GLOBAL POLYLACTIC ACID (PLA) MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

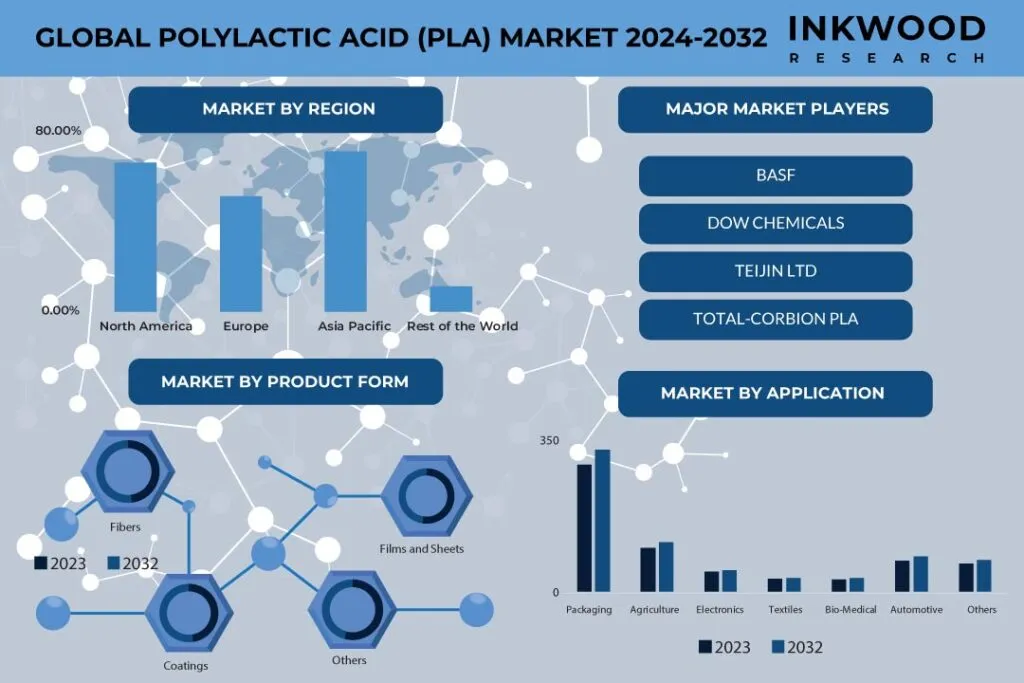

Global Polylactic Acid (PLA) Market by Product Form (Films and Sheets, Coatings, Fibers, Other Product Forms) Market by Application (Packaging, Agriculture, Electronics, Textiles, Medical, Automotive, Other Applications) Market by Raw Material (Corn, Sugarcane & Sugar Beet, Cassava, Other Raw Materials) by Geography

REPORTS » CHEMICALS AND MATERIALS » PLASTICS & POLYMERS, ELASTOMERS » GLOBAL POLYLACTIC ACID (PLA) MARKET FORECAST 2024-2032

MARKET OVERVIEW

In terms of revenue, the global polylactic acid (PLA) market was valued at $xx million in 2023 and is expected to reach $xx million by 2032, growing at a CAGR of 18.26% during the forecast period, 2024-2032.

The global polylactic acid (PLA) market is experiencing robust growth, driven by increasing awareness and adoption of sustainable and eco-friendly materials. Polylactic acid, a biodegradable and bio-based polymer derived from renewable resources such as corn starch or sugarcane, has garnered significant attention as an alternative to traditional petroleum-based plastics. The escalating demand for environmentally responsible solutions, coupled with a growing emphasis on reducing carbon footprints, has propelled the market forward.

As industries seek to align with green initiatives and sustainable manufacturing, polylactic acid emerges as a versatile and biocompatible material suitable for various applications. Packaging (food & beverage packaging, pet food packaging, consumer products packaging) remains a primary sector driving polylactic acid adoption, embracing this bioplastic for its packaging solutions.

