EUROPE ELECTRIC VEHICLE POLYMER MARKET FORECAST 2020-2028

Europe Electric Vehicle Polymer Market by Type (Engineering Plastics (Crylonitrile Butadiene Styrene (Abs), Polyamide (Pa), Polycarbonate (Pc), Polyurethane (Pu), Polypropylene (Pp), Polyvinyl Chloride (Pvc), Poly Methyl Methacrylate (Pmma), Polyethylene (Pe), Other Engineering Plastics), Elastomers (Rubber, Silicone Elastomer, Fluoro Elastomer, Other Elastomers), Other Types) by Application (Powertrain, External, Internal) and by Geography.

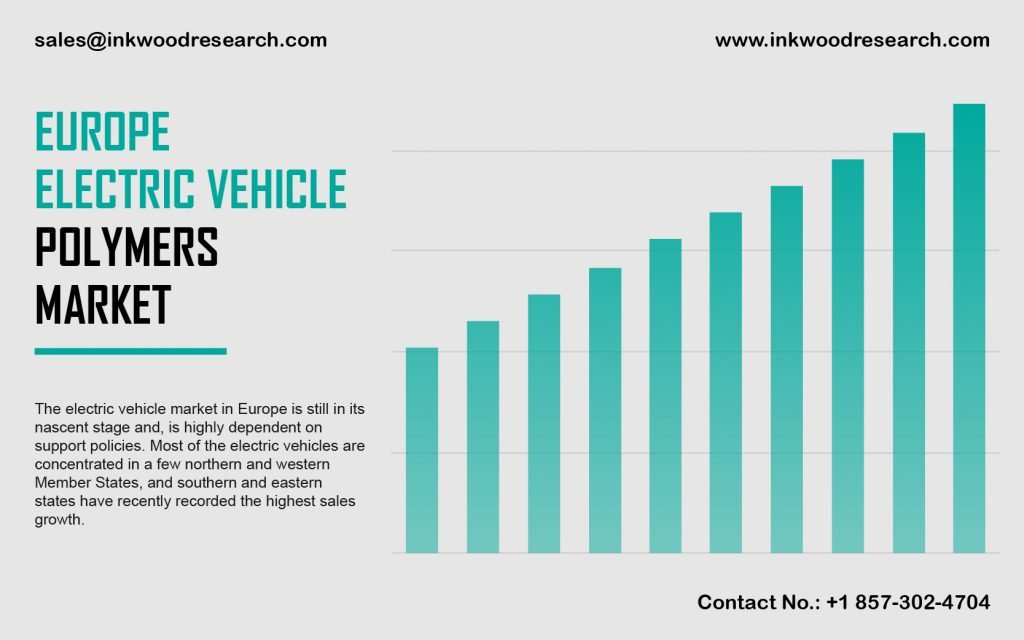

The Europe electric vehicle polymer market is evaluated to record a CAGR of 34.11% during the forecast period, 2020-2028. Technological developments and the growing environmental concerns are promoting market growth in the region.

To know more about this report, request a free sample copy.

The Europe electric vehicle polymer market is segmented into countries such as Russia, Poland, Germany, the UK, France, Italy, Belgium, and the rest of Europe. In the UK, electric vehicle sales experienced strong growth of about 27%, exhibiting the high rate of adoption in the country. The government’s policy framework aims to encourage and accommodate the growth of plug-in vehicles in the country in the coming years. In countries like Germany, the adoption of electric vehicles is increasing at a rate higher than 100%. The German companies have made huge investments in electric vehicle technology, including batteries and electric power trains. These factors are expected to increase the revenue share of Germany in the market.

In France, the demand for electric vehicles is assumed to increase as the rate of EV adoption is one of the highest in the world. Automotive manufacturers like Renault and Daimler introduced electric vehicles in the French market and are investing in enhancing the EV production facilities. The industry is expected to grow in the future, since the government has guaranteed to cut down petrol and diesel vehicles before 2040. Italy is expected to showcase a stable growth rate of the electric vehicle market, due to supportive government policies and the presence of a promising automotive industry. The manufacturers are adapting to the changing preferences of the customers.

Arkema SA, headquartered in Colombes, France, is engaged in manufacturing and supplying chemical products. Arkema announced a new program to recycle high-performance polyamides and PDF fluoropolymers in partnership with Agiplast in October 2019.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- RISE IN ADOPTION OF HIGH PERFORMANCE POLYMERS IN ELECTRIC VEHICLES

- POSITIVE OUTLOOK FOR ELECTRIC VEHICLE INDUSTRY

- PROACTIVE GOVERNMENT POLICIES ENCOURAGING THE USE OF ELECTRIC VEHICLES

- KEY RESTRAINTS

- VOLATILE RAW MATERIAL PRICES OF POLYMERS

- LACK OF ADEQUATE EV CHARGING STATIONS

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- REGULATORY FRAMEWORK – ELECTRIC VEHICLES

- MARKET BY TYPE

- ENGINEERING PLASTICS

- ACRYLONITRILE BUTADIENE STYRENE (ABS)

- POLYAMIDE (PA)

- POLYCARBONATE (PC)

- POLYURETHANE (PU)

- POLYPROPYLENE (PP)

- POLYVINYL CHLORIDE (PVC)

- POLY METHYL METHACRYLATE (PMMA)

- POLYETHYLENE (PE)

