CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

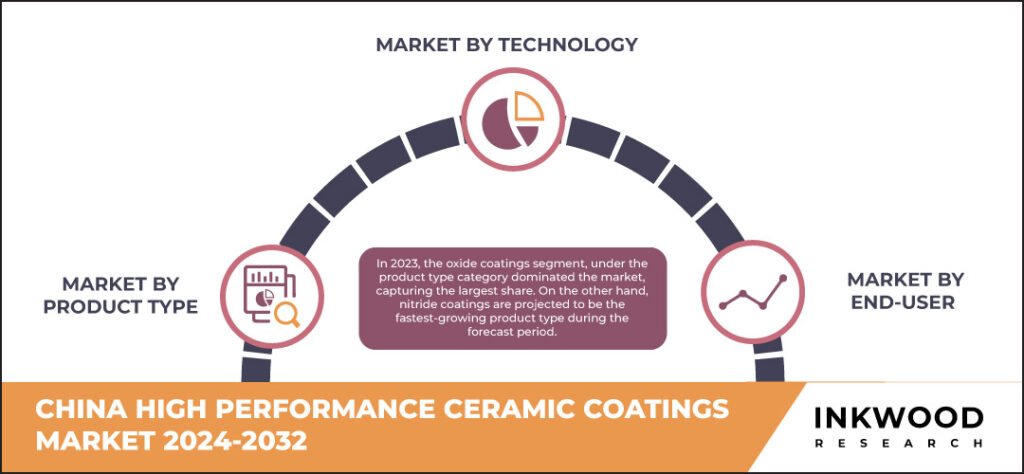

China High-Performance Ceramic Coatings Market by Product Type (Oxide Coatings, Nitride Coatings, Carbide Coatings) Market by Technology (Thermal Spray, Physical Vapor Deposition, Chemical Vapor Deposition, Other Technologies) Market by End-user (Automotive, Aerospace & Defense, General Industrial Tools & Machinery, Healthcare, Other End-users) by Geography

REPORTS » CHEMICALS AND MATERIALS » PAINTS AND COATINGS » CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

MARKET OVERVIEW

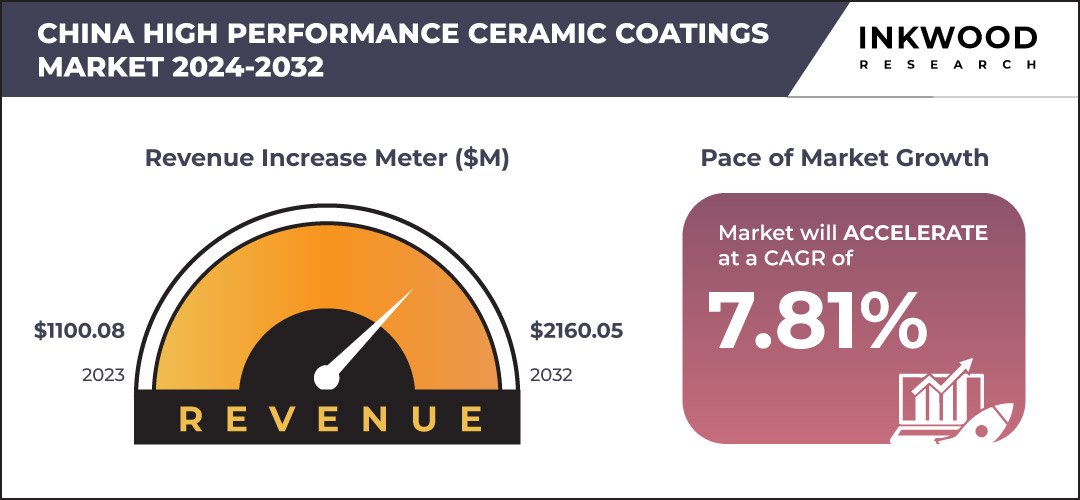

The China high-performance ceramic coatings market is predicted to grow at a CAGR of 7.81% over the forecast period of 2024-2032. The market was valued at $1100.08 million in 2023 and is expected to reach a revenue of $2160.05 million by 2032.

