GLOBAL DENTAL STERILIZATION MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

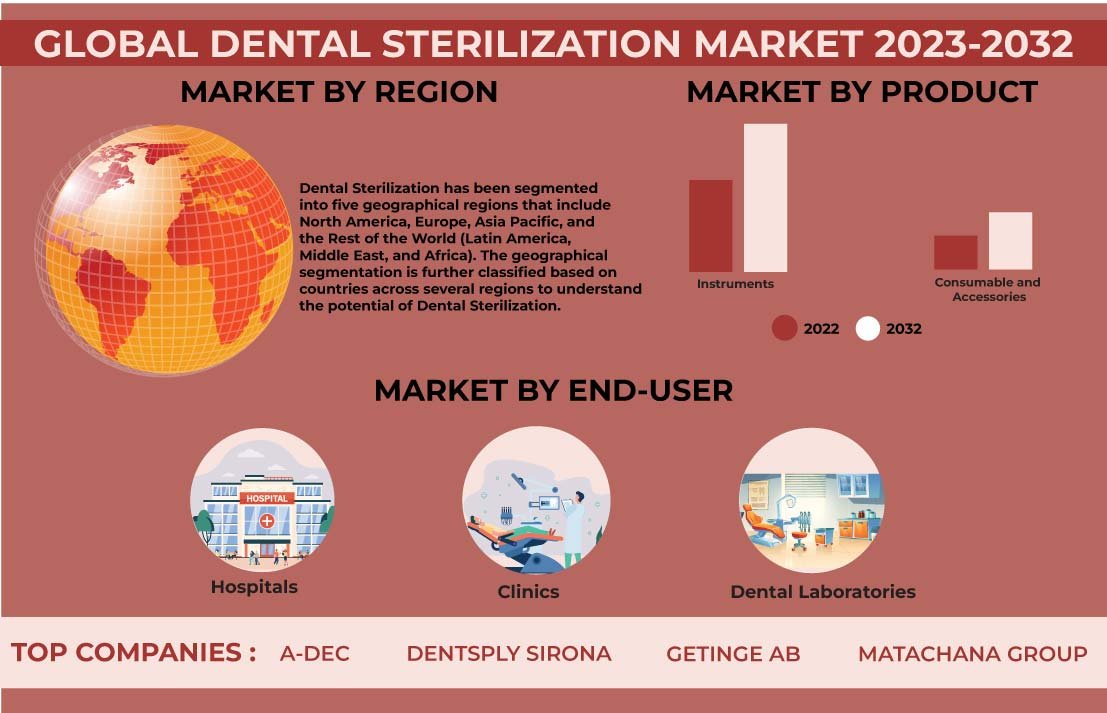

Global Dental Sterilization Market by Product (Instruments (Low-temperature Sterilizers, High-temperature Sterilizers, Washer Disinfectors, Ultrasonic Cleaners, Packaging Equipment), Consumables and Accessories (Instrument Disinfectants, Surface Disinfectants, Sterilization Indicators, Lubricants and Cleaning Solutions, Sterilization Packaging Accessories)) Market by End-user (Hospitals, Clinics, Dental Laboratories) by Geography

REPORTS » HEALTHCARE » MEDICAL DEVICES » GLOBAL DENTAL STERILIZATION MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global dental sterilization market was valued at $1160.50 million in 2023 and is expected to reach $2138.27 million by 2032, growing at a CAGR of 6.23% during the forecast period. The base year considered for the studied market is 2023, and the estimated period is between 2023 and 2032. The market study has also analyzed the impact of COVID-19 on the global dental sterilization market qualitatively as well as quantitatively.

Dentistry operations must closely adhere to a set of cleaning requirements in order to prevent infections. Aligning with this, dental sterilization is the process of cleaning equipment and removing potential infection sources. In dentistry, proper sterilization practices safeguard both patients and professionals, keeping germs from developing on dental devices and surfaces throughout the procedure. The process also prevents diseases from spreading from one person to the other.

