GLOBAL INDUSTRIAL ALCOHOLS MARKET FORECAST 2022-2028

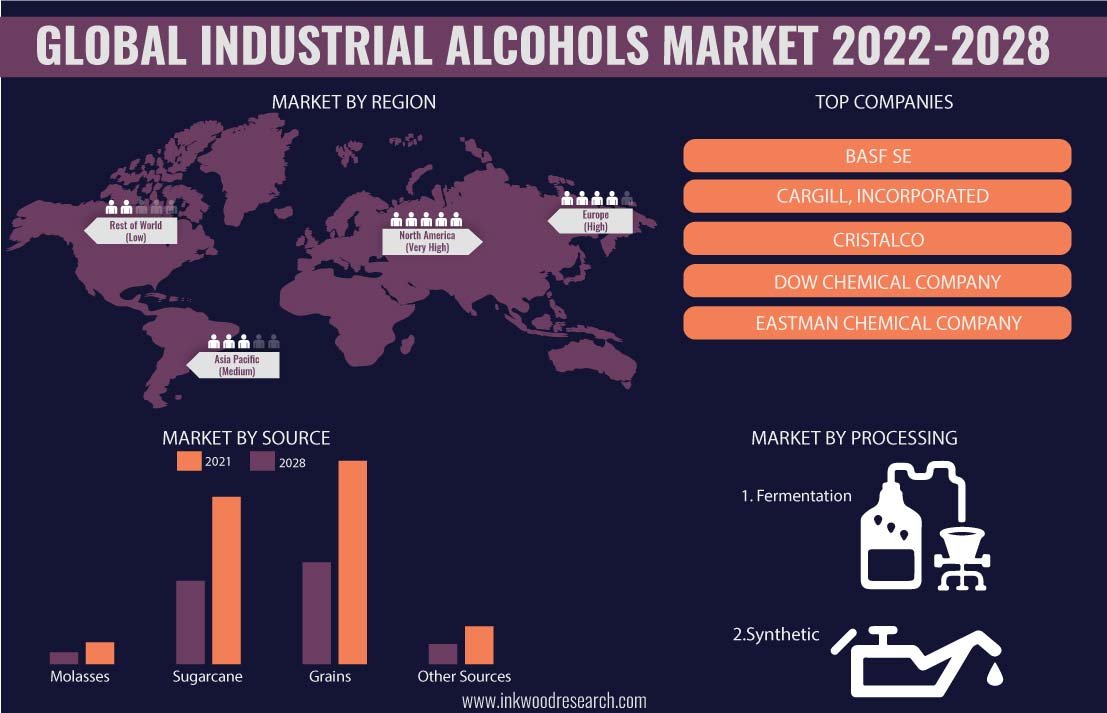

Global Industrial Alcohols Market by Processing (Fermentation, Synthetic) Market by Source (Molasses, Sugarcane, Grains, Other Sources) Market by Product Type (Isopropyl Alcohol, Methyl Alcohol, Ethyl Alcohol, Isobutyl Alcohol, Benzyl Alcohol, Other Product Types) Market by End-user (Fuel, Chemical Intermediates & Solvent, Pharmaceuticals, Personal Care Products, Food & Beverages, Other End-users) and by Geography

In terms of revenue, the global industrial alcohols market was valued at $xx billion in 2020, and is estimated to reach $302.68 billion by 2028, growing at a CAGR of 8.23% during the forecast period. In terms of volume, the market value was 178071.00 kilotons in 2020, and is set to project a CAGR of 9.88% over 2022-2028.

To learn more about this report, request a free sample copy

Key factors driving the global industrial alcohols market growth are:

- Increased adoption of biofuels as an alternative to petroleum

- Wide utilization of alcohols in multiple end-user applications

- Rising demand for ethanol

- There was an amplified demand for ethanol used in hand sanitizers during the COVID-19 pandemic. Disinfectants and hand sanitizers were among the most pursued products.

