EUROPE STERILIZATION EQUIPMENT MARKET FORECAST 2019-2028

Europe Sterilization Equipment Market by Equipment Type (High-temperature Sterilization Equipment (Wet/steam Sterilization Equipment, Dry Sterilization Equipment), Low-temperature Sterilization Equipment (Ethylene Oxide Sterilization Equipment, Hydrogen Peroxide Sterilization Equipment, Ozone Sterilization Equipment, Other Low -temperature Sterilization Equipment), Filtration Sterilization Equipment, Ionizing Radiation Sterilization Equipment (E-beam Radiation Sterilization Equipment, Gamma Sterilization Equipment, Other Ionizing Radiation Sterilization Equipment)) by End-user (Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Education and Research Institutes, Food and Beverage Industries, Other End-users) and by Geography.

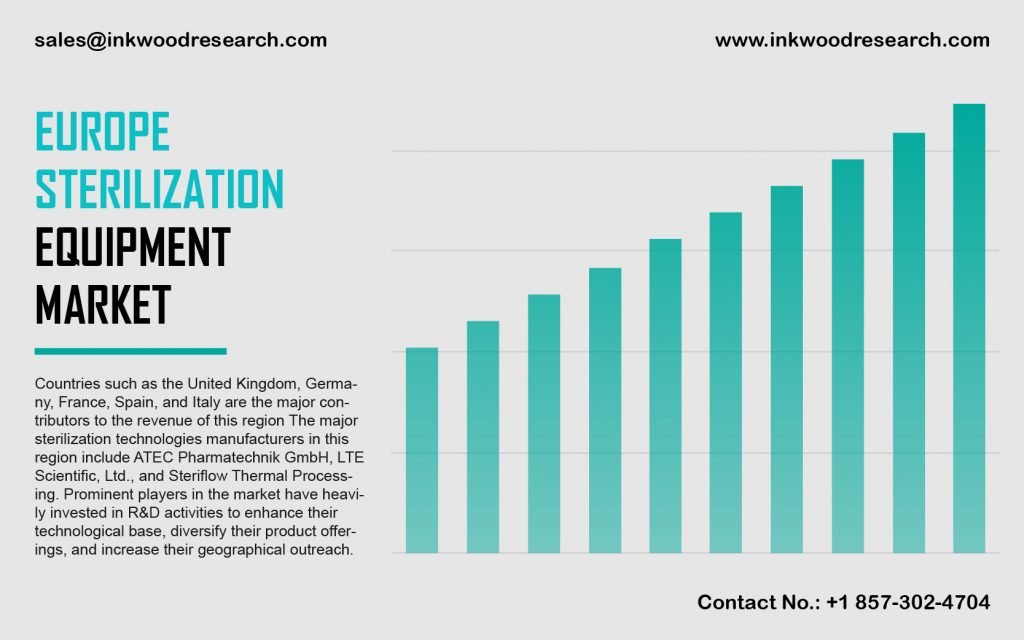

The Europe sterilization equipment market is expected to record a CAGR of 7.07%, during the forecast years of 2019 to 2028. The region’s market is predominantly driven by ionizing radiation sterilization and the presence of key sterilization equipment manufacturers.

To know more about this report, request a free sample copy

The United Kingdom, France, Italy, Germany, Spain, and the rest of Europe are analyzed for determining the Europe sterilization equipment market growth. Ionizing radiation sterilization has been approved in the United Kingdom for antibiotics, steroids, alkaloids, herbal medicines, raw plant products, and veterinary drugs. Drugs sterilized through the process of radiation sterilization need documented procedures, and the absence of harmful products, to be introduced into the United Kingdom’s market. However, the practice should not constitute the loss of biological activity. Prominent market players are also actively investing in research and development activities to enhance their technological foundation, increase their geographical horizons, and diversify their product contributions.

Moreover, Public Health England (PHE) in the United Kingdom monitors the number of infections through regular surveillance programs. It also recommends measures to prevent and control infections developed through hospitals, schools, and care homes. Additionally, the country’s government has introduced numerous initiatives to reduce the number of hospital-acquired infections (HAIs). As a result, these factors have created an increased need for sterilization equipment, which further fuels market growth.

