GLOBAL PAINTS & COATINGS MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

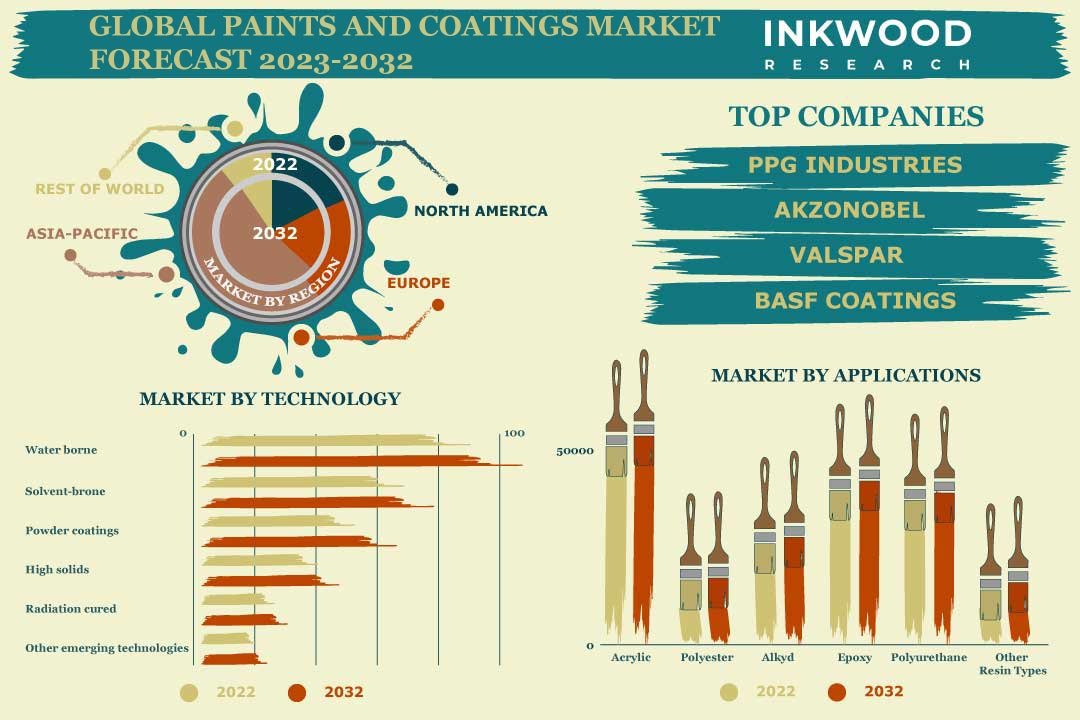

Global Paints & Coatings Market by Resin Type (Acrylic, Polyester, Alkyd, Epoxy, Polyurethane, Other Resin Type) by Technology (Waterborne, Solvent-borne, Powder Coatings, High Solids, Radiation Cured, Other Emerging Technologies) by Applications (Industrial (Automotive, Aerospace & Marine, Industrial Wood Coatings, Consumer Durables, General Industrial, Other Industrial Applications), Architectural (Interior, Exterior)) and by Geography.

REPORTS » CHEMICALS AND MATERIALS » PAINTS AND COATINGS » GLOBAL PAINTS & COATINGS MARKET FORECAST 2023-2032

MARKET OVERVIEW

In terms of revenue, the global paints & coatings market was valued at $148849.22 million in 2022 and is expected to reach $241624.05 million by 2032, growing at a CAGR of 4.97% during the forecast period, 2023 to 2032.

Paints & coatings entail liquid, paste, or powder compounds that are applied to surfaces in layers of varying thicknesses using multiple procedures and equipment, subsequently producing adherent films on the substrate’s surface. Depending on the technique of application, the intended qualities, the substrate to be coated, and environmental and economic constraints, paints constitute a variety of components. A paint’s qualities are defined by its qualitative and quantitative composition, which allows the viscosity, electrical resistance, and drying behavior to be tailored to the application conditions.

Coating is a broad phrase that refers to any material applied to a surface. Besides, they must meet a variety of specifications. Coatings protect the substrate from rusting, deterioration, and mechanical damage, serve as a decorative feature in applications such as automotive coverings, home furnishings, and household items, and are also used to provide information via roadway markings, data signs, and promotions, among others. The paint’s qualities also influence the properties of the coating layer, such as shine, elasticity, durability against scratches, toughness, adhesion, and surface structure. In addition, the cleanliness and absence of dust and oil on the substrate surface are also essential.

