GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

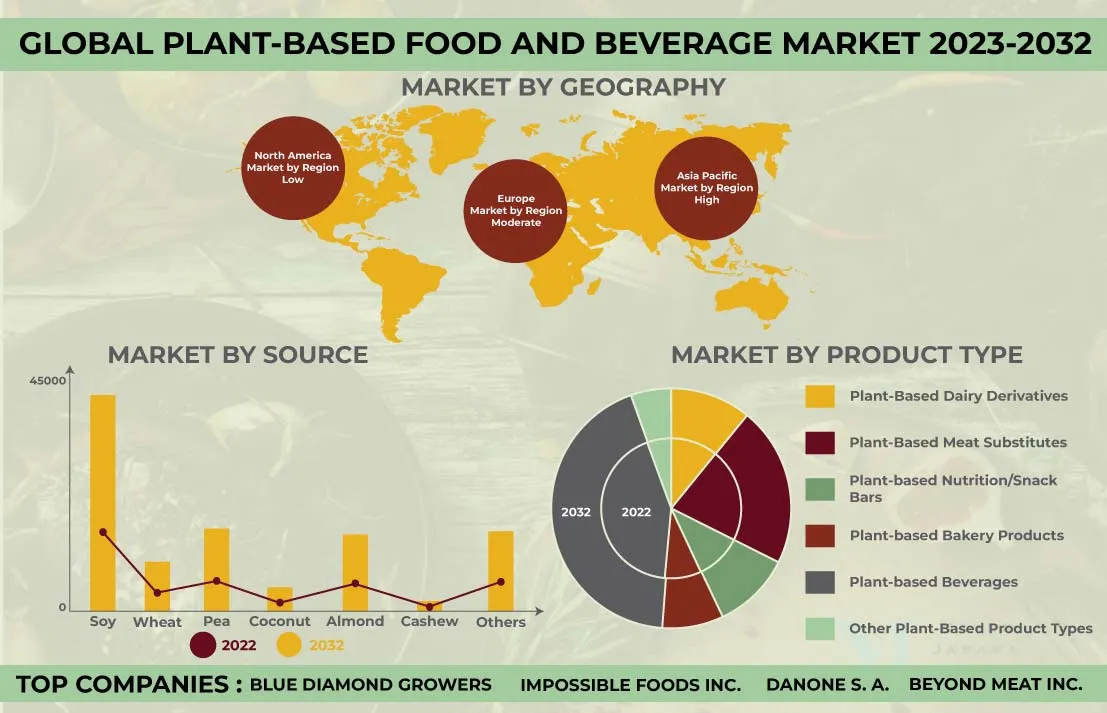

Global Plant-based Food & Beverage Market by Product Type (Plant-based Dairy Derivatives, Plant-based Meat Substitutes, Plant-based Nutrition/snack Bars, Plant-based Bakery Products, Plant-based Beverages, Other Product Types) Market by Source (Soy, Wheat, Pea, Coconut, Almond, Cashew, Other Sources) Market by Storage (Frozen, Refrigerated, Shelf-stable) Market by Distribution Channel (Store-based Distribution Channel, Non-store-based Distribution Channel) by Geography

REPORTS » CONSUMER GOODS » FOOD AND BEVERAGES » GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global plant-based food & beverage market was valued at $38259.20 million in 2022, and is expected to reach $104707.43 million by 2032, growing at a CAGR of 10.79% during the forecast period, 2023-2032.

The term ‘plant-based’ refers to foods and beverages sourced from plants, vegetables, fruits, seeds, nuts, and legumes. They typically contain few to no components of animal sources.

Plant-based food is defined by the Plant Based Foods Association as ‘a finished product consisting of ingredients derived from plants that include vegetables, fruits, whole grains, nuts, seeds and/or legumes (peas, beans, pulses, etc.). Additionally, fungi and algae, although not technically plants, will also be counted towards the percentage of plant-based ingredients.’

Several factors influence the adoption of a plant-based diet, including personal and planetary health concerns. Also, a plant-based diet may generally support a long and healthy life, aid in weight loss, increase energy, and help prevent some chronic diseases. For instance, according to the Good Food Institute, less emphasis on animal-based products may also help reduce the consequences of climate change, save water, encourage responsible land use, and improve animal welfare.

Read our latest blog on the Plant-based Food & Beverage Market

GROWTH ENABLERS

Key growth enablers of the global plant-based food & beverage market are:

- Growing adoption of vegan and vegetarian diets

- Favorable initiatives by governments and associations

- Government initiatives for the plant-based food & beverage industry revolve around increasing the value of agricultural products. In addition, these aim to guarantee the food supply chain’s sustainability and greater producer returns.

