GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

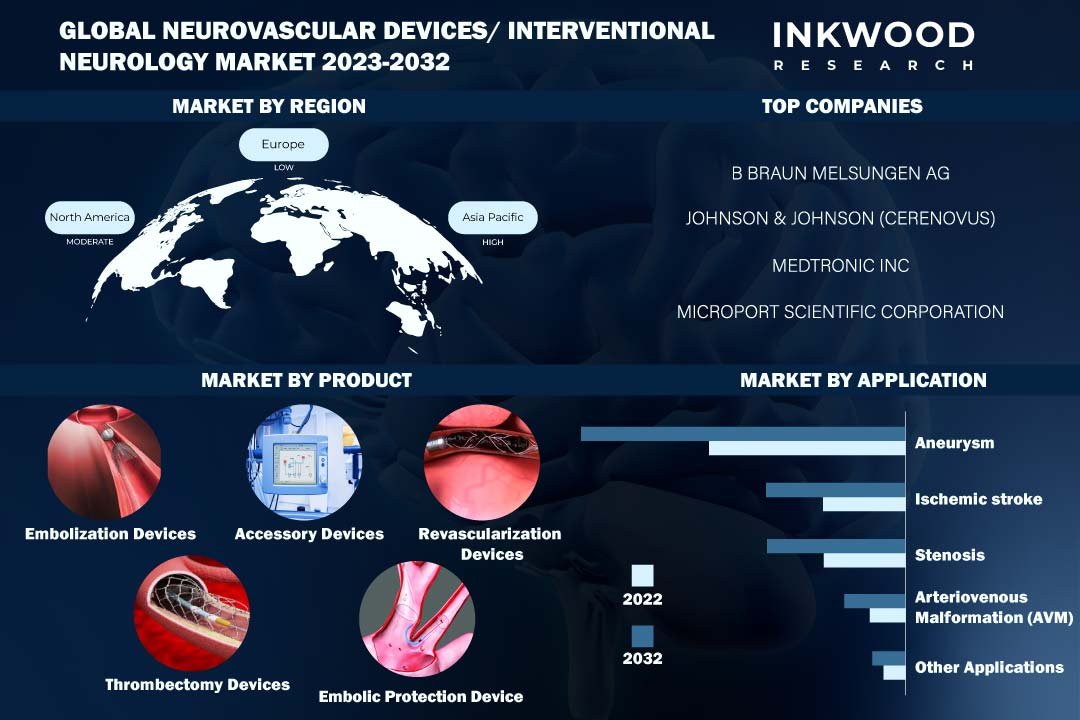

Global Neurovascular Devices / Interventional Neurology Market by Product (Embolization Devices, Accessory Devices, Revascularization Devices, Thrombectomy Devices, Embolic Protection Devices) Market by Application (Aneurysm, Ischemic Stroke, Stenosis, Arteriovenous Malformation, Other Applications) by Geography

REPORTS » HEALTHCARE » MEDICAL DEVICES » GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global neurovascular devices/interventional neurology market is expected to reach $5431.15 million by 2032, growing at a CAGR of 5.23% during the forecast period, 2023-2032.

Neurovascular devices treat disorders related to blood vessels that carry oxygen-rich blood to the brain. Several types of neurovascular devices exhibit different mechanisms of action. Accordingly, some of the neurovascular devices available in the market include clippings, embolic coils, coil assist stents, carotid artery stents, flow diversion stents, clot retrieval devices, etc.

Patients and healthcare providers alike are seeking strategies that improve recovery times and complication rates. In this regard, neurovascular devices such as flow diverters, stent retrievers, and aspiration catheters are paving the way for less invasive techniques to treat aneurysms and acute ischemic strokes, ultimately leading to better patient outcomes. Additionally, advancements in imaging technology and the integration of artificial intelligence (AI) in neurovascular devices further enable precise diagnosis of neurovascular disorders.

Read our latest blog on the Neurovascular Devices/Interventional Neurology Market

GROWTH ENABLERS

Key growth enablers of the global neurovascular devices/interventional neurology market:

- Significant rise in neurovascular conditions

- Lifestyle habits, genetic disorders, and associated chronic conditions contribute to the development of neurovascular diseases. Over recent years, the prevalence of neurological disorders has increased significantly; according to the 2022 global data provided by the Brain Aneurysm Foundation, around 15 million people suffer strokes worldwide every year.

