GLOBAL MEDICAL IMAGING INSTRUMENT MARKET FORECAST 2018-2026

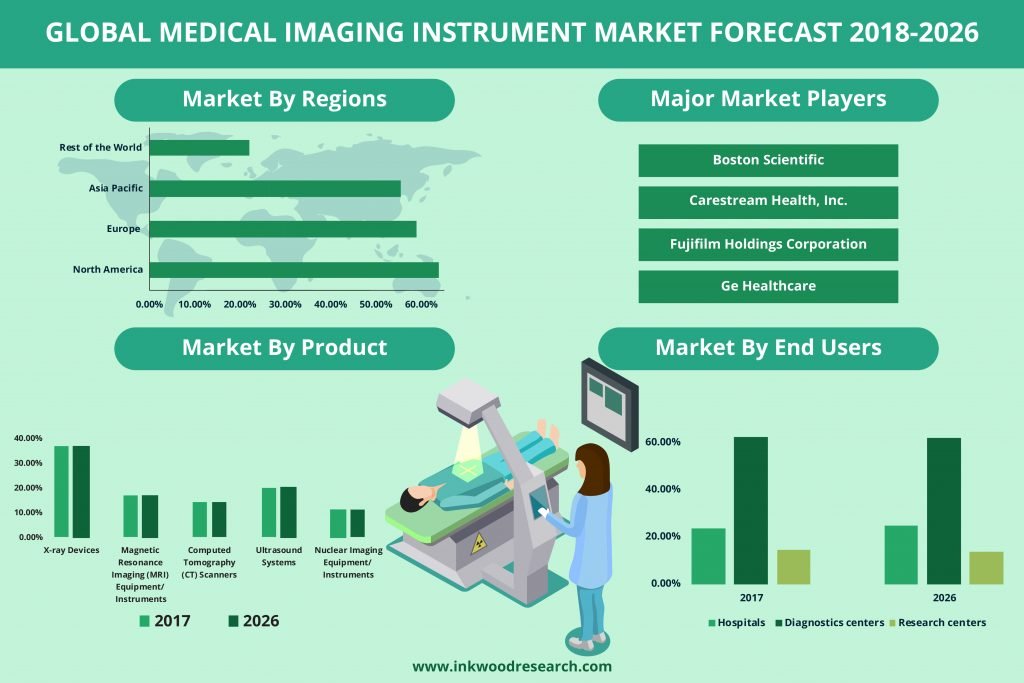

Global Medical Imaging Instrument Market by Products (X-ray Devices(Stationary, Portable, Magnetic Resonance Imaging (Mri) Equipment/ Instruments, Computed Tomography (Ct) Scanners, Ultrasound Systems, Nuclear Imaging Equipment/ Instruments) by End Users(Hospitals, Diagnostics Centers, Research Centers) & by Geography.

The Global Medical Imaging instrument market is anticipated to grow at a CAGR of 5.21% in terms of revenue and 5.76% in terms of the number of units sold between 2018 and 2026. Medical imaging helps in early detection and diagnosis of chronic diseases, thereby making treatment possible at early stages. It also aids medical experts and doctors to select and provide the most effective and appropriate line of treatment. The Medical Imaging instrument market is primarily driven by the following factors:

- Swelling occurrence of chronic diseases

- Increasing investments in the medical imaging instruments

- The rise in geriatric population

- Wide usages of cloud computing in medical imaging

To know more about this report, request a free sample copy

The important drivers increasing growth in the global medical imaging instrument market are growing occurrence of chronic diseases and increasing investments for medical imaging instruments. The increasing prevalence of chronic diseases across the globe provides ample of opportunities for the global medical imaging instruments market growth. The chronic diseases such as cancer, strokes, neurodegenerative diseases, COPD, cardiovascular diseases and others require imaging of the body parts for proper diagnosis of the disease. The investments in the imaging technologies and government initiatives to fight against chronic diseases are also fueling the global medical imaging instruments market growth.

The technology and applications of medical imaging instrument market are used extensively for various purposes. X-ray machines produce X-ray radiation used for medical diagnosis and interventional purposes (e.g., catheter placement). X-ray device applications are segmented into general radiography, dental, and mammography. In X-ray imagining systems an X-ray beam produced X-ray beam that passes through the body. X-ray devices are machines used for capturing pictures of dense tissues such as teeth and bones. These devices use X-radiation to obtain images of the structures. Magnetic imaging resonance (MRI) is an imaging technique that uses a magnetic field and radio wave to create detailed images of the human body. Imaging instruments that comprise of CT scanners have extensive application in cardiology, oncology, neurology and other applications. The medical imaging instruments that comprise of ultrasound systems have extensive applications in radiology/general imaging, obstetrics/ gynaecology (OB/GYN), cardiology, vascular, urology and other applications. Nuclear imaging equipment technologies use radioactive material for diagnosis and monitoring, and provides additional and in-depth data, resulting in efficient cost and clinical outcomes.