- OTHER ENGINEERING PLASTICS

- ELASTOMERS

- RUBBER

- SILICONE ELASTOMER

- FLUORO ELASTOMER

- OTHER ELASTOMERS

- OTHER TYPES

- ENGINEERING PLASTICS

- MARKET BY APPLICATION

- POWERTRAIN

- EXTERNAL

- INTERNAL

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- COMPANY PROFILES

- AGC CHEMICALS AMERICAS INC

- ARKEMA SA

- ASAHI KASEI CORPORATION

- BASF SE

- CELANESE CORPORATION

- CHINA PETROLEUM & CHEMICAL CORPORATION (SINOPEC)

- COVESTRO AG

- DAIKIN INDUSTRIES LTD

- DUPONT

- ELKEM ASA

- EVONIK INDUSTRIES AG

- JSR CORPORATION

- LANXESS AG

- LG CHEM LTD

- LYONDELLBASELL INDUSTRIES NV

- MITSUBISHI CHEMICAL HOLDINGS CORPORATION

- ROYAL DSM NV

- SAUDI BASIC INDUSTRIES CORPORATION (SABIC)

- SOLVAY SA

- SUMITOMO CHEMICAL COMPANY LIMITED

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ELECTRIC VEHICLE POLYMER

TABLE 2: OVERVIEW OF POLICIES REGARDING EV’S BY MAJOR COUNTRIES

TABLE 3: LIST OF FEW MERGER & ACQUISITION IN ELECTRIC VEHICLE & POLYMERS INDUSTRY

TABLE 4: REGULATORY FRAMEWORK – ELECTRIC VEHICLES

TABLE 5: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 6: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 7: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ENGINEERING PLASTICS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 8: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ENGINEERING PLASTICS, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 9: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ELASTOMERS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 10: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ELASTOMERS, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 11: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 12: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY APPLICATION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 13: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 14: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

FIGURES LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: EUROPE ELECTRIC VEHICLE POLYMER MARKET, GROWTH POTENTIAL, BY TYPE, IN 2019

FIGURE 6: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ENGINEERING PLASTICS, 2020-2028 (IN $ MILLION)

FIGURE 7: EUROPE ELECTRIC VEHICLE POLYMER MARKET, GROWTH POTENTIAL, BY ENGINEERING PLASTICS, IN 2019

FIGURE 8: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ACRYLONITRILE BUTADIENE STYRENE (ABS), 2020-2028 (IN $ MILLION)

FIGURE 9: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYAMIDE (PA), 2020-2028 (IN $ MILLION)

FIGURE 10: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYCARBONATE (PC), 2020-2028 (IN $ MILLION)

FIGURE 11: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYURETHANE (PU), 2020-2028 (IN $ MILLION)

FIGURE 12: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYPROPYLENE (PP), 2020-2028 (IN $ MILLION)

FIGURE 13: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYVINYL CHLORIDE (PVC), 2020-2028 (IN $ MILLION)

FIGURE 14: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLY METHYL METHACRYLATE (PMMA), 2020-2028 (IN $ MILLION)

FIGURE 15: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POLYETHYLENE (PE), 2020-2028 (IN $ MILLION)

FIGURE 16: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY OTHER ENGINEERING PLASTICS, 2020-2028 (IN $ MILLION)

FIGURE 17: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY ELASTOMERS, 2020-2028 (IN $ MILLION)

FIGURE 18: EUROPE ELECTRIC VEHICLE POLYMER MARKET, GROWTH POTENTIAL, BY ELASTOMERS, IN 2019

FIGURE 19: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY RUBBER, 2020-2028 (IN $ MILLION)

FIGURE 20: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY SILICONE ELASTOMER, 2020-2028 (IN $ MILLION)

FIGURE 21: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY FLUORO ELASTOMER, 2020-2028 (IN $ MILLION)

FIGURE 22: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY OTHER ELASTOMERS, 2020-2028 (IN $ MILLION)

FIGURE 23: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY OTHER TYPES, 2020-2028 (IN $ MILLION)

FIGURE 24: EUROPE ELECTRIC VEHICLE POLYMER MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2019

FIGURE 25: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY POWERTRAIN, 2020-2028 (IN $ MILLION)

FIGURE 26: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY EXTERNAL, 2020-2028 (IN $ MILLION)

FIGURE 27: EUROPE ELECTRIC VEHICLE POLYMER MARKET, BY INTERNAL, 2020-2028 (IN $ MILLION)

FIGURE 28: EUROPE ELECTRIC VEHICLE POLYMER MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 29: UNITED KINGDOM ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 30: GERMANY ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 31: FRANCE ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 32: ITALY ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 33: RUSSIA ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 34: BELGIUM ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 35: POLAND ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

FIGURE 36: REST OF EUROPE ELECTRIC VEHICLE POLYMER MARKET, 2020-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- MARKET BY TYPE

- ENGINEERING PLASTICS

- ACRYLONITRILE BUTADIENE STYRENE (ABS)

- POLYAMIDE (PA)

- POLYCARBONATE (PC)

- POLYURETHANE (PU)

- POLYPROPYLENE (PP)

- POLYVINYL CHLORIDE (PVC)

- POLY METHYL METHACRYLATE (PMMA)

- POLYETHYLENE (PE)

- OTHER ENGINEERING PLASTICS

- ELASTOMERS

- RUBBER

- SILICONE ELASTOMER

- FLUORO ELASTOMER

- OTHER ELASTOMERS

- OTHER TYPES

- ENGINEERING PLASTICS

- MARKET BY APPLICATION

- POWERTRAIN

- EXTERNAL

- INTERNAL

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.