GLOBAL AUTOMOTIVE FABRICS MARKET FORECAST 2019-2027

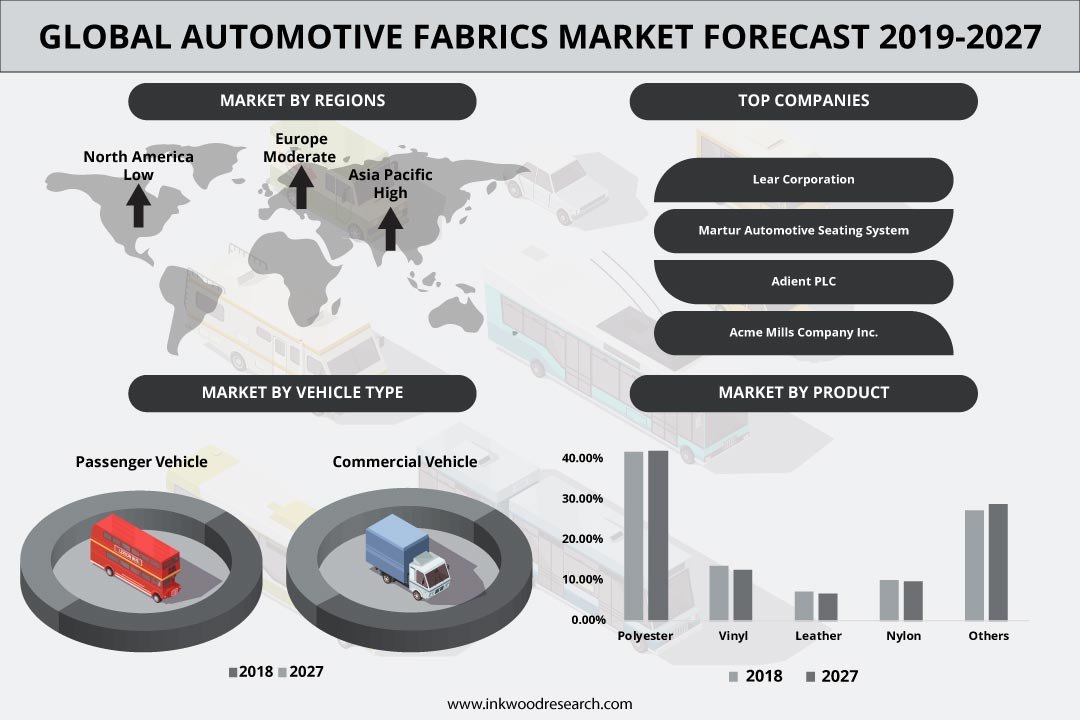

Global Automotive Fabrics Market by Product (Polyester, Vinyl, Leather, Nylon, Other Material) by Application (Carpets, Upholstery, Pre-assembled Interior Components, Tires, Safety-belts, Airbags, Other Applications) by Vehicle Type (Passenger Vehicle, Commercial Vehicle) by Geography.

The global automotive fabrics market was valued at $32246 million in 2018 & is estimated to generate net revenue of approximately $45919 million by 2027, growing at a CAGR of 3.89%.

Fabrics are not only used as apparels but also finds different textiles applications as rapid changes in the socio-economic structure are further shaping-up the society. They are utilized in various little known forms and technical areas. Automotive fabric is one such application. As per an estimation, an average family car consists of approximately 10-15kg of fabric. Majority of textile is utilized for interior trim, such as seat covers, door liners, roof, and carpets. The remaining chunk of fabric is utilized in other parts of the automobile.

To know more about this report, request a free sample copy.

All throughout the world, the most commonly used fabric for car seats has been polyester since it fundamentally follows the required standard factors of high abrasion, resistance and the prerequisite light and UV resistance. The fabric cover provides a soft touch, prevents bagging or creasing over several years of use. It also enhances the aesthetical value of the vehicle’s interior by providing deep & attractive sew lines. But robust backing can limit the stretching ability of knitted fabrics. Both leather and artificial leather are foam backed with a robust slide aid. Factors such as car laminate, seat centre panel, bolster, or back is used to decide upon the exact specification of cover components.