High pricing of medical imaging instruments is the major factors hindering the Medical Imaging instrument market. Charges for medical imaging instruments such as for a single MRI scan varies widely across the country for reasons beyond startup costs. For hospitals and imaging centers, the base price for machines is just the beginning. CT and MRI imaging machines usually cost about $100,000 per year to maintain.

The Global Medical Imaging instrument market segments include products, technologies, applications and end users:-

Products are segmented into:

- X-ray devices

- Stationary

- Floor to ceiling mounted systems

- Ceiling mounted systems

- Portable

- Mobile x-ray systems

- Handheld x-ray systems

- Magnetic resonance imaging (MRI) equipment/ instruments

- Closed MRI

- Open MRI

- Computed tomography (CT) scanners

- Stationary CT scanners

- Mobile CT scanners

- Ultrasound systems

- Compact/portable ultrasound system

- Cart/trolley based ultrasound system

- Nuclear imaging equipment/ instruments

- SPECT scanner

- Hybrid SPECT systems

- Standalone SPECT systems

- Hybrid pet

- Planar scintigraphy

Technologies are segmented into:

- X-ray devices

- Analog x-ray technology

- Digital radiography

- Computed Radiography

- Magnetic resonance imaging (MRI) equipment/ instruments

- Low-field strength

- Medium- field strength

- High- field strength

- Computed tomography (CT) scanners

- Low-slice

- Medium- slice

- High- slice

- Ultrasound systems

- 2-D

- 3-D & 4-D

- Doppler

- High-intensity frequency ultrasound

- Lithotripsy

- Nuclear imaging equipment/ instruments

- SPECT scanner

- PET scanner

Applications are segmented into:

- X-ray devices

- General radiography

- Dental

- Mammography

- Magnetic resonance imaging (MRI) equipment/ instruments

- Brain and neurological MRI

- Spine and musculoskeletal MRI

- Vascular MRI

- Pelvic and abdominal MRI

- Breast MRI21% in terms of revenue and 5.76% in terms of the number of units sold

- Cardiac MRI21% in terms of revenue and 5.76% in terms of the number of units sold

- Computed tomography (CT) scanners

- Cardiology

- Oncology

- Neurology

- Other CT scanners

- Ultrasound systems

- Radiology/general imaging

- Obstetrics/gynecology (Ob/Gyn)

- Cardiology

- Vascular

- Urology

- Other applications

- Nuclear imaging systems

- Cardiology

- Oncology

- Neurology

- Other nuclear imaging systems

End users are segmented into:

- Hospitals

- Diagnostics centers

- Research centers

This report covers the present market conditions and the growth prospects of the global medical imaging instruments market for 2018-2026 and considered the revenue generated through the sales of medical imaging instruments for products, technologies, applications and end users to calculate the market size by considering 2017 as the base year.

Geographically, the global medical imaging instruments market has been segmented on the basis of four major regions, which include:

- Medical Imaging Instrument North America Market: The United States, Canada & Mexico

- Medical Imaging Instrument Asia-Pacific Market: China, India, Japan, Australia, South Korea & Rest of APAC

- Medical Imaging Instrument Europe Market: The United Kingdom, France, Germany, Spain, Italy & Rest of Europe

- Rest of World: Latin America & Middle East and Africa

The Medical Imaging instrument market in North America is expected to hold the largest share by 2026 owing to the escalating prevalence of cancer, rising prevalence of chronic & autoimmune diseases and grants provided by the federal for innovation & development related to medical imaging. On the other hand, the Asia-Pacific market is anticipated to be the fastest-growing region for the medical imaging instrument market. Asia-Pacific medical imaging instruments market is mainly driven by the rising prevalence of cancer, presence of independent departments related to nuclear medicine, rising number of road accidents and bone fractures, increasing geriatric population, investments and initiatives made by the private organizations along with escalating medical tourism in the region.

The medical imaging instrument market is segmented based on products which are sub-divided into X-ray devices, magnetic resonance imaging (MRI) equipment/ instruments, computed tomography (ct) scanners, ultrasound systems & nuclear imaging equipment/ instruments. The market is also segmented on the basis of end users which are sub-divided into hospitals, diagnostics centers & research centers. X-ray machines produce X-ray radiation. This radiation is then used for medical diagnosis and interventional purposes (e.g., catheter placement). Magnetic resonance imaging (MRI) equipment is a diagnostic instrument for the medical investigations. Computer tomography (CAT) scanners are diagnostic imaging equipment that uses an arrangement of computer technology and X-rays to yield horizontal or axial, imageries of the physique. Medical ultrasound (also called ultrasonography or diagnostic sonography) is a diagnostic imaging technique based on the application of ultrasound. Nuclear medicine imaging procedures are non-invasive imaging procedures with the exception of intravenous injections. Imaging systems are used by medical professionals in the hospitals for the purpose of visualization of the body to diagnose pathological changes and precisely target therapeutic procedures. Diagnostic centers are ancillary services towards evaluating an individual’s medical condition in a timely and cost-effective manner. Research centers are amongst the foremost end users of medical imaging instruments, especially in areas of life science research.

