GLOBAL PROTEIN INGREDIENTS MARKET FORECAST 2017-2024

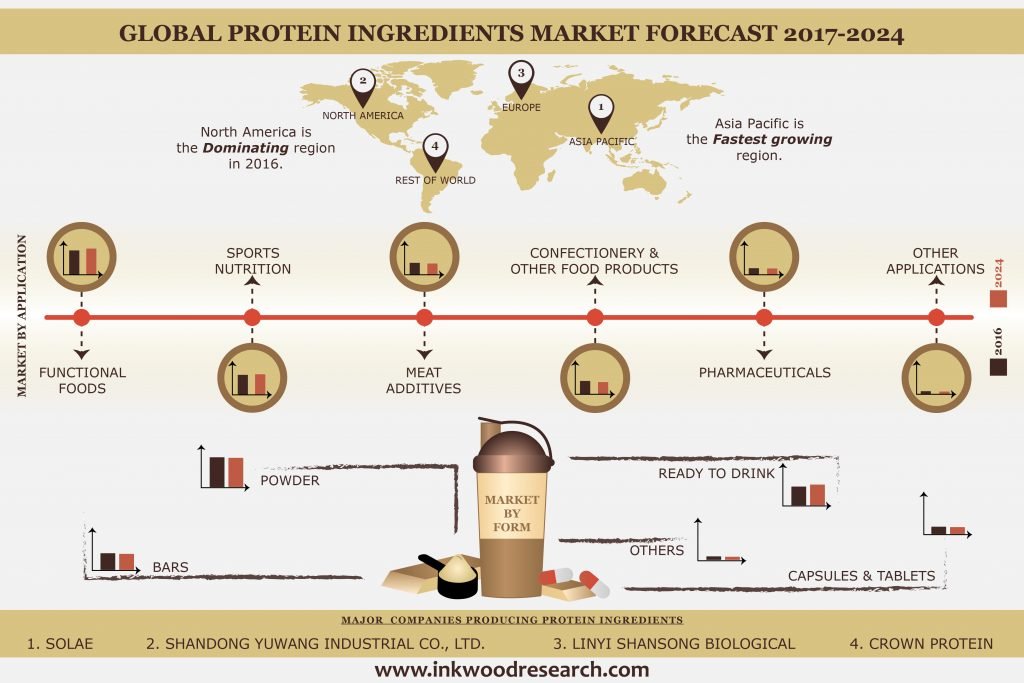

Global Protein Ingredients Market by Feedstock(Soy, Wheat, Pea, Canola, Whey, Milk, Casein, Egg, Beef, Pork) by Form(Powder, Bars, Ready to Drink, Capsules & Tablets) by Application(Functional Foods, Sports Nutrition, Meat Additives, Confectionery & Other Food Products, Pharmaceuticals) & by Geography

The global protein ingredients market is expected to grow from 4,513.49-kilo tons in 2016 to 6101.5-kilo tons by 2024, at a CAGR of 3.87% between 2017 and 2024. The base year considered for the study is 2016 and the forecast period is between 2017 and 2024. Shifting focus towards health benefits from dietary consumption along with strong application in cosmetic and food & beverages sector have led to an increase in demand of the protein ingredients market. Also, in the developing countries, the rising disposable incomes of the consumers have led to an increase in the demand for protein ingredients.

On the basis of feedstock, global protein ingredients market is segmented into the egg, pork, pea, soy, wheat, canola, whey, milk, beef, casein and others. Whey and soy, currently have the largest market share in global market. Due to the rising food safety concerns regarding proteins derived from animals, consumers are shifting towards proteins like pea, soybean, and canola. Soy protein is a major consumable protein, for those who are sensitive to dairy products or are looking for other protein options. Also due to its low-calorie content, wheat protein is more in demand in the dietary supplements market, particularly, in the weight management nutrition.