Read our latest blog on the Polylactic Acid (PLA) Market

GROWTH ENABLERS

Key growth enablers of the global polylactic acid (PLA) market:

- Increasing demand for sustainable packaging

- As global consciousness about environmental issues rises, consumers and businesses alike are increasingly seeking sustainable alternatives to traditional packaging materials. This shift is fueled by concerns about the ecological impact of non-biodegradable plastics and the desire to reduce the environmental footprint associated with packaging.

- Being biodegradable, polylactic acid breaks down naturally over time, minimizing the accumulation of plastic waste in landfills and oceans. Moreover, its renewable sourcing contributes to reducing dependency on finite fossil resources, aligning with the broader goals of sustainable and circular economies.

- In the packaging industry, polylactic acid’s versatility has led to its adoption in various applications, including food packaging, beverage containers, and other consumer goods. Its ability to maintain the necessary durability and barrier properties while still being compostable positions polylactic acid as a practical choice for companies striving to meet consumer demands for eco-friendly, flexible packaging without compromising on performance.

- Supportive government policies and regulations

- Consumer shift toward green products

GROWTH RESTRAINTS

Key growth restraining factors of the global polylactic acid (PLA) market:

- Relatively higher production costs of polylactic acid (PLA)

- Polylactic acids’ (PLA) limited heat resistance compared to conventional plastics

- Polylactic acid’s inherent limitations in heat resistance stem from its composition, which is derived from renewable resources like corn starch or sugarcane.

- Unlike some petroleum-based plastics that exhibit higher resistance to heat, polylactic acid begins to soften and lose structural integrity at relatively lower temperatures. This makes it less suitable for applications where exposure to heat is a critical factor, such as in hot beverage cups or containers designed for use in microwave ovens.

- Researchers and manufacturers are actively exploring ways to enhance polylactic acid’s thermal properties through various formulations and processing techniques.

- As technology advances, it is likely that polylactic acid’s heat resistance will improve, enabling its broader adoption across a wider spectrum of applications and contributing further to the evolution of sustainable packaging solutions.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Polylactic Acid (PLA) Market | Key Market Trends

- Ongoing research and development initiatives are dedicated to improving polylactic acid’s (PLA) heat resistance. This has resulted in the creation of new polylactic acid variants capable of withstanding higher temperatures, broadening the scope of potential applications beyond its traditional limitations. This development addresses the need for PLA in applications requiring increased heat tolerance, such as hot beverage containers and microwaveable products.

- There is a growing interest in formulating polylactic acid blends by combining them with other bio-based materials. This approach aims to enhance polylactic acid’s overall properties, including strength and flexibility. By creating polylactic acid blends, researchers and manufacturers are expanding the range of applications for this biodegradable polymer, making it more versatile and adaptable to diverse industrial needs. This trend reflects a concerted effort to overcome specific limitations of polylactic acid and promote its adoption in a broader array of industries seeking sustainable and environmentally friendly materials.

MARKET SEGMENTATION

Market Segmentation – Product Form, Application, and Raw Material –

Market by Product Form:

- Films and Sheets

- Coatings

- Fibers

- Other Product Forms

Market by Application:

- Packaging

- Agriculture

- Electronics

- Textiles

- Medical

- In the field of medical devices, polylactic acid is commonly employed for the fabrication of biodegradable sutures and implants. The material’s ability to degrade naturally over time eliminates the need for subsequent removal surgeries, reducing patient discomfort and risks associated with long-term implantation.

- Polylactic acid’s compatibility with medical sterilization methods, such as gamma irradiation and ethylene oxide treatment, further enhances its suitability for medical applications. This makes polylactic acid suitable for manufacturing disposable medical equipment, including hospital gowns, surgical drapes, and trays.

- Additionally, polylactic acid serves as a viable material for drug delivery systems. Its controlled degradation allows for the sustained release of medications, enhancing therapeutic outcomes while minimizing the need for frequent dosing.

- Automotive

- Other Applications

Market by Raw Material:

- Corn

- Corn-based polylactic acid offers several environmental advantages. First, corn is a renewable resource, and its cultivation supports the concept of a closed carbon cycle. The carbon dioxide absorbed by corn during its growth offsets the emissions released during polylactic acid production, making it a carbon-neutral material.