The American Dental Association (ADA) and the Centers for Disease Control (CDC) have created policies to prevent cross-infection among dental patients. Accordingly, each time a dental tool is used, it must be carefully cleaned and sterilized. Moreover, to avoid infection, dental treatments, like any other medical profession, must rigorously adhere to certain cleanliness rules.

All dental assistants, hygienists, and dentists undergo training in dental sterilization and infection control as part of their official education. Through this, patients are less likely to become unwell or infected in a clinic, given the excellent infection control methods.

Read our latest blog on the Dental Sterilization Market

GROWTH ENABLERS

Key growth enablers of the global dental sterilization market:

- Dangers related to cross-transmission and infection

- The importance of hygiene and sanitization in the effectiveness of a dental operation cannot be overstated. Furthermore, in medical operations, the danger of infection is significant, and infection transmission is a serious concern. Cross-infection occurs when hazardous organisms such as bacteria and viruses transfer from one person to another.

- Diseases can spread from person to person, from pieces of equipment to person, or within the body. Additionally, during the COVID-19 pandemic, there was a higher emphasis on keeping dental equipment and instruments clean and sanitary.

- In the medical avenue, sterilization of dental equipment and devices is crucial, as hundreds of people die each year as a result of improper disinfection and poor equipment cleanliness.

- Sterilization not only kills disease-causing microorganisms but also eliminates transmissible agents like bacteria and spores by employing sterilization techniques like radiation, chemicals, and heat, thus lowering the risk of infection.

- Several infection control campaigns are being established in order to raise awareness about the cleaning and sterilization of dental equipment and tools, as well.

- High prevalence of dental diseases & disorders

- Increased need for cosmetic dentistry

GROWTH RESTRAINTS

Key growth restraining factors of the global dental sterilization market:

- High cost of dental treatments

- Specialized equipment and supplies, such as X-ray machines, dental drills, dental implants, and dental crowns, are required for dental treatments. These materials and equipment can be expensive to buy as well as maintain.

- To become a licensed professional, dentists must undertake extensive study and training. This can be expensive, and the costs are frequently passed on to patients. Moreover, rent or fees for the clinic’s practice facility may also be included in the overhead charges. These costs cover all personnel wages, supplies, taxes, power, medical waste disposal, sterilization process, and others.

- The high cost of dental treatment may also be accredited to the nursing team’s and staff’s expertise and degree of training. An excellent dentist practice will properly compensate the staff, maintain a clean workplace, updated instruments, and consider other major aspects that top dental treatment entails. However, these expenses are transferred to the patient’s treatment costs, thus hindering the global dental sterilization market growth.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Dental Sterilization Market | Key Market Trends

- Dental tourism refers to the practice of traveling to a foreign nation to acquire dental treatments that are usually less expensive or of greater quality than those offered in the traveler’s native country. This trend has grown in popularity over recent years, thus boosting the need for dental care in renowned dental tourism locations. Dental clinics in these nations also attract foreign consumers by offering competitive costs and high-quality services, which drives innovation and investments in the dental industry.

- In dentistry, like in other professions, digital alternatives for traditional work practices are continually emerging. In this regard, there have been tremendous improvements in dental technologies aimed at providing dental patients with modern and precise remedies to traditional dental ailments. As a result, the most recent solutions are being created to offer products and methods that dental practitioners may use to successfully help, detect, or diagnose numerous dental disorders and oral ailments. Several techniques in dental practices are evolving as well, including communication and computerized information management, digital radiography, and diagnostic photography. Furthermore, computerized approaches are also being used in dental treatments for procedures like impression-taking, treatment planning, and implant surgery.

MARKET SEGMENTATION

Market Segmentation Analysis – Product and End-User –

Market by Product:

- Instruments

- Instruments is expected to be the largest revenue-generating segment under the product category by 2032.

- Dental sterilization instruments are essential to ensure that dental instruments are safe and free from harmful microorganisms. Sterilization is the process of killing or eliminating all microorganisms, including bacteria, viruses, and fungi, from dental instruments. This is critical in preventing the transmission of infectious diseases between patients and dental professionals.

- Some common methods of sterilization are autoclaving, chemical sterilization, and dry heat sterilization. Dental instruments that require sterilization include those that come into contact with blood, saliva, or other bodily fluids, such as handpieces, burs, and scalers.

