GLOBAL NANOCOATINGS MARKET FORECAST 2019-2027

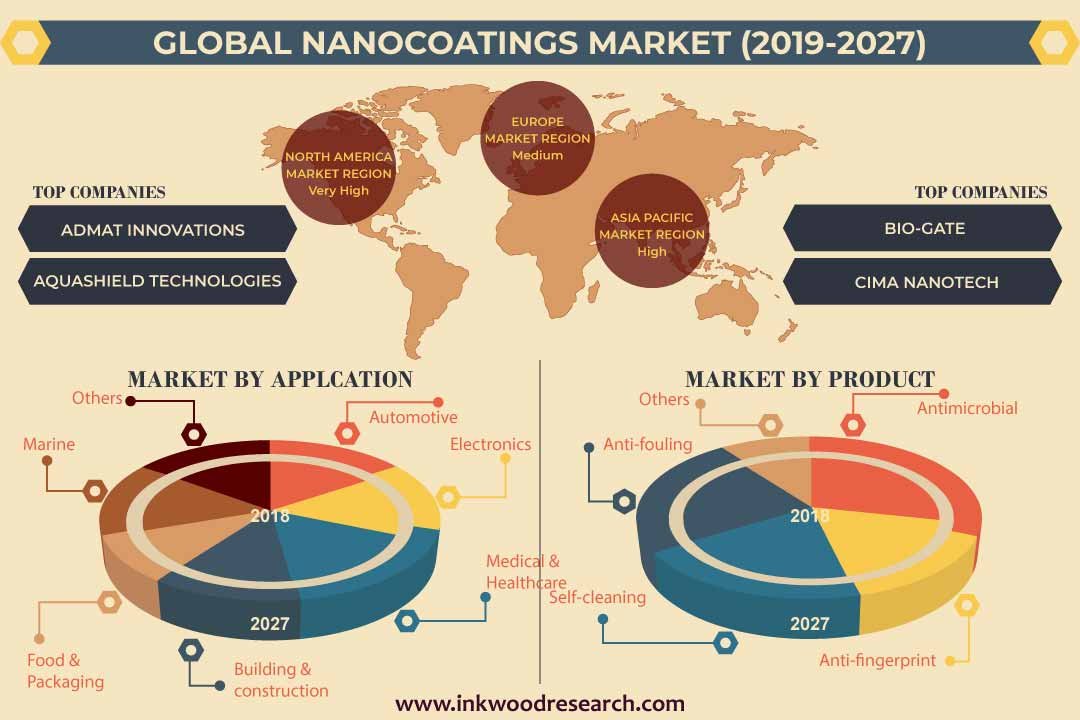

Global Nanocoatings Market Is Segmented by Application( Automotive, Electronics, Medical & Healthcare, Building & Construction, Food & Packaging, Marine Industry) by Product( Anti-microbial Nano-coatings, Anti-finger Printnano-coatings, Self-cleaning Nano-coatings, Easy-to-clean & Anti-fouling Nano-coatings) & by Geography

Nanocoatings are the coatings which constitute particles in the nanometer scale (that is 10-9 m) and the film applied is also of the nanometer scale thickness. They offer various benefits such as protection from temperature, abrasion resistance, UV resistance, acts as a filter for harmful microbes making it a more widely utilized coating technique globally. Global nanocoating market that was valued $XX million in 2018 is anticipated to grow $XX million in 2027 with an estimated CAGR 22.07% for the forecast period 2019-2027. The base year considered for the study is 2018 and the estimated period is between 2019 and 2027. Several factors responsible for the market growth are:

- Superior properties of nanocoatings

- Booming Automotive Industry

- Growing demand for medical equipment coatings

- Rising industrialization in the Asia Pacific

- Technological advancements

To know more about this report, request a free sample copy.

To know more about this report, request a free sample copy.

Factors such as an increase in the construction activities demanding durability and aesthetic appearance of the buildings and performance benefits offered by nanocoatings are expected to drive the nanocoatings market growth primarily. These coatings are utilized for protecting electronics such as smartphones from water; solar panels from dirt and dust; inhibit equipment from degrading harsh under an environment like snow. Nanocoatings finds its applications for interior and exterior residential paintings, interior house furnishings, glass and facade coatings of tall buildings, coatings of automobile exterior and interior parts, and coating of various industrial buildings. Nanocoatings are also used for small applications in other industries such as electronics, consumer goods and medical products.