- For instance, in addition to enhancing Canada’s standing as a premier supplier of plant proteins, the Canadian government promised to invest $100 million in plant-based meat. It was granted to Merit Functional Foods, which produces animal protein substitutes using homegrown canola plants and yellow peas.

- Consequently, government initiatives are projected to supplement the expanding health and sustainability trends.

- Trending health and sustainability lifestyle choices

- Surging food safety and animal welfare concerns

GROWTH RESTRAINTS

Key growth restraining factors of the global plant-based food & beverage market are:- Challenges associated with sensory properties & allergic reactions of certain plant proteins

- Exorbitant costs of plant-based products

- The market growth for plant-based substitutes is constrained by their high costs compared to animal-based substitutes. In addition, high processing, technological, fortification, and packaging costs hinder market growth.

- For instance, soy protein is a cheap ingredient because it is a byproduct of the soybean oil extraction process and is widely available.

- However, creating tofu from soy and making it acceptable for use as a meat substitute in burgers may require additional processing, which drives up the price of the finished good.

- Accordingly, it is imperative to guarantee competitive prices to make plant-based food items at least as appealing as their conventional counterparts.

KEY MARKET TRENDS

Global Plant-Based Food & Beverage Market | Top Trends

- The seafood category is expected to gain more relevance among the plant-based alternatives to foods and beverages. Although many fish and seafood substitutes are available, most plant-based seafood producers have focused on widely consumed species, including plant-based tuna, plant-based salmon, plant-based lobster, and plant-based prawns.

- A product’s plant-based origins are reflected in and supported by its packaging, further contributing to its sustainability credentials. This is significant since 53% of consumers prefer brands with strong environmental packaging credentials, with many turning away from animal products due to environmental concerns. Comparatively, plant-based beverage cartons have a smaller carbon footprint than alternative packaging made of renewable content paperboard from FSCTM certified and/or regulated sources.

- With more animal-free goods gaining acceptance, plant-based concepts have expanded beyond traditional dairy and meat substitutes. For instance, new product developments like the introduction of plant-based sweets. Turmeric, matcha, goji, black garlic, dragon fruit, hemp, chia, beets, manuka honey, ginger, lingonberries, maca, and mushrooms are among the ingredients in plant-based sweets. They support physical and mental health.

MARKET SEGMENTATION

Market Segmentation – Product Type, Source, Storage, and Distribution Channel –

Market by Product Type:

- Plant-Based Dairy Derivatives

- Plant-Based Ice Cream & Frozen Desserts

- Plant-Based Cheese

- Plant-Based Yoghurt

- Plant-Based Creamer

- Plant-Based Diary Spreads & Dips

- Plant-Based Meat Substitutes

- Textured Vegetable Protein

- Tofu

- Tempeh

- Mycoprotein, Seitan, and Other Meat Substitutes

- Plant-Based Nutrition/Snack Bars

- Plant-Based Bakery Products

- Plant-Based Beverages

- Plant-Based Milk

- Soy Milk

- Almond Milk

- Other Plant-Based Milk

- Packaged Smoothies

- Coffee

- Tea

- Other Plant-Based Beverages

- Other Product Types

- Plant-based beverages are the dominating product type in the market.

- These include aqueous extracts made from the breakdown of cereals, pseudo-cereals, oilseeds of legumes, and nuts, which are primary alternatives to cow’s milk.

Market by Source:

- Soy

- Wheat

- Pea

- Coconut

- Almond

- Almond is the fastest-growing source in the market.

- In the United States, food & drink manufacturers use almonds to produce granola bars, morning cereals, and many other products.

- Besides, companies frequently substitute almond flour for conventional wheat flour due to the increasing demand for gluten-free products.

- Also, given its high-protein and low-fat content, almond milk is becoming increasingly popular, supplementing the segment’s growth.

- Moreover, food & beverage producers are actively committing to R&D to launch commodities like almond-based ice cream, confections, and baked goods.

- Cashew

- Other Sources

Market by Storage:

- Frozen

- Refrigerated

- Shelf-Stable

Market by Distribution Channel:

- Store-Based Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Other Store-Based Distribution Channels

- Non-Store-Based Distribution Channel

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Nordic Countries, and Rest of Europe

- Asia-Pacific: China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is the fastest-growing region in the global plant-based food & beverage market. A significant component of Asian cuisine has always been vegetarian, and the region has successfully embraced the trend for specific vegetarian dishes, such as meat and dairy substitutes.

