GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

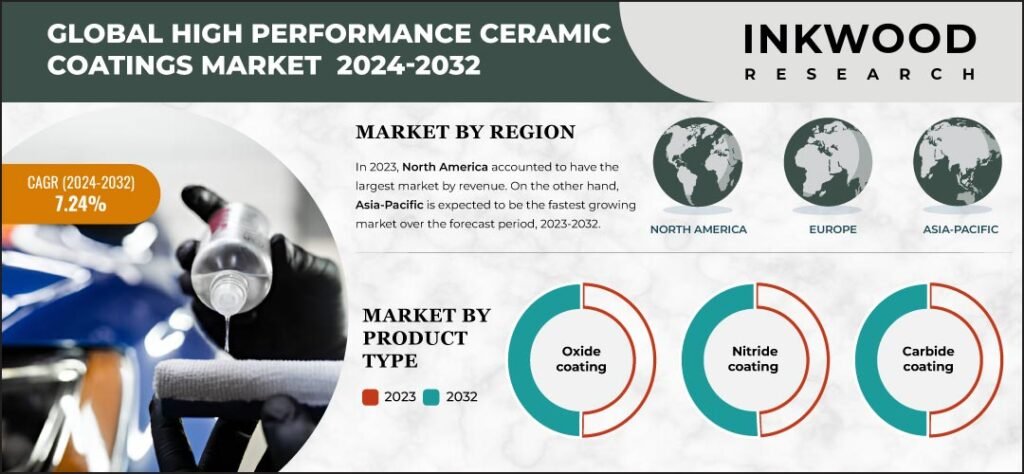

Global High-Performance Ceramic Coatings Market by Product Type (Oxide Coatings, Nitride Coatings, Carbide Coatings) Market by Technology (Thermal Spray, Physical Vapor Deposition, Chemical Vapor Deposition, Other Technologies) Market by End-user (Automotive, Aerospace & Defense, General Industrial Tools & Machinery, Healthcare, Other End-users) by Geography

REPORTS » CHEMICALS AND MATERIALS » PAINTS AND COATINGS » GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

MARKET OVERVIEW

The global high-performance ceramic coatings market was valued at $9729.41 million in 2023 and is expected to reach $18212.41 million by 2032, growing at a CAGR of 7.24% during the forecast period 2024-2032. The base year considered for the study is 2023, and the estimated period is between 2024 and 2032. The market study has also analyzed the impact of COVID-19 on the high-performance ceramic coatings market qualitatively as well as quantitatively.

High-performance ceramic coatings are advanced protective materials made from ceramic nanoparticles or polymer-ceramic composites. Renowned for their exceptional durability, hardness, and ability to withstand extreme conditions like abrasion, corrosion, and high temperatures, these coatings are extensively used across industries such as automotive, aerospace, electronics, and energy. By forming a thin but highly effective protective layer, they improve surface performance and longevity. The key properties of these coatings include low friction, excellent thermal stability, and, in some cases, hydrophobic or oleophobic characteristics. Further, these coatings are essential for protecting critical components, enhancing efficiency, and reducing wear and maintenance in a wide range of applications.

Read our latest blog on the High-Performance Ceramic Coatings Market

GROWTH ENABLERS

Key growth enablers of the global high-performance ceramic coatings market:

- Surging demand for automobiles

- The global high-performance ceramic coatings market is expanding due to rising global demand for automobiles. According to the European Automobile Manufacturers Association (ACEA), global motor vehicle production saw a significant 5.7% growth in 2022, reaching 85.4 million units.

- The rise in automobile production directly contributes to the growing need for advanced protective coatings. High-performance ceramic coatings are sought after for their exceptional durability and resistance to environmental elements.

- These coatings have become vital in addressing the stringent demands of the expanding automotive sector. As the industry increases its production capacity, the demand for specialized coatings continues to grow.

- The main objective is to protect vehicles from corrosion, wear, and environmental damage. This persistent trend continues to drive the growth and significance of the high-performance ceramic coatings market.

- Rising aerospace applications

- Increasing usage in medical devices

- Technological advancements

GROWTH RESTRAINTS

Key growth restraining factors of the global high-performance ceramic coatings market:

- High cost of ceramic coatings

- The high cost of ceramic coatings in the high-performance coatings sector is driven by several factors, with the primary one being the substantial expense of the specialized raw materials used in their production.

- Materials like advanced ceramics and high-performance compounds require complex manufacturing processes, contributing to higher production costs. Furthermore, applying ceramic coatings involves specialized techniques, skilled labor, and often advanced equipment, which further increases the overall expenses.

- As a result, the high cost of these coatings limits their widespread use across industries, making them less viable for applications where cost-effectiveness is a priority. This price challenge reduces their competitiveness against more affordable alternatives, thereby constraining their market reach.

