EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET FORECAST 2021-2028

Europe Blood Flow Measurement Devices Market by Type (Ultrasonic Doppler Blood Flow Meters, Laser Doppler Blood Flow Meters, Electromagnetic Blood Flow Meters) Market by Application (Peripheral Vascular Disease, Diabetes, Gastroenterology, Tumor Monitoring and Angiogenesis, Intracranial Monitoring in Stroke and Brain Injury, Dermatology, Other Applications) by Geography.

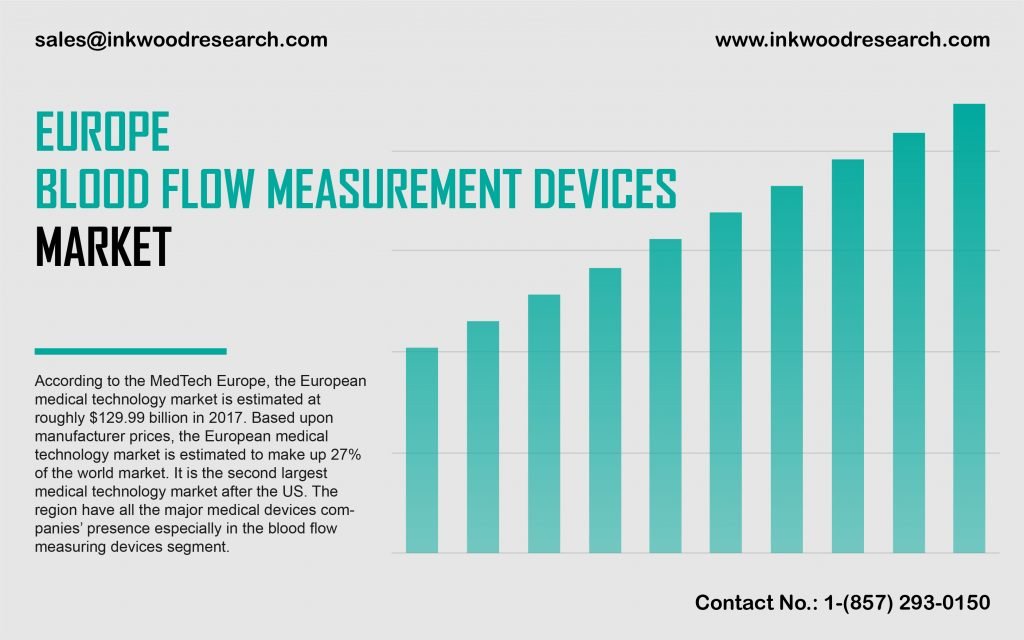

The Europe blood flow measurement devices market is set to project a CAGR of 8.44% during the forecast period, 2021-2028. The region has the presence of many medical devices companies, particularly in the blood flow measuring devices segment. Also, several countries of the region are leaders in medical device innovations, exporting their products worldwide.

To learn more about this report, request a free sample copy

The Europe blood flow measurement devices market growth assessment includes the analysis of Belgium, Russia, the United Kingdom, Italy, Poland, Germany, France, and Rest of Europe. The availability of competent professionals and advanced healthcare infrastructure make the UK a lucrative market for blood flow measurement devices. Also, chronic diseases are highly prevalent in the UK, especially strokes, cardiovascular diseases, diabetes, etc. In 2017, as per stats, 21% of the total adult population was obese, higher than most EU countries. In addition, the medical device market is the third-largest in Europe, after Germany and France. Moreover, several large US companies operate their subsidiaries in the UK. Such factors, along with the large presence of several small scale medical device companies and a few global manufacturers, provide immense growth opportunities.

A sophisticated healthcare system and a high per capita income make Italy a mature market for medical devices. This further increases the demand for a vast range of cutting-edge medical equipment. Also, the government is the key purchaser of medical devices. In addition, public hospitals account for more than 75% of medical device sales. At the same time, Italy has a large local manufacturing medical devices industry. The other important growth drivers are the elderly population, the growing demand for high-quality care, higher life expectancy, and the rising population.