- Also, a majority of consumers are moving toward plant-based diets due to health, dietary needs, palate preferences, and environmental & animal welfare concerns. Accordingly, this has driven investments in the regional market.

- For instance, the post-pandemic impact, increased environmental consciousness, and rising support for animal rights have facilitated significant growth in the South Korean plant-based food & beverage market.

- Furthermore, the Asia-Pacific plant-based food & beverage market has identified product costs, labeling challenges, and health concerns over over-processing as some of the biggest barriers to the sector becoming generally accepted despite exceptional growth over the previous years.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Some of the major players in the global plant-based food & beverage market are:

- Beyond Meat Inc

- Danone SA

- Nestle SA

- General Mills Inc

- Blue Diamond Growers

Key strategies adopted by some of these companies:

- In September 2022, ADM acquired Comhan, a major South African flavor distributor, facilitating the development of novel products that respond to regional preferences and needs.

- In April 2023, Beyond Meat announced the restaurant launch of Beyond Pepperoni and Beyond Chicken Fillet. The promise of Beyond Meat to provide plant-based proteins with the additional health & environmental advantages of plant-based meat is met by these products.

- In August 2022, ADM and New Culture, a pioneer in animal-free dairy, collaborated to create products that will benefit from New Culture’s advances in new ingredients and animal-free dairy products. Also, this is expected to promote the development and commercialization of plant-based dairy products.

- In December 2022, The Hain Celestial Group Inc announced the completion of the divestiture of its Westbrae Natural® brand, which is now taken over by Bush Brothers & Company.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product Type, Source, Storage, Distribution Channel |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | ADM, Amy’s Kitchen Inc, Beyond Meat Inc, Blue Diamond Growers, Campbell Soup Company, Conagra Brands, Daiya Foods Inc, Danone SA, General Mills Inc, Impossible Foods Inc, KeVita Inc, Living Harvest Tempt, Meatless Farm, Nestle SA, The Hain Celestial Group Inc |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON PLANT-BASED FOOD & BEVERAGE MARKET

- MAJOR MARKET FINDINGS

- EMERGENCE OF HEMP MILK AS A SUBSTITUTE FOR DAIRY-BASED MILK

- FAST FOOD BECOMES PLANT-BASED IN EUROPE AND NORTH AMERICA

MARKET DYNAMICS

- KEY DRIVERS

- GROWING ADOPTION OF VEGAN AND VEGETARIAN DIETS

- FAVORABLE INITIATIVES BY GOVERNMENTS AND ASSOCIATIONS

- TRENDING HEALTH AND SUSTAINABILITY LIFESTYLE CHOICES

- SURGING FOOD SAFETY AND ANIMAL WELFARE CONCERNS

- KEY RESTRAINTS

- CHALLENGES ASSOCIATED WITH SENSORY PROPERTIES & ALLERGIC REACTIONS OF CERTAIN PLANT PROTEINS

- EXORBITANT COSTS OF PLANT-BASED PRODUCTS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