- Alcohol-based hand sanitizers comprise between 60% and 95% of isopropyl alcohol, n-propanol, or ethanol. They are effective for killing the virus. Hence, hand sanitizers with more than 70% isopropanol and 60% ethanol were recommended for hand hygiene.

- Therefore, companies increased the manufacture of industrial alcohols used in commercial disinfectants and hand sanitizer production.

Key factors restraining the market growth are:

- Rising prices of raw material

- The ongoing imports of corn in the United States and Brazil further add transportation costs, thereby increasing the prices of corn- and soybean-based fuels. This is expected to raise the raw material prices during the forecasted period, consequently restraining the market growth.

The report on the global industrial alcohols market includes the segmentation analysis of source, processing, product type, and end-user.

Market by Source:

- Molasses

- Sugarcane

- Sugarcane is anticipated to be the fastest-growing source in the market in terms of revenue and volume. It is one of the most common feedstocks for industrial alcohols, worldwide. Besides, the energy balance of alcohol produced by sugarcane is the highest among all feedstocks. This tropical plant is extremely sugar-rich. Its molecules do not require breaking down by enzymes, before fermentation becomes viable.

- Grains

- In 2020, grains had the majority of market share, i.e., 46.92%, in the market by source, in terms of revenue. In the biofuel industry, grains such as corn, wheat, and barley mainly provide starch. Wheat and corn are the two most common type of feedstocks used for producing industrial alcohols. Moreover, wheat is a suitable raw material for alcohol production.

- Other Sources

Geographically, the global industrial alcohols market has been segmented on the basis of four major regions, which includes:

- North America: The United States and Canada

- North America emerged as the largest region in the global market, with its share estimated at 49.64% in 2020. The United States has played a promising role in the region’s market. It overtook Brazil in 2006 to become the world’s largest ethanol producer. Since then, the production of ethanol in the country has been increasing over time. In the United States, the primary feedstock for ethanol production is corn.

- In the United States, approximately 40% of the total corn production is utilized for ethanol production. The production of fuel ethanol in the United States has been increasing over the past decade. In 2018, the United States produced 16,100 million gallons of ethanol for fuel. The major ethanol-producing states in the country are Iowa, Nebraska, Minnesota, Indiana, Ohio, etc.

- Europe: The United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, Middle East & Africa

The major players in the global industrial alcohols market are:

- Cargill Inc

- MGP Ingredients Inc

- Sigma Aldrich

- The Andersons Inc

- BASF SE

- Others

Key strategies adopted by some of these companies:

In October 2020, a 48-million-gallons per-year Corn Plus ethanol facility in Minnesota was acquired by Greenfield Global Inc. Green Plains Inc and Xerox Holdings Corporation signed a contract in May, 2020. Green Plains would supply FDA-approved FCC-grade alcohol to Xerox Holdings Corporation.

Key trends of the global industrial alcohols market:

- In order to promote renewable energy and reduce greenhouse gas emissions, mandatory ethanol blending is increasing in various countries. Such initiatives by various governments are likely to boost ethanol consumption in the future.

- The developing and developed countries are investing heavily in biofuels’ production to cater to problems arising due to the rising oil prices, which is positively impacting the market growth.

- The fuel segment is anticipated to be the most lucrative for investment. This is attributed to increased ethanol usage as a motor fuel in the automotive industry and less dependence on greenhouse gas emissions from vehicles.

Frequently Asked Questions (FAQs):

- Does this report cover the impact of COVID-19 on the industrial alcohols market?

A: Yes, this report covers the impact of COVID-19 on the industrial alcohols market, qualitatively as well as quantitatively.

- Which categories of industrial alcohols are covered in this report?

A: The industrial alcohols market by product type covers isopropyl alcohol, ethyl alcohol, isobutyl alcohol, benzyl alcohol, methyl alcohol & other product types.

- Which are the major markets for industrial alcohols?