Global automotive fabrics market is primarily driven by the following factors:

- Increase in the concern for the safety of the passengers

- Rising demand for vehicles

- Safety rules & regulations of the government

- The rise in the demand for luxury features

- Financial flexibility for the automobile purchase

One of the important drivers has been the increase in the concern for the safety of the passengers. Also, the increasing numbers of road accidents are propelling various car manufacturers to install different active and passive safety systems, thereby, minimizing the road mishaps as much as possible. Thus, car manufacturers should provide smart and crashworthy vehicles to curb the fatality on roads in developing countries, where automobile safety regulations are currently more lenient as compared to that of the developed countries. Thus, the rise in the occurrences of road accidents creates additional demand for the fabric for enhancing the safety features in the vehicles, which, in turn, drives the global automotive fabric market.

The automotive fabrics market is segmented on the basis of application, where they are further classified into Carpets, Upholstery, Pre-assembled interior components, Tires, Safety-belts, Airbags and others. Automotive upholstery encompasses the interior of any vehicle that includes the seat covers, door insides, the trunk space, and the boot space. The primary need for automotive upholstery is to provide comfort to the passengers and provide a pleasant ambiance of the vehicle interiors.

Volatility in raw materials prices and the impact of leather production on the environment are the major factors hindering the automotive fabrics market.

Global automotive fabrics market segmented based on application and product.

By application, global automotive fabrics market is further sub-segmented into:

- Carpets

- Upholstery

- Pre-assembled interior components

- Tires

- Safety-belts

- Airbags

- Others

By product, global automotive fabrics market is further sub-segmented into:

- Polyester

- Vinyl

- Leather

- Nylon

- Others

By Vehicle type, global automotive fabrics market is further sub-segmented into:

- Passenger Vehicle

- Commercial Vehicle

Geographically, the global automotive fabrics market has been segmented on the basis of five major regions, which includes:

- North America Automotive Fabrics Market: the United States & Canada

- Europe Automotive Fabrics Market: United Kingdom, Germany, France, Spain, Italy, Russia & Rest of Europe

- Asia Pacific Automotive Fabrics Market: China, India, Japan, Australia, South Korea & Rest of Asia Pacific

- Rest of World: Latin America and Middle East & Africa

The Asia Pacific region was the highest contributor to the global market. The countries considered in the Asia Pacific region are China, India, Japan, Australia, South Korea and RoAPAC.

The Asia Pacific region had made up the largest market for automotive fabrics in 2018. The rise in automotive manufacturing plants and an increase in demand for the raw material components are expected to fuel the growth of the automotive fabric market. Furthermore, the increase in disposable income in the Asian countries will boost the automotive sales in this region.

The major market players of the global automotive fabrics market are:

- Lear Corporation

- Martur Automotive Seating System

- Adient PLC

- Acme Mills Company Inc.

- Grupo Antolín-Irausa, S.A.

- Heathcoat Fabrics Ltd

- Seiren Co. Ltd.

- Suminoe Textile Co. Ltd.

- SRF Limited

- Toyota Boshoku Corporation

- Faurecia S.A

- Magna International Inc.

The company profile section essentially covers the analysis of important market players. These companies are using organic and inorganic strategies for growth. For instance, in June 2019, Lear Corporation and the company, Plug and Play, got into a strategic partnership focused on advancing mobility innovation in the automotive industry.

Key findings of the global automotive fabrics market

- Airbags are the fastest-growing application in automotive fabrics market

- Polyester is the dominant product in automotive fabrics market

- A passenger vehicle is the major vehicle type using automotive fabrics

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- AIRBAGS IS THE FASTEST GROWING APPLICATION IN AUTOMOTIVE FABRICS MARKET