In terms of type segment, the self-cleaning segment dominated the nanocoatings market in 2018. The dominance of this segment can be attributed to the extensive employment of self-cleaning nanocoatings across various end-user industries, including construction, automotive and others. Self-cleaning nanocoatings can clean up automatically by undergoing a chemical change. Self-cleaning nanocoatings have bionic and photocatalytic as the two sub-types that undergo self-re-generation and redox reaction mechanisms respectively to clean and retain their structural integrity.

On the flips side, the anti-fingerprint coating is anticipated to be the fastest growing segment. Anti-fingerprint nanocoatings make fingerprints invisible to the naked eye. It is transparent and provides long-term fingerprint protection. Anti-fingerprint nanocoatings resist the oil, dirt, dust and other chemicals (cosmetics) carried by the fingers, thereby, reducing degradation rate by human errors alongside maintaining the thickness of the coating film to minimize the adherence of fingerprints onto them. Increasing incorporation of touch-based displays in various applications such as electronics, automotive and aerospace is expected to increase the growth of the anti-fingerprint nanocoatings market.

With increasing adoption of nanocoatings, newer challenges have been introduced in the market. Factors like unstable raw materials prices, stringent government regulations, intense competition among manufacturers, high cost & complex methods are hindering the market growth. The last few years have witnessed rising concerns regarding the adverse effects of nanocoatings on the environment & human body. Nanoparticles, being small in size, pose a high risk of getting absorbed into the living organisms, reaching their bloodstream and organs, and interfering with the normal functioning of the body. Nanoparticles, if not handled properly during the manufacturing of nanocoatings, can act as air pollutants with the potential of causing severe respiratory diseases. There are many speculations regarding the safe use of nanocoatings in the food & packaging industry. For instance, Food and Drug Administration (FDA) in the U.S tested the nanomaterials for pharmacotoxicity.

The report on global nanocoatings market comprises of segmentation by type and application.

Market Type is sub-segmented into:

- Self-Cleaning (Photocatalytic)

- Anti-Microbial

- Anti-Fingerprint

- Conductive

- Self-Cleaning (Bionic)

- Anti-Corrosion

- Abrasion and Wear resistant

- Anti-Fouling

- UV-Resistant

- Other Types (Anti-Icing, Thermal Barrier)

Market by Application is sub-segmented into:

- Electronics

- Energy

- Food & Packaging

- Construction

- Marine

- Military & Defense

- Automotive

- Aerospace

- Healthcare

- Others (Exterior Protection, Tools, Textiles, Water-treatment equipment)

Geographically, the global nanocoatings market has been segmented into four major regions, which are:

- North America: The United States & Canada

- Europe: United Kingdom, Germany, France, Spain, Italy, Norway, Netherlands, Belgium, Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, South East Asia, Australia & New Zealand, Rest of Asia Pacific

- Rest of World: Latin America, Middle East & Africa

In 2018, North America dominated the market. The presence of major manufacturers of nanocoating materials like Nanomech Inc., EIKOS Inc., CIMA Nanotech, Duraseal Coatings Company LLC and Nanophase Technologies Corporation in North America caused intensive competition among the major players. The nanocoatings markets in the US and Canada are still in the growing phase in terms of technology, and product penetration is owing to the huge demand for nanocoatings in the automotive and healthcare industries. Although it seems like the automobile market in North America would have reached its saturation point, the growth of people refurbishing their vehicles have increased multifold, thereby augmenting the mandate of the automotive interior materials market which increases the demand for nanocoatings. The US is one of the largest automobile producers in the world. Many top automakers have manufacturing plants in the US, such as General Motors, Ford, Chrysler and Honda.

On the other hand, Asia Pacific is anticipated to be the fastest growing region in the market with a CAGR of XX% during the forecast period 2019-2027. The market in the Asia Pacific is expected to witness the highest growth during the forecast period due to the expanding electronics and automotive industries in China and India. Asia-Pacific is an attractive market for nanocoating manufacturers owing to increasing constructional activities. China, Japan, South Korea and India are the major revenue contributors in the region. Low prices of raw material, cheap labor costs and supportive policies on foreign investments are few of the factors that attract the nanocoatings manufacturers to invest in Asia-Pacific. China is the highest revenue generator in Asia-Pacific for the nanocoatings market. It is also a global leader in the manufacture of nanocoatings, anti-corrosive nanocoatings (used in ship construction and oil tanks) and in the production of nano-textiles and clothing.

The global nanocoatings market is segmented based on various parameters such as type and application. Based on the type, the nanocoatings market is classified into anti-fingerprint, anti-microbial, easy-to-clean & anti-fouling, self-cleaning (bionic & photocatalytic), conductive, anti-corrosion, abrasion, weather resistant, UV resistant & others (anti-icing & thermal barrier). Based on application, the global nanocoatings market is classified into nanocoatings for electronics, energy, food & packaging, construction, marine, military & defense, automotive, aerospace, healthcare and others.