To learn more about this report, request a free sample copy

The global protein ingredients market is also segmented on the type of form i.e. powder, ready to drink, tablets, bars, capsules and other forms. Currently, the powder form of protein ingredients holds the largest market share and it is expected to continue its dominance during the forecast period. The powder form of the protein is more popular than any other forms of protein as it is considered as one of the purest forms of the protein. The shelf life of powdered protein is much more than liquid and bars forms. However, the ready to drink protein market is expected to grow fast during the forecast period. Ease of intake and digestion and a rise in the demand for overall convenience foods and beverages has resulted in a higher demand for ready to drink form of protein ingredients.

Geographically, global protein ingredient market is segmented into North America, Europe, Asia-Pacific and Rest of world. Currently, Europe has the lion share of the market, however, a tough competition is expected from North America in the coming years. Increasing demand for high protein products has been a major driving force for growth in Europe. Also, Asia-Pacific is expected to grow fast during the forecast period. Higher availability of wide range of protein ingredient feedstock due to prevalent diverse agro-climatic zones defines the strong potential of Asia-Pacific in the market.

Marketing strategies by major companies, increasing preferences for protein ingredients, increasing awareness regarding functional properties, and technological advancements are some of the major drivers in global protein ingredients market. Increase in the expenditure by companies involved in protein ingredients supply backed by raising awareness among consumers will continue to drive higher demand. Also, a rise in the disposable incomes has resulted in an increase in the demand for a quality protein which is available in different forms.

Archer Daniels Midland Company, Solae, Shandong Sinoglory Health Food Company, Ltd, Solbar, Ltd, Nutripea, Harbin Hi-Tech Soybean Food Co., Ltd, Linyi Shansong Biological Products Co Ltd, Crown Protein are some of the major companies in global protein ingredients market. Overall, the strategy of the competing companies is to mark a unique position in the global market. Therefore, the protein ingredients producers are focused on collaborating with companies to tap new markets for product sales and distribution and gain various advantages in the entire value chain of the protein ingredients market.

- RESEARCH SCOPE

- STUDY DELIVERABLES

- SCOPE OF THE STUDY MARKET AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- EXECUTIVE SUMMARY

- MARKET DETERMINANTS

- MARKET DRIVERS

- MARKETING STRATEGIES BY MAJOR COMPANIES

- INCREASING PREFERENCES FOR PROTEIN INGREDIENTS

- INCREASING AWARENESS REGARDING FUNCTIONAL PROPERTIES

- TECHNOLOGICAL ADVANCEMENTS

- MARKET RESTRAINTS

- AVAILABILITY OF SUBSTITUTE

- HEALTH CONCERNS

- MARKET OPPORTUNITIES

- INCREASING MARKET FOR WEIGHT MANAGEMENT

- INCREASING DEMAND IN SPORTS NUTRITION SEGMENT

- GROWING DISTRIBUTION NETWORK GLOBALLY

- INCREASING APPLICATION IN VARIOUS INDUSTRY

- MARKET CHALLENGES

- LACK OF HEALTH BENEFIT KNOWLEDGE

- CHANGING CLIMATES IN DIFFERENT REGIONS AFFECTING PRODUCTIVITY

- RISING PRICES OF COMMODITIES

- EMERGING MARKETS FOR PROTEINS

- INTRODUCTION

- TREND IN PROTEIN CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES EXPORTS AND IMPORTS

- PRODUCT LIFECYCLE OF PROTEINS

- PRODUCT PORTFOLIO MAPPING

- INNOVATIONS IN PRODUCTS/PROCESS IN PROTEINS

- MARKET DRIVERS

- MARKET SEGMENTATION

- BY FEEDSTOCK

- SOY

- WHEAT

- PEA

- CANOLA

- WHEY

- MILK

- CASEIN

- EGG

- BEEF

- PORK

- OTHER FEEDSTOCK

- BY FORM

- POWDER

- BARS

- READY TO DRINK

- CAPSULES & TABLETS

- OTHER FORMS

- BY APPLICATION

- FUNCTIONAL FOODS

- SPORTS NUTRITION

- MEAT ADDITIVES

- CONFECTIONERY & OTHER FOOD PRODUCTS

- PHARMACEUTICALS

- OTHER APPLICATIONS

- BY FEEDSTOCK

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- BARGAINING POWER OF SUPPLIERS