- Strokes are categorized as the world’s leading cause of mortality and a primary cause of disability, according to the World Health Organization (WHO). Stroke risk increases with age, and the aging global population contributes to the higher prevalence of stroke. Besides, according to the Centers for Disease Control and Prevention (CDC), around 800,000 persons suffered from a stroke in the United States in January 2021, with more than 75% of strokes occurring in people over the age of 65.

- Smoking, hypertension, and a family history of other linked disorders also entail the risk factors for brain aneurysms. Hence, as the number of brain aneurysms diagnosed rises, the demand for new medical technologies and equipment that can successfully diagnose and treat these disorders is set to increase, as well.

- Preference for minimally invasive procedures

- Geriatric population’s vulnerability to neurovascular diseases

- Underlying diseases are a risk factor for neurovascular diseases

GROWTH RESTRAINTS

Key restraining factors of the global neurovascular devices/interventional neurology market:

- Exorbitant costs of neurovascular devices

- Neurovascular devices are frequently built using cutting-edge technologies, such as novel materials, intricate designs, and precise engineering. The development and production of such sophisticated devices necessitates massive R&D expenses, which are passed on to users.

- The high cost of embolization coils and related goods could hinder industry expansion. Since the coils are formed of expensive bare metal platinum and alloys, the product’s manufacturing cost is higher. Furthermore, detachable coils are more expensive than pushable coils.

- Overall, the pricing of the coils varies according to their diameter, length, and volume. As a result, the high cost of products subsequently influences the cost of the operation.

- Lack of trained neurosurgeons

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Neurovascular Devices/Interventional Neurology Market | Top Market Trends

- The prevalence of neurovascular disorders has increased, alongside the demand for novel and sophisticated neurovascular devices used in therapy. As a result, prominent industry participants have increased their emphasis on developing new devices. For instance, scientists at the Indian Institute of Technology (IIT), Mandi, in partnership with PGMIER Chandigarh, have created a wearable device to detect and diagnose stroke caused by decreased blood flow to the brain.

- The healthcare industry has undergone dramatic upheavals over recent years. The sector has also witnessed numerous technological developments, including stem cell therapy, smart brain prosthetics, and transcranial MRI-guided, focused ultrasound. Moreover, countries across the world prefer innovative healthcare technologies, and with a need for better healthcare facilities, rising economies’ healthcare systems are favoring Technology-Enabled Care (TEC) solutions.

MARKET SEGMENTATION

Market Segmentation – Product and Application

Market by Product:

- Embolization Devices

- Embolic Coil

- Coated Detachable Coils

- Bare Detachable Coils

- Coil Assist Stent

- Clippings

- Coil Assist Balloon

- Accessory Devices

- Microcatheters

- Micro Guidewires

- Revascularization Devices

- Carotid Artery Stents

- Flow Diversion Stents

- Thrombectomy Devices

- The thrombectomy devices segment, under the product category, is set to grow with the highest CAGR of 5.62% between 2023 to 2032.

- A thrombus is a blood clot that forms in a vessel. A thrombectomy procedure that involves using neurovascular devices is a minimally invasive surgical procedure that removes a thrombus from a blood vessel. Aligning with this, thrombectomy devices work toward removing blood clots to restore normal perfusion in the affected body area.

- Ischemic strokes occur due to blood clots forming in blood vessels. Here, thrombectomy devices are employed in the treatment of ischemic stroke. Accordingly, a major factor driving the segment’s growth is the surging incidence of ischemic strokes owing to unhealthy and sedentary lifestyles.

- Clot Retrieval Devices

- Suction and Aspiration Devices

- Snares

- Embolic Protection Devices

- Balloon Occlusion Devices

- Distal Filter Devices

Market by Application:

- Aneurysm

- Aneurysm is set to be the major application during the forecast period.

- Advancements in neurovascular devices are leading to the introduction of embolization devices such as embolic coils and coil assist stents. These were developed to provide better treatment for aneurysms as compared to clippings.

- Technological advancements gradually led to the development of the modified version of embolic coils with upgraded properties. For instance, coated coils allow the treatment of complex forms of aneurysms with a reduced recurrence rate compared to bare detachable coils.