Getinge AB, headquartered in Sweden, is extensively active within the healthcare division. The company offers products and services for sterilization centers, intensive care units, life science companies and institutions, and elderly care. Moreover, its operations are divided into diverse business areas, such as medical systems, extended care, and infection control. In April 2020, Getinge and WaterAid entered a partnership to facilitate access to clean water, sanitation, and hygiene across healthcare institutions worldwide.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- DEVELOPMENT OF STERILIZATION EQUIPMENT

- MARKET DEFINITION

- KEY DRIVERS

- HOSPITAL PREVENTION MEASURES AGAINST NOSOCOMIAL INFECTIONS

- RISE IN THE NUMBER OF SURGICAL PROCEDURES

- GROWTH IN PHARMACEUTICAL INDUSTRIES

- DEMAND FROM FOOD & BEVERAGE INDUSTRY

- KEY RESTRAINTS

- REGULATIONS ASSOCIATED WITH HARMFUL GASES (FOR LOW TEMPERATURE STERILIZATION EQUIPMENT’S)

- REGULATIONS IN MANUFACTURING STERILIZATION EQUIPMENT

- RISE IN COST OF STERILIZATION EQUIPMENT & DEVICES

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- REGULATORY FRAMEWORK

- IMPACT OF COVID 19 ON STERILIZATION EQUIPMENT MARKET

- MARKET BY EQUIPMENT TYPE

- HIGH-TEMPERATURE STERILIZATION EQUIPMENT

- WET/STEAM STERILIZATION EQUIPMENT

- DRY STERILIZATION EQUIPMENT

- LOW-TEMPERATURE STERILIZATION EQUIPMENT

- ETHYLENE OXIDE STERILIZATION EQUIPMENT

- HYDROGEN PEROXIDE STERILIZATION EQUIPMENT

- OZONE STERILIZATION EQUIPMENT

- OTHER LOW -TEMPERATURE STERILIZATION EQUIPMENT

- FILTRATION STERILIZATION EQUIPMENT

- IONIZING RADIATION STERILIZATION EQUIPMENT

- E-BEAM RADIATION STERILIZATION EQUIPMENT

- GAMMA STERILIZATION EQUIPMENT

- OTHER IONIZING RADIATION STERILIZATION EQUIPMENT

- HIGH-TEMPERATURE STERILIZATION EQUIPMENT

- MARKET BY END-USER

- HOSPITALS AND CLINICS

- PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

- EDUCATION AND RESEARCH INSTITUTES

- FOOD AND BEVERAGE INDUSTRIES

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

- EUROPE

- COMPANY PROFILES

- 3M COMPANY

- ADVANCED STERILIZATION (ACQUIRED BY FORTIVE)

- ANDERSEN PRODUCTS INC

- BELIMED AG

- CANTEL MEDICAL

- CARDINAL HEALTH

- GETINGE AB

- MATACHANA

- MMM GROUP

- SOTERA HEALTH

- STERIS CORPORATION

- STRYKER CORPORATION (TSO3 INC)

- SYSTEC GMBH

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – STERILIZATION EQUIPMENT

TABLE 2: REGULATORY FRAMEWORK

TABLE 3: EUROPE STERILIZATION EQUIPMENT MARKET, BY EQUIPMENT TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 4: EUROPE STERILIZATION EQUIPMENT MARKET, BY EQUIPMENT TYPE, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 5: EUROPE STERILIZATION EQUIPMENT MARKET, BY HIGH-TEMPERATURE STERILIZATION EQUIPMENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 6: EUROPE STERILIZATION EQUIPMENT MARKET, BY HIGH-TEMPERATURE STERILIZATION EQUIPMENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 7: EUROPE STERILIZATION EQUIPMENT MARKET, BY LOW-TEMPERATURE STERILIZATION EQUIPMENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 8: EUROPE STERILIZATION EQUIPMENT MARKET, BY LOW-TEMPERATURE STERILIZATION EQUIPMENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 9: EUROPE STERILIZATION EQUIPMENT MARKET, BY IONIZING RADIATION STERILIZATION EQUIPMENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 10: EUROPE STERILIZATION EQUIPMENT MARKET, BY IONIZING RADIATION STERILIZATION EQUIPMENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 11: EUROPE STERILIZATION EQUIPMENT MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 12: EUROPE STERILIZATION EQUIPMENT MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 13: EUROPE STERILIZATION EQUIPMENT MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 14: EUROPE STERILIZATION EQUIPMENT MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: EUROPE STERILIZATION EQUIPMENT MARKET, GROWTH POTENTIAL, BY EQUIPMENT TYPE, IN 2019

FIGURE 6: EUROPE STERILIZATION EQUIPMENT MARKET, BY HIGH-TEMPERATURE STERILIZATION, 2019-2028 (IN $ MILLION)