China, recognized as the world’s fastest-growing and second-largest economy, stands as a leader in industrial and manufacturing sectors like steel, automotive, and electric vehicles. This robust economic foundation offers significant opportunities for the high-performance ceramic coatings market. The increasing use of these coatings in critical industries, such as steel production and automotive manufacturing, is expected to drive demand. As a global manufacturing powerhouse, producing over half of the world’s steel, aluminum, and cement, China relies on high-performance ceramic coatings to improve the efficiency and longevity of machinery and equipment.

To Know More About This Report, Request a Free Sample Copy

China’s energy sector, which fuels the world’s second-largest economy, also highlights the importance of advanced coatings. In the rapidly expanding automotive sector, China has become the world’s largest automobile producer. The government’s ambitious goals for automobile output, targeting 35 million units by 2025, signal continued growth in this sector. With China leading the global vehicle market, high-performance ceramic coatings will be vital in ensuring the quality and durability of automotive components.

Additionally, China’s dominance as the largest producer and consumer of chemical products underscores the growing relevance of high-performance ceramic coatings. The chemicals industry, a major contributor to industrial emissions, represents a key area where these coatings can enhance environmental sustainability and equipment protection. As China continues to strengthen its position as a manufacturing and economic powerhouse, the growing demand for advanced coatings across multiple industries solidifies its role as a key player in the global high-performance ceramic coatings market.

The China High-performance Ceramic Coatings Market: 7.81% CAGR (2024-2032)

Need a custom report or have specific data requirements? Let us know!

The China high-performance ceramic coatings market segmentation incorporates the market by product type, technology, and end-user. The technology segment is further differentiated into thermal spray, physical vapor deposition, chemical vapor deposition, and other technologies. Thermal spray coating is a process that combines a heat source with a wire or powder coating material, which is then melted into droplets and sprayed onto a surface at high velocity. This technique, also known as spray welding, plasma spray, HVOF, or flame spray, is commonly applied to metal substrates.

Thermal spray coatings are used on a wide range of components in rotating and moving machine parts, such as automobile engines, aerospace turbines, and machine tools, which operate in harsh environments where erosion, wear, corrosion, or heat can shorten component lifespan. The increasing demand from the automotive, aerospace, heavy machinery, and military and civil airliner industries has led to a rise in the use of thermal spray coating technology.

Physical vapor deposition (PVD) is a technique that uses processes like sputtering targets and evaporation slugs to deposit thin material layers, commonly applied in manufacturing items requiring thin films for mechanical, optical, and electronic functions. PVD-based coatings are known for their hardness, corrosion resistance, abrasion resistance, oxidation resistance, and high impact strength, making them highly sought after in the automotive and aerospace industries. The growing automotive sector and rising global demand for automobiles are key drivers of the increased use of PVD-based high-performance ceramic coatings. Additionally, increased R&D in space technologies, along with the surge in satellite and space shuttle production, further boosts the demand for these coatings.

Chemical vapor deposition is a vacuum deposition technique used to create high-quality, high-performance materials commonly employed in the semiconductor industry for producing thin films. The increasing use of advanced technology gadgets like laptops, smartphones, and LED TVs, along with the improving standard of living, is driving demand for consumer electronics. As a result, the rise in production and sales of these electronics is boosting the need for chemical vapor deposition-based high-performance ceramic coatings, which is expected to propel market growth.

Some of the leading players in the China high-performance ceramic coatings market are Bodycote Plc, Compagnie de Saint-Gobain SA, Linde plc, etc.