- Effective treatment options are more crucial as aneurysm prevalence increases. In this regard, endovascular operations are used to repair aneurysms and avert potential ruptures by using neurovascular devices such as flow diverters, stents, coils, and embolization devices.

- Ischemic Stroke

- Stenosis

- Arteriovenous Malformation (AVM)

- Other Applications

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, France, Germany, Spain, Italy, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

-

- The Asia-Pacific neurovascular devices/interventional neurology market is anticipated to grow with the highest CAGR of 5.46% between 2023 to 2032.

-

- China is among the most populated countries globally, with the maximum number of patients living with neurological disorders. The country also has experienced a significant rise in the geriatric population, with strokes representing the leading cause of death among the elderly.

-

- About 2 million stroke cases are reported in China. Aligning with this, the country’s government is facilitating advanced techniques for stroke prevention and treatment procedures. These also entail standardizing procedures for stroke care for physicians across the nation.

-

- In Japan, the incidences of ischemic stroke have led to the development of neurological studies and treatments. The country’s aging population also poses a variety of problems, one of which is the increase in neurological disorders.

-

- Stroke is considered a result of cerebral infarctions, and it is the fourth leading cause of mortality and the leading cause of severe disability. Furthermore, in Japan, there were over 2,565 general hospitals with departments dedicated to neurology as of October 2021.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global neurovascular devices/interventional neurology market:

- B. Braun Melsungen AG

- Medtronic Inc

- Stryker Corporation

- Terumo Corporation

- Johnson & Johnson (Cerenovus)

Key strategies adopted by some of these companies:

- In August 2022, Affera Inc was acquired by Medtronic PLC. With this acquisition, the company’s offering for radiofrequency ablation and focal pulsed field diagnostics was expanded to include the very first cardiac mapping and navigation platform.

- In order to start a firm that will use sound stimulation to activate the brain, Pixie Dust Technologies, a portfolio company of Abies Ventures, Shionogi Healthcare, and Shionogi, agreed to a business cooperation agreement in September 2022.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Acandis GmbH, Asahi Intecc, B Braun Melsungen AG, Balt, Integer Holdings Corporation, Johnson & Johnson (Cerenovus), Kaneka Corporation, Medtronic Inc, Memry Corporation, MicroPort Scientific Corporation, Penumbra Inc, Phenox Inc, Rapid Medical, Stryker Corporation, Terumo Corporation, Sensome |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

- MAJOR MARKET FINDINGS

- GOVERNMENT INITIATIVES TO CREATE AWARENESS ABOUT NEUROVASCULAR DISEASES

- EARLY DETECTION OF ARTERIOVENOUS MALFORMATION (AVM)

- THROMBECTOMY IMPROVES PATIENT OUTCOMES AND REDUCES DISABILITY RATE

-

MARKET DYNAMICS

- KEY DRIVERS

- SIGNIFICANT RISE IN INCIDENCE OF NEUROVASCULAR CONDITIONS

- PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES

- GERIATRIC POPULATION’S VULNERABILITY TO NEUROVASCULAR DISEASES

- UNDERLYING DISEASES ARE A RISK FACTOR FOR NEUROVASCULAR DISEASES

- KEY RESTRAINTS

- EXORBITANT COSTS OF NEUROVASCULAR DEVICES

- LACK OF TRAINED NEUROSURGEONS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

- GROWTH PROSPECT MAPPING FOR THAILAND

- GROWTH PROSPECT MAPPING FOR MIDDLE EAST & AFRICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

-

MARKET BY PRODUCT

- EMBOLIZATION DEVICES

- EMBOLIC COILS

- COATED DETACHABLE COILS

- BARE DETACHABLE COILS

- COIL ASSIST STENT

- CLIPPINGS

- COIL ASSIST BALLOON

- EMBOLIC COILS

- ACCESSORY DEVICES

- MICROCATHETERS

- MICRO GUIDEWIRES

- REVASCULARIZATION DEVICES

- CAROTID ARTERY STENTS

- FLOW DIVERSION STENTS

- THROMBECTOMY DEVICES

- CLOT RETRIEVAL DEVICES

- SUCTION AND ASPIRATION DEVICES

- SNARES

- EMBOLIC PROTECTION DEVICES

- BALLOON OCCLUSION DEVICES

- DISTAL FILTER DEVICES

- EMBOLIZATION DEVICES

-

MARKET BY APPLICATION

- ANEURYSM

- ISCHEMIC STROKE

- STENOSIS

- ARTERIOVENOUS MALFORMATION (AVM)

