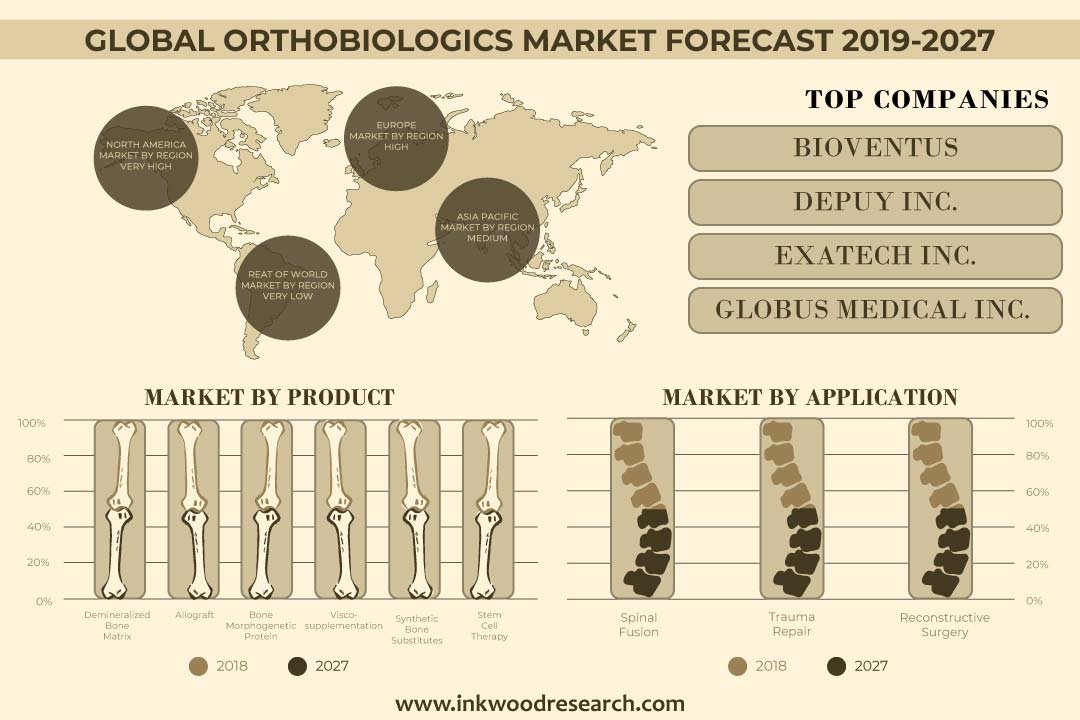

GLOBAL ORTHOBIOLOGICS MARKET FORECAST 2019-2027

Global Orthobiologics Market By End-user (hospitals, Orthopedic Clinics) By Products (demineralized Bone Matrix (dbm), Allograft, Bone Morphogenetic Protein (bmp), Viscosupplementation, Synthetic Bone Substitutes, Stem Cell Therapy, Other Products) By Application (spinal Fusion, Trauma Repair, Reconstructive Surgery, Tendon And Ligament, Other Applications) By Geography.

The global orthobiologics market was valued at $7378.42 billion in 2018 & is estimated to generate net revenue of approximately $11575.02 billion by 2027, growing at a CAGR of 5.14% Improvements in orthobiologics led to the expansion of tissue bone grafts and renewal products that hasten the reducing hospital visits, the bone healing process, and stays. The orthobiologics market is primarily driven by the following factors:

- Surging demand for spinal fusion surgeries

- Increasing geriatric population

- Increase orthopedic related diseases due to lifestyle choices

- Technological advancement

To know more about this report, request a free sample copy

The important drivers that are supporting the growth of the global orthobiologics market are the surging demand for spinal fusion surgeries and the increasing orthopaedic-related diseases occurring due to lifestyle choices. The demand for rapid recovery reduced hospital stay, and better patient outcome resulted in many medical facilities conducting spinal fusion surgery to repair the vertebrae and treat painful conditions of the spine. Aging can intensify complications in the human body, making most people aged 60 years and above susceptible to orthobiologics diseases such as arthritis and spinal deformity.

