GLOBAL MICRO IRRIGATION SYSTEMS MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

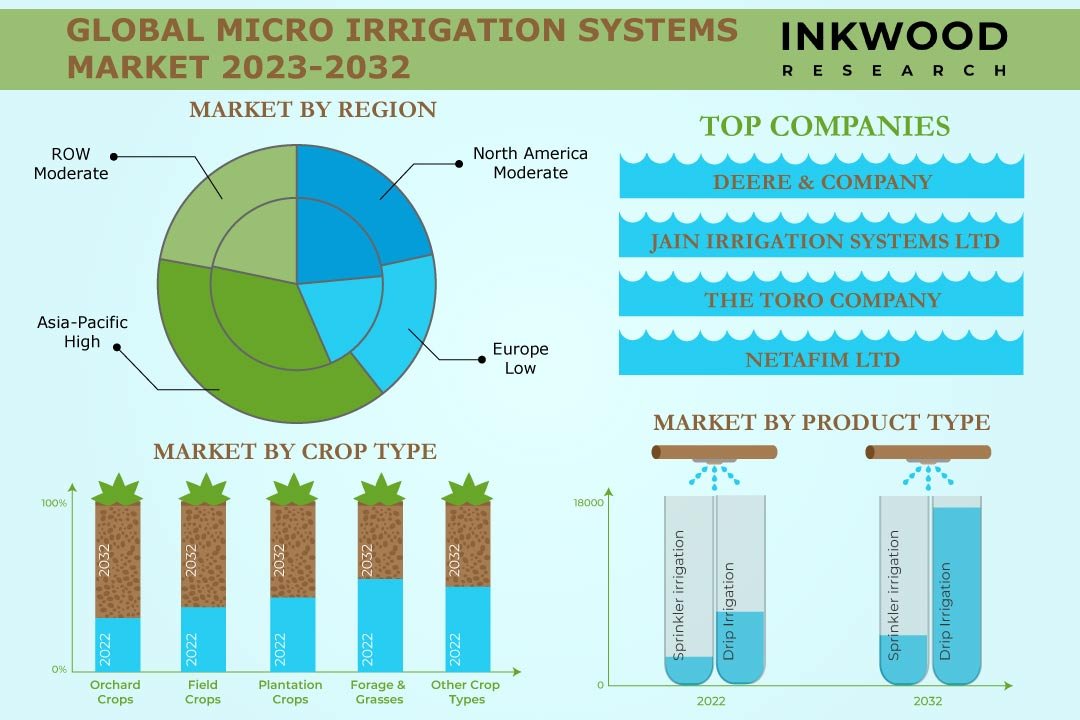

Global Micro Irrigation Systems Market by Product Type (Sprinkler Irrigation, Drip Irrigation) Market by Crop Type (Orchard Crops, Field Crops, Plantation Crops, Forage & Grasses, Other Crop Types) Market by End-user (Agriculture, Parks & Nursery, Greenhouse, Other End-users) by Geography

REPORTS » AGRICULTURE » AGRICULTURAL EQUIPMENT » GLOBAL MICRO IRRIGATION SYSTEMS MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global micro irrigation systems market is expected to reach $22040.36 million by 2032, growing at a CAGR of 8.75% during the forecast period, 2023-2032. The base year considered for the study is 2022, and the estimated period is between 2023 and 2032. The market study has also analyzed the impact of COVID-19 on the micro irrigation systems market qualitatively as well as quantitatively.

Micro irrigation systems are an efficient method of irrigation that ensures precise delivery of water directly to plant roots. These systems, also referred to as drip irrigation or localized irrigation, rely on a network of tubes, emitters, and valves to distribute water and nutrients with utmost precision, minimizing any wastage.

The primary goal of micro irrigation systems is to enhance water efficiency, mitigate water evaporation and runoff, and foster optimal plant growth by providing water directly to the root zone. They find extensive application in diverse agricultural environments, including commercial farms, orchards, vineyards, nurseries, and home gardens.

Read our latest blog on the Micro Irrigation Systems Market

GROWTH ENABLERS

Key enablers of the global micro irrigation systems market growth are:

- Depleting water resources

- Growing population and decreasing per capita arable land

- The continuous growth of the global population has led to the expansion of various industries, including those focused on water conservation. According to recent estimates from the United Nations, the global population reached 7.8 billion as of December 2020. Furthermore, data released by Worldometer indicates that the world population has reached 8 billion people in 2023.

- Governments around the world are prioritizing the expansion of food production to meet the needs of their growing populations. However, with limited arable land available, there is a requirement for high per capita crop yields to fulfill global food demand. As a result, there is an increasing demand for micro irrigation systems equipped with advanced technologies.