- Proper sterilization techniques must be followed to ensure that dental instruments are safe for use and that patients are protected from infection.

- Low-Temperature Sterilizers

- High-Temperature Sterilizers

- Washer Disinfectors

- Ultrasonic Cleaners

- Packaging Equipment

- Consumables and Accessories

- Instrument Disinfectants

- Surface Disinfectants

- Sterilization Indicators

- Lubricants and Cleaning Solutions

- Sterilization Packaging Accessories

Market by End-User:

- Hospitals

- Clinics

- The clinics segment under the end-user category is expected to grow with the highest CAGR of 6.34% during the forecast period.

- The number of dental clinics across the globe is on the rise. These facilities have the expertise to treat patients, particularly as their patient base continues to grow annually.

- However, when compared to hospitals, these healthcare environments have similar infection prevention and control criteria. The manner of application to meet the criteria varies depending on the type of service offered by the outpatient center to the community.

- One of the most challenging tasks for clinics is staying informed and implementing steps in response to developments in sterilization technology and disinfection products. Besides, most infections are avoidable since various rules are in place to ensure that clinics adhere to the same stringent safety requirements as hospitals.

- Dental Laboratories

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Vietnam, Thailand, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is projected to lead the global dental sterilization market over the forecast years.

- The growing healthcare expenditure in the Asia-Pacific is driving the need for dental sterilization products and services. Governments in countries such as China, India, and Japan are investing in their healthcare infrastructure, which is expected to further boost the demand for dental sterilization products and services. Furthermore, Asian countries such as Vietnam, China, India, Thailand, South Korea, and others are popular destinations for dental treatments.

- With the increasing focus on infection control in dental practices, dental sterilization has become a critical component of ensuring patient safety. Regulatory bodies, such as the World Health Organization (WHO) and national health authorities, have issued guidelines for infection control in dental practices. These factors have further driven the demand for dental sterilization products and services in the region.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global dental sterilization market:

- Dentsply Sirona Inc

- Matachana Group

- Midmark Corporation

- Envista Holdings Corporation

- Getinge AB

- A-Dec Inc

Key strategies adopted by some of these companies:

- In March 2023, Getinge announced the acquisition of Ultra Clean Systems Inc, a major United States manufacturer of ultrasonic cleaning technology used to disinfect surgical equipment in hospitals and operation centers.

- In January 2023, Steelco Group introduced the New DS 610 G2 Series, a 12-DIN-tray sterilizer designed to reduce water and energy usage while offering excellent productivity and process efficiency.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Market by Product and End-user |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | A-Dec, De Lama SpA, Dentsply Sirona Inc, Dürr Dental, Envista Holdings Corporation, Getinge AB, Hu-Friedy, Matachana Group, Midmark Corporation, Nakanishi Inc, Planmeca Oy, Scican Ltd, Steelco SpA, Tuttnauer, W&H Group |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- MEDICAL TOURISM IS A PROMINENT GROWTH ENABLER

- NORTH AMERICA: LARGEST MARKET FOR DENTAL STERILIZATION

- AGING POPULATION’S HIGH SUSCEPTIBILITY TO DENTAL DISEASES

- INCREASED ROLE OF GOVERNMENT REGULATIONS IN DENTAL TREATMENTS

MARKET DYNAMICS

- KEY DRIVERS

- HIGH PREVALENCE OF DENTAL DISEASES & DISORDERS

- DANGERS OF CROSS-TRANSMISSION AND INFECTION

- INCREASED NEED FOR COSMETIC DENTISTRY

- KEY RESTRAINTS

- HIGH COSTS OF DENTAL TREATMENTS

- KEY DRIVERS

KEY ANALYTICS

- KEY TECHNOLOGY TRENDS/KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

MARKET BY PRODUCT

- INSTRUMENTS

- LOW-TEMPERATURE STERILIZERS

- HIGH-TEMPERATURE STERILIZERS

- WASHER DISINFECTORS

- ULTRASONIC CLEANERS

- PACKAGING EQUIPMENT

- CONSUMABLES AND ACCESSORIES

- INSTRUMENT DISINFECTANTS

- SURFACE DISINFECTANTS

- STERILIZATION INDICATORS

- LUBRICANTS AND CLEANING SOLUTIONS

- STERILIZATION PACKAGING ACCESSORIES

- INSTRUMENTS

MARKET BY END-USER

- HOSPITALS

- CLINICS

- DENTAL LABORATORIES

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA DENTAL STERILIZATION MARKET DRIVERS