The major market players in the global Medical Imaging instrument market are:

- Boston Scientific

- Carestream Health, Inc.

- Fujifilm Holdings Corporation

- Ge Healthcare

- Medtronic Plc

Company Profiles covers analysis of important players.

The sole purpose of Boston Scientific was to benefit the public health by bringing more accessible, lower-cost and lower-trauma medical options to patients. Boston Scientific’s interventional cardiology business unit manufactures products used to diagnose and treat coronary artery disease and other cardiovascular disorders. Boston Scientific’s Urology/pelvic health business unit develops, manufactures and sells devices to treat various urological and pelvic conditions. Medtronic PLC (Medtronic or ‘the company’) is engaged in providing medical technology solutions. The company functions through four sectors that manufacture and sell device-based medical therapies: restorative therapies group; minimally invasive therapies group; cardiac and vascular group; and diabetes group.

Key Findings of the Global Medical Imaging instrument market:

- X-ray device holds the largest market share

- Nuclear imaging instruments are anticipated to grow at a faster rate during the forecast period

- North America is dominating the medical imaging system market in terms of geography

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- X-RAY DEVICES HOLDS THE LARGEST MARKET SHARE

- NUCLEAR IMAGING INSTRUMENTS ARE ANTICIPATED TO GROW AT A FASTER RATE DURING THE FORECAST PERIOD

- MARKET DETERMINANTS

- MARKET DRIVERS

- SWELLING OCCURRENCE OF CHRONIC DISEASES

- INCREASING INVESTMENTS IN MEDICAL IMAGING INSTRUMENTS

- RISE IN GERIATRIC POPULATION

- WIDE USAGE OF CLOUD COMPUTING IN MEDICAL IMAGING

- MARKET RESTRAINTS

- HIGH PRICING OF MEDICAL IMAGING INSTRUMENTS

- MARKET OPPORTUNITIES

- WIDE USAGE OF MEDICAL IMAGING INSTRUMENTS IN NON-INVASIVE PROCEDURES

- GROWING USAGES OF MEDICAL INSTRUMENTS IN DRUGS DISCOVERY

- SURGE IN DEMAND FOR 3D MEDICAL IMAGING EQUIPMENT

- MARKET CHALLENGES

- REGULATORY ISSUES

- LACK OF SKILLED PROFESSIONALS

- MARKET DRIVERS

- MARKET SEGMENTATION

- MARKET BY PRODUCTS 2018-2026

- X-RAY DEVICES

- STATIONARY

- FLOOR TO CEILING MOUNTED SYSTEMS

- CEILING MOUNTED SYSTEMS

- PORTABLE

- MOBILE X-RAY SYSTEMS

- HANDHELD X-RAY SYSTEMS

- STATIONARY

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- CLOSED MRI

- OPEN MRI

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- STATIONARY CT SCANNERS

- MOBILE CT SCANNERS

- ULTRASOUND SYSTEMS

- COMPACT/PORTABLE ULTRASOUND SYSTEM

- CART/TROLLEY BASED ULTRASOUND SYSTEM

- NUCLEAR IMAGING EQUIPMENT/ INSTRUMENTS

- SPECT SCANNER

- HYBRID SPECT SYSTEMS

- STANDALONE SPECT SYSTEMS

- HYBRID PET

- PLANAR SCINTIGRAPHY

- SPECT SCANNER

- X-RAY DEVICES

- MARKET BY TECHNOLOGY 2018-2026

- X-RAY DEVICES

- ANALOG X-RAY TECHNOLOGY

- DIGITAL RADIOGRAPHY

- COMPUTED RADIOGRAPHY

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- LOW-FIELD STRENGTH

- MEDIUM- FIELD STRENGTH

- HIGH- FIELD STRENGTH

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- LOW-SLICE

- MEDIUM- SLICE

- HIGH- SLICE

- ULTRASOUND SYSTEMS

- 2-D

- 3-D & 4-D

- DOPPLER

- HIGH-INTENSITY FREQUENCY ULTRASOUND

- LITHOTRIPSY

- NUCLEAR IMAGING EQUIPMENT/ INSTRUMENTS

- SPECT SCANNER

- PET SCANNER

- X-RAY DEVICES

- MARKET BY APPLICATION 2018-2026

- X-RAY DEVICES

- GENERAL RADIOGRAPHY

- DENTAL

- MAMMOGRAPHY

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- BRAIN AND NEUROLOGICAL MRI