Read our latest blog on the Paints And Coatings Market

GROWTH ENABLERS

Key growth enablers of the global paints & coatings market:

- Developments in construction and property sectors

- Due to the rapid increase in population across the globe, the demand for residential construction is considerably increasing, thus augmenting the usage of architectural paints & coatings. This factor, in turn, drives the global paints & coatings market.

- The global construction sector, over the upcoming decade, is expected to expand in real terms by an annual average of 3.2% to a nominal value of more than $6.0 trillion.

- In this regard, the construction sector in the Asia-Pacific has been witnessing steady growth over recent years, given the presence of rapidly emerging economies, swift urbanization, and the increase in infrastructural spending.

- Moreover, the increasing presence of foreign companies in the Asia-Pacific has also created a heightened need for the commercial construction of new buildings, offices, production houses, etc., thus propelling the region’s demand for paint & coatings.

- Thriving furniture sector

- Demand for waterborne paints

- Introduction of personalized solutions

GROWTH RESTRAINTS

Key restraining factors of the global paints & coatings market:

- Environmental concerns

- Uncertainty in raw material prices

- Regulatory challenges

- Paints & coatings are potentially hazardous during the production stages. This is mainly because the manufacturing processes involve high temperatures and high-pressure reactions, which can be dangerous unless controlled carefully.

- In addition, some of these manufactured paints & coatings have adverse impacts on both living organisms and the environment. Due to this, regulations in the global paints & coatings market, primarily in terms of assessing and managing the risks involved in the manufacturing, transporting and disposing of chemicals, have increased.

- Paints & coatings must also be compliant with multifaceted regulations that govern the handling, manufacturing, labeling, as well as shipping and storage of the product.

- Additional compliance costs for these changing regulations, as different countries and geographies have different regulations, further poses a major restraint for paints & coatings companies.

- Geopolitical tensions

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Paints & Coatings Market | Key Market Trends

- A significant degree of improvement has emerged in both paint technology and paint protection technology. Paints have become much harder with the introduction of nano-silica particles into the clearcoats and significant improvements in resin chemistry. Moreover, nanoparticles are also comprehensively used to improve sealant technology, which makes them last up to a year, unlike traditional sealants.

- A new area of interest in the global paints & coatings market is the use of nanotechnology. Thousands of patents have already been issued only for the coatings industry. These nanoparticles, characterized as small ceramic or metallic particles, improve the quality of paint & coating formulations, such as scratch, wear, corrosion, and UV resistance.

- Biocides are also being used in paints in order to improve their longevity while maintaining their quality. Furthermore, biocide additives are designed to safeguard paints from being damaged during storage or to keep fungi and algae from growing on the applied paints. The market for biocides in paints will continue to grow due to the switch from solvent-based to water-based paints as they are not hazardous for human health and the environment, and minimize fungal and algae growth.

MARKET SEGMENTATION

Market Segmentation – Resin Type, Technology, and Application – Market by Resin Type:- Acrylic

- The acrylic segment, under the resin type category, is projected to grow with the highest CAGR of 5.11% during the forecast period.

- Acrylic resins are one of the most widely used polymers in the global paints & coatings market, with the two principal forms being thermoplastic and thermoset.

- While thermoplastic acrylic resins are characterized as synthetic resins acquired by polymerizing various acrylic monomers, thermoset acrylic resins are cured at elevated temperatures by reacting with other polymers.

- Acrylic resins develop properties such as transparency, high colorability, and UV resistance in coating solutions. Moreover, they are often used in waterborne systems, thus resulting in low VOC emissions.

- The application of acrylic coatings leads to high surface hardness. In applications such as decks, roofing, and walls, acrylic coatings offer elastomeric finishes in order to enhance the surface’s UV resistance, if employed with certain fluids.

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- Other Resin Types

- Waterborne

- Solvent-Borne

- Powder Coatings

- Powder coatings is anticipated to be the leading technology during the forecasting years. The segment is mainly dominated by consumer goods and industrial applications.

- Powder coating is the technique of applying dry paint to a part. In a normal wet coating, like automotive coating, the solids are suspended in a liquid carrier, which must evaporate before the production of the solid coating.