- OTHER APPLICATIONS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET DRIVERS

- NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET CHALLENGES

- NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET DRIVERS

- EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET CHALLENGES

- EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET DRIVERS

- ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET CHALLENGES

- ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET DRIVERS

- REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET CHALLENGES

- REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ACANDIS GMBH

- COMPANY OVERVIEW

- PRODUCT LIST

- ASAHI INTECC

- COMPANY OVERVIEW

- PRODUCT LIST

- BALT

- COMPANY OVERVIEW

- PRODUCT LIST

- B BRAUN MELSUNGEN AG

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- INTEGER HOLDINGS CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- JOHNSON & JOHNSON (CERENOVUS)

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- KANEKA CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- MEDTRONIC INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEMRY CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- MICROPORT SCIENTIFIC CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PENUMBRA INC

- COMPANY OVERVIEW

- PRODUCT LIST

- PHENOX INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- RAPID MEDICAL

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SENSOME

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- STRYKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TERUMO CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ACANDIS GMBH

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY

TABLE 2: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY PRODUCT, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL EMBOLIZATION DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL EMBOLIZATION DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIZATION DEVICES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIZATION DEVICES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL EMBOLIC COILS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL EMBOLIC COILS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL EMBOLIZATION DEVICES MARKET, BY EMBOLIC COILS, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL EMBOLIZATION DEVICES MARKET, BY EMBOLIC COILS, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL BARE DETACHABLE COILS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL BARE DETACHABLE COILS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL COIL ASSIST STENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL COIL ASSIST STENT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL CLIPPINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL CLIPPINGS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL COIL ASSIST BALLOON MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL COIL ASSIST BALLOON MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL ACCESSORY DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL ACCESSORY DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ACCESSORY DEVICES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ACCESSORY DEVICES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL MICROCATHETERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL MICROCATHETERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL MICRO GUIDEWIRES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL MICROCATHETERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL REVASCULARIZATION DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL REVASCULARIZATION DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY REVASCULARIZATION DEVICES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY REVASCULARIZATION DEVICES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL CAROTID ARTERY STENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL CAROTID ARTERY STENT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL FLOW DIVERSION STENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL FLOW DIVERSION STENT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: GLOBAL THROMBECTOMY DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL THROMBECTOMY DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY THROMBECTOMY DEVICES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY THROMBECTOMY DEVICES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 40: GLOBAL CLOT RETRIEVAL DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL CLOT RETRIEVAL DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: GLOBAL SUCTION AND ASPIRATION DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL SUCTION AND ASPIRATION DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: GLOBAL SNARES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL SNARES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 46: GLOBAL EMBOLIC PROTECTION DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL EMBOLIC PROTECTION DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 48: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIC PROTECTION DEVICES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIC PROTECTION DEVICES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 50: GLOBAL BALLOON OCCLUSION DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 51: GLOBAL BALLOON OCCLUSION DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 52: GLOBAL DISTAL FILTER DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 53: GLOBAL DISTAL FILTER DEVICES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 54: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY APPLICATION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 56: GLOBAL ANEURYSM MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 57: GLOBAL ANEURYSM MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 58: GLOBAL ISCHEMIC STROKE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 59: GLOBAL ISCHEMIC STROKE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 60: GLOBAL STENOSIS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 61: GLOBAL STENOSIS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 62: GLOBAL ARTERIOVENOUS MALFORMATION (AVM) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 63: GLOBAL ARTERIOVENOUS MALFORMATION (AVM) MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 64: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 65: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 66: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 67: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 68: NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 69: NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 70: NORTH AMERICANEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

TABLE 71: KEY PLAYERS OPERATING IN NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

TABLE 72: EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 73: EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 74: EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

TABLE 75: KEY PLAYERS OPERATING IN EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

TABLE 76: ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 77: ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 78: ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

TABLE 79: KEY PLAYERS OPERATING IN ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

TABLE 80: REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 81: REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 82: REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET REGULATORY FRAMEWORK

TABLE 83: KEY PLAYERS OPERATING IN REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET

