NORTH AMERICA UV LED MARKET FORECAST 2019-2028

North America Uv Led Market by Technology (Uv – A, Uv – B, Uv – C) by Application (Uv Curing, Medical Light Therapy, Sterilization, Optical Sensors and Instrumentation, Counterfeit Detection, Other Applications) and by Geography.

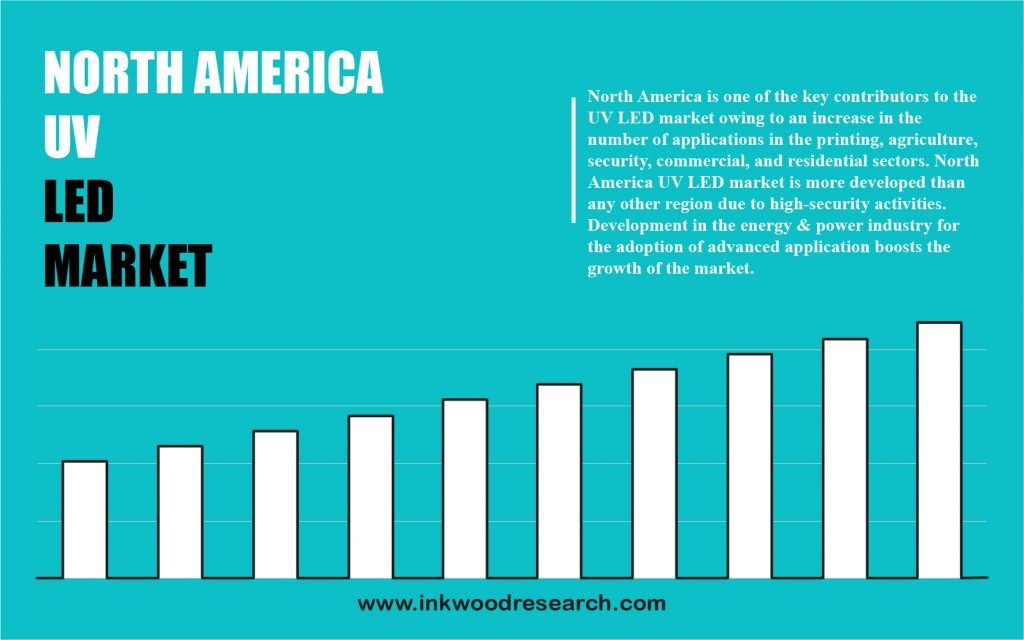

The North America UV LED market is estimated to harbor a CAGR of 19.33%, across the forecast period of 2019 to 2028. The key factors influencing the market growth include increased applications within sectors such as printing, security, agriculture, residential, and commercial.

To know more about this report, request a free sample copy

The United States and Canada are analyzed for determining the North America UV LED market growth. Over the years, UV lights have been used in the United States across enterprises, military, and customer products. The Food and Drug Administration (FDA), has approved UV light radiation as a pathogen control method to treat food. However, as a food and beverage pathogen minimizer, the use of UV-C has been developing at a slow pace among manufacturers.

Moreover, low-pressure air, surface, and water disinfection and sanitization, in addition to the presence of government regulations in the United States, have resulted in an increased demand for UV treatments. According to the 2018 Environmental Protection Agency (EPA) report, one out of three Americans who consume water from streams was estimated to be susceptible to drinking polluted water. However, the conventional water purification system is expensive, and also vulnerable to mercury leakage. The rising awareness of benefits associated with treated water consumption has influenced the market with regard to the UV C LEDs segment.