The nanocoatings market is a highly fragmented one, and the key players operating in the market are:

- Buhler AG

- Nanogate AG

- Bio-Gate AG

- Nanofilm Ltd.

- Nanophase Technologies Corporation

- And other companies

Market share analysis with company profiles of the prominent market players is discussed in detail. Most of the companies look for strategies such as merger & acquisition, partnership, contracts, agreements and new product launch to gain a competitive edge over other companies. For example, In August 2017, P2i received funding of £10 million from Clydesdale Bank and Yorkshire Bank. In July 2017, Micronetics and Surfix have collaborated to develop a capillary driven plastic chip with a coating that will help people to take medical tests at home. In June 2017, Nanophase partnered with Eminess Technologies, a company that produces products for polishing surfaces. In December 2016, Nanogate AG acquired Jay Industries Inc. to expand its customer base in the U.S. as well as in the Asian markets.

Key findings of the global nanocoatings market:

- Healthcare industry has become one of the major end-users of nanocoatings, where these coatings are mainly used for sterilizing medical equipment to prevent infections.

- Product innovation plays a vital role as the fragmented nature of Nanocoatings market results in companies developing new products to gain competitive advantage.

- There has been a steady rise in demand for functional coatings

- Growing application of nanocoatings on the display screen of electronic devices for extending their utility life.

- There has been widening applications of nanocoatings in the industries for automotive, building and construction, water treatment equipment, healthcare, food & packaging, marine industry, energy and others.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY & FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- ASIA PACIFIC IS THE MOST PROMISING REGIONAL MARKET

- WIDENING USES OF NANOCOATINGS

- PRODUCT INNOVATION

- GROWING NEED FOR FUNCTIONAL COATINGS ON THE DISPLAY SCREEN OF ELECTRONICS

- MARKET DYNAMICS

- TIMELINE OF NANOCOATINGS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- SUPERIOR PROPERTIES OF NANOCOATINGS

- BOOMING AUTOMOTIVE INDUSTRY

- GROWING DEMAND FOR MEDICAL EQUIPMENT COATINGS

- RISING INDUSTRIALIZATION IN ASIA PACIFIC

- TECHNOLOGICAL ADVANCEMENT

- MARKET RESTRAINTS

- HEALTH & ENVIRONMENT SAFETY AT RISK

- UNSTABLE RAW MATERIALS PRICES

- MARKET OPPORTUNITIES

- VARIOUS APPLICATIONS SUBSTITUTING TOWARDS NANOCOATING

- FUNCTIONAL COATINGS DEMAND ON RISE

- MARKET CHALLENGES

- STRINGENT GOVERNMENT REGULATIONS

- INTENSE COMPETITION AMONG MANUFACTURERS

- HIGH COST & COMPLEX METHODS REQUIRED

- MARKET BY TYPE

- SELF-CLEANING (PHOTOCATALYTIC)

- ANTI-MICROBIAL

- ANTI-FINGERPRINT

- CONDUCTIVE

- SELF-CLEANING (BIONIC)

- ANTI-CORROSION

- ABRASION & WEAR RESISTANT

- ANTI-FOULING

- UV-RESISTANT

- OTHER TYPES

- MARKET BY APPLICATION

- ELECTRONICS

- ENERGY

- FOOD & PACKAGING

- CONSTRUCTION

- MARINE

- MILITARY & DEFENCE

- AUTOMOTIVE

- AEROSPACE

- HEALTHCARE

- OTHERS APPLICATIONS

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- VALUE CHAIN ANALYSIS

- SUPPLIERS-MANUFACTURERS

- MANUFACTURERS-END USERS

- MANUFACTURING PROCESS

- KEY BUYING CRITERIA

- APPLICABILITY

- DURABILITY

- COST-EFFECTIVENESS

- ENVIRONMENT-FRIENDLY

- WATERPROOF

- LEGAL, POLICY & REGULATORY FRAMEWORK

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- NORWAY

- NETHERLANDS

- BELGIUM

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- SOUTHEAST ASIA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- KEY CORPORATE STRATEGIES

- AGREEMENTS, CONTRACTS, COLLABORATIONS & PARTNERSHIPS

- BUSINESS EXPANSIONS

- NEW PRODUCT LAUNCHES & DEVELOPMENTS

- MERGERS & ACQUISITIONS

- OTHER KEY STRATEGIES

- COMPANY PROFILE

- ADMAT INNOVATIONS

- AKZO NOBEL N.V.