- Furthermore, using corn as a feedstock reduces dependency on finite fossil resources, contributing to the development of a more sustainable and circular economy.

- The use of corn in polylactic acid production aligns with the global push towards bio-based, biodegradable, and environmentally friendly alternatives to traditional plastics.

- While there are discussions about the impact of using food crops for industrial purposes, ongoing research aims to explore non-food biomass sources to ensure the sustainable and responsible development of polylactic acid and other bio-based materials.

- Sugarcane & Sugar Beet

- Cassava

- Other Raw Materials

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- The polylactic acid (PLA) market in North America, encompassing the United States and Canada, is poised for significant growth, driven by several factors contributing to the increasing demand for sustainable and eco-friendly materials.

- One primary driver is the heightened awareness of environmental concerns and a growing preference for sustainable products among consumers and businesses. This shift towards eco-consciousness has spurred a demand for biodegradable alternatives to traditional plastics, with polylactic acid emerging as a frontrunner.

- Both the United States and Canada have witnessed a surge in regulations and initiatives promoting sustainable packaging practices, encouraging the adoption of polylactic acid in the packaging industry.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global polylactic acid (PLA) market:

- BASF

- Danimer Scientific

- Dow Chemicals

- Futerro SA

- Mitsubishi Chemical Holding Corporation

- Teijin Ltd

Key strategies adopted by some of these companies:

- In January 2023, Futerro, a major polylactic acid bioplastics producer, announced a joint venture with PTT Global Chemical to build a large-scale polylactic acid production facility in Thailand, expanding its reach in Southeast Asia.

- NatureWorks LLC, in April 2023, introduced Ingeo biopolymer fiber for nonwoven applications, targeting the hygiene and wipes market with its sustainable and biodegradable properties.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product Form, Application, and Raw Material |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | BASF, Danimer Scientific, Dow Chemicals, Futerro SA, Mitsubishi Chemical Holding Corporation, Teijin Ltd, Good Natured Products Inc, Green Bioplastics, Innovia Films, NatureWorks LLC, Synbra Holding BV, Thyssenkrupp AG, Total-Corbion PLA, Zhejiang Hisun Biomaterials Co Ltd |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES `

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON POLYLACTIC ACID (PLA) MARKET

- MAJOR MARKET FINDINGS

- INCREASING UTILIZATION OF PLA IN BIOMEDICAL APPLICATIONS

- KEY MARKET PLAYERS ACTIVELY ENGAGING IN SUSTAINABILITY INITIATIVES

- INCREASING POPULARITY IN 3D PRINTING DUE TO ITS VERSATILITY

- PLA: POSITIVE ENVIRONMENTAL IMPACT

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING DEMAND FOR SUSTAINABLE PACKAGING

- SUPPORTIVE GOVERNMENT POLICIES AND REGULATIONS

- CONSUMER SHIFT TOWARDS GREEN PRODUCTS

- KEY RESTRAINTS

- RELATIVELY HIGHER PRODUCTION COSTS OF PLA

- PLA’S LIMITED HEAT RESISTANCE COMPARED TO CONVENTIONAL PLASTICS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- FOCUS ON HEAT-RESISTANT PLA VARIANTS

- DEVELOPMENT OF PLA BLENDS

- INTRODUCTION OF HIGH-PERFORMANCE PLA GRADES

- RAPID EXPANSION OF END USE INDUSTRIES INCORPORATING PLA

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIAL SOURCING

- LACTIC ACID PRODUCTION

- MANUFACTURING OF PLA PRODUCTS

- DISTRIBUTION AND LOGISTICS

- CONSUMER USAGE

- KEY BUYING CRITERIA

- BIODEGRADABILITY AND COMPOSTABILITY

- CERTIFICATIONS AND STANDARDS

- QUALITY AND PERFORMANCE

- COST COMPETITIVENESS

- REGULATORY FRAMEWORK

- KEY MARKET TRENDS

MARKET BY PRODUCT FORM

- FILMS AND SHEETS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FIBERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER PRODUCT FORMS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FILMS AND SHEETS

