MEXICO CANCER PAIN MANAGEMENT MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

Mexico Cancer Pain Management Market by Drug Type (Opioids, Morphine, Non-opioids, Acetaminophen, Non-steroidal Anti-inflammatory Drugs, Nerve Blockers) Market by Disease Indication (Lung Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Blood Cancer, Other Disease Indications)

REPORTS » PHARMACEUTICALS » MEXICO CANCER PAIN MANAGEMENT MARKET FORECAST 2024-2032

MARKET OVERVIEW

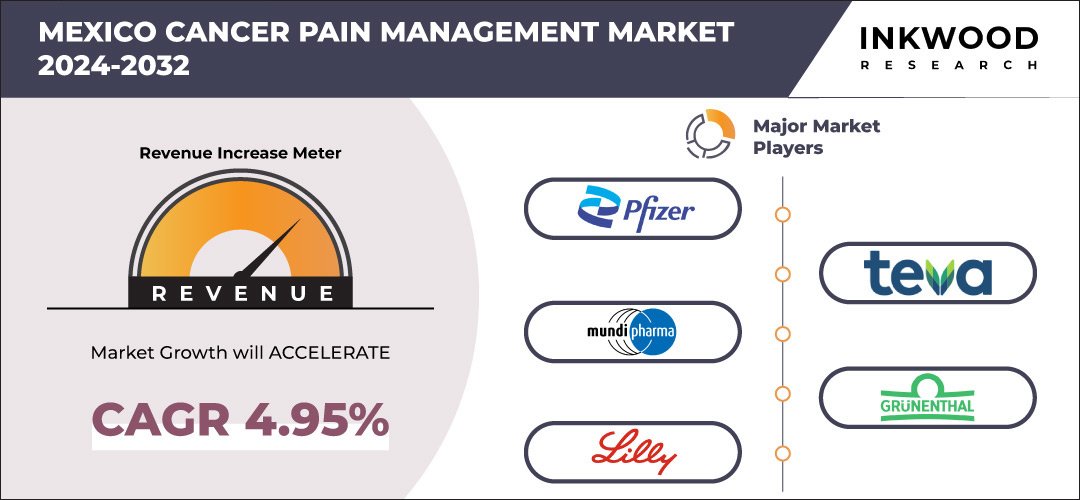

The Mexico cancer pain management market is predicted to grow with a CAGR of 4.95% during the forecast period 2024-2032. According to the Global Cancer Observatory, Mexico registered 207,154 new cancer cases in 2022. The country experienced 96,210 cancer-related deaths that year, highlighting the significant impact of the disease on the population. Additionally, the number of prevalent cancer cases over five years reached 577,487. Among these, prostate cancer emerged as one of the most frequently diagnosed types, posing a major health challenge for men in Mexico.

Cancer pain treatment is a crucial aspect of cancer care, significantly affecting patients’ quality of life. Addressing cancer pain requires a multifaceted approach, including pharmacological treatments such as cancer pain medications (opioids and non-opioid medications), along with non-pharmacological interventions like physical therapy, psychological support, and complementary therapies. Public health initiatives and policies aimed at improving cancer pain management in Mexico are essential. These initiatives should focus on raising awareness about the importance of pain management in cancer care, advocating for patients’ rights to receive adequate pain relief, and ensuring that pain management is an integral part of cancer treatment protocols.

To Know More About This Report, Request a Free Sample Copy

Collaboration between government agencies, healthcare institutions, non-governmental organizations, and the pharmaceutical industry is necessary to develop and implement effective strategies for advanced cancer pain management. This includes investing in research and development of new cancer pain relief drugs and therapies, as well as improving access to existing treatments.

However, managing cancer pain in Mexico faces significant challenges due to concerns about opioid side effects and addiction. Opioids are essential for relieving moderate to severe cancer-related pain. Still, they come with a high risk of side effects such as nausea, constipation, and respiratory depression, as well as potential addiction issues. Addressing these concerns is crucial to ensure effective pain management while mitigating the risks associated with opioid use in the Mexico cancer pain management market.

Need a custom report or have specific data requirements? Let us know!

The report on the Mexico cancer pain management market includes the segmentation analysis based on drug type and disease indication.

Market by Drug Type:

- Opioids

- Morphine

- Fentanyl

- Other Morphines

- Non-Opioids

- Acetaminophen

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDS)

- Nerve Blockers

Market by Disease Indication:

- Lung Cancer

- Colorectal Cancer

- Breast Cancer

- Prostate Cancer

- Blood Cancer

- Other Disease Indications

Inkwood Research’s report on the Mexico cancer pain management market provides in-depth insights as well as the market’s segmentation analysis. The detailed evaluation of the market includes Competitive Landscape and Value Chain Analysis.

Key players operating in the Mexico cancer pain management market include Pfizer, Teva Pharmaceutical Industries Limited, Mundipharma International, Eli Lilly Company, Grünenthal Pharma GmbH & Co KG, etc.