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF BUYERS

- THREAT OF SUBSTITUTES

- COMPETITIVE RIVALRY BETWEEN EXISTING PLAYERS

- VALUE CHAIN ANALYSIS

- SUPPLY CHAIN ANALYSIS

- BCCS ANALYSIS

- PRICE TREND ANALYSIS

- PORTER’S FIVE FORCE MODEL

- REGIONAL ANALYSIS

- NORTH AMERICA

- US

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- THAILAND

- INDIA

- AUSTRALIA

- REST OF ASIA-PACIFIC (ROAPAC)

- REST OF WORLD

- BRAZIL

- EGYPT

- SOUTH AFRICA

- OTHERS

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- INTRODUCTION

- STRATEGIES ADOPTED BY KEY PLAYERS

- CAPACITY ANALYSIS- BY COMPANY

- PRODUCT ANALYSIS- BY COMPANY

- PRICE ANALYSIS- BY COMPANY

- COMPANY PROFILES

- ARCHER DANIELS MIDLAND COMPANY

- SOLAE

- SHANDONG YUWANG INDUSTRIAL CO., LTD

- SHANDONG SINOGLORY HEALTH FOOD CO., LTD

- GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD

- SOLBAR

- NUTRIPEA

- HARBIN HI-TECH SOYBEAN FOOD CO., LTD

- LINYI SHANSONG BIOLOGICAL PRODUCTS CO LTD

- CROWN PROTEIN

TABLE LIST

TABLE 1 INNOVATIONS IN PRODUCTS/PROCESS IN PROTEINS

TABLE 2 GLOBAL PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK, (2014-2019), KILO TONS

TABLE 3 GLOBAL PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK, (2020-2024), KILO TONS

TABLE 4 GLOBAL PROTEIN INGREDIENTS MARKET, BY SOY, (2014-2019), KILO TONS

TABLE 5 GLOBAL PROTEIN INGREDIENTS MARKET, BY SOY, (2020-2024), KILO TONS

TABLE 6 GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEAT, (2014-2019), KILO TONS

TABLE 7 GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEAT, (2020-2024), KILO TONS

TABLE 8 GLOBAL PROTEIN INGREDIENTS MARKET, BY PEA, (2014-2019), KILO TONS

TABLE 9 GLOBAL PROTEIN INGREDIENTS MARKET, BY PEA, (2020-2024), KILO TONS

TABLE 10 GLOBAL PROTEIN INGREDIENTS MARKET, BY CANOLA, (2014-2019), KILO TONS

TABLE 11 GLOBAL PROTEIN INGREDIENTS MARKET, BY CANOLA, (2020-2024), KILO TONS

TABLE 12 GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEY, (2014-2019), KILO TONS

TABLE 13 GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEY, (2020-2024), KILO TONS

TABLE 14 GLOBAL PROTEIN INGREDIENTS MARKET, BY MILK, (2014-2019), KILO TONS

TABLE 15 GLOBAL PROTEIN INGREDIENTS MARKET, BY MILK, (2020-2024), KILO TONS

TABLE 16 GLOBAL PROTEIN INGREDIENTS MARKET, BY CASEIN, (2014-2019), KILO TONS

TABLE 17 GLOBAL PROTEIN INGREDIENTS MARKET, BY CASEIN, (2020-2024), KILO TONS

TABLE 18 GLOBAL PROTEIN INGREDIENTS MARKET, BY EGG, (2014-2019), KILO TONS

TABLE 19 GLOBAL PROTEIN INGREDIENTS MARKET, BY EGG, (2020-2024), KILO TONS

TABLE 20 GLOBAL PROTEIN INGREDIENTS MARKET, BY BEEF, (2014-2019), KILO TONS

TABLE 21 GLOBAL PROTEIN INGREDIENTS MARKET, BY BEEF, (2020-2024), KILO TONS

TABLE 22 GLOBAL PROTEIN INGREDIENTS MARKET, BY PORK, (2014-2019), KILO TONS

TABLE 23 GLOBAL PROTEIN INGREDIENTS MARKET, BY PORK, (2020-2024), KILO TONS

TABLE 24 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER SOURCES, (2014-2019), KILO TONS