A: Personal care products and fuel represent the largest end-use sectors, accounting for the lion’s share of industrial alcohols’ worldwide demand.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASED ADOPTION OF BIOFUELS AS AN ALTERNATIVE TO PETROLEUM

- WIDE UTILIZATION OF ALCOHOLS IN MULTIPLE END-USER APPLICATIONS

- RISING DEMAND FOR METHANOL

- KEY RESTRAINTS

- RISING PRICES OF RAW MATERIAL

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON INDUSTRIAL ALCOHOLS MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PROCESSING (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FERMENTATION

- SYNTHETIC

- MARKET BY SOURCE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- MOLASSES

- SUGARCANE

- GRAINS

- OTHER SOURCES

- MARKET BY PRODUCT TYPE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- ISOPROPYL ALCOHOL

- METHYL ALCOHOL

- ETHYL ALCOHOL

- ISOBUTYL ALCOHOL

- BENZYL ALCOHOL

- OTHER PRODUCT TYPES

- MARKET BY END-USER (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FUEL

- CHEMICAL INTERMEDIATES & SOLVENT

- PHARMACEUTICALS

- PERSONAL CARE PRODUCTS

- FOOD & BEVERAGES

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- BRAZIL

- REST OF LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BASF SE

- CARGILL INCORPORATED

- CRISTALCO

- DOW CHEMICAL COMPANY

- EASTMAN CHEMICAL COMPANY

- ECOLAB

- EXXON MOBIL CORPORATION

- GREEN PLAINS INC

- GREENFIELD GLOBAL INC

- LINDE AG

- LYONDELLBASELL INDUSTRIES NV

- MGP INGREDIENTS INC

- RAÍZEN ENERGIA

- ROYAL DUCTH SHELL

- SIGMA ALDRICH CORPORATION

- THE ANDERSONS INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – INDUSTRIAL ALCOHOLS

TABLE 2: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 3: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 4: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 6: GLOBAL FERMENTATION MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: GLOBAL FERMENTATION MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 8: GLOBAL SYNTHETIC MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: GLOBAL SYNTHETIC MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 10: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 11: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 12: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 13: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 14: GLOBAL MOLASSES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: GLOBAL MOLASSES MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 16: GLOBAL SUGARCANE MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 17: GLOBAL SUGARCANE MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 18: GLOBAL GRAINS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 19: GLOBAL GRAINS MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 20: GLOBAL OTHER SOURCES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 21: GLOBAL OTHER SOURCES MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 22: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 23: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 24: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 25: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 26: GLOBAL ISOPROPYL ALCOHOL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 27: GLOBAL ISOPROPYL ALCOHOL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 28: GLOBAL METHYL ALCOHOL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 29: GLOBAL METHYL ALCOHOL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 30: GLOBAL ETHYL ALCOHOL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 31: GLOBAL ETHYL ALCOHOL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 32: GLOBAL ISOBUTYL ALCOHOL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 33: GLOBAL ISOBUTYL ALCOHOL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 34: GLOBAL BENZYL ALCOHOL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 35: GLOBAL BENZYL ALCOHOL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 36: GLOBAL OTHER PRODUCT TYPES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 37: GLOBAL OTHER PRODUCT TYPES MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 38: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 39: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY END-USER, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 40: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 41: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY END-USER, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 42: WORLDWIDE PRODUCTION OF FUEL ETHANOL, 2014-2018 (IN MILLION GALLONS)

TABLE 43: GLOBAL FUEL MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 44: GLOBAL FUEL MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 45: GLOBAL CHEMICAL INTERMEDIATES & SOLVENT MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 46: GLOBAL CHEMICAL INTERMEDIATES & SOLVENT MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 47: GLOBAL PHARMACEUTICALS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 48: GLOBAL PHARMACEUTICALS MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 49: GLOBAL PERSONAL CARE PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 50: GLOBAL PERSONAL CARE PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 51: GLOBAL FOOD & BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 52: GLOBAL FOOD & BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 53: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 54: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 55: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 56: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 57: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 58: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 59: NORTH AMERICA INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 60: NORTH AMERICA INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 61: NORTH AMERICA INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 62: NORTH AMERICA INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 63: EUROPE INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 64: EUROPE INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 65: EUROPE INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 66: EUROPE INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 67: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 68: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 69: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 70: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 71: REST OF WORLD MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 72: REST OF WORLD MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 73: REST OF WORLD MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 74: REST OF WORLD MARKET, BY REGION, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 75: LIST OF MERGERS & ACQUISITIONS

