LATIN AMERICA HALAL PHARMACEUTICALS MARKET FORECAST 2025-2032

SCOPE OF THE REPORT

Latin America Halal Pharmaceuticals Market by Drug Type (Analgesics, Pain Management Drugs, Anti-Inflammatory Drugs, Respiratory Drugs, Cardiovascular Drugs, Vaccines, Other Drug Types) Market by Dosage Form (Syrups, Capsules, Tablets, Powders, Other Dosage Forms) Market by Distribution Channel (Pharmacies, Hospitals, Other Distribution Channels) by Geography

REPORTS » PHARMACEUTICALS » LATIN AMERICA HALAL PHARMACEUTICALS MARKET FORECAST 2025-2032

MARKET OVERVIEW

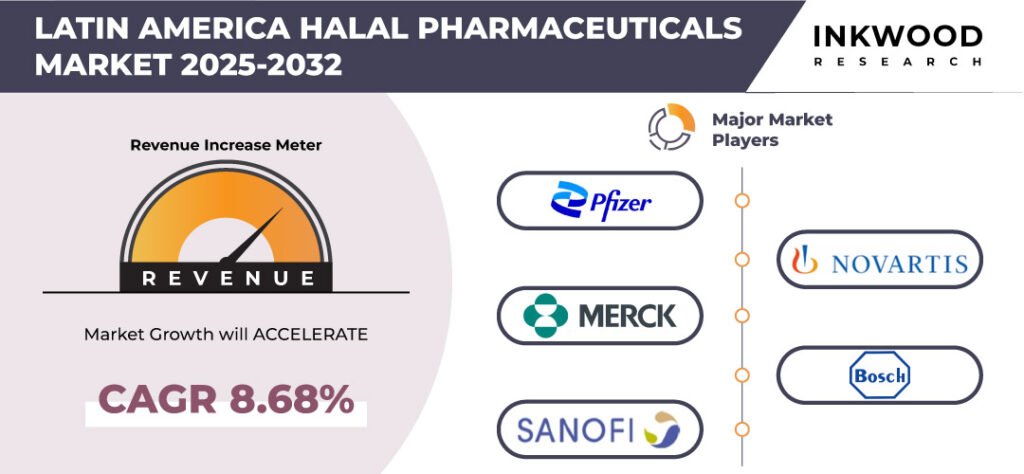

The Latin America halal pharmaceuticals market is anticipated to rise with a CAGR of 8.68% over the forecast years of 2025 to 2032. In Latin America, countries such as Brazil and Argentina are witnessing an increasing demand for halal-certified healthcare products. This growth can be attributed to the region’s expanding trade relationships with Muslim-majority countries and the rise in Muslim populations within urban areas.

Latin American consumers, particularly in metropolitan regions, are not only seeking halal food but also halal pharmaceuticals that align with their ethical, religious, and health considerations. Halal-certified pharmaceuticals, for example, ensure that products are free from alcohol, pork derivatives, or any other prohibited ingredients, making them a popular choice in multicultural markets.

To Know More About This Report, Request a Free Sample Copy

While the halal food sector has been a primary focus for Latin American exporters, the halal pharmaceutical market remains an emerging, untapped opportunity. There is a rising demand for ethical, organic, and non-GMO products, which creates a space for innovative solutions. Latin American pharmaceutical manufacturers can capitalize on this trend by introducing halal-certified versions of common over-the-counter products, supplements, and specialized medications.

Another important aspect of the market is the strengthening of trade relations between Latin American countries and the Gulf Cooperation Council (GCC) nations. The GCC is one of the largest consumers of halal products globally, and Latin American countries are actively working to meet the region’s strict halal certification standards.

In this regard, initiatives like halal certification workshops and trade programs are enabling Latin American companies to position themselves as suppliers of high-quality halal pharmaceuticals, boosting exports and tapping into the GCC’s growing demand.

The Latin America Halal Pharmaceuticals Market growth assessment encompasses a detailed evaluation of Brazil, Mexico, Argentina, and Rest of Latin America.

In Brazil, the halal market benefits from trade agreements with Muslim-majority countries and government-backed initiatives to improve halal certification processes. Similarly, Mexico is expanding its halal industry through trade partnerships and regulatory frameworks aligning with international standards.

However, the market faces challenges, including the complexities of obtaining halal certifications and compliance with stringent regulations. Consumer preferences are shifting toward natural, ethical, and organic products, influencing demand for halal-certified pharmaceuticals. Trends such as the rise in personalized health solutions and the growing acceptance of wellness-oriented products further shape the market.

The Latin America halal pharmaceuticals market is segmented into drug type, dosage form, and distribution channel. The distribution channel category is further segmented into pharmacies, hospitals, and other distribution channels,

Pharmacies play a pivotal role in offering trusted, regulated healthcare options, and consumers increasingly turn to them for halal alternatives. This trend is particularly prominent in urban areas of Brazil and Mexico, where consumers seek pharmaceuticals that align with their ethical, dietary, and religious values.

In 2021, Mexico saw a notable rise in pharmacies stocking specialized halal products, with a marked demand for halal-certified vitamins and supplements. Consumers prefer pharmacies for their accessibility, convenience, and assurance of product authenticity, as these stores typically adhere to strict regulatory standards.

