NORTH AMERICA DIGITAL GENOME MARKET FORECAST 2021-2028

North America Digital Genome Market by Product (Sequencing and Analyzer Instruments, DNA/RNA Analysis, Sequencing and Analysis Software, Sequencing Chips, Sample Prep Instruments) Market by Application (Diagnostics, Drug Discovery, Academic Research, Personalized Medicine, Agricultural, Other Applications) Market by End-user (Diagnostics and Forensic Labs, Academic Research Institutes, Hospitals, Other End-users) and by Geography.

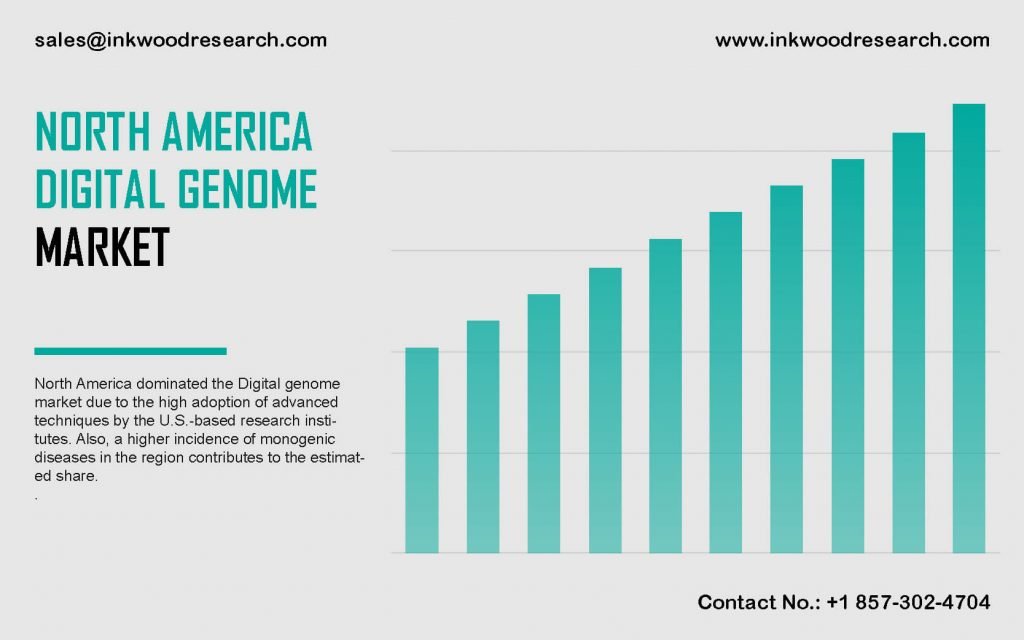

The North America digital genome market is expected to grow with a CAGR of 9.60%, over the forecast period of 2021 to 2028. The region’s market growth is supplemented by factors, such as, the increased adoption of advanced techniques by research institutes, the rising prevalence of monogenic disorders, and the high incidence of infectious conditions, Alzheimer’s disease, dementia, and cancer.

To learn more about this report, request a free sample copy

The North America digital genome market growth is analyzed by studying the United States and Canada. The high adoption rate of advanced technology, the availability of funds for genomic research, and the rising prevalence of well-established players, are primarily accredited to the United States’ significant share across the region’s market. Moreover, extensive research activity in the field of genomics, gene editing, modification, and cell line culture undertaken in the country, plays a crucial role in bolstering its digital genome market.

Multiple international manufacturers of DNA sequencing, equipment, platforms, and technologies are highly active in the United States. For instance, DNA sequencing giants like, Thermo Fisher Scientific, and Illumina, among others, have a leading corporate presence in the country. In this regard, the rising usage of DNA sequencing results in the increasing creation of genomic databases, such as, Ensembl Human Genome Server, and UCSC Human Genome Browser Gateway. Hence, these factors are further projected to drive the market growth in the United States.

Illumina Inc, headquartered in the United States, is an international manufacturer, developer, and manufacturer of solutions and products applied in several life science procedures and methods. The company’s key operating markets include, life sciences and genomics. It also provides a comprehensive product line, catering to applications, such as, the development of molecular tests, drug development, and advanced disease research.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASING FUNDING BY THE MANUFACTURERS AND GOVERNMENTS IN GENOMICS

- ADVANCEMENTS IN TECHNOLOGY

- SURGING PREVALENCE OF CHRONIC DISEASES

- KEY RESTRAINTS

- RISKS ASSOCIATED WITH SECURITY ISSUE OF DIGITAL GENOME

- LACK OF PROFESSIONALS WITH ADEQUATE KNOWLEDGE ABOUT THE GENOMIC TECHNOLOGY

- KEY DRIVERS

- KEY ANALYTICS

- PORTER’S FIVE FORCES ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- IMPACT OF COVID-19 ON DIGITAL GENOME MARKET

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCES ANALYSIS

- MARKET BY PRODUCT

- SEQUENCING AND ANALYZER INSTRUMENTS

- DNA/RNA ANALYSIS

- SEQUENCING AND ANALYSIS SOFTWARE

- SEQUENCING CHIPS

- SAMPLE PREP INSTRUMENTS

- MARKET BY APPLICATION

- DIAGNOSTICS

- DRUG DISCOVERY

- ACADEMIC RESEARCH

- PERSONALIZED MEDICINE

- AGRICULTURAL

- OTHER APPLICATIONS

- MARKET BY END-USER

- DIAGNOSTICS AND FORENSIC LABS

- ACADEMIC RESEARCH INSTITUTES

- HOSPITALS

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- BUSINESS EXPANSION/ APPROVAL/ ANNOUNCEMENT

- COMPANY PROFILE

- ABBOTT LABORATORIES

- AGILENT TECHNOLOGIES INC.

