GLOBAL FLEXIBLE ELECTRONICS MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

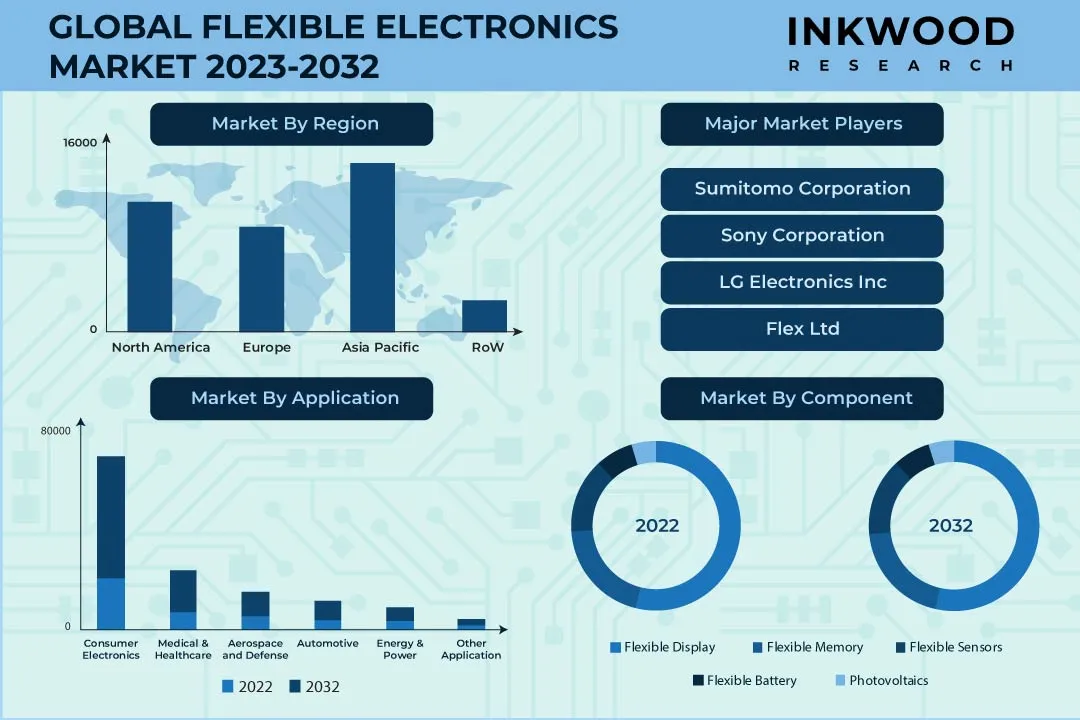

Global Flexible Electronics Market by Component (Flexible Display, Flexible Memory, Flexible Sensor, Flexible Battery, Flexible Photovoltaics) Market by Application (Consumer Electronics, Medical & Healthcare, Aerospace & Defense, Automotive, Energy & Power, Other Applications) by Geography

REPORTS » INFORMATION TECHNOLOGY » ICT HARDWARE » GLOBAL FLEXIBLE ELECTRONICS MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global flexible electronics market was valued at $xx million in 2022 and is expected to reach $82636.96 million by 2032, growing at a CAGR of 8.62% during the forecast period 2023 to 2032.

Electronics constructed on conformable or stretchy substrates – typically plastic, and also metal foil, paper, and flexible glass – are referred to as flexible electronics. They are included in a wide range of items, serving both the consumer and industrial markets. These goods constitute parts for cell phones and displays, instruments for measuring health and performance, tags for security, sensor parts for automobiles and aircraft, and sensors for agriculture and the environment.

Flexible electronics increase the portability, usability, and manufacturing viability of sensors. A number of industries, including healthcare (biosensors), the environment (gas sensors), transportation (autonomous driving), consumer electronics (fingerprint sensors), and others, are using sensors in new areas, primarily on account of the real-time data they gather.

Read our latest blog on the Flexible Electronics Market

GROWTH ENABLERS

Key growth enablers of the global flexible electronics market:

- Growing demand in healthcare sector

- Need for compact & cost-effective products

- Advancements in flexible display

- Increasing research and development activities

- The expansion of flexible electronic technology’s end-user applications is made possible by augmenting research and development in the investigated market as well as associated markets, such as flexible hybrid electronics (FHE).

- The approach can be used to print metal traces on a rose, a flexible, programmable LED display on a curled piece of paper, and metal traces on a gelatin cylinder, according to researchers, who believe it will broaden the application range of flexible electronics.

- Additionally, flexible electronics technology can also be utilized to create sensors that gauge a building’s structural soundness, the development of crops, or the creation of electrical contacts for solar cells.