- Micro irrigation systems help minimize water wastage and enhance crop productivity. Hence, the global demand for micro irrigation is being driven by escalating concerns regarding water scarcity and population growth.

- Favorable government initiatives

GROWTH RESTRAINTS

Key factors restraining the global micro irrigation systems market growth are:

- High initial setup costs

- Micro-irrigation systems comprise several components, including filters, regulators, valves, chemical injectors, pumps, and automation elements, all of which contribute to the overall installation expenses. For instance, the emitter, which may be a sprinkler, sprayer, or drip tube, accounts for approximately 35% of the total equipment cost. Furthermore, unfavorable weather conditions can cause damage to the tubes and accessories, resulting in increased maintenance expenses.

- To ensure optimal functionality, additional maintenance tasks such as flushing lateral lines, filtration, and the application of acid and chlorine are necessary. Additionally, to fully leverage the benefits of these systems, farmers must consistently monitor environmental conditions and schedule irrigation based on the specific requirements of their plants.

- Over irrigation & clogging issues

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Micro Irrigation Systems Market | Top Market Trends

- The micro irrigation system market is witnessing a growing trend toward minimizing freshwater wastage. This trend emphasizes the use of systems that supply water uniformly and precisely, resulting in reduced losses compared to other irrigation methods. The implementation of filtration through the SDI system further enhances water quality, benefiting both human health and the environment. By utilizing drip pipes and emitters, micro irrigation techniques ensure accurate water delivery at the base of the plants, promoting efficient water usage.

- Nurseries widely adopt micro irrigation systems such as capillary mat irrigation, micro-sprayers, spaghetti tubes, and micro-sprinklers for effective water application. The increasing demand for micro irrigation systems in nurseries is attributed to their effectiveness, low operating pressure, and ability to minimize water usage.

- Automation plays a vital role in micro irrigation by empowering farmers to have control over the irrigation process. Also, advancements in automation have simplified the installation of standalone controllers and valves. Additionally, computer-oriented programs and sensors enable automatic adjustments based on monitored parameters, facilitating desired performance levels.

MARKET SEGMENTATION

Market Segmentation – Product Type, Crop Type, and End-User –

Market by Product Type:

- Sprinkler Irrigation

- Drip Irrigation

- Drip Irrigation is anticipated to be the fastest-growing product type in the market, with an anticipated CAGR of 9.12%. Drip irrigation is a precise and efficient method of delivering water and nutrients directly to plant roots. Its targeted approach minimizes water wastage and conserves resources, making it popular in the global micro irrigation systems market.

- Drip irrigation aids in water & fertilizer conservation, and advancements in low-pressure systems with anti-clogging technologies are being adopted for cost-effectiveness.

Market by Crop Type:

- Orchard Crops

- Orchard crops are the largest revenue-generating crop type as of 2022. Micro irrigation systems are extensively used to irrigate orchard crops, such as fruits and nut-producing trees, for commercial food production.

- Low-pressure micro-sprinkler systems are favored for high-value crops and irregularly shaped orchard blocks. These systems offer increased irrigation efficiency and reduced labor costs. Similarly, customizable micro irrigation systems tailored to orchard needs present growth opportunities.

- Furthermore, fruit orchard irrigation can be achieved through overhead sprinklers, under-tree sprinklers, or precision irrigation, with each method chosen based on the specific area and microclimate.

- Moreover, drip irrigation is highly effective in conserving water and improving productivity in orchards.

- Field Crops

- Plantation Crops

- Forage & Grasses

- Other Crop Types

Market by End-User:

- Agriculture

- Parks & Nursery

- Greenhouse

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is anticipated to be the largest regional market, with a revenue share of 34.78% in 2022. The increasing trend of investing in research & development projects by the top market players, such as Jain Irrigation Systems Ltd, Netafim Ltd, Mahindra EPC Irrigation Limited, and Dayu Irrigation Group Co Ltd, is a significant growth driver.

- Asia-Pacific is at the forefront of the development of micro irrigation systems. Moreover, in countries like India, government initiatives aimed at allowing 100% foreign investments in the agricultural sector, specifically in areas such as seeds, plantation, vegetable cultivation, and horticulture, are expected to encourage the adoption of micro irrigation solutions.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

The major players in the global micro irrigation systems market are:

- Deere & Company

- Jain Irrigation Systems Ltd (JISL)

- Lindsay Corporation

- Nelson Irrigation Corporation

- Netafim Ltd

- Rain Bird Corporation

- Rivulis Irrigation

- The Toro Company

- Valmont Industries Inc (Valmont)

Key strategies adopted by some of these companies:

- In January 2023, Valmont Industries Inc successfully obtained a supply agreement to provide mechanized irrigation equipment and cutting-edge technology for agricultural development initiatives in Africa. In a major milestone, the company secured a substantial order valued at USD 85 million to deliver irrigation products and advanced solutions.