- BECTON, DICKINSON AND COMPANY (BD)

- BIOMERIEUX SA

- BIO-RAD LABORATORIES INC

- HOFFMANN-LA ROCHE

- ILLUMINA INC

- INSCRIPTA

- OXFORD NANOPORE TECHNOLOGIES LTD

- PACIFIC BIOSCIENCE

- PERKINELMER INC

- QIAGEN NV

- REGENERON PHARMACEUTICALS

- THERMO FISHER SCIENTIFIC INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – DIGITAL GENOME

TABLE 2: NORTH AMERICA DIGITAL GENOME MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: NORTH AMERICA DIGITAL GENOME MARKET, BY PRODUCT, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA DIGITAL GENOME MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: NORTH AMERICA DIGITAL GENOME MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: NORTH AMERICA DIGITAL GENOME MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: NORTH AMERICA DIGITAL GENOME MARKET, BY END-USER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: NORTH AMERICA DIGITAL GENOME MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: NORTH AMERICA DIGITAL GENOME MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: LEADING PLAYERS OPERATING IN NORTH AMERICA DIGITAL GENOME MARKET

LIST OF FIGURES

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: OPPORTUNITY MATRIX

FIGURE 3: VENDOR LANDSCAPE

FIGURE 4: KEY INVESTMENT INSIGHTS

FIGURE 5: NORTH AMERICA DIGITAL GENOME MARKET, BY PRODUCT, IN 2020

FIGURE 6: NORTH AMERICA DIGITAL GENOME MARKET, BY SEQUENCING AND ANALYZER INSTRUMENTS, 2021-2028 (IN $ MILLION)

FIGURE 7: NORTH AMERICA DIGITAL GENOME MARKET, BY DNA/RNA ANALYSIS, 2021-2028 (IN $ MILLION)

FIGURE 8: NORTH AMERICA DIGITAL GENOME MARKET, BY SEQUENCING AND ANALYSIS SOFTWARE, 2021-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA DIGITAL GENOME MARKET, BY SEQUENCING CHIPS, 2021-2028 (IN $ MILLION)

FIGURE 10: NORTH AMERICA DIGITAL GENOME MARKET, BY SAMPLE PREP INSTRUMENTS, 2021-2028 (IN $ MILLION)

FIGURE 11: NORTH AMERICA DIGITAL GENOME MARKET, BY APPLICATION, IN 2020

FIGURE 12: NORTH AMERICA DIGITAL GENOME MARKET, BY DIAGNOSTICS, 2021-2028 (IN $ MILLION)

FIGURE 13: NORTH AMERICA DIGITAL GENOME MARKET, BY DRUG DISCOVERY, 2021-2028 (IN $ MILLION)

FIGURE 14: NORTH AMERICA DIGITAL GENOME MARKET, BY ACADEMIC RESEARCH, 2021-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA DIGITAL GENOME MARKET, BY PERSONALIZED MEDICINE, 2021-2028 (IN $ MILLION)

FIGURE 16: NORTH AMERICA DIGITAL GENOME MARKET, BY AGRICULTURAL, 2021-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA DIGITAL GENOME MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 18: NORTH AMERICA DIGITAL GENOME MARKET, BY END-USER, IN 2020

FIGURE 19: NORTH AMERICA DIGITAL GENOME MARKET, BY DIAGNOSTICS AND FORENSIC LABS, 2021-2028 (IN $ MILLION)

FIGURE 20: NORTH AMERICA DIGITAL GENOME MARKET, BY ACADEMIC RESEARCH INSTITUTES, 2021-2028 (IN $ MILLION)

FIGURE 21: NORTH AMERICA DIGITAL GENOME MARKET, BY HOSPITALS, 2021-2028 (IN $ MILLION)

FIGURE 22: NORTH AMERICA DIGITAL GENOME MARKET, BY OTHER END-USERS, 2021-2028 (IN $ MILLION)

FIGURE 23: NORTH AMERICA DIGITAL GENOME MARKET, COUNTRY OUTLOOK, 2020 & 2028 (IN %)

FIGURE 24: UNITED STATES DIGITAL GENOME MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: CANADA DIGITAL GENOME MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY PRODUCT

- SEQUENCING AND ANALYZER INSTRUMENTS

- DNA/RNA ANALYSIS

- SEQUENCING AND ANALYSIS SOFTWARE

- SEQUENCING CHIPS

- SAMPLE PREP INSTRUMENTS

- MARKET BY APPLICATION

- DIAGNOSTICS

- DRUG DISCOVERY

- ACADEMIC RESEARCH

- PERSONALIZED MEDICINE

- AGRICULTURAL

- OTHER APPLICATIONS

- MARKET BY END-USER

- DIAGNOSTICS AND FORENSIC LABS

- ACADEMIC RESEARCH INSTITUTES

- HOSPITALS

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.