TABLE 25 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER SOURCES, (2020-2024), KILO TONS

TABLE 26 GLOBAL PROTEIN INGREDIENTS MARKET, BY FORM, (2014-2019), KILO TONS

TABLE 27 GLOBAL PROTEIN INGREDIENTS MARKET, BY FORM, (2020-2024), KILO TONS

TABLE 28 GLOBAL PROTEIN INGREDIENTS MARKET, BY POWDER, (2014-2019), KILO TONS

TABLE 29 GLOBAL PROTEIN INGREDIENTS MARKET, BY POWDER, (2020-2024), KILO TONS

TABLE 30 GLOBAL PROTEIN INGREDIENTS MARKET, BY BARS, (2020-2024), KILO TONS

TABLE 31 GLOBAL PROTEIN INGREDIENTS MARKET, BY BARS, (2014-2019), KILO TONS

TABLE 32 GLOBAL PROTEIN INGREDIENTS MARKET, BY READY TO DRINK, (2014-2019), KILO TONS

TABLE 33 GLOBAL PROTEIN INGREDIENTS MARKET, BY READY TO DRINK, (2020-2024), KILO TONS

TABLE 34 GLOBAL PROTEIN INGREDIENTS MARKET, BY CAPSULES & TABLETS, (2014-2019), KILO TONS

TABLE 35 GLOBAL PROTEIN INGREDIENTS MARKET, BY CAPSULES & TABLETS, (2020-2024), KILO TONS

TABLE 36 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER FORMS, (2014-2019), KILO TONS

TABLE 37 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER FORMS, (2020-2024), KILO TONS

TABLE 38 GLOBAL PROTEIN INGREDIENTS MARKET, BY APPLICATION, (2014-2019), KILO TONS

TABLE 39 GLOBAL PROTEIN INGREDIENTS MARKET, BY APPLICATION, (2020-2024), KILO TONS

TABLE 40 GLOBAL PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL FOODS, (2014-2019), KILO TONS

TABLE 41 GLOBAL PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL FOODS, (2020-2024), KILO TONS

TABLE 42 GLOBAL PROTEIN INGREDIENTS MARKET, BY SPORTS NUTRITION, (2014-2019), KILO TONS

TABLE 43 GLOBAL PROTEIN INGREDIENTS MARKET, BY SPORTS NUTRITION, (2020-2024), KILO TONS

TABLE 44 GLOBAL PROTEIN INGREDIENTS MARKET, BY MEAT ADDITIVES, (2014-2019), KILO TONS

TABLE 45 GLOBAL PROTEIN INGREDIENTS MARKET, BY MEAT ADDITIVES, (2020-2024), KILO TONS

TABLE 46 GLOBAL PROTEIN INGREDIENTS MARKET, BY CONFECTIONERY & OTHER FOOD PRODUCTS, (2014-2019), KILO TONS

TABLE 47 GLOBAL PROTEIN INGREDIENTS MARKET, BY CONFECTIONERY & OTHER FOOD PRODUCTS, (2020-2024), KILO TONS

TABLE 48 GLOBAL PROTEIN INGREDIENTS MARKET, BY PHARMACEUTICALS, (2014-2019), KILO TONS

TABLE 49 GLOBAL PROTEIN INGREDIENTS MARKET, BY PHARMACEUTICALS, (2020-2024), KILO TONS

TABLE 50 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER APPLICATIONS, (2014-2019), KILO TONS