The applications of orthobiologics market are used extensively for various purposes. Spinal fusion is an operating process used to accurate difficulties with the trivial jaws of the spine (vertebrae). The bone defect is the second most common phenomenon after orthobiologics trauma. Bone grafts are used to fill the voids formed due to bone defects. Knees, hips, and foot and ankle bones are vulnerable to degeneration with aging. Reconstructive surgery is all about mending people and reinstating function. It is executed to overhaul and reshape bodily structures exaggerated by developmental abnormalities, infections, trauma/injuries, birth defects, tumors, and disease. Tendon & ligament is an ortho-biologic surgery that is carried out for repairing the torn-out ligament or muscles. The extensive growth in tendon & ligament repair mechanism drives healthy growth in the orthobiologics market as ortho biologics used to accelerate the recovery and repair procedure of the torn ligament or muscle. Other applications of orthobiologics include the oral and maxillofacial surgery that specializes in the treatment of several defects, injuries and diseases in the jaws, face, neck, head, and the soft and hard tissues of the mouth and maxillofacial region including, face and jaws.

Stringent government policies and post-surgery complications are the major factors hindering the orthobiologics market. Stringent government regulations and policies are estimated to be one of the major factors that are holding back the growth of the market. Healthcare reforms (such as Stark self-referral law and fraud & abuse law) are estimated to have affected the orthobiologics surgeons. While the orthobiologics surgery is a fairly straight forward method, however, there are certain post-surgery complications that are estimated to hinder the growth of the orthobiologics market.

The global orthobiologics market segments include products, applications, and end-users.

Products are sub-segmented into:

- Bone morphogenetic protein (BMP)

- Stem cell therapy

- Synthetic bone substitutes

- Allograft

- Demineralized bone matrix (DBM)

- Viscosupplementation

-

- One-injection

- Three-injection

- Five-injection

- Other Product

Applications are sub-segmented into:

- Spinal Fusion

- Tendon and ligament

- Reconstructive Surgery

- Trauma Repair

- Other Applications

End-users are segmented into:

- Hospitals

- Orthopedic Clinics

This report covers the present market conditions and the growth prospects of the Global orthobiologics market for 2019-2027 and considered the revenue generated through the sales of orthobiologics products as well as applications to calculate the market size by considering 2018 as the base year.

Geographically, the global orthobiologics market has been segmented on the basis of four major regions, which include:

- North America Orthobiologics Market – The United States. & Canada

- Asia-Pacific Orthobiologics Market – China, India, Japan, Australia, South Korea & Rest of APAC

- Europe Orthobiologics Market – The United Kingdom, France, Germany, Spain, Italy and Rest of Europe

- Rest of World- Latin America & Middle East and Africa

The orthobiologics market in North America is expected to hold the largest share by 2027 possibilities of more awareness about orthobiologics is a driving force for surgeons to switch from automated implants to biological implants. North America orthobiologics market constitutes approx. 43% share. The United States orthobiologics market has the largest share in North America and it’s expected to grow continuously. The Canadian region will also have growth driven by aging population, increasing research investments and an increased number of road accidents.

On the other hand, the Asia-Pacific market is anticipated to the fastest-growing region for the orthobiologics market. China accounts for the largest share of the Asian orthobiologics market. The market in this geographic segment is slated to grow further due to the augmented growth in research, and the growth in the aging population in the country. The market in India and Japan is expected to witness the highest growth owing to the rising geriatric population and the increasing number of road accidents in the country.

The orthobiologics market is segmented based on products which are sub-divided into demineralized bone Matrix (DBM), bone morphogenetic protein (BMP), allograft, synthetic bone substitutes, Viscosupplementation, stem cell therapy, and others and segmented on the basis of end-user which is sub-divided into hospitals and orthopedic clinics.