- GROWTH PROSPECT MAPPING FOR SOUTH KOREA

- GROWTH PROSPECT MAPPING FOR BRAZIL

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIAL SUPPLIERS

- FOOD MANUFACTURERS

- DISTRIBUTORS

- END-USERS

MARKET BY PRODUCT TYPE

- PLANT-BASED DAIRY DERIVATIVES

- PLANT-BASED ICE CREAM & FROZEN DESSERTS

- PLANT-BASED CHEESE

- PLANT-BASED YOGURT

- PLANT-BASED CREAMER

- PLANT-BASED DAIRY SPREADS & DIPS

- PLANT-BASED MEAT SUBSTITUTES

- TEXTURED VEGETABLE PROTEIN

- TOFU

- TEMPEH

- MYCOPROTEIN, SEITAN, AND OTHER MEAT SUBSTITUTES

- PLANT-BASED NUTRITION/SNACK BARS

- PLANT-BASED BAKERY PRODUCTS

- PLANT-BASED BEVERAGES

- PLANT-BASED MILK

- SOY MILK

- ALMOND MILK

- OTHER PLANT-BASED MILK

- PACKAGED SMOOTHIES

- COFFEE

- TEA

- OTHER PLANT-BASED BEVERAGES

- PLANT-BASED MILK

- OTHER PRODUCT TYPES

- PLANT-BASED DAIRY DERIVATIVES

MARKET BY SOURCE

- SOY

- WHEAT

- PEA

- COCONUT

- ALMOND

- CASHEW

- OTHER SOURCES

MARKET BY STORAGE

- FROZEN

- REFRIGERATED

- SHELF-STABLE

MARKET BY DISTRIBUTION CHANNEL

- STORE-BASED DISTRIBUTION CHANNEL

- SUPERMARKETS/HYPERMARKETS

- CONVENIENCE STORES

- SPECIALTY STORES

- OTHER STORE-BASED DISTRIBUTION CHANNELS

- NON-STORE-BASED DISTRIBUTION CHANNEL

- STORE-BASED DISTRIBUTION CHANNEL

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET DRIVERS

- NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET CHALLENGES

- NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE PLANT-BASED FOOD & BEVERAGE MARKET DRIVERS

- EUROPE PLANT-BASED FOOD & BEVERAGE MARKET CHALLENGES

- EUROPE PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE PLANT-BASED FOOD & BEVERAGE MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- NORDIC COUNTRIES

- NORDIC COUNTRIES PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET DRIVERS

- ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET CHALLENGES

- ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- MALAYSIA

- MALAYSIA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET DRIVERS

- REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET CHALLENGES

- REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA PLANT-BASED FOOD & BEVERAGE MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- ACQUISITIONS

- PRODUCT LAUNCHES

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ADM

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- AMY’S KITCHEN INC

- COMPANY OVERVIEW

- PRODUCT LIST

- BEYOND MEAT INC

- COMPANY OVERVIEW

- PRODUCT LIST

- BLUE DIAMOND GROWERS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CAMPBELL SOUP COMPANY

- COMPANY OVERVIEW

- PRODUCT LIST

- CONAGRA BRANDS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- DAIYA FOODS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- DANONE SA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GENERAL MILLS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- IMPOSSIBLE FOODS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- KEVITA INC

- COMPANY OVERVIEW

- PRODUCT LIST

- LIVING HARVEST TEMPT

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEATLESS FARM

- COMPANY OVERVIEW

- PRODUCT LIST

- NESTLE SA

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- THE HAIN CELESTIAL GROUP INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ADM

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – PLANT-BASED FOOD & BEVERAGE

TABLE 2: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL PLANT-BASED DAIRY DERIVATIVES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL PLANT-BASED DAIRY DERIVATIVES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED DAIRY DERIVATIVES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED DAIRY DERIVATIVES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL PLANT-BASED ICE CREAM & FROZEN DESSERTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL PLANT-BASED ICE CREAM & FROZEN DESSERTS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL PLANT-BASED CHEESE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL PLANT-BASED CHEESE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL PLANT-BASED YOGURT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL PLANT-BASED YOGURT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL PLANT-BASED CREAMER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL PLANT-BASED CREAMER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL PLANT-BASED DAIRY SPREADS & DIPS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL PLANT-BASED DAIRY SPREADS & DIPS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL PLANT-BASED MEAT SUBSTITUTES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL PLANT-BASED MEAT SUBSTITUTES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MEAT SUBSTITUTES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MEAT SUBSTITUTES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL TOFU MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL TOFU MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL TEMPEH MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL TEMPEH MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL MYCOPROTEIN, SEITAN, AND OTHER MEAT SUBSTITUTES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL MYCOPROTEIN, SEITAN, AND OTHER MEAT SUBSTITUTES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL PLANT-BASED NUTRITION/SNACK BARS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL PLANT-BASED NUTRITION/SNACK BARS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL PLANT-BASED BAKERY PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL PLANT-BASED BAKERY PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL PLANT-BASED BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL PLANT-BASED BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED BEVERAGES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED BEVERAGES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: GLOBAL PLANT-BASED MILK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL PLANT-BASED MILK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 40: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MILK, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MILK, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: GLOBAL SOY MILK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL SOY MILK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: GLOBAL ALMOND MILK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL ALMOND MILK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 46: GLOBAL OTHER PLANT-BASED MILK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL OTHER PLANT-BASED MILK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 48: GLOBAL PACKAGED SMOOTHIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: GLOBAL PACKAGED SMOOTHIES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 50: GLOBAL COFFEE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 51: GLOBAL COFFEE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 52: GLOBAL TEA MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 53: GLOBAL TEA MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 54: GLOBAL OTHER PLANT-BASED BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: GLOBAL OTHER PLANT-BASED BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 56: GLOBAL OTHER PRODUCT TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 57: GLOBAL OTHER PRODUCT TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 58: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SOURCE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 59: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SOURCE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 60: GLOBAL SOY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 61: GLOBAL SOY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 62: GLOBAL WHEAT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 63: GLOBAL WHEAT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 64: GLOBAL PEA MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 65: GLOBAL PEA MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 66: GLOBAL COCONUT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 67: GLOBAL COCONUT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 68: GLOBAL ALMOND MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 69: GLOBAL ALMOND MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 70: GLOBAL CASHEW MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 71: GLOBAL CASHEW MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 72: GLOBAL OTHER SOURCES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 73: GLOBAL OTHER SOURCES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 74: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY STORAGE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 75: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY STORAGE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 76: GLOBAL FROZEN MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 77: GLOBAL FROZEN MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 78: GLOBAL REFRIGERATED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 79: GLOBAL REFRIGERATED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 80: GLOBAL SHELF-STABLE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 81: GLOBAL SHELF-STABLE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 82: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 83: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY DISTRIBUTION CHANNEL, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 84: GLOBAL STORE-BASED DISTRIBUTION CHANNEL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 85: GLOBAL STORE-BASED DISTRIBUTION CHANNEL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 86: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY STORE-BASED DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 87: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY STORE-BASED DISTRIBUTION CHANNEL, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 88: GLOBAL SUPERMARKETS/HYPERMARKETS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 89: GLOBAL SUPERMARKETS/HYPERMARKETS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 90: GLOBAL CONVENIENCE STORES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 91: GLOBAL CONVENIENCE STORES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 92: GLOBAL SPECIALTY STORESMARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 93: GLOBAL SPECIALTY STORESMARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 94: GLOBAL OTHER STORE-BASED DISTRIBUTION CHANNELS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 95: GLOBAL OTHER STORE-BASED DISTRIBUTION CHANNELS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 96: GLOBAL NON-STORE-BASED DISTRIBUTION CHANNEL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 97: GLOBAL NON-STORE-BASED DISTRIBUTION CHANNEL MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 98: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 99: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 100: NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 101: NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 102: NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

