GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET FORECAST 2019-2028

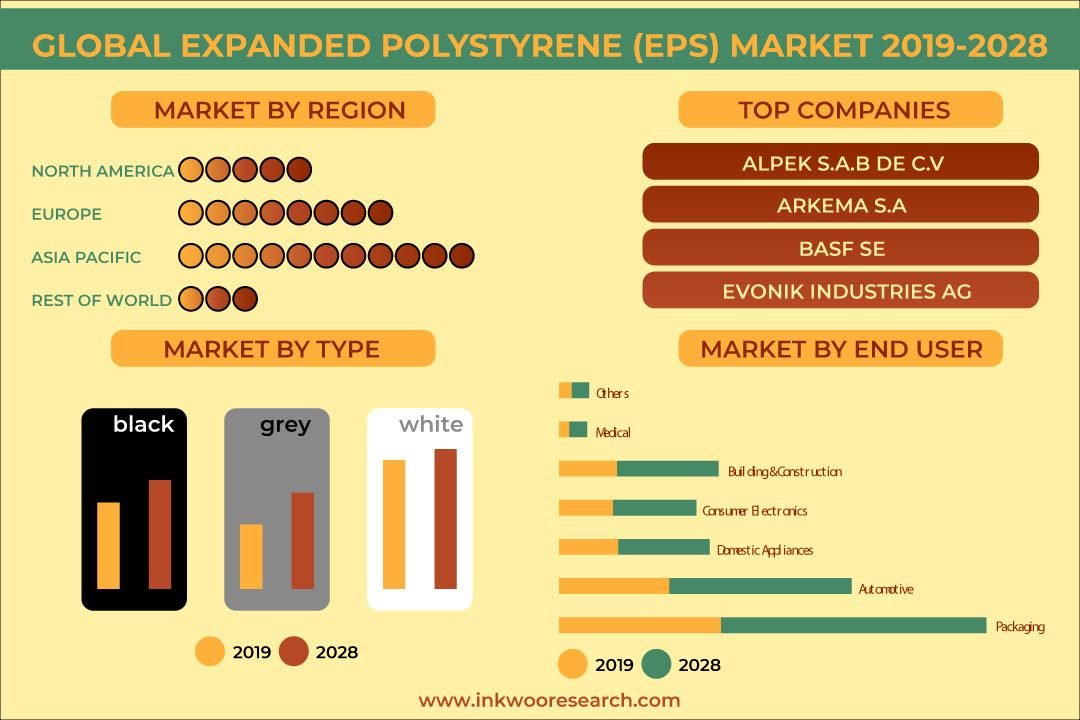

Global Expanded Polystyrene (Eps) Market by Type (White Eps, Grey Eps, Black Eps) by End-user (Packaging, Automotive, Domestic Appliances, Consumer Electronics, Building & Construction, Medical, Other End-users) and by Geography.

Inkwood Research estimates that the global expanded polystyrene (EPS) market will grow with an anticipated CAGR of 5.54% during the forecast period, and will reach revenue of $11062.09 million by 2028. In terms of volume, the market is set to register a CAGR of 4.85%. The base year considered for the market study is 2018. The forecasted period is between 2019 and 2028.

To learn more about this report, request a free sample copy

Expanded polystyrene (EPS) is a firm insulation material. It has a closed enclosure arrangement that offers certain advantages for insulation. Furthermore, the growing use of expanded polystyrene in the end-use industries is one of the major factors that boost the growth of the global expanded polystyrene (EPS) market.

Key factors driving the global expanded polystyrene (EPS) market growth:

- Benefit over other insulators

- Rising demand in the building & construction and packaging industries

- Increasing demand for lightweight materials in the automobile industry

- The polymer industry is one of the largest manufacturing sectors.

- The automotive end-use industry is a major consumer of plastic materials.

- The use of plastics in automobiles to improve vehicle downsizing is proving to be an efficient, cost-effective way to boost the vehicle’s mileage.

- Moreover, the need for enhanced fuel efficiency has also been increased.

Key factors restraining market growth:

- Volatility in crude oil prices

- EPS is attained from crude oil. Therefore, variations in the costs of crude oil directly affect the price of raw materials, thereby impacting the production process.

