NORTH AMERICA SMART COATINGS MARKET FORECAST 2021-2028

North America Smart Coatings Market by Layer (Single-layer, Multi-layer) Market by Type (Anti-microbial, Anti-corrosion, Anti-fouling, Anti-icing, Self-cleaning, Self-healing, Other Types) Market by End-user (Building & Construction, Automotive, Marine, Aerospace & Defence, Other End-users) and by Geography

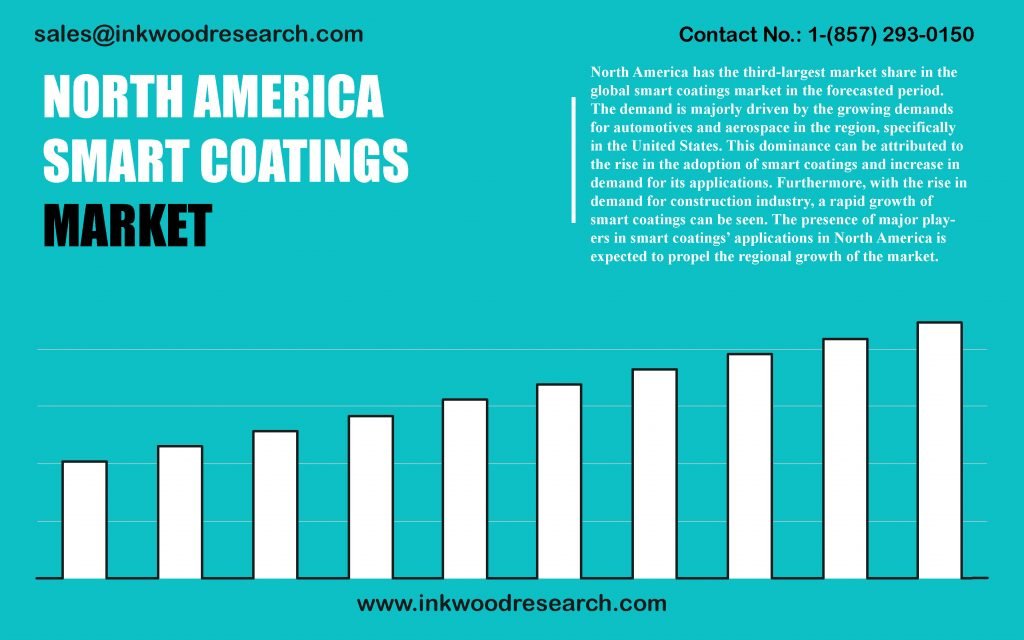

The North America smart coatings market is estimated to register a CAGR of 22.27% over the forecasted period. Factors such as the augmenting aerospace and automotive industries, the presence of leading market players, the rising adoption of smart coatings as well as the surging requirements for their applications are primarily credited to the regional market’s growth.

To learn more about this report, request a free sample copy

The North America smart coatings market growth evaluation includes the analysis of the United States and Canada. The potential applications for different types of smart coatings are extensive and varied. The United States government is involved in the utilization of smart coatings for applications like camouflage, bioweapon detection and destruction, corrosion control, and others. The demand for functional surfaces in the country is primarily observed across automotive, aerospace, textile, energy, construction, marine, biomedical, communication, electronics, and numerous other industries.

The United States has active research programs within the government’s agencies, supplementing the efforts of various academic groups, as well. For instance, the U.S. Army’s Smart Coatings™ Material Program investigates smart coatings with the aim of minimizing cost, maintenance burdens, equipment downtime, as well as the need for hazardous painting/de-painting operations. Moreover, the research efforts also concentrate on developing intelligent materials with diverse capabilities. As a result, these factors are set to influence the North America smart coatings market growth during the forecasting years.

3M Company, headquartered in the United States, is a diversified technology company. It markets and manufactures a wide range of innovative products, such as touch screen and touch monitors, packaging and interconnection devices, dental and orthodontic products, transportation safety products, skin health and infection prevention products, filtration products, consumer and office tapes and adhesives, medical and surgical supplies, home care products, and others.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND FROM CONSTRUCTION SECTOR

- BENEFITS OFFERED BY SMART COATING OVER TRADITIONAL COATING

- RISE IN MERGERS AND ACQUISITIONS AMONG SMART COATING-RELATED COMPANIES

- KEY RESTRAINTS

- HIGH PRICE OF SMART COATINGS

- UNFAVORABLE ENVIRONMENTAL REGULATIONS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON SMART COATINGS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY BUYING CRITERIA