- AQUASHIELD TECHNOLOGIES

- BASF

- BIO GATE (SYNTOSBETEILIGUNGS GMBH)

- CG2 NANOCOATINGS INC.

- EIKOS INC.

- INFRAMAT CORPORATION

- INTEGRAN TECHNOLOGIES

- NANO-CARE AG

- NANOFILM LTD. (PEN INC.)

- NANOPHASE TECHNOLOGIES CORPORATION

- NANOVERE TECHNOLOGIES LLC

- NILIMA NANOTECHNOLOGIES

- P2I LTD.

- PPG INDUSTRIES INC.

- SURFIX BV-ADVANCED NANOCOATINGS

- TESLA NANOCOATINGS

TABLE LIST

TABLE 1: GLOBAL NANOCOATINGS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: NANOTECHNOLOGY DEVELOPMENT TIMELINE

TABLE 3: PRICE VARIATION OF ZINC AND IRON ORE

TABLE 4: GLOBAL NANOCOATINGS MARKET, BY TYPE, 2019-2027, (IN $ MILLION)

TABLE 5: ADVANTAGES & DISADVANTAGES OF SELF-CLEANING (PHOTOCATALYTIC) NANOCOATINGS

TABLE 6: PROMINENT FIRMS THAT OFFER SELF-CLEANING NANOCOATINGS (PHOTOCATALYTIC COATINGS)

TABLE 7: GLOBAL SELF-CLEANING (PHOTOCATALYTIC) MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 8: PROMINENT FIRMS THAT OFFER ANTI-MICROBIAL NANOCOATINGS

TABLE 9: GLOBAL ANTI-MICROBIAL MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 10: PROMINENT FIRMS THAT OFFER ANTI-FINGERPRINT NANOCOATINGS

TABLE 11: GLOBAL ANTI-FINGERPRINT MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 12: PROMINENT FIRMS THAT OFFER CONDUCTIVE NANOCOATINGS

TABLE 13: GLOBAL CONDUCTIVE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 14: GLOBAL SELF-CLEANING (BIONIC) MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 15: PROMINENT FIRMS THAT OFFER ANTI-CORROSION NANOCOATINGS

TABLE 16: GLOBAL ANTI-CORROSION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 17: PROMINENT FIRMS THAT OFFER ABRASION & WEAR RESISTANT NANOCOATINGS

TABLE 18: GLOBAL ABRASION & WEAR RESISTANT MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 19: PROMINENT FIRMS THAT OFFER ANTI-FOULING/EASY TO CLEAN NANOCOATINGS

TABLE 20: GLOBAL ANTI-FOULING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 21: PROMINENT FIRMS THAT OFFER U.V. PROTECTION NANOCOATINGS

TABLE 22: GLOBAL UV-RESISTANT MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 23: PROMINENT FIRMS THAT OFFER THERMAL BARRIER/FLAME RETARDANT NANOCOATINGS

TABLE 24: PROMINENT FIRMS THAT OFFER ANTI-ICING NANOCOATINGS

TABLE 25: GLOBAL OTHER TYPES MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 26: GLOBAL NANOCOATINGS MARKET, BY APPLICATION, 2019-2027, (IN $ MILLION)

TABLE 27: GLOBAL ELECTRONICS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 28: GLOBAL ENERGY MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 29: GLOBAL FOOD & PACKAGING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 30: GLOBAL CONSTRUCTION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 31: GLOBAL MARINE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 32: GLOBAL MILITARY & DEFENSE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 33: GLOBAL AUTOMOTIVE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 34: GLOBAL AEROSPACE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 35: GLOBAL HEALTHCARE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 36: GLOBAL OTHERS APPLICATIONS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 37: OPPORTUNITY MATRIX

TABLE 38: VENDOR LANDSCAPE

TABLE 39: LEGAL, POLICY & REGULATORY FRAMEWORK

TABLE 40: GLOBAL NANOCOATINGS MARKET, BY GEOGRAPHY, 2019-2027, (IN $ MILLION)

TABLE 41: NORTH AMERICA NANOCOATINGS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 42: EUROPE NANOCOATINGS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 43: ASIA PACIFIC NANOCOATINGS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 44: REST OF WORLD NANOCOATINGS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 45: LIST OF AGREEMENTS, CONTRACTS, COLLABORATIONS & PARTNERSHIPS

TABLE 46: LIST OF BUSINESS EXPANSIONS

TABLE 47: LIST OF NEW PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 48: LIST OF MERGERS & ACQUISITIONS

TABLE 49: LIST OF OTHER KEY STRATEGIES

LIST OF FIGURES

FIGURE 1: GLOBAL NANOCOATINGS MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2: ASIA PACIFIC NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: WORLDWIDE AUTOMOTIVE (CARS & COMMERCIAL VEHICLES) PRODUCTION, 2015-2020 (IN MILLION)