- In February 2022, Netafim USA, a subsidiary of Netafim Ltd, unveiled the AlphaDisc filter in the United States. This advanced filter is specifically engineered to prevent clogging in irrigation systems caused by organic contaminants.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product Type, Crop Type, End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Dayu Irrigation Group Co Ltd, Deere & Company, Hunter Industries, Irritec SpA, Jain Irrigation Systems Ltd (JISL), Lindsay Corporation, Mahindra EPC Irrigation Limited, Metzer, Nelson Irrigation Corporation, Netafim Ltd, Rain Bird Corporation, Rivulis Irrigation, The Toro Company, T-L Irrigation Co, Valmont Industries Inc |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- CHANGING TECHNOLOGICAL LANDSCAPE: GPS & REMOTE CONTROL INTEGRATION

- GLOBAL FOOD COMPANIES EMBRACE SUSTAINABLE PRACTICES FOR ETHICAL PRODUCT MARKETING

-

MARKET DYNAMICS

- INTRODUCTION: MICRO IRRIGATION SYSTEMS

- BENEFITS OFFERED BY MICRO IRRIGATION SYSTEMS OVER TRADITIONAL IRRIGATION

- RESTRICTS WATER LOSS ASSOCIATED WITH EVAPORATION AND DRAINAGE

- DISTRIBUTES WATER WITH HIGH UNIFORMITY

- OFFERS COMPLETE CONTROL OVER THE IRRIGATION PROCESS

- CONVENIENT AND EASY TO USE

- HELPS RESTRICT AND CONTROL WEED GROWTH

- COMPATIBLE PRODUCTS AND COMPONENTS

- SUITABLE FOR DIFFERENT TOPOGRAPHIES

- KEY DRIVERS

- DEPLETING WATER RESOURCES

- GROWING POPULATION AND DECREASING PER CAPITA ARABLE LAND

- FAVORABLE GOVERNMENT INITIATIVES

- KEY RESTRAINTS

- HIGH INITIAL SETUP COSTS

- OVER IRRIGATION & CLOGGING ISSUES

-

KEY ANALYTICS

- PARENT MARKET ANALYSIS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- VALUE CHAIN ANALYSIS

- MANUFACTURERS AND IMPORTERS

- MACHINERY DEALERS

- LOCAL SERVICE PROVIDERS

- END-USERS

- KEY BUYING CRITERIA

- AVAILABILITY

- BRAND VALUE

- PRICE

- USER-FRIENDLY AND DURABLE PRODUCTS

- PERFORMANCE

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

-

MARKET BY PRODUCT TYPE

- SPRINKLER IRRIGATION

- DRIP IRRIGATION

-

MARKET BY CROP TYPE

- ORCHARD CROPS

- FIELD CROPS

- PLANTATION CROPS

- FORAGE & GRASSES

- OTHER CROP TYPES

-

MARKET BY END-USER

- AGRICULTURE

- PARKS & NURSERY

- GREENHOUSE

- OTHER END-USERS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET DRIVERS

- NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE MICRO IRRIGATION SYSTEMS MARKET DRIVERS

- EUROPE MICRO IRRIGATION SYSTEMS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE MICRO IRRIGATION SYSTEMS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY MICRO IRRIGATION SYTEMS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET DRIVERS

- ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET DRIVERS

- REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEMS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- DIVESTITURES

- COMPANY PROFILES

- DAYU IRRIGATION GROUP CO LTD

- DEERE & COMPANY

- HUNTER INDUSTRIES

- IRRITEC SPA

- JAIN IRRIGATION SYSTEMS LTD (JISL)

- LINDSAY CORPORATION

- MAHINDRA EPC IRRIGATION LIMITED

- METZER

- NELSON IRRIGATION CORPORATION

- NETAFIM LTD

- RAIN BIRD CORPORATION

- RIVULIS IRRIGATION

- THE TORO COMPANY

- T-L IRRIGATION CO

- VALMONT INDUSTRIES INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – MICRO IRRIGATION SYSTEMS

TABLE 2: IRRIGATION SYSTEMS WITH THEIR EFFICIENCY

TABLE 3: DIFFERENT IRRIGATION METHODS WITH THEIR FIELD APPLICATIONS EFFICIENCY

TABLE 4: FEATURES OF MICRO-IRRIGATION SYSTEMS

TABLE 5: USE OF WATER ON DAILY BASIS IN TREES FOR DIFFERENT SPACING (IN GALLONS)

