRIVERS

- NORTH AMERICA RODENT CONTROL MARKET CHALLENGES

- NORTH AMERICA RODENT CONTROL MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA RODENT CONTROL MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE AND & ESTIMATES

- EUROPE RODENT CONTROL MARKET DRIVERS

- EUROPE RODENT CONTROL MARKET CHALLENGES

- EUROPE RODENT CONTROL MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE RODENT CONTROL MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET ESTIMATES & SIZES

- ASIA-PACIFIC RODENT CONTROL MARKET DRIVERS

- ASIA-PACIFIC RODENT CONTROL MARKET CHALLENGES

- ASIA-PACIFIC RODENT CONTROL MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC RODENT CONTROL MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET ESTIMATES & SIZES

- REST OF WORLD RODENT CONTROL MARKET DRIVERS

- REST OF WORLD RODENT CONTROL MARKET CHALLENGES

- REST OF WORLD RODENT CONTROL MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD RODENT CONTROL MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA RODENT CONTROL MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIP & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ABELL PEST CONTROL

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ANTICIMEX

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- BASF SE

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- BAYER AG

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ECOLAB INC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- MCCLOUD SERVICES

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- NEOGEN CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ORKIN PEST CONTROL

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- PELGAR INTERNATIONAL

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- PLUNKETTS PEST CONTROL INC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- RENTOKIL INITIAL PLC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ROLLINS INC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- SENESTECH CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- SYNGENTA AG

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- TERMINIX

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ABELL PEST CONTROL

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – RODENT CONTROL

TABLE 2: GLOBAL RODENT CONTROL MARKET, BY TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL RODENT CONTROL MARKET, BY TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL CHEMICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL CHEMICAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL MECHANICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL MECHANICAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL BIOLOGICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL BIOLOGICAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL OTHER TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL OTHER TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL RODENT CONTROL MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL RODENT CONTROL MARKET, BY APPLICATION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL RESIDENTIAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL RESIDENTIAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL COMMERCIAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL COMMERCIAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL INDUSTRIAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL INDUSTRIAL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL AGRICULTURE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL AGRICULTURE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL RODENT CONTROL MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL RODENT CONTROL MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: NORTH AMERICA RODENT CONTROL MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: NORTH AMERICA RODENT CONTROL MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: NORTH AMERICA RODENT CONTROL MARKET REGULATORY FRAMEWORK

TABLE 29: KEY PLAYERS OPERATING IN NORTH AMERICA RODENT CONTROL MARKET

TABLE 30: EUROPE RODENT CONTROL MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: EUROPE RODENT CONTROL MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: EUROPE RODENT CONTROL MARKET REGULATORY FRAMEWORK

TABLE 33: KEY PLAYERS OPERATING IN EUROPE RODENT CONTROL MARKET

TABLE 34: ASIA-PACIFIC RODENT CONTROL MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: ASIA-PACIFIC RODENT CONTROL MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: ASIA-PACIFIC RODENT CONTROL MARKET REGULATORY FRAMEWORK

TABLE 37: KEY PLAYERS OPERATING IN ASIA-PACIFIC RODENT CONTROL MARKET

TABLE 38: REST OF WORLD RODENT CONTROL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: REST OF WORLD RODENT CONTROL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 40: REST OF WORLD RODENT CONTROL MARKET REGULATORY FRAMEWORK

TABLE 41: KEY PLAYERS OPERATING IN REST OF WORLD RODENT CONTROL MARKET

TABLE 42: LIST OF MERGERS & ACQUISITIONS

TABLE 43: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 44: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 45: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: KEY BUYING CRITERIA

FIGURE 10: GLOBAL RODENT CONTROL MARKET, GROWTH POTENTIAL, BY TYPE, IN 2022

FIGURE 11: GLOBAL RODENT CONTROL MARKET, BY CHEMICAL, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL RODENT CONTROL MARKET, BY MECHANICAL, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL RODENT CONTROL MARKET, BY BIOLOGICAL, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL RODENT CONTROL MARKET, BY OTHER TYPES, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL RODENT CONTROL MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2022

FIGURE 16: GLOBAL RODENT CONTROL MARKET, BY RESIDENTIAL, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL RODENT CONTROL MARKET, BY COMMERCIAL, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL RODENT CONTROL MARKET, BY INDUSTRIAL, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL RODENT CONTROL MARKET, BY AGRICULTURE, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL RODENT CONTROL MARKET, BY OTHER APPLICATIONS, 2023-2032 (IN $ MILLION)

FIGURE 21: NORTH AMERICA RODENT CONTROL MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 22: UNITED STATES RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 23: CANADA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 24: EUROPE RODENT CONTROL MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 25: UNITED KINGDOM RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 26: GERMANY RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: FRANCE RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: ITALY RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: SPAIN RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: BELGIUM RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: POLAND RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: REST OF EUROPE RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: ASIA-PACIFIC RODENT CONTROL MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 34: CHINA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: JAPAN RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: INDIA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: SOUTH KOREA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: INDONESIA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: THAILAND RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: VIETNAM RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: AUSTRALIA & NEW ZEALAND RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: REST OF ASIA-PACIFIC RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: REST OF WORLD RODENT CONTROL MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 44: LATIN AMERICA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: MIDDLE EAST & AFRICA RODENT CONTROL MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

Asia-Pacific is the fastest-growing region in the global rodent control market.

The growth of e-commerce platforms has made it easier for consumers to access rodent control products and services online, expanding the market’s reach.

Residential is the largest revenue-generating application in the global rodent control market.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032