Demineralized bone matrix is an allograft decalcified to remove collagen, non-collagenous proteins, and other growth factors. Allografts come from donors, people who died in accidents or from sudden illnesses. Bone morphogenetic proteins are a group of growth factors such as cytokines that stimulate bone growth. These proteins, produced through genetic engineering, can help in bone healing. Viscosupplementation is a medical procedure during which lubricating fluid is injected into a joint. Stem cells have gained popularity for bone regeneration in the recent past. The hospital’s segment is one of the prime consumers of ethno biological products. The orthopedic clinics are the place where outpatients suffering from musculoskeletal diseases affecting their joints, muscle, and bone are examined and treated.

The major market players of the global orthobiologics market are:

- Medtronic Inc.

- Exatech Inc.

- Integra Lifesciences Holding Corporation

- Baxter International Inc.

- Depuy Inc. (Acquired By Johnson And Johnson)

Company Profiles covers analysis of important players. Medtronic is a medical device company. It was formed in the year 1949 with its headquarters in Dublin, Ireland. Its operative HQs are in Minnesota. Medtronic is one of the world’s major medicinal equipment development corporations. DePuy Synthes Companies (DePuy Synthes or ‘the division’) is a division of the diagnostics (MD&D) and medical device segment of Johnson & Johnson (J&J). The division offers a comprehensive portfolio of orthopedic and neuro products and services.

Key Findings of the global orthobiologics market:

- Hospitals are the largest revenue generating end user

- Spinal fusion is the fastest growing application

- Viscosupplementation holds the largest market share in terms of product

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- HOSPITALS ARE THE LARGEST REVENUE GENERATING END-USER

- SPINAL FUSION IS THE FASTEST GROWING APPLICATION

- VISCOSUPPLEMENTATION HOLDS THE LARGEST MARKET SHARE IN TERMS OF PRODUCTS

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- SURGING DEMAND FOR SPINAL FUSION SURGERIES

- INCREASING GERIATRIC POPULATION

- INCREASE ORTHOPAEDIC RELATED DISEASES DUE TO LIFESTYLE CHOICES

- TECHNOLOGICAL ADVANCEMENT

- MARKET RESTRAINTS

- STRINGENT GOVERNMENT POLICIES

- POST-SURGERY COMPLICATIONS

- HIGH COST OF ORTHOPEDICS IMPLANTS

- MARKET OPPORTUNITIES

- INCREASED UTILIZATION OF BONE REGENERATION TECHNOLOGY

- GROWING DISPOSABLE INCOME

- EXPANSION OF COST EFFECTIVE MEDICAL PRODUCTS

- HUGE MARKET OPPORTUNITIES IN DEVELOPING COUNTRIES

- MARKET CHALLENGES

- HIGH COST OF SPINAL FUSION SURGERY

- POOR PERFORMANCE OF BONE GRAFT SUBSTITUTE

- MARKET BY END-USER

- HOSPITALS

- ORTHOPEDIC CLINICS

- MARKET BY PRODUCTS

- DEMINERALIZED BONE MATRIX (DBM)

- ALLOGRAFT

- BONE MORPHOGENETIC PROTEIN (BMP)

- VISCOSUPPLEMENTATION

- ONE-INJECTION

- THREE-INJECTION

- FIVE-INJECTION

- SYNTHETIC BONE SUBSTITUTES

- STEM CELL THERAPY

- OTHER PRODUCTS

- MARKET BY APPLICATION

- SPINAL FUSION

- TRAUMA REPAIR

- RECONSTRUCTIVE SURGERY

- TENDON AND LIGAMENT

- OTHER APPLICATIONS

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF BUYER

- BARGAINING POWER OF SUPPLIER

- INTENSITY OF COMPETITIVE RIVALRY

- PESTEL ANALYSIS

- PATENT ANALYSIS

- KEY BUYING CRITERIA

- VALUE CHAIN ANALYSIS

- OPPORTUNITY MATRIX

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- INDIA

- CHINA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- COMPANY PROFILES

- AAP IMPLANTATE AG

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- ALLOSOURCE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- AMEDICA CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- BAXTER INTERNATIONAL INC.