GROWTH RESTRAINTS

Key restraining factors of the global flexible electronics market growth:

- Complex assembly processes

- Weak encapsulation techniques

- The encapsulations and substrates of flexible electronics for diverse bio-integrated systems have been designed with significant contributions from material innovation and mechanical design. However, there is still much to be achieved in terms of creating new materials while taking stretchability, heat dissipation, and biocompatibility into account.

- In addition, encapsulation methods for planar flexible electronics have been well established, ranging from different lamination methods to transfer printing methods, coating methods, and deposition methods. However, encapsulation methods for nonplanar flexible electronics and a mechanism study of their effects on functional devices are still relatively unexplored ground. Hence, weak encapsulation techniques will likely hinder the growth of the global flexible electronics market.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Flexible Electronics Market | Key Market Trends

- The development of mobile technology directly affects consumer behavior. Through mobile internet-connected gadgets like tablets and smartphones, consumers may effortlessly access online information and share details about their lives. This has also prompted a rise in the use of flexible displays like OLED screens, with the market for smartphones regarded as their main source of demand.

- Flexible electronics are driving technological transformation in the healthcare sector. On account of the aging population and rising incidence of chronic diseases, the medical system needs a dependable, long-term replacement for traditional, hands-on patient monitoring and treatment.

- As technology advances, an increasing number of factories are being automated, and the importance of connectivity is on the rise, as well. In this regard, industry 4.0 involves overall automation and upgrading of manufacturing architecture for process improvement and business information, combining all production and commerce activities within a company.

MARKET SEGMENTATION

Market Segmentation – Component and Application –

Market by Component:

- Flexible Display

- In 2022, the majority of the market share was captured by the flexible display segment under the component category.

- A visual output surface that can tolerate being folded, twisted and bent is called a flexible display.

- Flexible displays are also becoming common in foldable technologies, such as smartphones, which are designed to be folded. Besides, they can also be designed like a book.

- Moreover, flexible display panels are typically built of OLED displays.

- OLED

- E-Paper

- LCD

- Flexible Memory

- Flexible Sensor

- Photo Detector

- Bio Sensor

- Piezo Resistive

- CMOS Hybrid Sensor

- Other Flexible Sensors

- Flexible Battery

- Flexible Photovoltaics

Market by Application:

- Consumer Electronics

- Medical & Healthcare

- The medical & healthcare segment is anticipated to be the fastest-growing application in the global flexible electronics market.

- Numerous biosensors that can be worn for tracking individuals’ health have garnered the interest of scientific and business sectors over recent years.

- Since these devices can track a person’s health in real time, wearable biosensors are perceived as being extremely useful. They can also regulate aspects like heart temperature, rate, breath rate, respiration, alcohol, activity tracking, and other skin fluids like glucose, lactate, pH, cholesterol, etc., thus propelling their adoption in the medical & healthcare segment.

- Aerospace & Defense

- Automotive

- Energy & Power

- Other Applications

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

-

- Asia Pacific is anticipated to be the most dynamic regional market, with a share of 39.15% in 2022.

- The region is also expected to record the fastest growth rate, owing to an increase in consumer demand with a subsequent rise in the tech-savvy population.

- Leading nations that produce semiconductors, including China, Taiwan, and Japan, are located in the Asia-Pacific. These nations are home to a sizable number of pure-play foundries run by both domestic as well as international vendors.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global flexible electronics market:

- Sumitomo Corporation

- Sony Corporation

- LG Electronics Inc

- Flex Ltd

- Konica Minolta

- Japan Display Inc

Key strategies adopted by some of these companies:

- In December 2022, Konica Minolta declared a partnership with Brother International (India) Pvt Ltd to provide advanced A4 Printers, specially built for enterprise customers.

- LG Electronics, in September 2021, launched a cover window for a foldable device named ‘Real Folding Device,’ which was made with a special fiber coating.

- In July 2021, Japan Display Inc signed a document to sell its manufacturing subsidiary in Taiwan, named Kaohsiung Opto-Electronics, to Wistron Group.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Component and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Fujikura Ltd, Japan Display Inc, Konica Minolta Inc, AGC Inc, Sumitomo Corporation, Sony Corporation, LG Electronics Inc, AU Optronics Corporation, Samsung Electronics Co Ltd, Flex Ltd, Blue Spark Technologies, Flexpoint Sensor Systems Inc, Imprint Energy Inc, E Ink Holdings Inc, Thin Film Electronics ASA |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19