TABLE 103: KEY PLAYERS OPERATING IN NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET

TABLE 104: EUROPE PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 105: EUROPE PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 106: EUROPE PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

TABLE 107: KEY PLAYERS OPERATING IN EUROPE PLANT-BASED FOOD & BEVERAGE MARKET

TABLE 108: ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 109: ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 110: ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

TABLE 111: KEY PLAYERS OPERATING IN ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET

TABLE 112: REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 113: REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 114: REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET REGULATORY FRAMEWORK

TABLE 115: KEY PLAYERS OPERATING IN REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET

TABLE 116: LIST OF ACQUISITIONS

TABLE 117: LIST OF PRODUCT LAUNCHES

TABLE 118: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 119: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

FIGURE 5: GROWTH PROSPECT MAPPING FOR SOUTH KOREA

FIGURE 6: GROWTH PROSPECT MAPPING FOR BRAZIL

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2022

FIGURE 11: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED DAIRY DERIVATIVES, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY PLANT-BASED DAIRY DERIVATIVES, IN 2022

FIGURE 13: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED ICE CREAM & FROZEN DESSERTS, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED CHEESE, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED YOGURT, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED CREAMER, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED DAIRY SPREADS & DIPS, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MEAT SUBSTITUTES, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY PLANT-BASED MEAT SUBSTITUTES, IN 2022

FIGURE 20: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY TEXTURED VEGETABLE PROTEIN, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY TOFU, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY TEMPEH, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY MYCOPROTEIN, SEITAN, AND OTHER MEAT SUBSTITUTES, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED NUTRITION/SNACK BARS, 2023-2032 (IN $ MILLION)

FIGURE 25: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED BAKERY PRODUCTS, 2023-2032 (IN $ MILLION)

FIGURE 26: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED BEVERAGES, 2023-2032 (IN $ MILLION)

FIGURE 27: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY PLANT-BASED BEVERAGES, IN 2022

FIGURE 28: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PLANT-BASED MILK, 2023-2032 (IN $ MILLION)

FIGURE 29: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY PLANT-BASED MILK, IN 2022

FIGURE 30: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SOY MILK, 2023-2032 (IN $ MILLION)

FIGURE 31: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY ALMOND MILK, 2023-2032 (IN $ MILLION)

FIGURE 32: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY OTHER PLANT-BASED MILK, 2023-2032 (IN $ MILLION)