TABLE 76: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 77: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 78: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: COUNTRY-WISE FUEL ETHANOL PRODUCTION, 2019 (IN MILLION GALLONS)

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: PORTER’S FIVE FORCES ANALYSIS

FIGURE 4: OPPORTUNITY MATRIX

FIGURE 5: VENDOR LANDSCAPE

FIGURE 6: GLOBAL INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY PROCESSING, IN 2020

FIGURE 7: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY FERMENTATION, 2022-2028 (IN $ MILLION)

FIGURE 8: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SYNTHETIC, 2022-2028 (IN $ MILLION)

FIGURE 9: GLOBAL INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY SOURCE, IN 2020

FIGURE 10: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY MOLASSES, 2022-2028 (IN $ MILLION)

FIGURE 11: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY SUGARCANE, 2022-2028 (IN $ MILLION)

FIGURE 12: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY GRAINS, 2022-2028 (IN $ MILLION)

FIGURE 13: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY OTHER SOURCES, 2022-2028 (IN $ MILLION)

FIGURE 14: GLOBAL INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 15: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY ISOPROPYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 16: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY METHYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 17: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY ETHYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 18: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY ISOBUTYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 19: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY BENZYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 20: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY OTHER PRODUCT TYPES, 2022-2028 (IN $ MILLION)

FIGURE 21: GLOBAL INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2020

FIGURE 22: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY FUEL, 2022-2028 (IN $ MILLION)

FIGURE 23: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY CHEMICAL INTERMEDIATES & SOLVENT, 2022-2028 (IN $ MILLION)

FIGURE 24: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PHARMACEUTICALS, 2022-2028 (IN $ MILLION)

FIGURE 25: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY PERSONAL CARE PRODUCTS, 2022-2028 (IN $ MILLION)

FIGURE 26: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY FOOD & BEVERAGES, 2022-2028 (IN $ MILLION)

FIGURE 27: GLOBAL INDUSTRIAL ALCOHOLS MARKET, BY OTHER END-USERS, 2022-2028 (IN $ MILLION)

FIGURE 28: NORTH AMERICA INDUSTRIAL ALCOHOLS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 29: UNITED STATES INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 30: CANADA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 31: EUROPE INDUSTRIAL ALCOHOLS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 32: UNITED KINGDOM INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 33: GERMANY INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 34: FRANCE INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 35: ITALY INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 36: RUSSIA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 37: BELGIUM INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 38: POLAND INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 39: REST OF EUROPE INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 40: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 41: CHINA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 42: JAPAN INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 43: INDIA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 44: SOUTH KOREA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 45: INDONESIA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 46: THAILAND INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 47: VIETNAM INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 48: AUSTRALIA & NEW ZEALAND INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 49: REST OF ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 50: REST OF WORLD INDUSTRIAL ALCOHOLS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 51: BRAZIL INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 52: REST OF LATIN AMERICA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 53: MIDDLE EAST & AFRICA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

- MARKET BY PROCESSING (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FERMENTATION

- SYNTHETIC

- MARKET BY SOURCE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- MOLASSES

- SUGARCANE

- GRAINS

- OTHER SOURCES

- MARKET BY PRODUCT TYPE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- ISOPROPYL ALCOHOL

- METHYL ALCOHOL

- ETHYL ALCOHOL

- ISOBUTYL ALCOHOL

- BENZYL ALCOHOL

- OTHER PRODUCT TYPES

- MARKET BY END-USER (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FUEL

- CHEMICAL INTERMEDIATES & SOLVENT

- PHARMACEUTICALS

- PERSONAL CARE PRODUCTS

- FOOD & BEVERAGES

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- BRAZIL

- REST OF LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.