- Thus, volatility in crude oil prices restrains the growth of the expandable polystyrene market.

- Availability of substitute products

The report scope of the global expanded polystyrene (EPS) market covers the segmentation analysis of type and end-user.

Market by Type:

- Grey EPS

- White EPS

- White EPS is the dominating type in the market with regard to revenue and volume.

- It is a rigid, closed-cell foam plastic that has high thermal insulation. It reflects the sun better than other EPS.

- Therefore, its surface does not get very greasy in the heat of the sun. The rising use of white EPS in the construction and packaging drives its market growth.

- Black EPS

Geographically, the global expanded polystyrene (EPS) market has been segmented on the basis of four major regions, which includes:

- North America: the United States and Canada

- Europe: the United Kingdom, Germany, France, Italy, Belgium, Russia, Poland, and Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Malaysia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- The Asia Pacific is set to be the dominating and leading region in terms of revenue and volume.

- The usage of EPS insulation is increasing in the Asia Pacific, due to increasing possession of real estates, along with rising home renovation and construction undertakings.

- Moreover, the government in China has developed policies promoting building energy efficiency.

- The government initiatives also include increasing construction expenditure to develop public and commercial infrastructure, along with energy conservation initiatives to reduce greenhouse gas releases, which drive the market growth.

- Rest of World: Latin America, the Middle East & Africa.

The major players in the global expanded polystyrene (EPS) market are:

- BASF SE

- Ravago

- LG Corporation

- Evonik Industries AG

- Others

Key strategies adopted by some of these companies:

In April 2020, Bewisynbra Group AB entered into an agreement for the acquisition of a minority stake in a newly formed EPS insulation & packaging company based in the UK.

Key findings of the global expanded polystyrene (EPS) market:

- The growing demand for polystyrene in food packaging is driving the market growth.

- Grey EPS in the expanded polystyrene (EPS) market by type is likely to grow the fastest in the market, both in terms of revenue and volume.

- The advanced recycling techniques for polystyrene is fueling market demand.

Frequently Asked Questions & Answers (FAQs):

- Which is the dominating end-user with regard to volume in the expanded polystyrene (EPS) market?

A: Packaging is the dominating end-user in the expanded polystyrene (EPS) market in terms of volume.

- Which country offers lucrative growth opportunities in the expanded polystyrene (EPS) market?

A: India entails ample growth opportunities in the expanded polystyrene (EPS) market.

- Which are the top companies operating in the expanded polystyrene (EPS) market?

A: BASF SE, LG Corporation, and Ravago, are some of the top companies operating in the expanded polystyrene (EPS) market.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- BENEFIT OVER OTHER INSULATORS

- RISING DEMAND IN THE BUILDING & CONSTRUCTION AND PACKAGING INDUSTRIES

- RISE IN DEMAND FOR LIGHTWEIGHT MATERIALS IN THE AUTOMOBILE INDUSTRY

- KEY RESTRAINTS

- VOLATILITY IN CRUDE OIL PRICES

- AVAILABILITY OF SUBSTITUTE PRODUCTS

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- IMPACT OF COVID-19 ON EXPANDED POLYSTYRENE (EPS) MARKET

- MARKET BY TYPE

- WHITE EPS

- GREY EPS

- BLACK EPS

- MARKET BY END-USER

- PACKAGING

- AUTOMOTIVE

- DOMESTIC APPLIANCES

- CONSUMER ELECTRONICS

- BUILDING & CONSTRUCTION

- MEDICAL

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- MALAYSIA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ALPEK S.A.B DE CV

- ARKEMA SA

- BASF SE

- EVONIK INDUSTRIES AG

- KANEKA CORPORATION

- LG CORPORATION

- NOVA CHEMICAL CORPORATION

- SABIC

- STYROCHEM

- TOTAL SA

- RAVAGO

- SIBUR

- JACKON GMBH

- BEWISYNBRA GROUP AB

- SUNPOR KUNSTSTOFF GMBH

TABLE LIST

TABLE 1: MARKET SNAPSHOT – EXPANDED POLYSTYRENE (EPS)