- MARKET OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- CONMED CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- DEPUY INC (ACQUIRED BY JOHNSON AND JOHNSON)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- EXACTECH INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- INTEGRA LIFESCIENCES HOLDING CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- MEDTRONIC INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- NUVASIVE INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- RTI SURGICAL

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- SANOFI

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- SMITH & NEPHEW PLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- STRYKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- ZIMMER BIOMET INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- AAP IMPLANTATE AG

TABLE LIST

TABLE 1 GLOBAL ORTHOBIOLOGICS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 2 OLDER POPULATION BY AGE GROUP ( 1900 TO 2050)

TABLE 3 POST-SURGERY COMPLICATIONS

TABLE 4 GLOBAL ORTHOBIOLOGICS MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 5 GLOBAL HOSPITALS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 6 GLOBAL ORTHOPEDIC CLINICS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 7 GLOBAL ORTHOBIOLOGICS MARKET BY PRODUCTS 2019-2027 ($ MILLION)

TABLE 8 GLOBAL DEMINERALIZED BONE MATRIX (DBM) MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 9 GLOBAL ALLOGRAFT MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 10 GLOBAL BONE MORPHOGENETIC PROTEIN (BMP) MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 11 GLOBAL VISCOSUPPLEMENTATION MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 12 SINGLE INJECTION IN VISCOSUPPLEMENTATION COST AND DIFFERENT BRAND

TABLE 13 MULTIPLE INJECTIONS IN VISCOSUPPLEMENTATION

TABLE 14 GLOBAL SYNTHETIC BONE SUBSTITUTES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 15 GLOBAL STEM CELL THERAPY MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 16 GLOBAL OTHER PRODUCTS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 17 GLOBAL ORTHOBIOLOGICS MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 18 GLOBAL SPINAL FUSION MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 19 GLOBAL TRAUMA REPAIR MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 20 GLOBAL RECONSTRUCTIVE SURGERY MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 21 GLOBAL TENDON AND LIGAMENT MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 22 GLOBAL OTHER APPLICATIONS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 23 GLOBAL ORTHOBIOLOGICS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 24 NORTH AMERICA ORTHOBIOLOGICS MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 25 EUROPE ORTHOBIOLOGICS MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 26 AGE STRUCTURE OF GERMANY 2017

TABLE 27 ASIA-PACIFIC VETERINARY DIAGNOSTIC MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 28 SPORTS INJURIES CAUSED IN AUSTRALIA BY SPORTS IN 2016

TABLE 29 REST OF THE WORLD ORTHOBIOLOGICS MARKET 2019-2027 (IN $ MILLION)

FIGURES LIST

FIGURE 1 GLOBAL ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 2 INCREASING DEMAND OF MINIMAL INVASIVE TECHNOLOGIES 2010-2025 ($ MILLION)

FIGURE 3 GLOBAL ORTHOBIOLOGICS MARKET SHARE BY END-USER 2018 & 2027 (%)

FIGURE 4 GLOBAL ORTHOBIOLOGICS MARKET BY HOSPITALS 2019-2027 ($ MILLION)

FIGURE 5 GLOBAL ORTHOBIOLOGICS MARKET BY ORTHOPEDIC CLINICS 2019-2027 ($ MILLION)

FIGURE 6 GLOBAL ORTHOBIOLOGICS MARKET SHARE BY PRODUCTS 2018 & 2027 (%)

FIGURE 7 GLOBAL ORTHOBIOLOGICS MARKET BY DEMINERALIZED BONE MATRIX (DBM) 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL ORTHOBIOLOGICS MARKET BY ALLOGRAFT 2019-2027 ($ MILLION)

FIGURE 9 GLOBAL ORTHOBIOLOGICS MARKET BY BONE MORPHOGENETIC PROTEIN (BMP) 2019-2027 ($ MILLION)

FIGURE 10 GLOBAL ORTHOBIOLOGICS MARKET BY VISCOSUPPLEMENTATION 2019-2027 ($ MILLION)

FIGURE 11 GLOBAL VISCOSUPPLEMENTATION MARKET BY ONE-INJECTION 2019-2027 ($ MILLION)

FIGURE 12 GLOBAL VISCOSUPPLEMENTATION MARKET BY THREE-INJECTION 2019-2027 ($ MILLION)

