INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET FORECAST 2030-2040

SCOPE OF THE REPORT

India Durable Carbon Dioxide Removal (CDR) Demand Market by Sector (Consumer, Industrial, Mobility, Manufacturing/Technology and Hardware, Services, Energy, Digital, Healthcare)

REPORTS » REGIONAL REPORTS » COUNTRY » INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET FORECAST 2030-2040

MARKET OVERVIEW

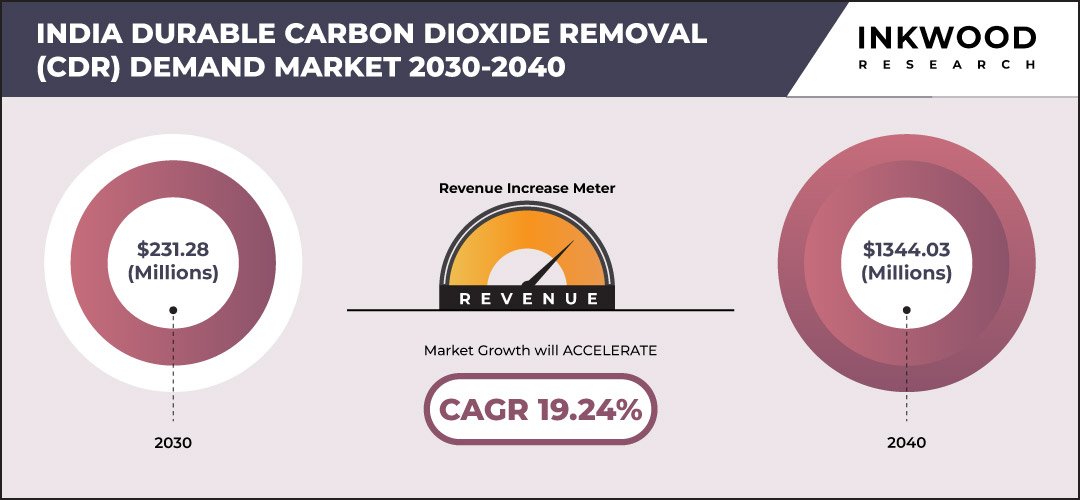

The India durable carbon dioxide removal (CDR) demand market is set to grow at a CAGR of 19.24% from 2030 to 2040, with the revenue expected to reach $1344.03 million by the end of 2040. In terms of volume, the market is expected to progress with a CAGR of 20.28%, reaching 7.05 million tons by 2040.

The market’s growth is largely driven by the increasing demand for carbon dioxide removal to manage residual CO2 emissions and the widespread adoption of durable CDR methods across various sectors, including services. Within the service sector, industries such as information technology, finance, and professional services are integrating CDR technologies as part of their sustainability initiatives. The use of durable carbon removal and storage methodologies is becoming more common as businesses focus on reducing their carbon footprint. Methods like direct air carbon capture and storage (DACCS) and biomass with carbon removal and storage (BiCRS) are being adopted to provide long-term solutions for carbon management.

To Know More About This Report, Request a Free Sample Copy

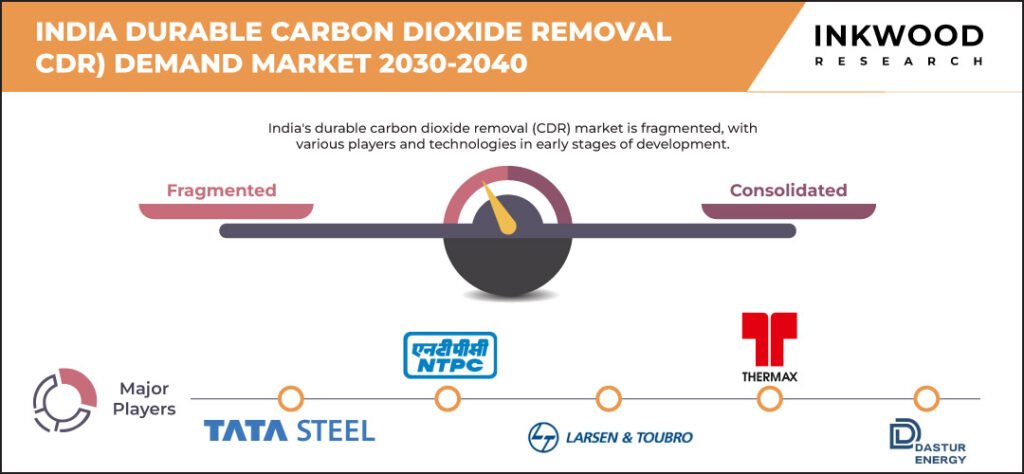

In addition to the service sector’s role in the durable carbon removal supply and demand, companies such as Tata Steel, NTPC Limited, and Larsen & Toubro (L&T) are also involved in deploying durable CDR solutions as part of their broader sustainability and emissions reduction strategies. The expansion of data centers and energy-intensive operations within the service industry has further contributed to the growing demand for durable CDR credits to offset emissions and comply with emerging carbon regulations.

Participation in voluntary and non-voluntary carbon markets is also becoming a key factor, with businesses exploring negative emissions technologies (NETs) to align with carbon reduction goals. While challenges such as high implementation costs and market complexity remain, the demand for durable CDR within India’s service sector is anticipated to continue expanding, helping drive decarbonization efforts in the country.

The India durable carbon dioxide removal (CDR) demand market is segmented into sectors, which are further sub-categorized into consumer, industrial, mobility, manufacturing/technology and hardware, services, energy, digital, and healthcare.