- SPINE AND MUSCULOSKELETAL MRI

- VASCULAR MRI

- PELVIC AND ABDOMINAL MRI

- BREAST MRI

- CARDIAC MRI

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- CARDIOLOGY

- ONCOLOGY

- NEUROLOGY

- OTHER CT SCANNERS

- ULTRASOUND SYSTEMS

- RADIOLOGY/GENERAL IMAGING

- OBSTETRICS/GYNECOLOGY (OB/GYN)

- CARDIOLOGY

- VASCULAR

- UROLOGY

- OTHER APPLICATIONS

- NUCLEAR IMAGING SYSTEMS

- CARDIOLOGY

- ONCOLOGY

- NEUROLOGY

- OTHER NUCLEAR IMAGING SYSTEMS

- X-RAY DEVICES

- MARKET BY END USER 2018-2026

- HOSPITALS

- DIAGNOSTICS CENTERS

- RESEARCH CENTERS

- MARKET BY PRODUCTS 2018-2026

- KEY ANALYTICAL

- PORTER’S FIVE FORCES ANALYSIS

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- BARGAINING POWER OF SUPPLIERS

- COMPETITIVE RIVALRY BETWEEN EXISTING PLAYERS

- MARKET POTENTIAL

- VALUE CHAIN ANALYSIS

- REGULATORY FRAMEWORK

- REGULATIONS IN NORTH AMERICA

- REGULATIONS IN EUROPE

- REGULATIONS IN ASIA PACIFIC

- PATENT ANALYSIS

- PORTER’S FIVE FORCES ANALYSIS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- THE UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF THE ASIA PACIFIC

- REST OF THE WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- AURORA IMAGING TECHNOLOGY, INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- BOSTON SCIENTIFIC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- BRUKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- CANON INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- CARESTREAM HEALTH, INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- COOK MEDICAL LLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- ELEKTA AB

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- FONAR CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- FUJIFILM HOLDINGS CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- GE HEALTHCARE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- HITACHI MEDICAL CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- HOLOGIC, INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- ICRCO INC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- MEDTRONIC PLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- MINDRAY

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- NEUSOFT MEDICAL SYSTEMS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- PHILIPS HEALTHCARE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- SIEMENS HEALTHCARE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- AURORA IMAGING TECHNOLOGY, INC.

TABLE LIST

TABLE 1 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 2 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 3 INVESTMENTS IN MEDICAL IMAGING DEVICES BY SOME OF THE MAJOR COMPANIES

TABLE 4 GLOBAL GERIATRIC POPULATIONS BY GEOGRAPHY 2015-2050

TABLE 5 PERCENTAGES OF AESTHETIC SURGERY PROCEDURES IN DIFFERENT COUNTRIES 2017

TABLE 6 COMPARISON OF NON-INVASIVE PROCEDURES TOOL

TABLE 7 ROLES OF IMAGING INSTRUMENTS IN SCIENCE AND CLINICAL MEDICINE

TABLE 8 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY PRODUCTS 2018-2026 ($ MILLION)

TABLE 9 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY PRODUCTS 2018-2026 (THOUSAND UNITS)

TABLE 10 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 11 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY TYPES 2018-2026 ($ MILLION)

TABLE 12 TYPES OF X-RAY MACHINE TO DIAGNOSE DISEASES

TABLE 13 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 14 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 15 GLOBAL X-RAY DEVICES MARKET IN STATIONARY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 16 GLOBAL X-RAY DEVICES MARKET IN STATIONARY BY TYPES 2018-2026 ($ MILLION)

TABLE 17 GLOBAL X-RAY DEVICES MARKET IN STATIONARY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 18 GLOBAL X-RAY DEVICES MARKET IN STATIONARY BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 19 GLOBAL X-RAY DEVICES MARKET IN PORTABLE BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 20 GLOBAL X-RAY DEVICES MARKET IN PORTABLE BY TYPES 2018-2026 ($ MILLION)

TABLE 21 GLOBAL X-RAY DEVICES MARKET IN PORTABLE BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 22 GLOBAL X-RAY DEVICES MARKET IN PORTABLE BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 23 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MRI EQUIPMENT BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 24 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MRI EQUIPMENT BY TYPES 2018-2026 ($ MILLION)

TABLE 25 PROS, CONS AND CLINICAL APPLICATIONS OF MR ANGIOGRAPHIC TECHNIQUES

TABLE 26 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MRI EQUIPMENT BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 27 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MRI EQUIPMENT BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 28 DIFFERENCES BETWEEN AN OPEN AND CLOSED MRI