FIGURE 4: NANOTECHNOLOGY MARKET GROWTH 2010-2015 ($MILLION)

FIGURE 5: GLOBAL NANOCOATINGS MARKET, BY SELF-CLEANING (PHOTOCATALYTIC), 2019-2027 (IN $ MILLION)

FIGURE 6: GLOBAL NANOCOATINGS MARKET, BY ANTI-MICROBIAL, 2019-2027 (IN $ MILLION)

FIGURE 7: GLOBAL NANOCOATINGS MARKET, BY ANTI-FINGERPRINT, 2019-2027 (IN $ MILLION)

FIGURE 8: GLOBAL NANOCOATINGS MARKET, BY CONDUCTIVE, 2019-2027 (IN $ MILLION)

FIGURE 9: GLOBAL NANOCOATINGS MARKET, BY SELF-CLEANING (BIONIC), 2019-2027 (IN $ MILLION)

FIGURE 10: GLOBAL NANOCOATINGS MARKET, BY ANTI-CORROSION, 2019-2027 (IN $ MILLION)

FIGURE 11: GLOBAL NANOCOATINGS MARKET, BY ABRASION & WEAR RESISTANT, 2019-2027 (IN $ MILLION)

FIGURE 12: GLOBAL NANOCOATINGS MARKET, BY ANTI-FOULING, 2019-2027 (IN $ MILLION)

FIGURE 13: GLOBAL NANOCOATINGS MARKET, BY UV-RESISTANT, 2019-2027 (IN $ MILLION)

FIGURE 14: GLOBAL NANOCOATINGS MARKET, BY OTHER TYPES, 2019-2027 (IN $ MILLION)

FIGURE 15: GLOBAL NANOCOATINGS MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 16: GLOBAL NANOCOATINGS MARKET, BY ENERGY, 2019-2027 (IN $ MILLION)

FIGURE 17: GLOBAL NANOCOATINGS MARKET, BY FOOD & PACKAGING, 2019-2027 (IN $ MILLION)

FIGURE 18: GLOBAL NANOCOATINGS MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 19: GLOBAL NANOCOATINGS MARKET, BY MARINE, 2019-2027 (IN $ MILLION)

FIGURE 20: GLOBAL NANOCOATINGS MARKET, BY MILITARY & DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 21: GLOBAL NANOCOATINGS MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 22: GLOBAL NANOCOATINGS MARKET, BY AEROSPACE, 2019-2027 (IN $ MILLION)

FIGURE 23: GLOBAL NANOCOATINGS MARKET, BY HEALTHCARE, 2019-2027 (IN $ MILLION)

FIGURE 24: GLOBAL NANOCOATINGS MARKET, BY OTHERS APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 25: PORTER’S FIVE FORCE ANALYSIS

FIGURE 26: STANDARD OPERATING PROCEDURE IN CHEMICAL MANUFACTURING COMPANY

FIGURE 27: KEY BUYING IMPACT ANALYSIS

FIGURE 28: GLOBAL NANOCOATINGS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 29: UNITED STATES NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: CANADA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: UNITED KINGDOM NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: GERMANY NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: FRANCE NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 34: SPAIN NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 35: ITALY NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 36: NORWAY NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 37: NETHERLANDS NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38: BELGIUM NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39: REST OF EUROPE NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40: CHINA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: JAPAN NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42: INDIA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 43: SOUTH KOREA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 44: SOUTHEAST ASIA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 45: AUSTRALIA & NEW ZEALAND NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 46: REST OF ASIA PACIFIC NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 47: LATIN AMERICA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 48: MIDDLE EAST & AFRICA NANOCOATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 49: MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2018 (IN %)

- MARKET BY TYPE

- SELF-CLEANING (PHOTOCATALYTIC)

- ANTI-MICROBIAL

- ANTI-FINGERPRINT

- CONDUCTIVE

- SELF-CLEANING (BIONIC)

- ANTI-CORROSION

- ABRASION & WEAR RESISTANT

- ANTI-FOULING

- UV-RESISTANT

- OTHER TYPES

- MARKET BY APPLICATION

- ELECTRONICS

- ENERGY

- FOOD & PACKAGING

- CONSTRUCTION

- MARINE

- MILITARY & DEFENCE

- AUTOMOTIVE

- AEROSPACE

- HEALTHCARE

- OTHERS APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- NORWAY

- NETHERLANDS

- BELGIUM

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- SOUTHEAST ASIA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.