- The powder coating process is similar to the liquid coating process, except that the coating is a dry powder rather than a liquid. The powder sticks to the parts due to the electrostatic charging of the powder and grounding of the parts.

- Furthermore, powder coatings are easy to apply and are of higher quality. The powder coating technology is also eco-friendly, as it generates no VOCs.

- High Solids

- Radiation Cured

- Other Technologies

- Aerospace

- Industrial Coating

- Wood Coating

- Protective Coating

- Marine Coating

- Refinish Automotive

- Automotive (OEM)

- The automotive (OEM) segment, under the application category, held the highest revenue share of 15.74% in 2022.

- The automotive industry is one of the major end-users of paints & coatings. Commonly used resins to produce automotive coatings include epoxy, acrylics, polyurethane, and others.

- Automotive coatings are used as protection against material corrosiveness, sunlight, and environmental effects, like acid rain, stone chips, car washing, blowing sand, hot-cold shocks, and UV radiation.

- In the automotive sector, paints & coatings are used in the interior and exterior parts of the vehicle to add a pleasant appeal. They are also used in metallic parts and plastic components for interiors as well as exteriors of the automobile.

- Furthermore, the demand from both categories of the automotive sector (OEM and refinish) is another major factor boosting the need for paints & coatings in the automotive sector.

- Packaging Coating

- Electronic Coating

- Architectural (Interior/Exterior)

- Special Coating

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- Asia-Pacific is set to be the fastest-growing as well as the dominating region during the forecast period, 2023 to 2032.

- Currently, the primary demand generator of Indonesia’s paints & coatings market is the architectural sector. The ambitious goal set by the country’s government to construct 10 million new homes in order to provide low-income individuals with suitable housing is also anticipated to increase the demand for paints & coatings in the upcoming years, thus bolstering the market growth in the Asia-Pacific.

- As one of the few business sectors with strong domestic players and local brands dominating the paints & coatings market in Asia-Pacific, Indonesia has more than 100 paint manufacturers. With a total capacity of 1,500,000 metric tons per year and more than 30,000 employees, the annual national demand equates to about 1,100,000 metric tons.

- Additionally, the market demand from the marine and furniture sectors has grown significantly over recent years. The latter offers vast potential as Indonesia is among the top three furniture manufacturers in ASEAN, alongside Vietnam and Malaysia.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global paints & coatings market:

- Akzo Nobel NV

- Berger Paints India Limited

- Nippon Paint Holdings Co Ltd

- Asian Paints Limited

- Kansai Paint Co Ltd

- Jotun Group

Key strategies adopted by some of these companies:

- Axalta, in March 2021, released the Spies Hecker® Waterborne Full System, its latest full-layer waterborne solution for refinishing. The novel auto refinish coating system aims to bring world-class technology to the refinishing industry, in addition to offering remarkable color performance and a high-quality professional finish.

- In February 2021, PPG acquired VersaFlex from DalFort Capital Partners. VersaFlex’s specialization entails epoxy, polyurea, and polyurethane coatings for water as well as wastewater infrastructure, transportation infrastructure, flooring, and industrial applications.

- Jotun signed an agreement with Wallenius Wilhelmsen in August 2020 to provide its Hull Performance Solutions (HPS) antifouling coating system across 42 vessels in the leading ship-owners’ advanced RoRo fleet.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Resin Type, Technology, Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Akzo Nobel NV, Berger Paints India Limited, Nippon Paint Holdings Co Ltd, Asian Paints Limited, Kansai Paint Co Ltd, Jotun Group, Axalta Coating Systems Ltd, Davies Paints Philippines Inc, Kova Paint Co Ltd, Pacific Paint (Boysen) Philippines Inc (Boysen Paints), PPG Industries Inc, PT Propan Raya ICC, RPM International Inc, The Sherwin-Williams Company, TOA Paint (Thailand) Public Company Limited, Haymes Paint |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- BIOCIDES ARE BEING USED IN PAINTS TO ENHANCE LONGEVITY