TABLE 29 GLOBAL MRI EQUIPMENT MARKET IN CLOSED MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 30 GLOBAL MRI EQUIPMENT MARKET IN CLOSED MRI BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 31 GLOBAL MRI EQUIPMENT MARKET IN OPEN MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 32 GLOBAL MRI EQUIPMENT MARKET IN OPEN MRI BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 33 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 34 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY TYPES 2018-2026 ($ MILLION)

TABLE 35 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 36 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 37 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 38 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 39 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IN BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 40 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 41 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 42 VARIOUS USES OF ULTRASOUND

TABLE 43 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY TYPES 2018-2026 ($ MILLION)

TABLE 44 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 45 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 46 GLOBAL ULTRASOUND SYSTEMS MARKET IN COMPACT/PORTABLE ULTRASOUND SYSTEM BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 47 GLOBAL ULTRASOUND SYSTEMS MARKET IN COMPACT/PORTABLE ULTRASOUND SYSTEM BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 48 GLOBAL ULTRASOUND SYSTEMS MARKET IN CART/TROLLEY BASED ULTRASOUND SYSTEM BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 49 GLOBAL ULTRASOUND SYSTEMS MARKET IN CART/TROLLEY BASED ULTRASOUND SYSTEM BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 50 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 51 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY TYPES 2018-2026 ($ MILLION)

TABLE 52 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 53 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 54 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 55 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY TYPES 2018-2026 ($ MILLION)

TABLE 56 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 57 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 58 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN HYBRID PET BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 59 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN HYBRID PET BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 60 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN PLANAR SCINTIGRAPHY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 61 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN PLANAR SCINTIGRAPHY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 62 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY TECHNOLOGY 2018-2026 ($ MILLION)

TABLE 63 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY TECHNOLOGY 2018-2026 (THOUSAND UNITS)

TABLE 64 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 65 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY TYPES 2018-2026 ($ MILLION)

TABLE 66 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 67 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 68 COMPARISON OF ANALOG, DIGITAL, AND COMPUTED RADIOGRAPHY

TABLE 69 GLOBAL X-RAY DEVICES MARKET IN ANALOG X-RAY TECHNOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 70 GLOBAL X-RAY DEVICES MARKET IN ANALOG X-RAY TECHNOLOGY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 71 GLOBAL X-RAY DEVICES MARKET IN DIGITAL RADIOGRAPHY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 72 GLOBAL X-RAY DEVICES MARKET IN DIGITAL RADIOGRAPHY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 73 COMPARISON OF ANALOG AND DIGITAL RADIOGRAPHY

TABLE 74 GLOBAL X-RAY DEVICES MARKET IN COMPUTED RADIOGRAPHY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 75 GLOBAL X-RAY DEVICES MARKET IN COMPUTED RADIOGRAPHY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 76 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 77 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY TYPES 2018-2026 ($ MILLION)

TABLE 78 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 79 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 80 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN LOW-FIELD STRENGTH BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 81 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT IN LOW-FIELD STRENGTH BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 82 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN MEDIUM- FIELD STRENGTH BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 83 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT IN MEDIUM- FIELD STRENGTH BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 84 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN HIGH- FIELD STRENGTH BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 85 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT IN HIGH- FIELD STRENGTH BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 86 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 87 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY TYPES 2018-2026 ($ MILLION)

TABLE 88 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 89 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 90 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IN LOW-SLICE BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 91 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN LOW-SLICE BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 92 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IN MEDIUM- SLICE BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 93 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN MEDIUM- SLICE BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 94 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IN HIGH- SLICE BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 95 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN HIGH- SLICE BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 96 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 97 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY TYPES 2018-2026 ($ MILLION)

TABLE 98 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 99 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 100 GLOBAL ULTRASOUND SYSTEMS MARKET IN 2-D BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 101 GLOBAL ULTRASOUND SYSTEMS MARKET IN 2-D BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 102 GLOBAL ULTRASOUND SYSTEMS MARKET IN 3-D & 4-D BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 103 GLOBAL ULTRASOUND SYSTEMS MARKET IN 3-D & 4-D BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 104 GLOBAL ULTRASOUND SYSTEMS MARKET IN DOPPLER BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 105 GLOBAL ULTRASOUND SYSTEMS MARKET IN DOPPLER BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 106 GLOBAL ULTRASOUND SYSTEMS MARKET IN HIGH-INTENSITY FREQUENCY ULTRASOUND BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 107 GLOBAL ULTRASOUND SYSTEMS MARKET IN HIGH-INTENSITY FREQUENCY ULTRASOUND BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 108 GLOBAL ULTRASOUND SYSTEMS MARKET IN LITHOTRIPSY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 109 GLOBAL ULTRASOUND SYSTEMS MARKET IN LITHOTRIPSY BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 110 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 111 USES OF NUCLEAR MEDICINE IMAGING PROCEDURES WITHIN THE BODY

TABLE 112 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY TYPES 2018-2026 ($ MILLION)