- Issues regarding thermal spray process reliability and consistency

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global High-Performance Ceramic Coatings Market | Top Market Trends

- Plasma spray coatings, utilizing techniques such as HV-APS and SPS, improve wear resistance and thermal stability for essential components in the aerospace, automotive, and energy sectors. The technology’s versatility in repairing worn parts, dedication to sustainability, and strict compliance with quality standards position it as a key solution for high-performance ceramic coatings.

- Environmental sustainability is transforming the global high-performance ceramic coatings market, particularly within the energy sector. Industries are adopting ceramic coatings to enhance efficiency and lower emissions, in line with global environmental goals. This transition encourages the creation of eco-friendly solutions that deliver improved performance while minimizing the environmental footprint.

MARKET SEGMENTATION

Need a custom report or have specific data requirements? Let us know!

Market Segmentation – Product Type, Technology, and End-User –

Market by Product Type:

- Oxide Coatings

- In 2023, the oxide coatings segment was the largest product type category in the global high-performance ceramic coatings market.

- Oxide coatings are a vital part of the global high-performance ceramic coatings market, offering essential protection by resisting corrosion and providing electrical insulation.

- These coatings improve aesthetics, making them ideal for luxury goods, while also functioning as effective undercoatings for protective products. In challenging environments, oxide coatings provide exceptional temperature and wear resistance, making them indispensable for industries that require high-performance ceramic materials.

- Nitride Coatings

- Carbide Coatings

Market by Technology:

- Thermal Spray

- Physical Vapor Deposition

- Chemical Vapor Deposition

- Other Technologies

Market by End-User:

- Automotive

- Aerospace & Defense

- General Industrial Tools & Machinery

- Healthcare

- The healthcare segment is projected to be the fastest-growing end-user category over the forecast period.

- These coatings are gaining popularity for dental implants because of their excellent wear resistance and biochemical inertness. The rising use of plasma-sprayed hydroxyapatite coatings by dental surgeons has significantly increased demand.

- Moreover, the aging population in Asia and Europe has increased in dental and orthopedic surgeries, further fueling the demand for high-performance ceramic coatings. These coatings offer improved durability and biocompatibility, making them well-suited for medical implants and contributing to market growth in the healthcare sector.

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- In 2023, North America was the major region in the global high-performance ceramic coatings market.

- Industries such as automotive, aerospace, and energy are increasingly looking for solutions to enhance the lifespan of critical components while boosting their performance. High-performance ceramic coatings provide outstanding resistance to wear, corrosion, and high temperatures, resulting in reduced downtime, lower maintenance costs, and improved fuel efficiency.

- In the United States and Canada, the energy sector’s global leadership depends on high-performance ceramic coatings for components used in electricity generation, highlighting their vital role in maintaining the efficiency and reliability of energy infrastructure.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global high-performance ceramic coatings market:

- A&A Coatings

- APS Materials Inc

- Aremco Products Inc

- Bodycote Plc

- Compagnie de Saint-Gobain SA

- Linde plc

- Zircotec Ltd

Key strategies adopted by some of these companies:

- Zircotec launched Primary Gunmetal Grey™ in March 2023, a ceramic coating specifically designed to provide an affordable and versatile solution for reducing the surface temperatures of exhaust systems.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product Type, Technology, and End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | A&A Coatings, APS Materials Inc, Aremco Products Inc, Bodycote Plc, Compagnie de Saint-Gobain SA, Evonik Industries AG, Keronite Group Ltd, Linde plc, NanoShine Ltd, Oerlikon Balzers, Swain Tech Coatings Inc, Zircotec Ltd |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- GOVERNMENT INITIATIVES IN SEMICONDUCTOR PRODUCTION PROPEL THE HIGH-PERFORMANCE CERAMIC COATINGS MARKET WORLDWIDE

- WIDESPREAD EXPANSION DRIVEN BY THE RISING DEMAND FOR HIGH-PERFORMANCE CERAMIC COATINGS IN DENTISTRY

MARKET DYNAMICS

- KEY DRIVERS

- SURGING DEMAND FOR AUTOMOBILES

- RISING AEROSPACE APPLICATIONS

- INCREASING USAGE IN MEDICAL DEVICES

- TECHNOLOGICAL ADVANCEMENTS

- KEY RESTRAINTS

- HIGH COST OF CERAMIC COATINGS

- ISSUES REGARDING THERMAL SPRAY PROCESS RELIABILITY AND CONSISTENCY

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS

- KEY MARKET TRENDS

- ADVANCEMENTS IN PLASMA SPRAY COATINGS

- RISING CONSCIOUSNESS OF ENVIRONMENTAL SUSTAINABILITY

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTIONS

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR UNITED KINGDOM AND GERMANY