- NORTH AMERICA DENTAL STERILIZATION MARKET CHALLENGES

- NORTH AMERICA DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA DENTAL STERILIZATION MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE DENTAL STERILIZATION MARKET DRIVERS

- EUROPE DENTAL STERILIZATION MARKET CHALLENGES

- EUROPE DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE DENTAL STERILIZATION MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC DENTAL STERILIZATION MARKET DRIVERS

- ASIA-PACIFIC DENTAL STERILIZATION MARKET CHALLENGES

- ASIA-PACIFIC DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC DENTAL STERILIZATION MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD DENTAL STERILIZATION MARKET DRIVERS

- REST OF WORLD DENTAL STERILIZATION MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD DENTAL STERILIZATION MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA DENTAL STERILIZATION MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- A-DEC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- DE LAMA SPA

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- DENTSPLY SIRONA INC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- DURR DENTAL

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ENVISTA HOLDINGS CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- GETINGE AB

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- HU-FRIEDY

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- MATACHANA GROUP

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- MIDMARK CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- NAKANISHI INC

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- PLANMECA OY

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- SCICAN LTD

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- STEELCO SPA

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- TUTTNAUER

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- W&H GROUP

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- A-DEC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – DENTAL STERILIZATION

TABLE 2: GLOBAL DENTAL STERILIZATION MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL DENTAL STERILIZATION MARKET, BY PRODUCT, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL DENTAL STERILIZATION MARKET, BY INSTRUMENTS, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL DENTAL STERILIZATION MARKET, BY INSTRUMENTS, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL LOW-TEMPERATURE STERILIZERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL LOW-TEMPERATURE STERILIZERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL HIGH-TEMPERATURE STERILIZERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL HIGH-TEMPERATURE STERILIZERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL WASHER DISINFECTORS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL WASHER DISINFECTORS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL ULTRASONIC CLEANERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL ULTRASONIC CLEANERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL PACKAGING EQUIPMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL PACKAGING EQUIPMENT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL DENTAL STERILIZATION MARKET, BY CONSUMABLES AND ACCESSORIES, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL DENTAL STERILIZATION MARKET, BY CONSUMABLES AND ACCESSORIES, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL INSTRUMENT DISINFECTANTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL INSTRUMENT DISINFECTANTS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL SURFACE DISINFECTANTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL SURFACE DISINFECTANTS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL STERILIZATION INDICATORS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL STERILIZATION INDICATORS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL LUBRICANTS AND CLEANING SOLUTIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL LUBRICANTS AND CLEANING SOLUTIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL STERILIZATION PACKAGING ACCESSORIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL STERILIZATION PACKAGING ACCESSORIES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: GLOBAL DENTAL STERILIZATION MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL DENTAL STERILIZATION MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: GLOBAL HOSPITALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL HOSPITALS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 32: GLOBAL CLINICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL CLINICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: GLOBAL DENTAL STERILIZATION MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL DENTAL STERILIZATION MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 36: NORTH AMERICA DENTAL STERILIZATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: NORTH AMERICA DENTAL STERILIZATION MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: NORTH AMERICA DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

TABLE 39: KEY PLAYERS OPERATING IN NORTH AMERICA DENTAL STERILIZATION MARKET

TABLE 40: EUROPE DENTAL STERILIZATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: EUROPE DENTAL STERILIZATION MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: EUROPE DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

TABLE 43: KEY PLAYERS OPERATING IN EUROPE DENTAL STERILIZATION MARKET

TABLE 44: ASIA-PACIFIC DENTAL STERILIZATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: ASIA-PACIFIC DENTAL STERILIZATION MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 46: ASIA-PACIFIC DENTAL STERILIZATION MARKET REGULATORY FRAMEWORK