TABLE 113 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 114 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING EQUIPMENT BY TYPES 2018-2026 (THOUSAND UNITS)

TABLE 115 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 116 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN SPECT SCANNER BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 117 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN PET SCANNER BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 118 GLOBAL NUCLEAR IMAGING EQUIPMENT MARKET IN PET SCANNER BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 119 EFFECTIVENESS OF PET IN DETECTION OF VARIOUS DISEASES

TABLE 120 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY APPLICATION 2018-2026 ($ MILLION)

TABLE 121 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 122 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN X-RAY DEVICES BY TYPES 2018-2026 ($ MILLION)

TABLE 123 TARGET DISEASE STATISTICS

TABLE 124 GLOBAL X-RAY DEVICES MARKET IN GENERAL RADIOGRAPHY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 125 GLOBAL X-RAY DEVICES MARKET IN DENTAL BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 126 GLOBAL X-RAY DEVICES MARKET IN MAMMOGRAPHY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 127 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 128 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT BY TYPES 2018-2026 ($ MILLION)

TABLE 129 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN BRAIN AND NEUROLOGICAL MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 130 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN SPINE AND MUSCULOSKELETAL MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 131 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN VASCULAR MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 132 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN PELVIC AND ABDOMINAL MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 133 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN BREAST MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 134 GLOBAL MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT MARKET IN CARDIAC MRI BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 135 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 136 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN COMPUTED TOMOGRAPHY (CT) SCANNERS BY TYPES 2018-2026 ($ MILLION)

TABLE 137 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN CARDIOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 138 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN ONCOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 139 DESCRIPTIONS AND RATIONALE OF CT SCANNER FOR CANCER SURVEILLANCE

TABLE 140 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN NEUROLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 141 GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS MARKET IN OTHER CT SCANNERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 142 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 143 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN ULTRASOUND SYSTEMS BY TYPES 2018-2026 ($ MILLION)

TABLE 144 GLOBAL ULTRASOUND SYSTEMS MARKET IN RADIOLOGY/GENERAL IMAGING BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 145 GLOBAL ULTRASOUND SYSTEMS MARKET IN OBSTETRICS/GYNAECOLOGY (OB/GYN) BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 146 BENIGN GYNAECOLOGICAL DISEASE AND THEIR SYMPTOMS THAT USE MEDICAL IMAGING DEVICES

TABLE 147 GLOBAL ULTRASOUND SYSTEMS MARKET IN CARDIOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 148 GLOBAL ULTRASOUND SYSTEMS MARKET IN VASCULAR BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 149 GLOBAL ULTRASOUND SYSTEMS MARKET IN UROLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 150 GLOBAL ULTRASOUND SYSTEMS MARKET IN OTHER APPLICATIONS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 151 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING SYSTEMS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 152 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN NUCLEAR IMAGING SYSTEMS BY TYPES 2018-2026 ($ MILLION)

TABLE 153 GLOBAL IN NUCLEAR IMAGING SYSTEMS MARKET IN CARDIOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 154 GLOBAL IN NUCLEAR IMAGING SYSTEMS MARKET IN ONCOLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 155 BENEFITS OF PET/MRI COMPARED TO PET/CT

TABLE 156 GLOBAL IN NUCLEAR IMAGING SYSTEMS MARKET IN NEUROLOGY BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 157 GLOBAL IN NUCLEAR IMAGING SYSTEMS MARKET IN OTHER NUCLEAR IMAGING SYSTEMS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 158 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY END USER 2018-2026 ($ MILLION)

TABLE 159 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN HOSPITALS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 160 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN DIAGNOSTICS CENTERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 161 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET IN RESEARCH CENTERS BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 162 RAW MATERIALS OF MEDICAL IMAGING INSTRUMENT

TABLE 163 SUPPLIERS OF RAW MATERIALS

TABLE 164 MEDICAL IMAGING INSTRUMENTS MANUFACTURERS WITH PRODUCTS

TABLE 165 DISTRIBUTORS IN MEDICAL IMAGING INSTRUMENT MARKET

TABLE 166 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY GEOGRAPHY 2018-2026 ($ MILLION)

TABLE 167 GLOBAL MEDICAL IMAGING INSTRUMENT MARKET BY GEOGRAPHY 2018-2026 (THOUSAND UNITS)

TABLE 168 NORTH AMERICA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

TABLE 169 NORTH AMERICA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

TABLE 170 ESTIMATED NEW CANCER CASES OF MALES IN THE UNITED STATES 2017 (%)

TABLE 171 ESTIMATED NEW CANCER CASES OF FEMALES IN THE UNITED STATES 2017 (%)