FIGURE 13 GLOBAL VISCOSUPPLEMENTATION MARKET BY FIVE-INJECTION 2019-2027 ($ MILLION)

FIGURE 14 GLOBAL ORTHOBIOLOGICS MARKET BY SYNTHETIC BONE SUBSTITUTES 2019-2027 ($ MILLION)

FIGURE 15 GLOBAL ORTHOBIOLOGICS MARKET BY STEM CELL THERAPY 2019-2027 ($ MILLION)

FIGURE 16 GLOBAL ORTHOBIOLOGICS MARKET BY OTHER PRODUCTS 2019-2027 ($ MILLION)

FIGURE 17 GLOBAL ORTHOBIOLOGICS MARKET SHARE BY APPLICATION 2018 & 2027 (%)

FIGURE 18 GLOBAL ORTHOBIOLOGICS MARKET BY SPINAL FUSION 2019-2027 ($ MILLION)

FIGURE 19 GLOBAL ORTHOBIOLOGICS MARKET BY TRAUMA REPAIR 2019-2027 ($ MILLION)

FIGURE 20 GLOBAL ORTHOBIOLOGICS MARKET BY RECONSTRUCTIVE SURGERY 2019-2027 ($ MILLION)

FIGURE 21 GLOBAL ORTHOBIOLOGICS MARKET BY TENDON AND LIGAMENT 2019-2027 ($ MILLION)

FIGURE 22 GLOBAL ORTHOBIOLOGICS MARKET BY OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 23 PORTER’S FIVE FORCE MODEL

FIGURE 24 GLOBAL ORTHOBIOLOGICS MARKET REGIONAL OUTLOOK 2018 & 2027 (%)

FIGURE 25 HEALTHCARE EXPENDITURE IN THE UNITED STATES 2014 & 2025 (% OF GDP)

FIGURE 26 THE UNITED STATES ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 27 CANADA ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 28 EUROPE ORTHOBIOLOGICS MARKET BY COUNTRY 2018 & 2027

FIGURE 29 THE UNITED KINGDOM ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 30 FRANCE ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 31 GERMANY ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 32 SPAIN ORTHOBIOLOGICS MARKET, 2019-2027 ($ MILLION)

FIGURE 33 ITALY ORTHOBIOLOGICS MARKET, 2019-2027 ($ MILLION)

FIGURE 34 REST OF EUROPE ORTHOBIOLOGICS MARKET 2019-2027 ($ MILLION)

FIGURE 35 ASIA PACIFIC ORTHOBIOLOGICS MARKET BY COUNTRY 2018 & 2027

FIGURE 36 GROWING AGING POPULATION RATE 2010 AND 2050

FIGURE 37 INDIA VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 38 CHINA VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 39 JAPAN VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 40 AUSTRALIA VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 41 SOUTH KOREA VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 42 REST OF ASIA-PACIFIC VETERINARY DIAGNOSTIC MARKET 2019-2027 ($ MILLION)

FIGURE 43 LATIN AMERICA ORTHOBIOLOGICS MARKET 2019-2027 (IN $ MILLION)

FIGURE 44 MIDDLE EAST AND AFRICA ORTHOBIOLOGICS MARKET 2019-2027 (IN $ MILLION)

FIGURE 45 ORTHOBIOLOGICS COMPANY MARKET SHARE 2018 (% )

- MARKET BY END-USER

- HOSPITALS

- ORTHOPEDIC CLINICS

- MARKET BY PRODUCTS

- DEMINERALIZED BONE MATRIX (DBM)

- ALLOGRAFT

- BONE MORPHOGENETIC PROTEIN (BMP)

- VISCOSUPPLEMENTATION

- ONE-INJECTION

- THREE-INJECTION

- FIVE-INJECTION

- SYNTHETIC BONE SUBSTITUTES

- STEM CELL THERAPY

- OTHER PRODUCTS

- MARKET BY APPLICATION

- SPINAL FUSION

- TRAUMA REPAIR

- RECONSTRUCTIVE SURGERY

- TENDON AND LIGAMENT

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- INDIA

- CHINA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.