Furthermore, pharmacies are also becoming platforms for education, with many offering guidance on halal health products. As awareness grows, pharmacies in the region are likely to become key players in the expansion of the halal pharmaceutical market.

Some of the leading players operating in the Latin America halal pharmaceuticals market include Novartis, Pfizer, Merck, AbbVie, Sanofi, etc.

Novartis, headquartered in Basel, Switzerland, is a global healthcare company that operates through various business segments, including pharmaceuticals, eye care (Alcon), and generics (Sandoz). The company develops and markets a wide range of innovative products, including prescription medications, vaccines, and consumer health products.

In Latin America, Novartis serves numerous countries, including Brazil, Mexico, and Argentina, with a focus on addressing both common and complex health issues. Regarding halal pharmaceuticals, Novartis has developed a portfolio that ensures compliance with halal standards, particularly in markets with significant Muslim populations.

Further, the company’s halal-certified products include certain over-the-counter medications, supplements, and injectable formulations, aligning with religious dietary laws and ethical considerations.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2025-2032 |

| Base Year | 2024 |

| Market Historical Years | 2018-2023 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Drug Type, Dosage Form, and Distribution Channel |

| Countries Analyzed | Brazil, Mexico, Argentina, and Rest of Latin America |

| Companies Analyzed | AbbVie, Bosch Pharmaceuticals, CCM Pharmaceuticals Sdn Bhd, Chemical Company of Malaysia Bhd, Embil Pharmaceuticals Co Ltd, Hovid, Merck, Noor Vitamins, Novartis, Nutramedical Incorporated, Pfizer, Pharmaniaga Bhd, Rosemont Pharmaceuticals, Sanofi, Simpor Pharma Sendirian Berhad |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- BRAZIL IS THE LEADING EXPORTER OF HALAL-CERTIFIED HEALTHCARE PRODUCTS IN THE REGION

- LOCAL PHARMACEUTICAL COMPANIES IN MEXICO ARE ALIGNING PRODUCT PORTFOLIOS TO CATER TO THE HALAL SEGMENT

- INCREASING CONSUMER PREFERENCE FOR ETHICAL AND CLEAN-LABEL PRODUCTS

- GROWING FOCUS ON BIOLOGICS AND BIOSIMILARS IN HALAL FORMULATIONS IS EXPANDING

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING MUSLIM POPULATION IS DRIVING DEMAND FOR SHARIA-COMPLIANT HEALTHCARE PRODUCTS

- RISING AWARENESS ABOUT HALAL CERTIFICATION AMONG CONSUMERS

- EXPANSION OF HALAL PHARMACEUTICAL MANUFACTURING IN NON-MUSLIM-MAJORITY COUNTRIES

- KEY RESTRAINTS

- HIGH COSTS ASSOCIATED WITH HALAL CERTIFICATION AND COMPLIANCE

- LIMITED AVAILABILITY OF HALAL-CERTIFIED RAW MATERIALS

- REGULATORY INCONSISTENCIES ACROSS DIFFERENT REGIONS ARE AFFECTING MARKET ENTRY

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS – HALAL

- KEY MARKET TRENDS

- GROWING INTEGRATION OF HALAL PHARMACEUTICALS IN GLOBAL SUPPLY CHAINS

- INCREASING R&D INVESTMENTS IN HALAL BIOPHARMACEUTICALS

- BRAZIL’S HALAL PHARMACEUTICAL EXPORTS ARE INCREASING DUE TO STRATEGIC TRADE RELATIONS WITH MIDDLE EASTERN COUNTRIES

- RISING COLLABORATIONS BETWEEN PHARMACEUTICAL COMPANIES AND HALAL CERTIFICATION BODIES

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIAL SOURCING AND CERTIFICATION

- RESEARCH AND DEVELOPMENT OF HALAL FORMULATIONS

- HALAL-CERTIFIED MANUFACTURING PROCESSES

- QUALITY ASSURANCE AND REGULATORY COMPLIANCE

- PACKAGING AND LABELING WITH HALAL STANDARDS

- DISTRIBUTION AND SUPPLY CHAIN MANAGEMENT

- RETAIL AND CONSUMER OUTREACH

- REGULATORY FRAMEWORK AND COMPLIANCE BODIES

MARKET BY DRUG TYPE

- ANALGESICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PAIN MANAGEMENT DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ANTI-INFLAMMATORY DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RESPIRATORY DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARDIOVASCULAR DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- VACCINES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER DRUG TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ANALGESICS

MARKET BY DOSAGE FORM

- SYRUPS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CAPSULES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TABLETS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POWDERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER DOSAGE FORMS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SYRUPS

MARKET BY DISTRIBUTION CHANNEL

- PHARMACIES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOSPITALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER DISTRIBUTION CHANNELS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PHARMACIES