With its headquarters in the United States, Electronic Sensor Technology Inc, is a chemical vapor analysis process developer. The company’s systems apply gas chromatography calculations and technology to diverse enterprises, such as chemical, environmental, food and beverages, healthcare, life science, and ecology. Its product portfolio includes Computer Integrated zNose Model 4600, Portable zNose Model 4200, etc.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- PARENT MARKET ANALYSIS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASE IN INITIATIVES BY GOVERNMENT

- SURGING USAGE OF UV CURING IN NEW APPLICATIONS

- BAN ON MERCURY LAMPS PROPELLED THE NEED OF UV LEDs

- GROWING USAGE OF SAFE AND ECO-FRIENDLY PRODUCTS

- KEY RESTRAINTS

- HIGH COST OF UV LED DEVICES

- EXCESS THERMAL HEAT GENERATED BY THE UV LEDs

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- SUPPLY CHAIN ANALYSIS

- IMPACT OF COVID-19 ON UV-LED MARKET

- INNOVATIONS IN UV-LED PRODUCTS DUE TO COVID-19

- REGULATORY FRAMEWORK

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHT

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY TECHNOLOGY

- UV-A

- UV-B

- UV-C

- MARKET BY APPLICATION

- UV CURING

- MEDICAL LIGHT THERAPY

- STERILIZATION

- OPTICAL SENSORS AND INSTRUMENTATION

- COUNTERFEIT DETECTION

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- NORTH AMERICA

- COMPANY PROFILES

- CRYSTAL IS INC (ASAHI KASEI)

- EPIGAP OPTRONIC GMBH

- HERAEUS HOLDING GMBH

- HONLE UV AMERICA INC

- KONINKLIJKE PHILIPS NV

- LG INNOTEK CO LTD

- LUMILEDS HOLDING BV

- NICHIA CORPORATION

- NITRIDE SEMICONDUCTORS CO LTD

- NORDSON CORPORATION

- OSRAM

- PHOSEON TECHNOLOGY

- SEMILEDS CORPORATION

- SENSOR ELECTRONIC TECHNOLOGY

- SEOULVIOSYS CO LTD

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – UV LED

TABLE 2: NORTH AMERICA UV LED MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: NORTH AMERICA UV LED MARKET, BY TECHNOLOGY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA UV LED MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: NORTH AMERICA UV LED MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: NORTH AMERICA UV LED MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: NORTH AMERICA UV LED MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: SUPPLY CHAIN ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: NORTH AMERICA UV LED MARKET, BY TECHNOLOGY, IN 2019

FIGURE 6: NORTH AMERICA UV LED MARKET, BY UV-A, 2019-2028 (IN $ MILLION)

FIGURE 7: NORTH AMERICA UV LED MARKET, BY UV-B, 2019-2028 (IN $ MILLION)

FIGURE 8: NORTH AMERICA UV LED MARKET, BY UV-C, 2019-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA UV LED MARKET, BY APPLICATION, IN 2019

FIGURE 10: NORTH AMERICA UV LED MARKET, BY UV CURING, 2019-2028 (IN $ MILLION)

FIGURE 11: NORTH AMERICA UV LED MARKET, BY MEDICAL LIGHT THERAPY, 2019-2028 (IN $ MILLION)

FIGURE 12: NORTH AMERICA UV LED MARKET, BY STERILIZATION, 2019-2028 (IN $ MILLION)

FIGURE 13: NORTH AMERICA UV LED MARKET, BY OPTICAL SENSORS AND INSTRUMENTATION, 2019-2028 (IN $ MILLION)

FIGURE 14: NORTH AMERICA UV LED MARKET, BY COUNTERFEIT DETECTION, 2019-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA UV LED MARKET, BY OTHER APPLICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 16: NORTH AMERICA UV LED MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 17: THE UNITED STATES UV LED MARKET, 2020-2028 (IN $ MILLION)

FIGURE 18: CANADA UV LED MARKET, 2020-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY TECHNOLOGY

- UV-A

- UV-B

- UV-C

- MARKET BY APPLICATION

- UV CURING

- MEDICAL LIGHT THERAPY

- STERILIZATION

- OPTICAL SENSORS AND INSTRUMENTATION

- COUNTERFEIT DETECTION

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.