MARKET BY APPLICATION (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: KILOMETRIC TONS)

- PACKAGING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AGRICULTURE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ELECTRONICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TEXTILES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MEDICAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AUTOMOTIVE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PACKAGING

MARKET BY RAW MATERIAL

- CORN

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SUGARCANE & SUGAR BEET

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CASSAVA

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER RAW MATERIALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CORN

GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: KILOMETRIC TONS)

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA POLYLACTIC ACID (PLA) MARKET DRIVERS

- NORTH AMERICA POLYLACTIC ACID (PLA) MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA POLYLACTIC ACID (PLA) MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE POLYLACTIC ACID (PLA) MARKET DRIVERS

- EUROPE POLYLACTIC ACID (PLA) MARKET CHALLENGES

- KEY PLAYERS IN EUROPE POLYLACTIC ACID (PLA) MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- ITALY

- ITLAY POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET DRIVERS

- ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD POLYLACTIC ACID (PLA) MARKET DRIVERS

- REST OF WORLD POLYLACTIC ACID (PLA) MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD POLYLACTIC ACID (PLA)MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA POLYLACTIC ACID (PLA) MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- BASF

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- DANIMER SCIENTIFIC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- DOW CHEMICALS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- FUTERRO SA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GOOD NATURED PRODUCTS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GREEN BIOPLASTICS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- INNOVIA FILMS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MITSUBISHI CHEMICAL HOLDING CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- NATUREWORKS LLC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SYNBRA HOLDING BV

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TEIJIN LTD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- THYSSENKRUPP AG

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TOTAL-CORBION PLA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ZHEJIANG HISUN BIOMATERIALS CO LTD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BASF

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – POLYLACTIC ACID

TABLE 2: REGULATORY FRAMEWORK

TABLE 3: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY PRODUCT FORM, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY PRODUCT FORM, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 5: GLOBAL FILMS AND SHEETS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL FILMS AND SHEETS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 7: GLOBAL COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL COATINGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 9: GLOBAL FIBERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL FIBERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION),

TABLE 11: GLOBAL OTHER PRODUCT FORMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL OTHER PRODUCT FORMS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 13: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 15: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 16: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 17: GLOBAL PACKAGING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL PACKAGING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 19: GLOBAL AGRICULTURE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL AGRICULTURE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 21: GLOBAL ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 23: GLOBAL TEXTILES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL TEXTILES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 25: GLOBAL MEDICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL MEDICAL MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 27: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 29: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 31: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 32: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 33: GLOBAL CORN MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 34: GLOBAL CORN MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 35: GLOBAL SUGARCANE & SUGAR BEET MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 36: GLOBAL SUGARCANE & SUGAR BEET MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 37: GLOBAL CASSAVA MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 38: GLOBAL CASSAVA MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION),

TABLE 39: GLOBAL OTHER RAW MATERIALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 40: GLOBAL OTHER RAW MATERIALS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 41: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 42: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 43: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 44: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 45: NORTH AMERICA POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 46: NORTH AMERICA POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 47: NORTH AMERICA POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 48: NORTH AMERICA POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 49: KEY PLAYERS OPERATING IN NORTH AMERICA POLYLACTIC ACID (PLA) MARKET

TABLE 50: EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 51: EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 52: EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 53: EUROPE POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 54: KEY PLAYERS OPERATING IN EUROPE POLYLACTIC ACID (PLA) MARKET

TABLE 55: ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 56: ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 57: ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 58: ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 59: KEY PLAYERS OPERATING IN ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET

TABLE 60: REST OF WORLD POLYLACTIC ACID (PLA) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 61: REST OF WORLD POLYLACTIC ACID (PLA) MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 62: REST OF WORLD POLYLACTIC ACID (PLA) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN KILOMETRIC TONS)

