INDIA CARTILAGE REPAIR MARKET FORECAST 2021-2025

India Cartilage Repair Market by Product (Cell-based, Non-cell-based) by Modality (Osteochondral Allograft, Microfracture & Chondroplasty, Juvenile, Allograft Fragment, Autologous Chondrocyte Implantation) by Type (Hyaline Cartilage, Fibrocartilage) by Application (Knee, Other Applications) by End-user (Hospital & Clinic, Ambulatory Surgical Center, Other End-users)

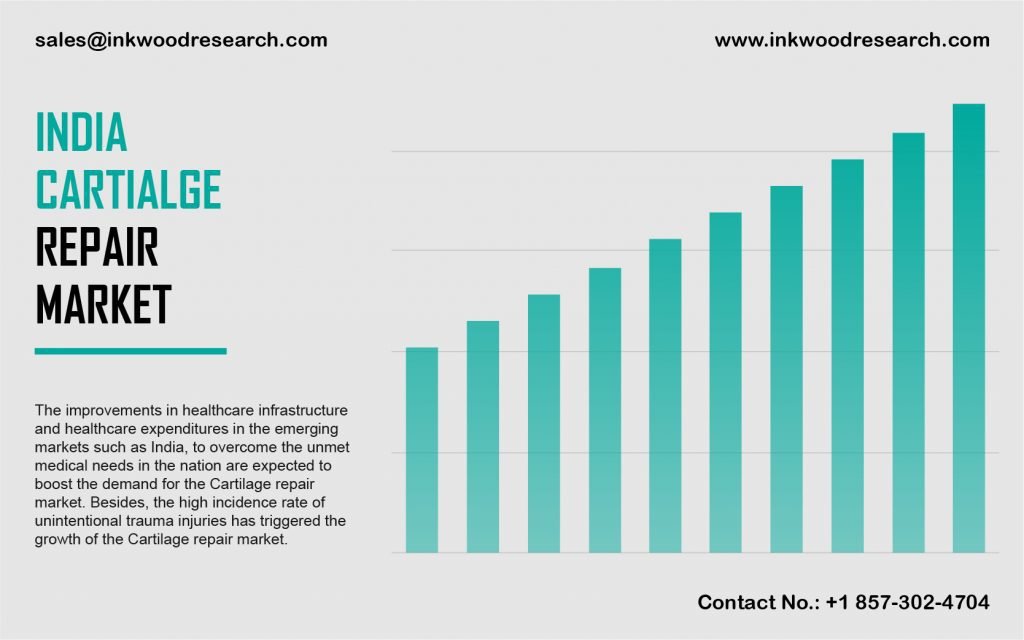

The India cartilage repair market is estimated to project a CAGR of 16.54% during the forecast period, 2021-2025. The factors evaluated to contribute to market growth are the growing number of healthcare reforms and the prevalence of lifestyle diseases. The base year considered for the study is 2020.

To learn more about this report, request a free sample copy

In India, the enhancements in healthcare infrastructure and healthcare expenditure, to regulate the unmet medical needs, are set to boost the demand for cartilage repair. Also, there is an increasing incidence of unintentional trauma injuries, which present growth opportunities. The country has the distinction of having the highest number of head injuries in the world, according to the Indian Head Injury Foundation. More than 100,000 lose their lives, and over 1 million suffer, due to serious head injuries. Moreover, the geriatric population of the country is set to increase in the coming years. Such aspects of the market are set to influence growth during the forecast period.

Johnson & Johnson is an investment holding company primarily engaged in healthcare products. The company is involved in the marketing and manufacturing of pharmaceutical and surgical equipment, personal care products, and research and development. The medical devices company entails products that are distributed to retailers & hospitals.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY ANALYTICS

- PORTER’S FIVE FORCES ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- IMPACT OF COVID-19 ON CARTILAGE REPAIR MARKET

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCES ANALYSIS

- MARKET BY PRODUCT

- CELL-BASED

- NON-CELL-BASED

- MARKET BY MODALITY

- OSTEOCHONDRAL ALLOGRAFT

- MICROFRACTURE & CHONDROPLASTY

- JUVENILE ALLOGRAFT FRAGMENT

- AUTOLOGOUS CHONDROCYTE IMPLANTATION

- MARKET BY TYPE

- HYALINE CARTILAGE

- FIBROCARTILAGE

- MARKET BY APPLICATION

- KNEE

- OTHER APPLICATIONS

- MARKET BY END-USER

- HOSPITAL & CLINIC

- AMBULATORY SURGICAL CENTER

- OTHER END-USERS

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- BUSINESS EXPANSION/ APPROVAL/ ANNOUNCEMENT

- COMPANY PROFILE

- BRAUN MELSUNGEN AG

- JOHNSON & JOHNSON

- MEDTRONIC PLC

- SMITH & NEPHEW PLC

- STRYKER CORPORATION

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – CARTILAGE REPAIR

TABLE 2: INDIA CARTILAGE REPAIR MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: INDIA CARTILAGE REPAIR MARKET, BY PRODUCT, FORECAST YEARS, 2021-2025 (IN $ MILLION)