- GROWTH PROSPECT MAPPING FOR CHINA AND INDIA

- GROWTH PROSPECT MAPPING FOR LATIN AMERICA AND MIDDLE EAST & AFRICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS

- MANUFACTURERS AND PRODUCTION

- RESEARCH AND DEVELOPMENT

- DISTRIBUTION AND SUPPLY CHAIN

- INSTALLATION AND APPLICATION

MARKET BY PRODUCT TYPE

- OXIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NITRIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARBIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OXIDE COATINGS

MARKET BY TECHNOLOGY

- THERMAL SPRAY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PHYSICAL VAPOR DEPOSITION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CHEMICAL VAPOR DEPOSITION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER TECHNOLOGIES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- THERMAL SPRAY

MARKET BY END-USER

- AUTOMOTIVE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AEROSPACE & DEFENSE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GENERAL INDUSTRIAL TOOLS & MACHINERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HEALTHCARE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AUTOMOTIVE

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET DRIVERS

- NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET DRIVERS

- EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET DRIVERS

- ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET DRIVERS

- REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- A&A COATINGS

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- APS MATERIALS INC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- AREMCO PRODUCTS INC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- BODYCOTE PLC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- COMPAGNIE DE SAINT-GOBAIN SA

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- EVONIK INDUSTRIES AG

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KERONITE GROUP LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- LINDE PLC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- NANOSHINE LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- OERLIKON BALZERS

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SWAIN TECH COATINGS INC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ZIRCOTEC LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- A&A COATINGS

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – HIGH-PERFORMANCE CERAMIC COATINGS

TABLE 2: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL OXIDE COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL OXIDE COATINGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL NITRIDE COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL NITRIDE COATINGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL CARBIDE COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL CARBIDE COATINGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY TECHNOLOGY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL THERMAL SPRAY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL THERMAL SPRAY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL PHYSICAL VAPOR DEPOSITION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL PHYSICAL VAPOR DEPOSITION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL CHEMICAL VAPOR DEPOSITION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL CHEMICAL VAPOR DEPOSITION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL OTHER TECHNOLOGIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL OTHER TECHNOLOGIES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL AEROSPACE & DEFENSE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL AEROSPACE & DEFENSE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL GENERAL INDUSTRIAL TOOLS & MACHINERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL GENERAL INDUSTRIAL TOOLS & MACHINERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: GLOBAL HEALTHCARE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL HEALTHCARE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 32: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: KEY PLAYERS OPERATING IN NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET

TABLE 37: EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 38: EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 39: KEY PLAYERS OPERATING IN EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET

TABLE 40: ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: KEY PLAYERS OPERATING IN ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET

TABLE 43: REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 44: REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 45: KEY PLAYERS OPERATING IN REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET

TABLE 46: LIST OF MERGERS & ACQUISITIONS

TABLE 47: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 48: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM AND GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA AND INDIA

FIGURE 6: GROWTH PROSPECT MAPPING FOR LATIN AMERICA AND MIDDLE EAST & AFRICA

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2023

FIGURE 11: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OXIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 12: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY NITRIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY CARBIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY TECHNOLOGY, IN 2023

FIGURE 15: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY THERMAL SPRAY, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PHYSICAL VAPOR DEPOSITION, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY CHEMICAL VAPOR DEPOSITION, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OTHER TECHNOLOGIES, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 20: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY AUTOMOTIVE, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY AEROSPACE & DEFENSE, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY GENERAL INDUSTRIAL TOOLS & MACHINERY, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY HEALTHCARE, 2024-2032 (IN $ MILLION)

FIGURE 24: GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OTHER END-USERS, 2024-2032 (IN $ MILLION)

FIGURE 25: NORTH AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 26: UNITED STATES HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 27: CANADA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 28: EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 29: UNITED KINGDOM HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 30: GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 31: FRANCE HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 32: ITALY HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: SPAIN HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 34: BELGIUM HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 35: POLAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: REST OF EUROPE HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN%)

FIGURE 38: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: JAPAN HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: INDIA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: SOUTH KOREA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: INDONESIA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: THAILAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 44: VIETNAM HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: AUSTRALIA & NEW ZEALAND HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: REST OF ASIA-PACIFIC HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 47: REST OF WORLD HIGH-PERFORMANCE CERAMIC COATINGS MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 48: LATIN AMERICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: MIDDLE EAST & AFRICA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

A: The global high-performance ceramic coatings market was valued at $9729.41 million in 2023.

A: In 2023, the aerospace & defense segment was the largest end-user category in the global high-performance ceramic coatings market.

A: High-performance ceramic coatings extend the lifespan of components, reduce the need for replacements, and lower overall maintenance costs. They also enhance energy efficiency by providing thermal barriers and decreasing friction in industrial applications, contributing to reduced energy consumption.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

UNITED STATES HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032