TABLE 63: REST OF WORLD POLYLACTIC ACID (PLA) MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN KILOMETRIC TONS)

TABLE 64: KEY PLAYERS OPERATING IN REST OF WORLD POLYLACTIC ACID (PLA) MARKET

TABLE 65: LIST OF MERGERS & ACQUISITIONS

TABLE 66: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 67: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: MAJOR MARKET FINDINGS

FIGURE 2: MARKET DYNAMICS

FIGURE 3: KEY MARKET TRENDS

FIGURE 4: PORTER’S FIVE FORCES ANALYSIS

FIGURE 5: GROWTH PROSPECT MAPPING – NORTH AMERICA

FIGURE 6: GROWTH PROSPECT MAPPING – EUROPE

FIGURE 7: GROWTH PROSPECT MAPPING – ASIA-PACIFIC

FIGURE 8: GROWTH PROSPECT MAPPING – REST OF WORLD

FIGURE 9: MARKET MATURITY ANALYSIS

FIGURE 10: MARKET CONCENTRATION ANALYSIS

FIGURE 11: VALUE CHAIN ANALYSIS

FIGURE 12: KEY BUYING CRITERIA

FIGURE 13: GLOBAL POLYLACTIC ACID (PLA) MARKET, GROWTH POTENTIAL, BY PRODUCT FORM, IN 2023

FIGURE 14: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY FILMS AND SHEETS, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY FIBERS, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY OTHER PRODUCT FORMS, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL POLYLACTIC ACID (PLA) MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2023

FIGURE 19: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY PACKAGING, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY AGRICULTURE, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY ELECTRONICS, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY TEXTILES, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY MEDICAL, 2024-2032 (IN $ MILLION)

FIGURE 24 GLOBAL POLYLACTIC ACID (PLA) MARKET, BY AUTOMOTIVE, 2024-2032 (IN $ MILLION)

FIGURE 25: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY OTHER APPLICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 26: GLOBAL POLYLACTIC ACID (PLA) MARKET, GROWTH POTENTIAL, BY RAW MATERIAL, IN 2023

FIGURE 27: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY CORN, 2024-2032 (IN $ MILLION)

FIGURE 28: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY SUGARCANE & SUGAR BEET, 2024-2032 (IN $ MILLION)

FIGURE 29: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY CASSAVA, 2024-2032 (IN $ MILLION)

FIGURE 30: GLOBAL POLYLACTIC ACID (PLA) MARKET, BY OTHER RAW MATERIALS, 2024-2032 (IN $ MILLION)

FIGURE 31: NORTH AMERICA POLYLACTIC ACID (PLA) MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 32: UNITED STATES POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: CANADA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 34: EUROPE POLYLACTIC ACID (PLA) MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 35: UNITED KINGDOM POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: GERMANY POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: FRANCE POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: ITALY POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: SPAIN POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: BELGIUM POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: POLAND POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: REST OF EUROPE POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 44: CHINA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: JAPAN POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: INDIA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 47: SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 48: INDONESIA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: THAILAND POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 50: VIETNAM POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 51: AUSTRALIA & NEW ZEALAND POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 52: REST OF ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 53: REST OF WORLD POLYLACTIC ACID (PLA) MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 54: LATIN AMERICA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FIGURE 55: MIDDLE EAST & AFRICA POLYLACTIC ACID (PLA) MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

Polylactic acid finds applications in various sectors, including packaging (food containers, utensils, films), consumer goods (apparel, toys, furniture), agriculture (mulch films, seed trays), textiles (fibers, nonwovens), and biomedicine (implants, drug delivery systems).

High production costs compared to traditional plastics, limited feedstock availability, and infrastructure for collection and recycling are some of the main challenges hindering the wider adoption of polylactic acid across the global market.

Continued technological advancements, increasing investments in R&D, and focus on circular economy solutions are expected to drive further growth and innovation in the polylactic acid market. Additionally, collaborations between different players and supportive government policies will play a crucial role in expanding polylactic acid’s applications and market reach.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032