- PAINT MANUFACTURING COMPANIES USE LOW/ZERO VOLATILE ORGANIC COMPOUNDS TO ENSURE SAFE PAINT USE

- GLOBAL EXPANSION OF THE PAINTS & COATINGS MARKET FUELED BY RISING M&A ACTIVITY

-

MARKET DYNAMICS

- KEY DRIVERS

- DEVELOPMENTS IN CONSTRUCTION AND PROPERTY SECTORS

- THRIVING FURNITURE SECTOR

- DEMAND FOR WATERBORNE PAINTS

- INTRODUCTION OF PERSONALIZED SOLUTIONS

- KEY RESTRAINTS

- ENVIRONMENTAL CONCERNS

- UNCERTAINTY IN RAW MATERIAL PRICES

- REGULATORY CHALLENGES

- GEOPOLITICAL TENSIONS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR FRANCE

- GROWTH PROSPECT MAPPING FOR INDONESIA

- GROWTH PROSPECT MAPPING FOR LATIN AMERICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

-

MARKET BY RESIN TYPE

- ACRYLIC

- MARKET FORECAST

- SEGMENT ANALYSIS

- POLYESTER

- MARKET FORECAST

- SEGMENT ANALYSIS

- ALKYD

- MARKET FORECAST

- SEGMENT ANALYSIS

- EPOXY

- MARKET FORECAST

- SEGMENT ANALYSIS

- POLYURETHANE

- MARKET FORECAST

- SEGMENT ANALYSIS

- OTHER RESIN TYPES

- MARKET FORECAST

- SEGMENT ANALYSIS

- ACRYLIC

-

MARKET BY TECHNOLOGY

- WATERBORNE

- MARKET FORECAST

- SEGMENT ANALYSIS

- SOLVENT-BORNE

- MARKET FORECAST

- SEGMENT ANALYSIS

- POWDER COATINGS

- MARKET FORECAST

- SEGMENT ANALYSIS

- HIGH SOLIDS

- MARKET FORECAST

- SEGMENT ANALYSIS

- RADIATION CURED

- MARKET FORECAST

- SEGMENT ANALYSIS

- OTHER TECHNOLOGIES

- MARKET FORECAST

- SEGMENT ANALYSIS

- WATERBORNE

-

MARKET BY APPLICATION

- AEROSPACE

- MARKET FORECAST

- SEGMENT ANALYSIS

- INDUSTRIAL COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- WOOD COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- PROTECTIVE COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- MARINE COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- REFINISH AUTOMOTIVE

- MARKET FORECAST

- SEGMENT ANALYSIS

- AUTOMOTIVE (OEM)

- MARKET FORECAST

- SEGMENT ANALYSIS

- PACKAGING COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- ELECTRONIC COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- ARCHITECTURAL (INTERIOR/EXTERIOR)

- MARKET FORECAST

- SEGMENT ANALYSIS

- SPECIAL COATING

- MARKET FORECAST

- SEGMENT ANALYSIS

- AEROSPACE

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA PAINTS & COATINGS MARKET DRIVERS

- NORTH AMERICA PAINTS & COATINGS MARKET CHALLENGES

- NORTH AMERICA PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA PAINTS & COATINGS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE PAINTS & COATINGS MARKET DRIVERS

- EUROPE PAINTS & COATINGS MARKET CHALLENGES

- EUROPE PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE PAINTS & COATINGS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC PAINTS & COATINGS MARKET DRIVERS

- ASIA-PACIFIC PAINTS & COATINGS MARKET CHALLENGES

- ASIA-PACIFIC PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC PAINTS & COATINGS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD PAINTS & COATINGS MARKET DRIVERS

- REST OF WORLD PAINTS & COATINGS MARKET CHALLENGES

- REST OF WORLD PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD PAINTS & COATINGS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA PAINTS & COATINGS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- AKZO NOBEL NV

- ASIAN PAINTS LIMITED

- AXALTA COATING SYSTEMS LTD

- BERGER PAINTS INDIA LIMITED

- DAVIES PAINTS PHILIPPINES INC

- HAYMES PAINT

- JOTUN GROUP

- KANSAI PAINT CO LTD

- KOVA PAINT CO LTD

- NIPPON PAINT HOLDINGS CO LTD

- PACIFIC PAINT (BOYSEN) PHILIPPINES INC (BOYSEN PAINTS)

- PPG INDUSTRIES INC

- PT PROPAN RAYA ICC

- RPM INTERNATIONAL INC

- THE SHERWIN-WILLIAMS COMPANY

- TOA PAINT (THAILAND) PUBLIC COMPANY LIMITED

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – PAINTS & COATINGS

TABLE 2: RAW MATERIALS

TABLE 3: GLOBAL PAINTS & COATINGS MARKET, BY RESIN TYPE, HISTORICAL YEARS 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL PAINTS & COATINGS MARKET, BY RESIN TYPE, FORECAST YEARS 2023-2032 (IN $ MILLION)