- POLYESTER IS THE DOMINANT PRODUCT IN AUTOMOTIVE FABRICS MARKET

- PASSENGER VEHICLE IS THE MAJOR VEHICLE TYPE USING AUTOMOTIVE FABRICS

- MARKET DYNAMICS

- MARKET DEFINITION & SCOPE

- MARKET DRIVERS

- INCREASE IN THE CONCERN FOR SAFETY OF THE PASSENGERS

- RISING DEMAND FOR VEHICLES

- SAFETY RULES & REGULATIONS OF THE GOVERNMENT

- RISE IN THE DEMAND FOR LUXURY FEATURES

- FINANCIAL FLEXIBILITY FOR THE AUTOMOBILE PURCHASE

- MARKET RESTRAINTS

- LEATHER PRODUCTION IMPACT ON ENVIRONMENT

- FLUCTUATING RAW MATERIAL PRICES

- MARKET OPPORTUNITIES

- RISING DEMAND FOR IMPROVING THE AUTOMOBILE EFFICIENCY

- GROWING POPULARITY OF ECO-FRIENDLY FABRIC

- MARKET CHALLENGES

- RISING COST PRESSURE FROM DEMAND SIDE

- MARKET BY PRODUCT

- POLYESTER

- VINYL

- LEATHER

- NYLON

- OTHER MATERIAL

- MARKET BY APPLICATION

- CARPETS

- UPHOLSTERY

- PRE-ASSEMBLED INTERIOR COMPONENTS

- TIRES

- SAFETY-BELTS

- AIRBAGS

- OTHER APPLICATIONS

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLE

- COMMERCIAL VEHICLE

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- RUSSIA

- ROE (REST OF EUROPE)

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC (RoAPAC)

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- COMPANY PROFILE

- LEAR CORPORATION

- MARTUR AUTOMOTIVE SEATING SYSTEM

- ADIENT PLC

- ACME MILLS COMPANY INC.

- GRUPO ANTOLÍN-IRAUSA, S.A.

- HEATHCOAT FABRICS LTD.

- SEIREN CO. LTD.

- SUMINOE TEXTILE CO. LTD.

- SRF LIMITED

- TOYOTA BOSHOKU CORPORATION

- FAURECIA S.A

- MAGNA INTERNATIONAL INC.

- COMPANY PROFILE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE FABRICS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2 GLOBAL AUTOMOTIVE FABRICS MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 3 GLOBAL POLYESTER MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 4 GLOBAL VINYL MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 5 GLOBAL LEATHER MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 6 GLOBAL NYLON MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 7 GLOBAL OTHER MATERIAL MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 8 GLOBAL AUTOMOTIVE FABRICS MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 9 GLOBAL CARPET MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 10 GLOBAL UPHOLSTERY MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 11 GLOBAL PRE-ASSEMBLED INTERIOR COMPONENTS FURNISHINGS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 12 GLOBAL TIRES MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 13 GLOBAL SAFETY-BELTS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 14 GLOBAL AIRBAGS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 15 GLOBAL OTHER APPLICATIONS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 16 GLOBAL AUTOMOTIVE FABRICS MARKET, BY VEHICLE TYPE, 2019-2027 (IN $ MILLION)

TABLE 17 GLOBAL PASSENGER VEHICLE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 18 GLOBAL COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 19 OPPORTUNITY MATRIX

TABLE 20 VENDOR LANDSCAPE

TABLE 21 GLOBAL AUTOMOTIVE FABRICS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 22 NORTH AMERICA AUTOMOTIVE FABRICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 23 EUROPE AUTOMOTIVE FABRICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 24 ASIA PACIFIC AUTOMOTIVE FABRICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 25 REST OF WORLD AUTOMOTIVE FABRICS MARKET, BY REGIONS, 2019-2027 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1 GLOBAL AUTOMOTIVE FABRICS MARKET SHARE, BY APPLICATION 2018 & 2027 (%)

FIGURE 2 GLOBAL AIRBAGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3 GLOBAL POLYESTER MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4 GLOBAL PASSENGER VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 5 PORTER’S FIVE FORCE MODEL

FIGURE 6 VALUE CHAIN ANALYSIS

FIGURE 7 GLOBAL AUTOMOTIVE FABRICS MARKET, REGIONAL OUTLOOK, 2018 & 2027, (%)

FIGURE 8 UNITED STATES AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 9 CANADA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION

FIGURE 10 GERMANY AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 11 UNITED KINGDOM AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 12 FRANCE AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 13 SPAIN AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 14 ITALY AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 15 RUSSIA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 16 ROE AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 17 INDIA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18 CHINA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19 JAPAN AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20 SOUTH KOREA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21 AUSTRALIA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22 REST OF ASIA PACIFIC AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23 LATIN AMERICA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24 MIDDLE EAST AND AFRICA AUTOMOTIVE FABRICS MARKET, 2019-2027 (IN $ MILLION)

- MARKET BY PRODUCT

- POLYESTER

- VINYL

- LEATHER

- NYLON

- OTHER MATERIAL

- MARKET BY APPLICATION

- CARPETS

- UPHOLSTERY

- PRE-ASSEMBLED INTERIOR COMPONENTS

- TIRES

- SAFETY-BELTS

- AIRBAGS

- OTHER APPLICATIONS

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLE

- COMMERCIAL VEHICLE

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- RUSSIA

- ROE (REST OF EUROPE)

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC (RoAPAC)

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.