TABLE 4: INDIA CARTILAGE REPAIR MARKET, BY MODALITY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: INDIA CARTILAGE REPAIR MARKET, BY MODALITY, FORECAST YEARS, 2021-2025 (IN $ MILLION)

TABLE 6: INDIA CARTILAGE REPAIR MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: INDIA CARTILAGE REPAIR MARKET, BY TYPE, FORECAST YEARS, 2021-2025 (IN $ MILLION)

TABLE 8: INDIA CARTILAGE REPAIR MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: INDIA CARTILAGE REPAIR MARKET, BY APPLICATION, FORECAST YEARS, 2021-2025 (IN $ MILLION)

TABLE 10: INDIA CARTILAGE REPAIR MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: INDIA CARTILAGE REPAIR MARKET, BY END-USER, FORECAST YEARS, 2021-2025 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: OPPORTUNITY MATRIX

FIGURE 3: VENDOR LANDSCAPE

FIGURE 4: KEY INVESTMENT INSIGHTS

FIGURE 5: INDIA CARTILAGE REPAIR MARKET, BY PRODUCT, IN 2020

FIGURE 6: INDIA CARTILAGE REPAIR MARKET, BY CELL-BASED, 2021-2025 (IN $ MILLION)

FIGURE 7: INDIA CARTILAGE REPAIR MARKET, BY NON-CELL-BASED, 2021-2025 (IN $ MILLION)

FIGURE 8: INDIA CARTILAGE REPAIR MARKET, BY MODALITY, IN 2020

FIGURE 9: INDIA CARTILAGE REPAIR MARKET, BY OSTEOCHONDRAL ALLOGRAFT, 2021-2025 (IN $ MILLION)

FIGURE 10: INDIA CARTILAGE REPAIR MARKET, BY MICROFRACTURE & CHONDROPLASTY, 2021-2025 (IN $ MILLION)

FIGURE 11: INDIA CARTILAGE REPAIR MARKET, BY JUVENILE ALLOGRAFT FRAGMENT, 2021-2025 (IN $ MILLION)

FIGURE 12: INDIA CARTILAGE REPAIR MARKET, BY AUTOLOGOUS CHONDROCYTE IMPLANTATION, 2021-2025 (IN $ MILLION)

FIGURE 13: INDIA CARTILAGE REPAIR MARKET, BY TYPE, IN 2020

FIGURE 14: INDIA CARTILAGE REPAIR MARKET, BY HYALINE CARTILAGE, 2021-2025 (IN $ MILLION)

FIGURE 15: INDIA CARTILAGE REPAIR MARKET, BY FIBROCARTILAGE, 2021-2025 (IN $ MILLION)

FIGURE 16: INDIA CARTILAGE REPAIR MARKET, BY APPLICATION, IN 2020

FIGURE 17: INDIA CARTILAGE REPAIR MARKET, BY KNEE, 2021-2025 (IN $ MILLION)

FIGURE 18: INDIA CARTILAGE REPAIR MARKET, BY OTHER APPLICATIONS, 2021-2025 (IN $ MILLION)

FIGURE 19: INDIA CARTILAGE REPAIR MARKET, BY END-USER, IN 2020

FIGURE 20: INDIA CARTILAGE REPAIR MARKET, BY HOSPITAL & CLINIC, 2021-2025 (IN $ MILLION)

FIGURE 21: INDIA CARTILAGE REPAIR MARKET, BY AMBULATORY SURGICAL CENTER, 2021-2025 (IN $ MILLION)

FIGURE 22: INDIA CARTILAGE REPAIR MARKET, BY OTHER END-USERS, 2021-2025 (IN $ MILLION)

- MARKET BY PRODUCT

- CELL-BASED

- NON-CELL-BASED

- MARKET BY MODALITY

- OSTEOCHONDRAL ALLOGRAFT

- MICROFRACTURE & CHONDROPLASTY

- JUVENILE ALLOGRAFT FRAGMENT

- AUTOLOGOUS CHONDROCYTE IMPLANTATION

- MARKET BY TYPE

- HYALINE CARTILAGE

- FIBROCARTILAGE

- MARKET BY APPLICATION

- KNEE

- OTHER APPLICATIONS

- MARKET BY END-USER

- HOSPITAL & CLINIC

- AMBULATORY SURGICAL CENTER

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.