TABLE 51 GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER APPLICATIONS, (2020-2024), KILO TONS

TABLE 52 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY COUNTRY

TABLE 53 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY COUNTRY

TABLE 54 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 55 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 56 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 57 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 58 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 59 NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 60 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 61 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 62 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 63 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 64 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 65 U.S. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 66 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 67 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 68 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 69 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 70 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 71 CANADA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 72 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 73 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 74 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 75 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 76 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 77 MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 78 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY COUNTRY

TABLE 79 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY COUNTRY

TABLE 80 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 81 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 82 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 83 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 84 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 85 EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 86 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 87 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 88 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 89 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 90 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 91 GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 92 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 93 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 94 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 95 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 96 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 97 U.K. PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 98 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 99 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 100 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 101 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 102 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 103 FRANCE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 104 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 105 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 106 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 107 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 108 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 109 ITALY PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 110 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 111 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 112 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 113 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 114 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 115 RUSSIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 116 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 117 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 118 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 119 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 120 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 121 REST OF EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 122 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY COUNTRY

TABLE 123 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY COUNTRY

TABLE 124 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 125 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 126 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 127 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 128 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 129 ASIA PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 130 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 131 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 132 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 133 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 134 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 135 CHINA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 136 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 137 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 138 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 139 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 140 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 141 THAILAND PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 142 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 143 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 144 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 145 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 146 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 147 INDIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 148 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 149 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 150 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 151 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 152 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 153 AUSTRALIA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 154 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 155 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 156 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 157 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 158 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 159 REST OF ASIA-PACIFIC PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 160 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY COUNTRY

TABLE 161 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY COUNTRY

TABLE 162 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 163 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 164 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 165 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 166 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 167 REST OF THE WORLD PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 168 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 169 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 170 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 171 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 172 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 173 BRAZIL PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 174 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 175 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 176 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 177 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 178 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 179 EGYPT PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 180 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 181 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 182 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 183 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 184 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 185 SOUTH AFRICA PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 186 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY TYPE

TABLE 187 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY TYPE

TABLE 188 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY FORM

TABLE 189 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY FORM

TABLE 190 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2014-2019), KILO TONS, BY APPLICATION

TABLE 191 OTHERS PROTEIN INGREDIENTS MARKET SHARE, (2020-2024), KILO TONS, BY APPLICATION

TABLE 192 ADM PROTEIN INGREDIENTS PRODUCTS

TABLE 193 RECENT DEVELOPMENTS OF ADM

TABLE 194 SOLAE PROTEIN INGREDIENTS PRODUCTS

TABLE 195 RECENT DEVELOPMENTS OF SOLAE

TABLE 196 SHANDONG YUWANG INDUSTRIAL CO., LTD PROTEIN INGREDIENTS PRODUCTS

TABLE 197 RECENT DEVELOPMENTS SHANDONG YUWANG INDUSTRIAL CO., LTD

TABLE 198 SHANDONG SINOGLORY HEALTH FOOD CO., LTD PROTEIN INGREDIENTS PRODUCTS

TABLE 199 GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD PRODUCTS

TABLE 200 SOLBAR PROTEIN INGREDIENTS PRODUCTS

TABLE 201 RECENT DEVELOPMENTS OF SOLBAR

TABLE 202 NUTRIPEA PROTEIN INGREDIENTS PRODUCTS

TABLE 203 HARBIN HI-TECH SOYBEAN FOOD CO., LTD PROTEIN INGREDIENTS PRODUCTS

TABLE 204 LINYI SHANSONG BIOLOGICAL PRODUCTS CO. LTD PROTEIN INGREDIENTS PRODUCTS

TABLE 205 CROWN SOYA PROTEIN GROUP PROTEIN INGREDIENTS PRODUCTS

FIGURE LIST

FIGURE 1 RESEARCH METHODOLOGY

FIGURE 2 SOURCE OF PRIMARY DATA

FIGURE 3 SOURCE OF SECONDARY DATA

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 TREND IN EXPORT SHARE OF PROTEIN CONCENTRATES & TEXTURED PROTEIN SUBSTANCES