TABLE 6: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL SPRINKLER IRRIGATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL SPRINKLER IRRIGATION MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL DRIP IRRIGATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL DRIP IRRIGATION MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY CROP TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY CROP TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL ORCHARD CROPS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL ORCHARD CROPS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL FIELD CROPS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL FIELD CROPS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL PLANTATION CROPS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL PLANTATION CROPS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL FORAGE & GRASSES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL FORAGE & GRASSES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL OTHER CROP TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL OTHER CROP TYPES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL AGRICULTURE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL AGRICULTURE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL PARKS & NURSERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL PARKS & NURSERY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL GREENHOUSE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL GREENHOUSE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: KEY PLAYERS OPERATING IN NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET

TABLE 39: EUROPE MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 40: EUROPE MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 41: KEY PLAYERS OPERATING IN EUROPE MICRO IRRIGATION SYSTEMS MARKET

TABLE 42: ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: KEY PLAYERS OPERATING IN ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET

TABLE 45: REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 46: REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 47: KEY PLAYERS OPERATING IN REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET

TABLE 48: LIST OF MERGERS & ACQUISITIONS

TABLE 49: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 50: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 51: LIST OF DIVESTITURES

LIST OF FIGURES

FIGURE 1: WATER EFFICIENCY UNDER DIFFERENT IRRIGATION SYSTEMS

FIGURE 2: WORLDWIDE POPULATION ESTIMATES, 2020-2050 (IN BILLION)

FIGURE 3: ARABLE LAND PER CAPITA IN 1970, 2000 & 2050 (IN PER HA)

FIGURE 4: KEY MARKET TRENDS

FIGURE 5: SAMPLE PLAN OF WASTEWATER UTILIZATION

FIGURE 6: PORTER’S FIVE FORCES ANALYSIS

FIGURE 7: VALUE CHAIN ANALYSIS

FIGURE 8: KEY BUYING CRITERIA

FIGURE 9: MARKET MATURITY ANALYSIS

FIGURE 10: MARKET CONCENTRATION ANALYSIS

FIGURE 11: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2022

FIGURE 12: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY SPRINKLER IRRIGATION, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY DRIP IRRIGATION, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, GROWTH POTENTIAL, BY CROP TYPE, IN 2022

FIGURE 15: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY ORCHARD CROPS, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY FIELD CROPS, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY PLANTATION CROPS, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY FORAGE & GRASSES, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY OTHER CROP TYPES, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 21: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY AGRICULTURE, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY PARKS & NURSERY, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY GREENHOUSE, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL MICRO IRRIGATION SYSTEMS MARKET, BY OTHER END-USERS, 2023-2032 (IN $ MILLION)

FIGURE 25: NORTH AMERICA MICRO IRRIGATION SYSTEMS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 26: UNITED STATES MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: CANADA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: EUROPE MICRO IRRIGATION SYSTEMS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 29: UNITED KINGDOM MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: GERMANY MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: FRANCE MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: ITALY MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: SPAIN MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: BELGIUM MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: POLAND MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: REST OF EUROPE MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 38: CHINA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: JAPAN MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: INDIA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: SOUTH KOREA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: INDONESIA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: THAILAND MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: VIETNAM MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: AUSTRALIA & NEW ZEALAND MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: REST OF ASIA-PACIFIC MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: REST OF WORLD MICRO IRRIGATION SYSTEMS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 48: LATIN AMERICA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 49: MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEMS MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

As of 2022, the global micro irrigation systems market was valued at $9531.30 million.

Orchard crops are the fastest-growing crop type in the global micro irrigation systems market.

RELATED REPORTS

-

ASIA-PACIFIC BIOCHAR MARKET FORECAST 2024-2032

-

EUROPE BIOCHAR MARKET FORECAST 2024-2032

-

NORTH AMERICA BIOCHAR MARKET FORECAST 2024-2032

-

KENYA BIOCHAR MARKET FORECAST 2024-2032

-

INDIA BIOCHAR MARKET FORECAST 2024-2032

-

GLOBAL AGRICULTURAL BIOTECHNOLOGY MARKET FORECAST 2024-2032

-

GLOBAL BIOCHAR MARKET FORECAST 2024-2032

-

CHINA BIOCHAR MARKET FORECAST 2024-2032

-

GERMANY BIOCHAR MARKET FORECAST 2024-2032

-

UNITED STATES BIOCHAR MARKET FORECAST 2024-2032