FIGURE 7: EUROPE STERILIZATION EQUIPMENT MARKET, GROWTH POTENTIAL, BY HIGH-TEMPERATURE STERILIZATION EQUIPMENT, IN 2019

FIGURE 8: EUROPE STERILIZATION EQUIPMENT MARKET, BY WET/STEAM STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 9: ADVANTAGES & DISADVANTAGES OF WET/STEAM STERILIZATION EQUIPMENT’S

FIGURE 10: EUROPE STERILIZATION EQUIPMENT MARKET, BY DRY STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 11: ADVANTAGES & DISADVANTAGES OF DRY STERILIZATION EQUIPMENT’S

FIGURE 12: EUROPE STERILIZATION EQUIPMENT MARKET, BY LOW-TEMPERATURE STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 13: EUROPE STERILIZATION EQUIPMENT MARKET, GROWTH POTENTIAL, BY LOW-TEMPERATURE STERILIZATION EQUIPMENT, IN 2019

FIGURE 14: EUROPE STERILIZATION EQUIPMENT MARKET, BY ETHYLENE OXIDE STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 15: EUROPE STERILIZATION EQUIPMENT MARKET, BY HYDROGEN PEROXIDE STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 16: EUROPE STERILIZATION EQUIPMENT MARKET, BY OZONE STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 17: EUROPE STERILIZATION EQUIPMENT MARKET, BY OTHER LOW -TEMPERATURE STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 18: EUROPE STERILIZATION EQUIPMENT MARKET, BY FILTRATION STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 19: EUROPE STERILIZATION EQUIPMENT MARKET, BY IONIZING RADIATION STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 20: EUROPE STERILIZATION EQUIPMENT MARKET, GROWTH POTENTIAL, BY IONIZING RADIATION STERILIZATION EQUIPMENT, IN 2019

FIGURE 21: EUROPE STERILIZATION EQUIPMENT MARKET, BY E-BEAM RADIATION STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 22: EUROPE STERILIZATION EQUIPMENT MARKET, BY GAMMA STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 23: EUROPE STERILIZATION EQUIPMENT MARKET, BY OTHER IONIZING RADIATION STERILIZATION EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 24: EUROPE STERILIZATION EQUIPMENT MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 25: EUROPE STERILIZATION EQUIPMENT MARKET, BY HOSPITALS AND CLINICS, 2019-2028 (IN $ MILLION)

FIGURE 26: EUROPE STERILIZATION EQUIPMENT MARKET, BY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, 2019-2028 (IN $ MILLION)

FIGURE 27: EUROPE STERILIZATION EQUIPMENT MARKET, BY EDUCATION AND RESEARCH INSTITUTES, 2019-2028 (IN $ MILLION)

FIGURE 28: EUROPE STERILIZATION EQUIPMENT MARKET, BY FOOD AND BEVERAGE INDUSTRIES, 2019-2028 (IN $ MILLION)

FIGURE 29: EUROPE STERILIZATION EQUIPMENT MARKET, BY OTHER END-USERS, 2019-2028 (IN $ MILLION)

FIGURE 30: EUROPE STERILIZATION EQUIPMENT MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 31: UNITED KINGDOM STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: GERMANY STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: FRANCE STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: ITALY STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: SPAIN STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: REST OF EUROPE STERILIZATION EQUIPMENT MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

- EUROPE

- MARKET BY EQUIPMENT TYPE

- HIGH-TEMPERATURE STERILIZATION EQUIPMENT

- WET/STEAM STERILIZATION EQUIPMENT

- DRY STERILIZATION EQUIPMENT

- LOW-TEMPERATURE STERILIZATION EQUIPMENT

- ETHYLENE OXIDE STERILIZATION EQUIPMENT

- HYDROGEN PEROXIDE STERILIZATION EQUIPMENT

- OZONE STERILIZATION EQUIPMENT

- OTHER LOW -TEMPERATURE STERILIZATION EQUIPMENT

- FILTRATION STERILIZATION EQUIPMENT

- IONIZING RADIATION STERILIZATION EQUIPMENT

- E-BEAM RADIATION STERILIZATION EQUIPMENT

- GAMMA STERILIZATION EQUIPMENT

- OTHER IONIZING RADIATION STERILIZATION EQUIPMENT

- HIGH-TEMPERATURE STERILIZATION EQUIPMENT

- MARKET BY END-USER

- HOSPITALS AND CLINICS

- PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

- EDUCATION AND RESEARCH INSTITUTES

- FOOD AND BEVERAGE INDUSTRIES

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.