FIGURE 33: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PACKAGED SMOOTHIES, 2023-2032 (IN $ MILLION)

FIGURE 34: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY COFFEE, 2023-2032 (IN $ MILLION)

FIGURE 35: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY TEA, 2023-2032 (IN $ MILLION)

FIGURE 36: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY OTHER PLANT-BASED BEVERAGES, 2023-2032 (IN $ MILLION)

FIGURE 37: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY OTHER PRODUCT TYPES, 2023-2032 (IN $ MILLION)

FIGURE 38: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY SOURCE, IN 2022

FIGURE 39: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SOY, 2023-2032 (IN $ MILLION)

FIGURE 40: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY WHEAT, 2023-2032 (IN $ MILLION)

FIGURE 41: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY PEA, 2023-2032 (IN $ MILLION)

FIGURE 42: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY COCONUT, 2023-2032 (IN $ MILLION)

FIGURE 43: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY ALMOND, 2023-2032 (IN $ MILLION)

FIGURE 44: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY CASHEW, 2023-2032 (IN $ MILLION)

FIGURE 45: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY OTHER SOURCES, 2023-2032 (IN $ MILLION)

FIGURE 46: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY STORAGE, IN 2022

FIGURE 47: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY FROZEN, 2023-2032 (IN $ MILLION)

FIGURE 48: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY REFRIGERATED, 2023-2032 (IN $ MILLION)

FIGURE 49: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SHELF-STABLE, 2023-2032 (IN $ MILLION)

FIGURE 50: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY DISTRIBUTION CHANNEL, IN 2022

FIGURE 51: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY STORE-BASED DISTRIBUTION CHANNEL, 2023-2032 (IN $ MILLION)

FIGURE 52: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, GROWTH POTENTIAL, BY STORE-BASED DISTRIBUTION CHANNEL, IN 2022

FIGURE 53: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SUPERMARKETS/HYPERMARKETS, 2023-2032 (IN $ MILLION)

FIGURE 54: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY CONVENIENCE STORES, 2023-2032 (IN $ MILLION)

FIGURE 55: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY SPECIALTY STORES, 2023-2032 (IN $ MILLION)

FIGURE 56: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY OTHER STORE-BASED DISTRIBUTION CHANNELS, 2023-2032 (IN $ MILLION)

FIGURE 57: GLOBAL PLANT-BASED FOOD & BEVERAGE MARKET, BY NON-STORE-BASED DISTRIBUTION CHANNEL, 2023-2032 (IN $ MILLION)

FIGURE 58: NORTH AMERICA PLANT-BASED FOOD & BEVERAGE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 59: UNITED STATES PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 60: CANADA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 61: EUROPE PLANT-BASED FOOD & BEVERAGE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 62: UNITED KINGDOM PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 63: GERMANY PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 64: FRANCE PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 65: ITALY PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 66: SPAIN PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 67: NORDIC COUNTRIES PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 68: REST OF EUROPE PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 69: ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 70: CHINA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 71: JAPAN PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 72: INDIA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 73: SOUTH KOREA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 74: MALAYSIA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 75: THAILAND PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 76: VIETNAM PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 77: AUSTRALIA & NEW ZEALAND PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 78: REST OF ASIA-PACIFIC PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 79: REST OF WORLD PLANT-BASED FOOD & BEVERAGE MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 80: LATIN AMERICA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 81: MIDDLE EAST & AFRICA PLANT-BASED FOOD & BEVERAGE MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

South Korea has the potential to experience exponential growth in the global plant-based food & beverage market.

Store-based distribution channels, which include supermarkets/hypermarkets and convenience stores, offer consumers a one-stop shop, varied goods at competitive prices, and easy accessibility, adding to the segment’s allure.

In the coming years, the global plant-based food & beverage market may offer lucrative opportunities for functional packaging.

RELATED REPORTS

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032

-

TAIWAN BABY DIAPER MARKET FORECAST 2025-2032

-

SOUTH AFRICA BABY DIAPER MARKET FORECAST 2025-2032

-

INDONESIA BABY DIAPER MARKET FORECAST 2025-2032

-

INDIA BABY DIAPER MARKET FORECAST 2025-2032

-

BRAZIL BABY DIAPER MARKET FORECAST 2025-2032

-

AUSTRALIA & NEW ZEALAND BABY DIAPER MARKET FORECAST 2025-2032

-

ALGERIA BABY DIAPER MARKET FORECAST 2025-2032