TABLE 2: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY TYPE, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 5: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY TYPE, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 6: GLOBAL WHITE EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL WHITE EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: GLOBAL WHITE EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 9: GLOBAL WHITE EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 10: GLOBAL GREY EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL GREY EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 12: GLOBAL GREY EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 13: GLOBAL GREY EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 14: GLOBAL BLACK EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL BLACK EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 16: GLOBAL BLACK EPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 17: GLOBAL BLACK EPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 18: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 20: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 21: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 22: GLOBAL PACKAGING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL PACKAGING MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 24: GLOBAL PACKAGING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 25: GLOBAL PACKAGING MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 26: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 28: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 29: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 30: GLOBAL DOMESTIC APPLIANCES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: GLOBAL DOMESTIC APPLIANCES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 32: GLOBAL DOMESTIC APPLIANCES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 33: GLOBAL DOMESTIC APPLIANCES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 34: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 35: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 36: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 37: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 38: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 39: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 40: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 41: GLOBAL BUILDING & CONSTRUCTION MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 42: GLOBAL MEDICAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 43: GLOBAL MEDICAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 44: GLOBAL MEDICAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 45: GLOBAL MEDICAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 46: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 47: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 48: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 49: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 50: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 51: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 52: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 53: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 54: NORTH AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 55: NORTH AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 56: NORTH AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 57: NORTH AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 58: EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 59: EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 60: EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 61: EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 62: ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 63: ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 64: ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 65: ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 66: REST OF WORLD EXPANDED POLYSTYRENE (EPS) MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 67: REST OF WORLD EXPANDED POLYSTYRENE (EPS) MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 68: REST OF WORLD EXPANDED POLYSTYRENE (EPS) MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 69: REST OF WORLD EXPANDED POLYSTYRENE (EPS) MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN KILOTONS)

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, GROWTH POTENTIAL, BY TYPE, IN 2019

FIGURE 6: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY WHITE EPS, 2019-2028 (IN $ MILLION)

FIGURE 7: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY GREY EPS, 2019-2028 (IN $ MILLION)

FIGURE 8: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY BLACK EPS, 2019-2028 (IN $ MILLION)

FIGURE 9: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 10: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY PACKAGING, 2019-2028 (IN $ MILLION)

FIGURE 11: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY AUTOMOTIVE, 2019-2028 (IN $ MILLION)

FIGURE 12: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY DOMESTIC APPLIANCES, 2019-2028 (IN $ MILLION)

FIGURE 13: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY CONSUMER ELECTRONICS, 2019-2028 (IN $ MILLION)

FIGURE 14: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY BUILDING & CONSTRUCTION, 2019-2028 (IN $ MILLION)

FIGURE 15: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY MEDICAL, 2019-2028 (IN $ MILLION)

FIGURE 16: GLOBAL EXPANDED POLYSTYRENE (EPS) MARKET, BY OTHER END-USERS, 2019-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 18: UNITED STATES EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 19: CANADA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 20: EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 21: UNITED KINGDOM EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 22: GERMANY EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 23: FRANCE EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 24: ITALY EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 25: RUSSIA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 26: BELGIUM EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 27: POLAND EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 28: REST OF EUROPE EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 29: ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 30: CHINA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 31: JAPAN EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: INDIA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: SOUTH KOREA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: MALAYSIA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: INDONESIA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: THAILAND EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 37: VIETNAM EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 38: AUSTRALIA & NEW ZEALAND EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 39: REST OF ASIA PACIFIC EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 40: REST OF WORLD EXPANDED POLYSTYRENE (EPS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 41: LATIN AMERICA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

FIGURE 42: MIDDLE EAST & AFRICA EXPANDED POLYSTYRENE (EPS) MARKET, 2019-2028 (IN $ MILLION)

- MARKET BY TYPE

- WHITE EPS

- GREY EPS

- BLACK EPS

- MARKET BY END-USER

- PACKAGING

- AUTOMOTIVE

- DOMESTIC APPLIANCES

- CONSUMER ELECTRONICS

- BUILDING & CONSTRUCTION

- MEDICAL

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- MALAYSIA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.