TABLE 5: GLOBAL ACRYLIC MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL ACRYLIC MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 7: GLOBAL POLYESTER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL POLYESTER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 9: GLOBAL ALKYD MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL ALKYD MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 11: GLOBAL EPOXY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL EPOXY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 13: GLOBAL POLYURETHANE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL POLYURETHANE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 15: GLOBAL OTHER RESIN TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 16: GLOBAL OTHER RESIN TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 17: GLOBAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, HISTORICAL YEARS 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, FORECAST YEARS 2023-2032 (IN $ MILLION)

TABLE 19: GLOBAL WATERBORNE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL WATERBORNE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 21: GLOBAL SOLVENT-BORNE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL SOLVENT-BORNE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 23: GLOBAL POWDER COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL POWDER COATINGS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 25: GLOBAL HIGH SOLIDS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL HIGH SOLIDS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 27: GLOBAL RADIATION CURED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL RADIATION CURED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 29: GLOBAL OTHER TECHNOLOGIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: GLOBAL OTHER TECHNOLOGIES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 31: GLOBAL PAINTS & COATINGS MARKET, BY APPLICATION, HISTORICAL YEARS 2018-2022 (IN $ MILLION)

TABLE 32: GLOBAL PAINTS & COATINGS MARKET, BY APPLICATION, FORECAST YEARS 2023-2032 (IN $ MILLION)

TABLE 33: GLOBAL AEROSPACE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 34: GLOBAL AEROSPACE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 35: GLOBAL INDUSTRIAL COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 36: GLOBAL INDUSTRIAL COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 37: GLOBAL WOOD COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 38: GLOBAL WOOD COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 39: GLOBAL PROTECTIVE COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 40: GLOBAL PROTECTIVE COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 41: GLOBAL MARINE COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 42: GLOBAL MARINE COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 43: GLOBAL REFINISH AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 44: GLOBAL REFINISH AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 45: GLOBAL AUTOMOTIVE (OEM) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 46: GLOBAL AUTOMOTIVE (OEM) MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 47: GLOBAL PACKAGING COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 48: GLOBAL PACKAGING COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 49: GLOBAL ELECTRONIC COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 50: GLOBAL ELECTRONIC COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 51: GLOBAL ARCHITECTURAL (INTERIOR/EXTERIOR) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 52: GLOBAL ARCHITECTURAL (INTERIOR/EXTERIOR) MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 53: GLOBAL SPECIAL COATING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 54: GLOBAL SPECIAL COATING MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 55: GLOBAL PAINTS & COATINGS MARKET, BY GEOGRAPHY, HISTORICAL YEARS 2018-2022 (IN $ MILLION)

TABLE 56: GLOBAL PAINTS & COATINGS MARKET, BY GEOGRAPHY, FORECAST YEARS 2023-2032 (IN $ MILLION)

TABLE 57: NORTH AMERICA PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS 2018-2022 (IN $ MILLION)

TABLE 58: NORTH AMERICA PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS 2023-2032 (IN $ MILLION)

TABLE 59: NORTH AMERICA PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

TABLE 60: KEY PLAYERS OPERATING IN NORTH AMERICA PAINTS & COATINGS MARKET

TABLE 61: EUROPE PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 62: EUROPE PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 63: EUROPE PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

TABLE 64: KEY PLAYERS OPERATING IN EUROPE PAINTS & COATINGS MARKET

TABLE 65: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 66: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 67: ASIA-PACIFIC PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

TABLE 68: KEY PLAYERS OPERATING IN ASIA-PACIFIC PAINTS & COATINGS MARKET

TABLE 69: REST OF WORLD PAINTS & COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 70: REST OF WORLD PAINTS & COATINGS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 71: REST OF WORLD PAINTS & COATINGS MARKET REGULATORY FRAMEWORK

TABLE 72: KEY PLAYERS OPERATING IN REST OF WORLD PAINTS & COATINGS MARKET

TABLE 73: LIST OF MERGERS & ACQUISITIONS

TABLE 74: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 75: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 76: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR FRANCE