TABLE 84: LIST OF MERGERS & ACQUISITIONS

TABLE 85: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 86: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 87: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

FIGURE 5: GROWTH PROSPECT MAPPING FOR THAILAND

FIGURE 6: GROWTH PROSPECT MAPPING FOR MIDDLE EAST & AFRICA

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2022

FIGURE 11: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIZATION DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY EMBOLIZATION DEVICES, IN 2022

FIGURE 13: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIC COILS, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY EMBOLIC COILS, IN 2022

FIGURE 15: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COATED DETACHABLE COILS, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY BARE DETACHABLE COILS, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COIL ASSIST STENT, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY CLIPPINGS, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY COIL ASSIST BALLOON, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ACCESSORY DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY ACCESSORY DEVICES, IN 2022

FIGURE 22: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY MICROCATHETERS, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY MICRO GUIDEWIRES, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY REVASCULARIZATION DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 25: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY REVASCULARIZATION DEVICES, IN 2022

FIGURE 26: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY CAROTID ARTERY STENTS, 2023-2032 (IN $ MILLION)

FIGURE 27: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY FLOW DIVERSION STENTS, 2023-2032 (IN $ MILLION)

FIGURE 28: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY THROMBECTOMY DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 29: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY THROMBECTOMY DEVICES, IN 2022

FIGURE 30: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY CLOT RETRIEVAL DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 31: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY SUCTION AND ASPIRATION DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 32: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY SNARES, 2023-2032 (IN $ MILLION)

FIGURE 33: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY EMBOLIC PROTECTION DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 34: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY EMBOLIC PROTECTION DEVICES, IN 2022

FIGURE 35: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY BALLOON OCCLUSION DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 36: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY DISTAL FILTER DEVICES, 2023-2032 (IN $ MILLION)

FIGURE 37: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2022

FIGURE 38: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ANEURYSM, 2023-2032 (IN $ MILLION)

FIGURE 39: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ISCHEMIC STROKE, 2023-2032 (IN $ MILLION)

FIGURE 40: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY STENOSIS, 2023-2032 (IN $ MILLION)

FIGURE 41: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY ARTERIOVENOUS MALFORMATION (AVM), 2023-2032 (IN $ MILLION)

FIGURE 42: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY OTHER APPLICATIONS, 2023-2032 (IN $ MILLION)

FIGURE 43: GLOBAL NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, BY GEOGRAPHY, 2022 & 2032 (IN %)

FIGURE 44: NORTH AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 45: UNITED STATES NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: CANADA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 48: UNITED KINGDOM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 49: GERMANY NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 50: FRANCE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 51: ITALY NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 52: SPAIN NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 53: POLAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 54: BELGIUM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 55: REST OF EUROPE NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 56: ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 57: CHINA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 58: JAPAN NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 59: INDIA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 60: SOUTH KOREA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 61: INDONESIA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 62: THAILAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 63: VIETNAM NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 64: AUSTRALIA & NEW ZEALAND NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 65: REST OF ASIA-PACIFIC NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 66: REST OF WORLD NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 67: LATIN AMERICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FIGURE 68: MIDDLE EAST & AFRICA NEUROVASCULAR DEVICES/INTERVENTIONAL NEUROLOGY MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

Neurovascular devices restore normal blood flow and prevent difficulties by accessing blood vessels with minimally invasive techniques and offering therapies such as coiling, stenting, or embolization.

The recovery period varies according to the procedure and the patient’s condition. Some patients may be discharged the same day, while others may require a few days in the hospital.

Open surgery may be an option for neurovascular treatments in some circumstances. Minimally invasive treatments utilizing neurovascular implants, on the other hand, are frequently preferred due to their lower risk and faster recovery times.

RELATED REPORTS

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

FRANCE SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

GERMANY SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

CANADA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

UNITED STATES SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

GLOBAL ORTHOGNATHIC CRANIOMAXILLOFACIAL (CMF) DEVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC ORTHOGNATHIC CRANIOMAXILLOFACIAL (CMF) DEVICES MARKET FORECAST 2025-2032

-

EUROPE ORTHOGNATHIC CRANIOMAXILLOFACIAL (CMF) DEVICES MARKET FORECAST 2025-2032