- MAJOR MARKET FINDINGS

- SHIFT FROM HARD & RIGID ELECTRONICS BOXES TO SOFTER ELECTRONICS

- RAPID RISE OF WEARABLES ESSENTIAL FOR MARKET GROWTH

- ADVANCEMENTS IN MANUFACTURING INDUSTRY

MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND IN HEALTHCARE SECTOR

- NEED FOR COMPACT & COST-EFFECTIVE PRODUCTS

- ADVANCEMENTS IN FLEXIBLE DISPLAY

- INCREASE IN RESEARCH & DEVELOPMENT ACTIVITIES

- KEY RESTRAINTS

- COMPLEX ASSEMBLY PROCESSES

- WEAK ENCAPSULATION TECHNIQUES

- KEY DRIVERS

KEY ANALYTICS

- ANALYSIS OF TECHNOLOGY

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- MATERIALS

- SUBSTRATES

- PACKAGING

- PROCESSING/ TESTING EQUIPMENT

MARKET BY COMPONENT

- FLEXIBLE DISPLAY

- OLED

- E-PAPER

- LCD

- FLEXIBLE MEMORY

- FLEXIBLE SENSOR

- PHOTO DETECTOR

- BIO SENSOR

- PIEZO RESISTIVE

- CMOS HYBRID SENSOR

- OTHER FLEXIBLE SENSORS

- FLEXIBLE BATTERY

- FLEXIBLE PHOTOVOLTAICS

- FLEXIBLE DISPLAY

MARKET BY APPLICATION

- CONSUMER ELECTRONICS

- MEDICAL & HEALTHCARE

- AEROSPACE & DEFENSE

- AUTOMOTIVE

- ENERGY & POWER

- OTHER APPLICATIONS

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA FLEXIBLE ELECTRONICS MARKET DRIVERS

- NORTH AMERICA FLEXIBLE ELECTRONICS MARKET CHALLENGES

- NORTH AMERICA FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA FLEXIBLE ELECTRONICS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE FLEXIBLE ELECTRONICS MARKET DRIVERS

- EUROPE FLEXIBLE ELECTRONICS MARKET CHALLENGES

- EUROPE FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE FLEXIBLE ELECTRONICS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET DRIVERS

- ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET CHALLENGES

- ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD FLEXIBLE ELECTRONICS MARKET DRIVERS

- REST OF WORLD FLEXIBLE ELECTRONICS MARKET CHALLENGES

- REST OF WORLD FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD FLEXIBLE ELECTRONICS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA FLEXIBLE ELECTRONICS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AGC INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- AU OPTRONICS CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- BLUE SPARK TECHNOLOGIES

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- E INK HOLDINGS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- FLEX LTD

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- FLEXPOINT SENSOR SYSTEMS INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- FUJIKURA LTD

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- IMPRINT ENERGY INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- JAPAN DISPLAY INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- KONICA MINOLTA INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- LG ELECTRONICS INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- SAMSUNG ELECTRONICS CO LTD

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- SONY CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- SUMITOMO CORPORATION

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- THINFILM ELECTRONICS ASA

- COMPANY OVERVIEW

- PRODUCTS LIST

- AGC INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – FLEXIBLE ELECTRONICS

TABLE 2: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY COMPONENT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY COMPONENT, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL FLEXIBLE DISPLAY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL FLEXIBLE DISPLAY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE DISPLAY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE DISPLAY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL OLED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL OLED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL E-PAPER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL E-PAPER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL LCD MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL LCD MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL FLEXIBLE MEMORY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL FLEXIBLE MEMORY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL FLEXIBLE SENSOR MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL FLEXIBLE SENSOR MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE SENSOR, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE SENSOR, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL PHOTO DETECTOR MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL PHOTO DETECTOR MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL BIO SENSOR MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL BIO SENSOR MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL PIEZO RESISTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL PIEZO RESISTIVE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL CMOS HYBRID SENSOR MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL CMOS HYBRID SENSOR MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL OTHER FLEXIBLE SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL OTHER FLEXIBLE SENSORS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL FLEXIBLE BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL FLEXIBLE BATTERY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL FLEXIBLE PHOTOVOLTAICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL FLEXIBLE PHOTOVOLTAICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY APPLICATION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: GLOBAL MEDICAL & HEALTHCARE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL MEDICAL & HEALTHCARE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 40: GLOBAL AEROSPACE & DEFENSE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL AEROSPACE & DEFENSE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: GLOBAL ENERGY & POWER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL ENERGY & POWER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 46: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 48: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 50: NORTH AMERICA FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 51: NORTH AMERICA FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 52: NORTH AMERICA FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

TABLE 53: KEY PLAYERS OPERATING IN NORTH AMERICA FLEXIBLE ELECTRONICS MARKET

TABLE 54: EUROPE FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: EUROPE FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 56: EUROPE FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

TABLE 57: KEY PLAYERS OPERATING IN EUROPE FLEXIBLE ELECTRONICS MARKET

TABLE 58: ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 59: ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 60: ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

TABLE 61: KEY PLAYERS OPERATING IN ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET

TABLE 62: REST OF WORLD FLEXIBLE ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 63: REST OF WORLD FLEXIBLE ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 64: REST OF WORLD FLEXIBLE ELECTRONICS MARKET REGULATORY FRAMEWORK

TABLE 65: KEY PLAYERS OPERATING IN REST OF WORLD FLEXIBLE ELECTRONICS MARKET

TABLE 66: LIST OF MERGERS & ACQUISITIONS

TABLE 67: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 68: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 69: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: COMPONENTS OF FLEXIBLE ELECTRONICS

FIGURE 2: KEY MARKET TRENDS

FIGURE 3: PORTER’S FIVE FORCES ANALYSIS

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 5: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

FIGURE 6: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 7: GROWTH PROSPECT MAPPING FOR UNITED ARAB EMIRATES

FIGURE 8: MARKET MATURITY ANALYSIS

FIGURE 9: MARKET CONCENTRATION ANALYSIS

FIGURE 10: VALUE CHAIN ANALYSIS

FIGURE 11: GLOBAL FLEXIBLE ELECTRONICS MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2022

FIGURE 12: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE DISPLAY, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL FLEXIBLE ELECTRONICS MARKET, GROWTH POTENTIAL, BY FLEXIBLE DISPLAY, IN 2022

FIGURE 14: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY OLED, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY E-PAPER, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY LCD, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE MEMORY, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE SENSOR, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL FLEXIBLE ELECTRONICS MARKET, GROWTH POTENTIAL, BY FLEXIBLE SENSOR, IN 2022

FIGURE 20: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY PHOTO DETECTOR, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY BIO SENSOR, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY PIEZO RESISTIVE, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY CMOS HYBRID SENSOR, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY OTHER FLEXIBLE SENSORS, 2023-2032 (IN $ MILLION)

FIGURE 25: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE BATTERY, 2023-2032 (IN $ MILLION)

FIGURE 26: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY FLEXIBLE PHOTOVOLTAICS, 2023-2032 (IN $ MILLION)

FIGURE 27: GLOBAL FLEXIBLE ELECTRONICS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2022

FIGURE 28: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY CONSUMER ELECTRONICS, 2023-2032 (IN $ MILLION)

FIGURE 29: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY MEDICAL & HEALTHCARE, 2023-2032 (IN $ MILLION)

FIGURE 30: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY AEROSPACE & DEFENSE, 2023-2032 (IN $ MILLION)

FIGURE 31: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY AUTOMOTIVE, 2023-2032 (IN $ MILLION)

FIGURE 32: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY ENERGY & POWER, 2023-2032 (IN $ MILLION)

FIGURE 33: GLOBAL FLEXIBLE ELECTRONICS MARKET, BY OTHER APPLICATIONS, 2023-2032 (IN $ MILLION)

FIGURE 34: GLOBAL FLEXIBLE ELECTRONICS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 35: NORTH AMERICA FLEXIBLE ELECTRONICS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 36: UNITED STATES FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: CANADA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: EUROPE FLEXIBLE ELECTRONICS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 39: UNITED KINGDOM FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: GERMANY FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: FRANCE FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: ITALY FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: SPAIN FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: BELGIUM FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: POLAND FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: REST OF EUROPE FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 48: CHINA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 49: JAPAN FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 50: INDIA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 51: SOUTH KOREA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 52: INDONESIA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 53: THAILAND FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 54: VIETNAM FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 55: AUSTRALIA & NEW ZEALAND FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 56: REST OF ASIA-PACIFIC FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 57: REST OF WORLD FLEXIBLE ELECTRONICS MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 58: LATIN AMERICA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FIGURE 59: MIDDLE EAST & AFRICA FLEXIBLE ELECTRONICS MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

Flexible electronics are characterized as electronics built on conformable or stretchy substrates, typically plastic, but also metal foil, paper, and flexible glass.

Flexible photovoltaics is the fastest-growing component in the global flexible electronics market.

RELATED REPORTS

-

GLOBAL GAMING MARKET FORECAST 2025-2032

-

ASIA-PACIFIC GAMING MARKET FORECAST 2025-2032

-

EUROPE GAMING MARKET FORECAST 2025-2032

-

NORTH AMERICA GAMING MARKET FORECAST 2025-2032

-

INDONESIA GAMING MARKET FORECAST 2025-2032

-

BRAZIL GAMING MARKET FORECAST 2025-2032

-

JAPAN GAMING MARKET FORECAST 2025-2032

-

GLOBAL CODING & MARKING MARKET FORECAST 2025-2032

-

ASIA-PACIFIC CODING & MARKING MARKET FORECAST 2025-2032

-

EUROPE CODING & MARKING MARKET FORECAST 2025-2032