FIGURE 5: GROWTH PROSPECT MAPPING FOR INDONESIA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: GLOBAL PAINTS & COATINGS MARKET, GROWTH POTENTIAL BY RESIN TYPE, IN 2022

FIGURE 11: GLOBAL PAINTS & COATINGS MARKET, BY ACRYLIC, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL PAINTS & COATINGS MARKET, BY POLYESTER, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL PAINTS & COATINGS MARKET, BY ALKYD, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL PAINTS & COATINGS MARKET, BY EPOXY, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL PAINTS & COATINGS MARKET, BY POLYURETHANE, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL PAINTS & COATINGS MARKET, BY OTHER RESIN TYPES, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL PAINTS & COATINGS MARKET, GROWTH POTENTIAL BY TECHNOLOGY, IN 2022

FIGURE 18: GLOBAL PAINTS & COATINGS MARKET, BY WATERBORNE, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL PAINTS & COATINGS MARKET, BY SOLVENT-BORNE, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL PAINTS & COATINGS MARKET, BY POWDER COATINGS, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL PAINTS & COATINGS MARKET, BY HIGH SOLIDS, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL PAINTS & COATINGS MARKET, BY RADIATION CURED, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL PAINTS & COATINGS MARKET, BY OTHER TECHNOLOGIES, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL PAINTS & COATINGS MARKET, GROWTH POTENTIAL BY APPLICATION, IN 2022

FIGURE 25: GLOBAL PAINTS & COATINGS MARKET, BY AEROSPACE, 2023-2032 (IN $ MILLION)

FIGURE 26: GLOBAL PAINTS & COATINGS MARKET, BY INDUSTRIAL COATING, 2023-2032 (IN $ MILLION)

FIGURE 27: GLOBAL PAINTS & COATINGS MARKET, BY WOOD COATING, 2023-2032 (IN $ MILLION)

FIGURE 28: GLOBAL PAINTS & COATINGS MARKET, BY PROTECTIVE COATING, 2023-2032 (IN $ MILLION)

FIGURE 29: GLOBAL PAINTS & COATINGS MARKET, BY MARINE COATING, 2023-2032 (IN $ MILLION)

FIGURE 30: GLOBAL PAINTS & COATINGS MARKET, BY REFINISH AUTOMOTIVE, 2023-2032 (IN $ MILLION)

FIGURE 31: GLOBAL PAINTS & COATINGS MARKET, BY AUTOMOTIVE (OEM), 2023-2032 (IN $ MILLION)

FIGURE 32: GLOBAL PAINTS & COATINGS MARKET, BY PACKAGING COATING, 2023-2032 (IN $ MILLION)

FIGURE 33: GLOBAL PAINTS & COATINGS MARKET, BY ELECTRONIC COATING, 2023-2032 (IN $ MILLION)

FIGURE 34: GLOBAL PAINTS & COATINGS MARKET, BY ARCHITECTURAL (INTERIOR/EXTERIOR), 2023-2032 (IN $ MILLION)

FIGURE 35: GLOBAL PAINTS & COATINGS MARKET, BY SPECIAL COATING, 2023-2032 (IN $ MILLION)

FIGURE 36: NORTH AMERICA PAINTS & COATINGS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 37: UNITED STATES PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: CANADA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: EUROPE PAINTS & COATINGS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 40: UNITED KINGDOM PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: GERMANY PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: FRANCE PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: ITALY PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: SPAIN PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: BELGIUM PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: POLAND PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: REST OF EUROPE PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 48: ASIA-PACIFIC PAINTS & COATINGS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 49: CHINA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 50: JAPAN PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 51: INDIA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 52: SOUTH KOREA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 53: INDONESIA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 54: THAILAND PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 55: VIETNAM PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 56: AUSTRALIA & NEW ZEALAND PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 57: REST OF ASIA-PACIFIC PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 58: REST OF WORLD PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 59: LATIN AMERICA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 60: MIDDLE EAST & AFRICA PAINTS & COATINGS MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

The global paints & coatings market size witnessed a downfall of around 13% in 2020.

Waterborne technology held the largest share in the global paints & coatings market with a revenue of $59741.70 million in 2022.

The emergence of technologies such as nanotechnology, fluoropolymer, and pigment encapsulation are among the key trends set to drive the global paints & coatings market growth during the forecast period.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032