- RAW MATERIALS

- PRICE

- QUALITY

- MARKET BY LAYER

- SINGLE-LAYER

- MULTI-LAYER

- MARKET BY TYPE

- ANTI-MICROBIAL

- ANTI-CORROSION

- ANTI-FOULING

- ANTI-ICING

- SELF-CLEANING

- SELF-HEALING

- OTHER TYPES

- MARKET BY END-USER

- BUILDING & CONSTRUCTION

- AUTOMOTIVE

- MARINE

- AEROSPACE & DEFENCE

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- 3M COMPANY

- AKZONOBEL NV

- ANCATT INC

- AXALTA COATING SYSTEM

- BASF SE

- EASTMAN CHEMICAL COMPANY

- EI DU PONT DE NEMOURS AND COMPANY

- HEMPEL A/S

- JOTUN A/S

- NEI CORPORATION

- NIPPON STEEL CORPORATION

- PPG INDUSTRIES INC

- ROYAL DSM NV

- TESLA NANOCOATINGS INC

- THE DOW CHEMICAL COMPANY

- THE SHERWIN-WILLIAMS COMPANY

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SMART COATINGS

TABLE 2: NORTH AMERICA SMART COATINGS MARKET, BY LAYER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: NORTH AMERICA SMART COATINGS MARKET, BY LAYER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA SMART COATINGS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: NORTH AMERICA SMART COATINGS MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: NORTH AMERICA SMART COATINGS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: NORTH AMERICA SMART COATINGS MARKET, BY END-USER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: NORTH AMERICA SMART COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: NORTH AMERICA SMART COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: LEADING PLAYERS OPERATING IN NORTH AMERICA SMART COATINGS MARKET

TABLE 11: LIST OF MERGERS & ACQUISITIONS

TABLE 12: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 13: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 14: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: KEY BUYING CRITERIA

FIGURE 6: NORTH AMERICA SMART COATINGS MARKET, GROWTH POTENTIAL, BY LAYER, IN 2020

FIGURE 7: NORTH AMERICA SMART COATINGS MARKET, BY SINGLE LAYER, 2021-2028 (IN $ MILLION)

FIGURE 8: NORTH AMERICA SMART COATINGS MARKET, BY MULTI-LAYER, 2021-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA SMART COATINGS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2020

FIGURE 10: NORTH AMERICA SMART COATINGS MARKET, BY ANTI-MICROBIAL, 2021-2028 (IN $ MILLION)

FIGURE 11: NORTH AMERICA SMART COATINGS MARKET, BY ANTI-CORROSION, 2021-2028 (IN $ MILLION)

FIGURE 12: NORTH AMERICA SMART COATINGS MARKET, BY ANTI-FOULING, 2021-2028 (IN $ MILLION)

FIGURE 13: NORTH AMERICA SMART COATINGS MARKET, BY ANTI-ICING, 2021-2028 (IN $ MILLION)

FIGURE 14: NORTH AMERICA SMART COATINGS MARKET, BY SELF-CLEANING, 2021-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA SMART COATINGS MARKET, BY SELF-HEALING, 2021-2028 (IN $ MILLION)

FIGURE 16: NORTH AMERICA SMART COATINGS MARKET, BY OTHER TYPES, 2021-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA SMART COATINGS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2020

FIGURE 18: NORTH AMERICA SMART COATINGS MARKET, BY BUILDING & CONSTRUCTION, 2021-2028 (IN $ MILLION)

FIGURE 19: NORTH AMERICA SMART COATINGS MARKET, BY AUTOMOTIVE, 2021-2028 (IN $ MILLION)

FIGURE 20: NORTH AMERICA SMART COATINGS MARKET, BY MARINE, 2021-2028 (IN $ MILLION)

FIGURE 21: NORTH AMERICA SMART COATINGS MARKET, BY AEROSPACE & DEFENCE, 2021-2028 (IN $ MILLION)

FIGURE 22: NORTH AMERICA SMART COATINGS MARKET, BY OTHER END-USERS, 2021-2028 (IN $ MILLION)

FIGURE 23: NORTH AMERICA SMART COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 24: UNITED STATES SMART COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: CANADA SMART COATINGS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY LAYER

- SINGLE-LAYER

- MULTI-LAYER

- MARKET BY TYPE

- ANTI-MICROBIAL

- ANTI-CORROSION

- ANTI-FOULING

- ANTI-ICING

- SELF-CLEANING

- SELF-HEALING

- OTHER TYPES

- MARKET BY END-USER

- BUILDING & CONSTRUCTION

- AUTOMOTIVE

- MARINE

- AEROSPACE & DEFENCE

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.