TABLE 47: KEY PLAYERS OPERATING IN ASIA-PACIFIC DENTAL STERILIZATION MARKET

TABLE 48: REST OF WORLD DENTAL STERILIZATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: REST OF WORLD DENTAL STERILIZATION MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 50: KEY PLAYERS OPERATING IN REST OF WORLD DENTAL STERILIZATION MARKET

TABLE 51: LIST OF MERGERS & ACQUISITIONS

TABLE 52: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 53: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 54: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY TECHNOLOGY TRENDS/KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

FIGURE 5: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL DENTAL STERILIZATION MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2022

FIGURE 10: GLOBAL DENTAL STERILIZATION MARKET, BY INSTRUMENTS, 2023-2032 (IN $ MILLION)

FIGURE 11: GLOBAL DENTAL STERILIZATION MARKET, GROWTH POTENTIAL, BY INSTRUMENTS, IN 2022

FIGURE 12: GLOBAL DENTAL STERILIZATION MARKET, BY LOW-TEMPERATURE STERILIZERS, 2023-2032 (IN $ MILLION)

FIGURE 13: GLOBAL DENTAL STERILIZATION MARKET, BY HIGH-TEMPERATURE STERILIZERS, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL DENTAL STERILIZATION MARKET, BY WASHER DISINFECTORS, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL DENTAL STERILIZATION MARKET, BY ULTRASONIC CLEANERS, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL DENTAL STERILIZATION MARKET, BY PACKAGING EQUIPMENT, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL DENTAL STERILIZATION MARKET, BY CONSUMABLES AND ACCESSORIES, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL DENTAL STERILIZATION MARKET, GROWTH POTENTIAL, BY CONSUMABLES AND ACCESSORIES, IN 2022

FIGURE 19: GLOBAL DENTAL STERILIZATION MARKET, BY INSTRUMENT DISINFECTANTS, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL DENTAL STERILIZATION MARKET, BY SURFACE DISINFECTANTS, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL DENTAL STERILIZATION MARKET, BY STERILIZATION INDICATORS, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL DENTAL STERILIZATION MARKET, BY LUBRICANTS AND CLEANING SOLUTIONS, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL DENTAL STERILIZATION MARKET, BY STERILIZATION PACKAGING ACCESSORIES, 2023-2032 (IN $ MILLION)

FIGURE 24: GLOBAL DENTAL STERILIZATION MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 25: GLOBAL DENTAL STERILIZATION MARKET, BY HOSPITALS, 2023-2032 (IN $ MILLION)

FIGURE 26: GLOBAL DENTAL STERILIZATION MARKET, BY CLINICS, 2023-2032 (IN $ MILLION)

FIGURE 27: GLOBAL DENTAL STERILIZATION MARKET, BY DENTAL LABORATORIES, 2023-2032 (IN $ MILLION)

FIGURE 28: NORTH AMERICA DENTAL STERILIZATION MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 29: UNITED STATES DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: CANADA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: EUROPE DENTAL STERILIZATION MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 32: UNITED KINGDOM DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: GERMANY DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: FRANCE DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: ITALY DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: SPAIN DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: BELGIUM DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: POLAND DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: REST OF EUROPE DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: ASIA-PACIFIC DENTAL STERILIZATION MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 41: CHINA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: JAPAN DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: INDIA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: SOUTH KOREA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: INDONESIA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: THAILAND DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: VIETNAM DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 48: AUSTRALIA & NEW ZEALAND DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 49: REST OF ASIA-PACIFIC DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 50: REST OF WORLD DENTAL STERILIZATION MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 51: LATIN AMERICA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FIGURE 52: MIDDLE EAST & AFRICA DENTAL STERILIZATION MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

As of 2022, the global dental sterilization market was valued at $1160.50 million.

Yes, the market study has also analyzed major trends in the global dental sterilization market.

Instruments is the largest revenue-generating product in the global dental sterilization market.

Hospitals is set to be the dominating end-user in the global dental sterilization market.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032