GEOGRAPHICAL ANALYSIS

- LATIN AMERICA

- MARKET SIZE & ESTIMATES

- COUNTRY ANALYSIS

- BRAZIL

- BRAZIL HALAL PHARMACEUTICALS MARKET SIZE & OPPORTUNITIES

- MEXICO

- MEXICO HALAL PHARMACEUTICALS MARKET SIZE & OPPORTUNITIES

- ARGENTINA

- ARGENTINA HALAL PHARMACEUTICALS MARKET SIZE & OPPORTUNITIES

- REST OF LATIN AMERICA

- REST OF LATIN AMERICA HALAL PHARMACEUTICALS MARKET SIZE & OPPORTUNITIES

- BRAZIL

- LATIN AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ABBVIE

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BOSCH PHARMACEUTICALS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CCM PHARMACEUTICALS SDN BHD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CHEMICAL COMPANY OF MALAYSIA BHD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- EMBIL PHARMACEUTICALS CO LTD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HOVID

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MERCK

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- NOOR VITAMINS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- NOVARTIS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- NUTRAMEDICAL INCORPORATED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PFIZER

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PHARMANIAGA BHD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ROSEMONT PHARMACEUTICALS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SANOFI

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SIMPOR PHARMA SENDIRIAN BERHAD

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ABBVIE

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – HALAL PHARMACEUTICALS

TABLE 2: REGULATORY FRAMEWORK AND COMPLIANCE BODIES

TABLE 3: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DRUG TYPE, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 4: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DRUG TYPE, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 5: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DOSAGE FORM, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 6: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DOSAGE FORM, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 7: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 8: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 9: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 10: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY COUNTRY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 11: LIST OF MERGERS & ACQUISITIONS

TABLE 12: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 13: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 14: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: MAJOR MARKET FINDINGS

FIGURE 2: MARKET DYNAMICS

FIGURE 3: KEY MARKET TRENDS

FIGURE 4: PORTER’S FIVE FORCES ANALYSIS

FIGURE 5: GROWTH PROSPECT MAPPING

FIGURE 6: MARKET MATURITY ANALYSIS

FIGURE 7: MARKET CONCENTRATION ANALYSIS

FIGURE 8: VALUE CHAIN ANALYSIS

FIGURE 9: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, GROWTH POTENTIAL, BY DRUG TYPE, IN 2024

FIGURE 10: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY ANALGESICS, 2025-2032 (IN $ MILLION)

FIGURE 11: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY PAIN MANAGEMENT DRUGS, 2025-2032 (IN $ MILLION)

FIGURE 12: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY ANTI-INFLAMMATORY DRUGS, 2025-2032 (IN $ MILLION)

FIGURE 13: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY RESPIRATORY DRUGS, 2025-2032 (IN $ MILLION)

FIGURE 14: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY CARDIOVASCULAR DRUGS, 2025-2032 (IN $ MILLION)

FIGURE 15: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY VACCINES, 2025-2032 (IN $ MILLION)

FIGURE 16: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY OTHER DRUG TYPES, 2025-2032 (IN $ MILLION)

FIGURE 17: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, GROWTH POTENTIAL, BY DOSAGE FORM, IN 2024

FIGURE 18: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY SYRUPS, 2025-2032 (IN $ MILLION)

FIGURE 19: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY CAPSULES, 2025-2032 (IN $ MILLION)

FIGURE 20: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY TABLETS, 2025-2032 (IN $ MILLION)

FIGURE 21: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY POWDERS, 2025-2032 (IN $ MILLION)

FIGURE 22: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY OTHER DOSAGE FORMS, 2025-2032 (IN $ MILLION)

FIGURE 23: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, GROWTH POTENTIAL, BY DISTRIBUTION CHANNEL, IN 2024

FIGURE 24: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY PHARMACIES, 2025-2032 (IN $ MILLION)

FIGURE 25: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY HOSPITALS, 2025-2032 (IN $ MILLION)

FIGURE 26: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, BY OTHER DISTRIBUTION CHANNELS, 2025-2032 (IN $ MILLION)

FIGURE 27: LATIN AMERICA HALAL PHARMACEUTICALS MARKET, COUNTRY OUTLOOK, 2024 & 2032 (IN %)

FIGURE 28: BRAZIL HALAL PHARMACEUTICALS MARKET, 2025-2032 (IN $ MILLION)

FIGURE 29: MEXICO HALAL PHARMACEUTICALS MARKET, 2025-2032 (IN $ MILLION)

FIGURE 30: ARGENTINA HALAL PHARMACEUTICALS MARKET, 2025-2032 (IN $ MILLION)

FIGURE 31: REST OF LATIN AMERICA HALAL PHARMACEUTICALS MARKET, 2025-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032

-

TAIWAN BABY DIAPER MARKET FORECAST 2025-2032

-

SOUTH AFRICA BABY DIAPER MARKET FORECAST 2025-2032

-

INDONESIA BABY DIAPER MARKET FORECAST 2025-2032

-

INDIA BABY DIAPER MARKET FORECAST 2025-2032

-

BRAZIL BABY DIAPER MARKET FORECAST 2025-2032

-

AUSTRALIA & NEW ZEALAND BABY DIAPER MARKET FORECAST 2025-2032

-

ALGERIA BABY DIAPER MARKET FORECAST 2025-2032