TABLE 172 FUNDING BY FEDERAL GOVERNMENT FOR TREATMENT OF CHRONIC DISEASES

TABLE 173 ROAD FATALITIES BY AGE GROUP IN CANADA

TABLE 174 EUROPE MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

TABLE 175 EUROPE IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

TABLE 176 FREQUENCIES OF CARDIAC PROCEDURES IN GERMANY 2016

TABLE 177 NUMBER OF REPORTED ROAD CASUALTIES IN GREAT BRITAIN IN 2016

TABLE 178 ASIA PACIFIC MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

TABLE 179 ASIA PACIFIC MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

TABLE 180 ESTIMATED MOST COMMONLY DIAGNOSED CANCERS IN MALES IN AUSTRALIA 2017

TABLE 181 ESTIMATED MOST COMMONLY DIAGNOSED CANCERS IN FEMALES IN AUSTRALIA 2017

TABLE 182 REST OF THE WORLD MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

TABLE 183 REST OF THE WORLD MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

TABLE 184 NEW CASES OF CANCER BY GENDER IN BRAZIL 2016

TABLE 185 VARIOUS TYPES OF CANCERS THAT RECOMMENDED BY DEPARTMENT OF HEALTH-ABU DHABI

FIGURE LIST

FIGURE 1 PROCESS OF CLOUD COMPUTING IN MEDICAL IMAGING

FIGURE 2 GLOBAL STATIONARY MARKET IN FLOOR TO CEILING MOUNTED SYSTEMS 2018-2026 ($ MILLION)

FIGURE 3 GLOBAL STATIONARY MARKET IN FLOOR TO CEILING MOUNTED SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 4 GLOBAL STATIONARY MARKET IN CEILING MOUNTED SYSTEMS 2018-2026 ($ MILLION)

FIGURE 5 GLOBAL STATIONARY MARKET IN CEILING MOUNTED SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 6 GLOBAL PORTABLE MARKET IN MOBILE X-RAY SYSTEMS 2018-2026 ($ MILLION)

FIGURE 7 GLOBAL PORTABLE MARKET IN MOBILE X-RAY SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 8 GLOBAL PORTABLE MARKET IN HANDHELD X-RAY SYSTEMS 2018-2026 ($ MILLION)

FIGURE 9 GLOBAL PORTABLE MARKET IN HANDHELD X-RAY SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 10 GLOBAL CANCER DEATHS 2015 & 2030 (MILLION)

FIGURE 11 GLOBAL SPECT SCANNER MARKET IN HYBRID SPECT SYSTEMS 2018-2026 ($ MILLION)

FIGURE 12 GLOBAL SPECT SCANNER MARKET IN HYBRID SPECT SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 13 GLOBAL SPECT SCANNER MARKET IN STANDALONE SPECT SYSTEMS 2018-2026 ($ MILLION)

FIGURE 14 GLOBAL SPECT SCANNER MARKET IN STANDALONE SPECT SYSTEMS 2018-2026 (THOUSAND UNITS)

FIGURE 15 POPULATION AGED ABOVE 65 YEARS, BY GEOGRAPHY 2015 & 2050 (%)

FIGURE 16 CHRONIC DISEASES IN THE UNITED STATES 2000-2030 (MILLIONS)

FIGURE 17 HEART DISEASE DEATHS IN AMERICA 2017 (%)

FIGURE 18 PERSON AGED 60 YEARS OR ABOVE, BY GEOGRAPHY 2017 (MILLIONS)

FIGURE 19 DEVELOPMENT OF HIGH-INTENSITY FREQUENCY ULTRASOUND TECHNOLOGY

FIGURE 20 INDIVIDUAL NEUROLOGICAL DISORDERS AS PERCENTAGES OF TOTAL NEUROLOGICAL DISORDERS

FIGURE 21 ESTIMATED INCIDENCE AND DEATHS FOR SELECTED CANCERS IN THE UNITED STATES 2010, 2013, AND 2018

FIGURE 22 COUNTRIES WITH THE INCIDENCE OF BREAST CANCER

FIGURE 23 MAJOR NCD DEATHS PER YEAR

FIGURE 24 MACRO & MICRO FACTORS FOR MEDICAL IMAGING SERVICES AT DIAGNOSTIC CENTRES

FIGURE 25 VALUE-BASED HEALTHCARE MODELS

FIGURE 26 PRIVATE HEALTH INSURANCE REVENUE 2015-2025 ($ TRILLION)

FIGURE 27 SHARE OF GLOBAL R&D FUNDING 2018

FIGURE 28 RESEARCH AREAS IN BIOMEDICAL IMAGING SYSTEMS

FIGURE 29 APPLICATIONS OF BIO-PHOTONICS AND BIO-MEDICAL IMAGING SYSTEMS IN RESEARCH

FIGURE 30 MANUFACTURING PROCESS OF MEDICAL IMAGING INSTRUMENT

FIGURE 31 THE UNITED STATES MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 32 THE UNITED STATES IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 33 CANADA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 34 CANADA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 35 MEXICO MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 36 MEXICO IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 37 GERMANY MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 38 GERMANY IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 39 RISING GERIATRIC POPULATION IN GERMANY 2015 & 2030 (%)