Deltex Medical Group produces fluid management and blood monitoring equipment. Also, it is a global leader in hemodynamic monitoring technology. Its main product is the ultrasound probe CardioQ-ODM that measures the rate of blood flow from the heart. It is headquartered in Chichester, West Sussex, the United Kingdom.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASE IN GERIATRIC POPULATION

- RISING DEMAND FOR ADVANCED TREATMENT

- PREVALENCE OF CHRONIC DISEASES

- GOVERNMENT INITIATIVES FOR HEALTHCARE IMPROVEMENT

- KEY RESTRAINTS

- VARYING MEDICAL DEVICE REGULATIONS

- SHORTAGE OF SKILLED RADIOLOGISTS AND HEALTHCARE PROFESSIONALS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON BLOOD FLOW MEASUREMENT DEVICES MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY TYPE

- ULTRASONIC DOPPLER BLOOD FLOW METERS

- LASER DOPPLER BLOOD FLOW METERS

- ELECTROMAGNETIC BLOOD FLOW METERS

- MARKET BY APPLICATION

- PERIPHERAL VASCULAR DISEASE

- DIABETES

- GASTROENTEROLOGY

- TUMOR MONITORING AND ANGIOGENESIS

- INTRACRANIAL MONITORING IN STROKE AND BRAIN INJURY

- DERMATOLOGY

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ADINSTRUMENTS LTD

- ARJOHUNTLEIGH

- BIOPAC SYSTEMS INC

- COMPUDEMICS LTD

- COOK MEDICAL

- DELTEX MEDICAL GROUP

- GE HEALTHCARE

- GETINGE GROUP

- KONINKLIJKE PHILIPS NV

- MEDISTIM ASA

- MEDTRONIC PLC

- MOOR INSTRUMENTS LTD

- PERIMED AB

- SCINOVIA CORP

- SIEMENS HEALTHINEERS

- TRANSONIC SYSTEMS INC

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – BLOOD FLOW MEASUREMENT DEVICES

TABLE 2: NUMBER OF PERSONS AGED 65 YEARS OR OVER, BY GEOGRAPHIC REGION, 2019 AND 2050

TABLE 3: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 4: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 5: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY APPLICATIONS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 6: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY APPLICATIONS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 7: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 8: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 9: LEADING PLAYERS OPERATING IN EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET

TABLE 10: LIST OF MERGERS & ACQUISITIONS

TABLE 11: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 12: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 13: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

FIGURE LIST

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX ($)

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, GROWTH POTENTIAL, BY TYPE, IN 2020

FIGURE 6: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY ULTRASONIC DOPPLER BLOOD FLOW METERS, 2021-2028 (IN $ MILLION)

FIGURE 7: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY LASER DOPPLER BLOOD FLOW METERS, 2021-2028 (IN $ MILLION)

FIGURE 8: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY ELECTROMAGNETIC BLOOD FLOW METERS, 2021-2028 (IN $ MILLION)

FIGURE 9: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, GROWTH POTENTIAL, BY APPLICATIONS, IN 2020

FIGURE 10: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY PERIPHERAL VASCULAR DISEASE, 2021-2028 (IN $ MILLION)

FIGURE 11: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY DIABETES, 2021-2028 (IN $ MILLION)

FIGURE 12: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY GASTROENTEROLOGY, 2021-2028 (IN $ MILLION)

FIGURE 13: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY TUMOR MONITORING AND ANGIOGENESIS, 2021-2028 (IN $ MILLION)

FIGURE 14: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY INTRACRANIAL MONITORING IN STROKE AND BRAIN INJURY, 2021-2028 (IN $ MILLION)

FIGURE 15: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY DERMATOLOGY, 2021-2028 (IN $ MILLION)

FIGURE 16: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 17: EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 18: UNITED KINGDOM BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 19: GERMANY BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 20: FRANCE BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 21: ITALY BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 22: RUSSIA BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 23: BELGIUM BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 24: POLAND BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: REST OF EUROPE BLOOD FLOW MEASUREMENT DEVICES MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- MARKET BY TYPE

- ULTRASONIC DOPPLER BLOOD FLOW METERS

- LASER DOPPLER BLOOD FLOW METERS

- ELECTROMAGNETIC BLOOD FLOW METERS

- MARKET BY APPLICATION

- PERIPHERAL VASCULAR DISEASE

- DIABETES

- GASTROENTEROLOGY

- TUMOR MONITORING AND ANGIOGENESIS

- INTRACRANIAL MONITORING IN STROKE AND BRAIN INJURY

- DERMATOLOGY

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.