Teva Pharmaceutical Industries Limited is a pharmaceutical company that manufactures medicines and biopharmaceutical products. The company offers cytotoxic substances, sterile products, hormones, and high-potency drugs. Additionally, Teva produces medications in various forms, including tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams. It focuses on the respiratory, central nervous system (CNS), pain, and oncology therapeutic areas. Teva operates across North America, Europe, Israel, and internationally. Founded in 1901, the company is headquartered in Tel Aviv, Israel.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Drug Type and Disease Indication |

| Countries Analyzed | Mexico |

| Companies Analyzed | Pfizer, Teva Pharmaceutical Industries Limited, Mundipharma International, Eli Lilly and Company, Grünenthal Pharma GmbH & Co KG |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT — MEXICO

- COUNTRY ANALYSIS — MEXICO

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON THE MEXICO CANCER PAIN MANAGEMENT MARKET

- MAJOR MARKET FINDINGS

- SURGE IN PERSONALIZED MEDICINE APPROACHES

- EXPANSION OF SPECIALIZED CANCER CARE FACILITIES

- LIMITATIONS IN CANCER MEASUREMENTS IMPACT HEALTHCARE AND POLICY

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING PREVALENCE OF CANCER IN MEXICO

- SURGE IN GERIATRIC POPULATION

- ADVANCEMENTS IN PAIN CONTROL AND PALLIATIVE CARE

- KEY RESTRAINTS

- REGULATORY CHALLENGES AND APPROVAL DELAYS

- LACK OF ACCESS TO OPIOID MEDICINE IN MEXICO

- INADEQUATE HEALTHCARE INFRASTRUCTURE

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- SUPPORTIVE GOVERNMENT POLICIES FOR CANCER PAIN MANAGEMENT

- ACTIVE R&D BY PHARMACEUTICAL COMPANIES

- PESTLE ANALYSIS

- POLITICAL

- ECONOMICAL

- SOCIAL

- TECHNOLOGICAL

- LEGAL

- ENVIRONMENTAL

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTIONS

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING — MEXICO

- VALUE CHAIN ANALYSIS

- RESEARCH & DEVELOPMENT

- REGULATORY APPROVAL

- MANUFACTURING

- DISTRIBUTION

- END-USERS

- KEY MARKET TRENDS

MARKET BY DRUG TYPE

- OPIOIDS

- MORPHINE

- FENTANYL

- OTHER MORPHINES

- NON-OPIOIDS

- ACETAMINOPHEN

- NON-STEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS)

- NERVE BLOCKERS

MARKET BY DISEASE INDICATION

- LUNG CANCER

- COLORECTAL CANCER

- BREAST CANCER

- PROSTATE CANCER

- BLOOD CANCER

- OTHER DISEASE INDICATIONS

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- PFIZER

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- TEVA PHARMACEUTICAL INDUSTRIES

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- MUNDIPHARMA INTERNATIONAL

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- GRÜNENTHAL PHARMA GMBH & CO KG

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ELI LILLY AND COMPANY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- PFIZER

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – CANCER PAIN MANAGEMENT

TABLE 2: MEXICO CANCER PAIN MANAGEMENT MARKET, BY DRUG TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: MEXICO CANCER PAIN MANAGEMENT MARKET, BY DRUG TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: MEXICO CANCER PAIN MANAGEMENT MARKET, BY MORPHINE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: MEXICO CANCER PAIN MANAGEMENT MARKET, BY MORPHINE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: MEXICO CANCER PAIN MANAGEMENT MARKET, BY DISEASE INDICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: MEXICO CANCER PAIN MANAGEMENT MARKET, BY DISEASE INDICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: LIST OF MERGERS & ACQUISITIONS

TABLE 9: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 10: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 11: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING — MEXICO

FIGURE 4: VALUE CHAIN ANALYSIS

FIGURE 5: MEXICO CANCER PAIN MANAGEMENT MARKET, GROWTH POTENTIAL, BY DRUG TYPE, IN 2023

FIGURE 6: MEXICO CANCER PAIN MANAGEMENT MARKET, BY OPIOIDS, 2024-2032 (IN $ MILLION)

FIGURE 7: MEXICO CANCER PAIN MANAGEMENT MARKET, BY MORPHINE, 2024-2032 (IN $ MILLION)

FIGURE 8: MEXICO CANCER PAIN MANAGEMENT MARKET, GROWTH POTENTIAL, BY MORPHINE, IN 2023

FIGURE 9: MEXICO CANCER PAIN MANAGEMENT MARKET, BY FENTANYL, 2024-2032 (IN $ MILLION)

FIGURE 10: MEXICO CANCER PAIN MANAGEMENT MARKET, BY OTHER MORPHINES, 2024-2032 (IN $ MILLION)

FIGURE 11: MEXICO CANCER PAIN MANAGEMENT MARKET, BY NON-OPIOIDS, 2024-2032 (IN $ MILLION)

FIGURE 12: MEXICO CANCER PAIN MANAGEMENT MARKET, BY ACETAMINOPHEN, 2024-2032 (IN $ MILLION)

FIGURE 13: MEXICO CANCER PAIN MANAGEMENT MARKET, BY NON-STEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS), 2024-2032 (IN $ MILLION)

FIGURE 14: MEXICO CANCER PAIN MANAGEMENT MARKET, BY NERVE BLOCKERS, 2024-2032 (IN $ MILLION)

FIGURE 15: MEXICO CANCER PAIN MANAGEMENT MARKET, GROWTH POTENTIAL, BY DISEASE INDICATION, IN 2023

FIGURE 16: MEXICO CANCER PAIN MANAGEMENT MARKET, BY LUNG CANCER, 2024-2032 (IN $ MILLION)

FIGURE 17: MEXICO CANCER PAIN MANAGEMENT MARKET, BY COLORECTAL CANCER, 2024-2032 (IN $ MILLION)

FIGURE 18: MEXICO CANCER PAIN MANAGEMENT MARKET, BY BREAST CANCER, 2024-2032 (IN $ MILLION)

FIGURE 19: MEXICO CANCER PAIN MANAGEMENT MARKET, BY PROSTATE CANCER, 2024-2032 (IN $ MILLION)

FIGURE 20: MEXICO CANCER PAIN MANAGEMENT MARKET, BY BLOOD CANCER, 2024-2032 (IN $ MILLION)

FIGURE 21: MEXICO CANCER PAIN MANAGEMENT MARKET, BY OTHER DISEASE INDICATIONS, 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

BRAZIL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032