FIGURE 40 HEALTHCARE EXPENDITURE IN GERMANY 2016 & 2017 ($ BILLION)

FIGURE 41 THE UNITED KINGDOM MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 42 THE UNITED KINGDOM IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 43 FRANCE MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 44 FRANCE IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 45 SPAIN MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 46 SPAIN MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 47 ITALY MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 48 ITALY IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 49 REST OF EUROPE MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 50 REST OF EUROPE IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 51 CHINA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 52 CHINA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 53 INDIA STATES MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 54 INDIA STATES IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 55 JAPAN MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 56 ANTICIPATED ELDERLY POPULATION IN JAPAN (%)

FIGURE 57 JAPAN STATES IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 58 AUSTRALIA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 59 AUSTRALIA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 60 SOUTH KOREA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 61 SOUTH KOREA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 62 REST OF THE ASIA PACIFIC MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 63 REST OF THE ASIA PACIFIC IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 64 LATIN AMERICA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 65 LATIN AMERICA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

FIGURE 66 MIDDLE EAST AND AFRICA MEDICAL IMAGING INSTRUMENT MARKET 2018-2026 ($ MILLION)

FIGURE 67 MIDDLE EAST AND AFRICA IMAGING INSTRUMENT MARKET 2018-2026 (THOUSAND UNITS)

- MARKET SEGMENTATION

- MARKET BY PRODUCTS 2018-2026

- X-RAY DEVICES

- STATIONARY

- FLOOR TO CEILING MOUNTED SYSTEMS

- CEILING MOUNTED SYSTEMS

- PORTABLE

- MOBILE X-RAY SYSTEMS

- HANDHELD X-RAY SYSTEMS

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- CLOSED MRI

- OPEN MRI

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- STATIONARY CT SCANNERS

- MOBILE CT SCANNERS

- ULTRASOUND SYSTEMS

- COMPACT/PORTABLE ULTRASOUND SYSTEM

- CART/TROLLEY BASED ULTRASOUND SYSTEM

- NUCLEAR IMAGING EQUIPMENT/ INSTRUMENTS

- SPECT SCANNER

- HYBRID SPECT SYSTEMS

- STANDALONE SPECT SYSTEMS

- HYBRID PET

- PLANAR SCINTIGRAPHY

- SPECT SCANNER

- STATIONARY

- X-RAY DEVICES

- MARKET BY TECHNOLOGY 2018-2026

- X-RAY DEVICES

- ANALOG X-RAY TECHNOLOGY

- DIGITAL RADIOGRAPHY

- COMPUTED RADIOGRAPHY

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- LOW-FIELD STRENGTH

- MEDIUM- FIELD STRENGTH

- HIGH- FIELD STRENGTH

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- LOW-SLICE

- MEDIUM- SLICE

- HIGH- SLICE

- ULTRASOUND SYSTEMS

- 2-D

- 3-D & 4-D

- DOPPLER

- HIGH-INTENSITY FREQUENCY ULTRASOUND

- LITHOTRIPSY

- NUCLEAR IMAGING EQUIPMENT/ INSTRUMENTS

- SPECT SCANNER

- PET SCANNER

- X-RAY DEVICES

- MARKET BY APPLICATION 2018-2026

- X-RAY DEVICES

- GENERAL RADIOGRAPHY

- DENTAL

- MAMMOGRAPHY

- MAGNETIC RESONANCE IMAGING (MRI) EQUIPMENT/ INSTRUMENTS

- BRAIN AND NEUROLOGICAL MRI

- SPINE AND MUSCULOSKELETAL MRI

- VASCULAR MRI

- PELVIC AND ABDOMINAL MRI

- BREAST MRI

- CARDIAC MRI

- COMPUTED TOMOGRAPHY (CT) SCANNERS

- CARDIOLOGY

- ONCOLOGY

- NEUROLOGY

- OTHER CT SCANNERS

- ULTRASOUND SYSTEMS

- RADIOLOGY/GENERAL IMAGING

- OBSTETRICS/GYNECOLOGY (OB/GYN)

- CARDIOLOGY

- VASCULAR

- UROLOGY

- OTHER APPLICATIONS

- NUCLEAR IMAGING SYSTEMS

- CARDIOLOGY

- ONCOLOGY

- NEUROLOGY

- OTHER NUCLEAR IMAGING SYSTEMS

- X-RAY DEVICES

- MARKET BY END USER 2018-2026

- HOSPITALS

- DIAGNOSTICS CENTERS

- RESEARCH CENTERS

- MARKET BY PRODUCTS 2018-2026

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- THE UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF THE ASIA PACIFIC

- REST OF THE WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.