FIGURE 8 TREND IN IMPORT SHARE OF PROTEIN CONCENTRATES & TEXTURED PROTEIN SUBSTANCES

FIGURE 9 PROTEIN PRODUCT LIFE CYCLE

FIGURE 10 PRODUCT PORTFOLIO MAPPING

FIGURE 11 PROTEIN INGREDIENT PATENTS BASIS-1995-2017

FIGURE 12 TREND IN PROTEIN INGREDIENT PATENTS BASIS-1995-2017

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 SOY AND CANOLA PROTEIN VALUE CHAIN

FIGURE 15 PEA PROTEIN VALUE CHAIN

FIGURE 16 MILK, WHEY, AND CASEIN PROTEIN VALUE CHAIN

FIGURE 17 PROTEIN INGREDIENTS SUPPLY CHAIN

FIGURE 18 BCCS ANALYSIS: PROTEIN INGREDIENTS

FIGURE 19 PROTEIN INGREDIENT PRICE ANALYSIS

FIGURE 20 SHIFT IN PROTEIN INGREDIENT FEEDSTOCK: 2017 VS 2024 MARKET SHARE

FIGURE 21 GROWTH POTENTIAL IN PROTEIN INGREDIENT FEEDSTOCK: 2017 TO 2024

FIGURE 22 SHIFT IN PROTEIN INGREDIENT FORM: 2017 VS 2024 MARKET SHARE

FIGURE 23 GROWTH POTENTIAL IN PROTEIN INGREDIENT FORM: 2017 TO 2024

FIGURE 24 SHIFT IN PROTEIN INGREDIENT APPLICATION: 2017 VS 2024 MARKET SHARE

FIGURE 25 GROWTH POTENTIAL IN PROTEIN INGREDIENT APPLICATION: 2017 TO 2024

FIGURE 26 NORTH AMERICA PROTEIN INGREDIENTS MARKET 2017 MARKET SHARE, 2017-2024 CAGR

FIGURE 27 EUROPE PROTEIN INGREDIENTS MARKET 2017 MARKET SHARE, 2017-2024 CAGR

FIGURE 28 ASIA-PACIFIC PROTEIN INGREDIENTS MARKET 2017 MARKET SHARE, 2017-2024 CAGR

FIGURE 29 STRATEGIES ADOPTED BY MAJOR PLAYERS

FIGURE 30 MAJOR PLAYER’S STRATEGY ANALYSIS PROTEIN INGREDIENTS

FIGURE 31 MAJOR PLAYER’S PRODUCT ANALYSIS PROTEIN INGREDIENTS

FIGURE 32 MAJOR PLAYER’S PRICE ANALYSIS PROTEIN INGREDIENTS

- MARKET SEGMENTATION

- BY FEEDSTOCK

- SOY

- WHEAT

- PEA

- CANOLA

- WHEY

- MILK

- CASEIN

- EGG

- BEEF

- PORK

- OTHER FEEDSTOCK

- BY FORM

- POWDER

- BARS

- READY TO DRINK

- CAPSULES & TABLETS

- OTHER FORMS

- BY APPLICATION

- FUNCTIONAL FOODS

- SPORTS NUTRITION

- MEAT ADDITIVES

- CONFECTIONERY & OTHER FOOD PRODUCTS

- PHARMACEUTICALS

- OTHER APPLICATIONS

- BY FEEDSTOCK

- REGIONAL ANALYSIS

- NORTH AMERICA

- US

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- RUSSIA

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- THAILAND

- INDIA

- AUSTRALIA

- REST OF ASIA-PACIFIC (ROAPAC)

- REST OF WORLD

- BRAZIL

- EGYPT

- SOUTH AFRICA

- OTHERS

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.