India Durable Carbon Dioxide Removal (CDR) Demand Market: 19.24% CAGR (2030-2040)

Need a custom report or have specific data requirements? Let us know!

In the manufacturing/technology and hardware sector, the demand for durable carbon dioxide removal (CDR) is linked to reducing emissions from production processes and supply chains. Companies producing electronics, machinery, and hardware are integrating CDR solutions to align with sustainability goals and comply with emission reduction regulations. The sector is exploring options like direct air capture (DAC) and carbon mineralization to offset emissions from energy-intensive manufacturing activities. Additionally, technology firms are incorporating CDR initiatives within their operations to offer carbon-neutral products and services, enhancing their environmental credentials.

Some of the top companies operating in the India durable carbon dioxide removal (CDR) demand market are Tata Steel, NTPC Limited, Larsen & Toubro (L&T), etc.

Tata Steel Ltd is a steel producer with integrated operations across mining, manufacturing, and marketing. The company is involved in raw material operations and iron-making, and it provides maintenance support services. Its product offerings include hot-rolled, cold-rolled, and galvanized steel, catering to industries such as automotive, construction, packaging, and engineering. Tata Steel operates manufacturing facilities in several countries, including India, Canada, the Netherlands, and the UK, with headquarters in Mumbai, India. As part of its sustainability strategy, the company also engages in carbon dioxide removal initiatives.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2030-2040 |

| Forecast Units | Revenue ($ Million), Volume (Million Tons) |

| Segments Analyzed | Sector |

| Countries Analyzed | India |

| Companies Analyzed | Tata Steel, NTPC Limited, Larsen & Toubro (L&T), Thermax Limited, Dastur Energy |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- MAJOR MARKET FINDINGS

- DIRECT AIR CAPTURE (DAC) IS DEVELOPING AS A METHOD FOR CO2 REMOVAL

- CONSUMER SECTOR REPRESENTS THE LARGEST SOURCE OF REVENUE GENERATION FOR CDR DEMAND

MARKET DYNAMICS

- KEY DRIVERS

- INCREASED GOVERNMENT INITIATIVES AIMED AT REDUCING CO2 EMISSIONS

- RISING INVESTMENT AND FUNDING IN THE CARBON DIOXIDE REMOVAL (CDR) INDUSTRY

- INCREASING FOCUS ON ADDRESSING CLIMATE CHANGE

- KEY RESTRAINTS

- INSUFFICIENT MECHANISMS FOR MONITORING, REPORTING, AND VERIFICATION (MRV)

- HIGH COSTS AND ENVIRONMENTAL CONCERNS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- INCREASING USE OF BLUE CARBON AND MICROALGAE IN CARBON DIOXIDE REMOVAL (CDR)

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR INDIA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- R&D

- TECHNOLOGY AND EQUIPMENT MANUFACTURING

- DEPLOYMENT AND OPERATIONS

- MONITORING, REPORTING, AND VERIFICATION (MRV)

- KEY BUYING CRITERIA

- COST-EFFECTIVENESS

- TECHNOLOGICAL EFFICIENCY

- REGULATORY COMPLIANCE

- ENVIRONMENTAL IMPACT

- KEY MARKET TRENDS

MARKET BY SECTOR (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: MILLION TONS)

- CONSUMER

- INDUSTRIAL

- MOBILITY

- MANUFACTURING/TECHNOLOGY AND HARDWARE

- SERVICES

- ENERGY

- DIGITAL

- HEALTHCARE

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- TATA STEEL

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- NTPC LIMITED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- LARSEN & TOUBRO (L&T)

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- THERMAX LIMITED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- DASTUR ENERGY

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TATA STEEL

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND

TABLE 2: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY SECTOR, 2030-2040 (IN $ MILLION)

TABLE 3: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY SECTOR, 2030-2040 (IN MILLION TONS)

TABLE 4: REGULATORY FRAMEWORK FOR INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET

TABLE 5: KEY PLAYERS OPERATING IN INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET

TABLE 6: LIST OF MERGERS & ACQUISITIONS

TABLE 7: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 8: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 9: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 4: MARKET MATURITY ANALYSIS

FIGURE 5: MARKET CONCENTRATION ANALYSIS

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: KEY BUYING CRITERIA

FIGURE 8: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, GROWTH POTENTIAL, BY SECTOR, IN 2030

FIGURE 9: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY CONSUMER, 2030-2040 (IN $ MILLION)

FIGURE 10: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY INDUSTRIAL, 2030-2040 (IN $ MILLION)

FIGURE 11: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY MOBILITY, 2030-2040 (IN $ MILLION)

FIGURE 12: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY MANUFACTURING/TECHNOLOGY AND HARDWARE, 2030-2040 (IN $ MILLION)

FIGURE 13: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY SERVICES, 2030-2040 (IN $ MILLION)

FIGURE 14: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY ENERGY, 2030-2040 (IN $ MILLION)

FIGURE 15: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY DIGITAL, 2030-2040 (IN $ MILLION)

FIGURE 16: INDIA DURABLE CARBON DIOXIDE REMOVAL (CDR) DEMAND MARKET, BY HEALTHCARE, 2030-2040 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

INDIA WIND ENERGY MARKET FORECAST 2025-2032

-

INDIA SOLAR ENERGY MARKET FORECAST 2025-2032

-

INDIA GREEN HYDROGEN MARKET FORECAST 2025-2032

-

INDIA GREEN BUILDING MATERIAL MARKET FORECAST 2025-2032

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

BRAZIL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032