Linde plc is a leading industrial gas and engineering company that supplies a variety of industrial, process, and specialty gases. Its product range includes atmospheric gases like oxygen, nitrogen, and argon, as well as process gases such as carbon dioxide, helium, and hydrogen. Linde designs and builds gas production equipment and offers gas processing services across multiple industries, including healthcare, manufacturing, and aerospace. The company operates cryogenic air separation, hydrogen, and carbon dioxide plants across APAC, EMEA, and the Americas. Headquartered in Guildford, Surrey, United Kingdom, Linde plays a vital role in the global gas market.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product Type, Technology, and End-User |

| Countries Analyzed | China |

| Companies Analyzed | Bodycote Plc, Compagnie de Saint-Gobain SA, Linde plc, Zhejiang Rhitz New Material Technology Co Ltd, Anhui Sinograce Chemical Co Ltd |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- GOVERNMENT INITIATIVES IN SEMICONDUCTOR PRODUCTION PROPEL THE HIGH-PERFORMANCE CERAMIC COATINGS MARKET

- WIDESPREAD EXPANSION DRIVEN BY THE RISING DEMAND FOR HIGH-PERFORMANCE CERAMIC COATINGS IN DENTISTRY

MARKET DYNAMICS

- KEY DRIVERS

- SURGING DEMAND FOR AUTOMOBILES

- RISING AEROSPACE APPLICATIONS

- INCREASING USAGE IN MEDICAL DEVICES

- TECHNOLOGICAL ADVANCEMENTS

- KEY RESTRAINTS

- HIGH COST OF CERAMIC COATINGS

- ISSUES REGARDING THERMAL SPRAY PROCESS RELIABILITY AND CONSISTENCY

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS

- KEY MARKET TRENDS

- ADVANCEMENTS IN PLASMA SPRAY COATINGS

- RISING CONSCIOUSNESS OF ENVIRONMENTAL SUSTAINABILITY

- PESTLE ANALYSIS

- POLITICAL

- ECONOMICAL

- SOCIAL

- TECHNOLOGICAL

- LEGAL

- ENVIRONMENTAL

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTIONS

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS

- MANUFACTURERS AND PRODUCTION

- RESEARCH AND DEVELOPMENT

- DISTRIBUTION AND SUPPLY CHAIN

- INSTALLATION AND APPLICATION

MARKET BY PRODUCT TYPE

- OXIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NITRIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARBIDE COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OXIDE COATINGS

MARKET BY TECHNOLOGY

- THERMAL SPRAY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PHYSICAL VAPOR DEPOSITION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CHEMICAL VAPOR DEPOSITION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER TECHNOLOGIES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- THERMAL SPRAY

MARKET BY END-USER

- AUTOMOTIVE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AEROSPACE & DEFENSE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GENERAL INDUSTRIAL TOOLS & MACHINERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HEALTHCARE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AUTOMOTIVE

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- ANHUI SINOGRACE CHEMICAL CO LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- BODYCOTE PLC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- COMPAGNIE DE SAINT-GOBAIN SA

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- LINDE PLC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ZHEJIANG RHITZ NEW MATERIAL TECHNOLOGY CO LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ANHUI SINOGRACE CHEMICAL CO LTD

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – HIGH-PERFORMANCE CERAMIC COATINGS

TABLE 2: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY TECHNOLOGY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: LIST OF MERGERS & ACQUISITIONS

TABLE 9: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 10: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 4: MARKET MATURITY ANALYSIS

FIGURE 5: MARKET CONCENTRATION ANALYSIS

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2023

FIGURE 8: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OXIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 9: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY NITRIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 10: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY CARBIDE COATINGS, 2024-2032 (IN $ MILLION)

FIGURE 11: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY TECHNOLOGY, IN 2023

FIGURE 12: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY THERMAL SPRAY, 2024-2032 (IN $ MILLION)

FIGURE 13: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY PHYSICAL VAPOR DEPOSITION, 2024-2032 (IN $ MILLION)

FIGURE 14: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY CHEMICAL VAPOR DEPOSITION, 2024-2032 (IN $ MILLION)

FIGURE 15: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OTHER TECHNOLOGIES, 2024-2032 (IN $ MILLION)

FIGURE 16: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 17: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY AUTOMOTIVE, 2024-2032 (IN $ MILLION)

FIGURE 18: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY AEROSPACE & DEFENSE, 2024-2032 (IN $ MILLION)

FIGURE 19: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY GENERAL INDUSTRIAL TOOLS & MACHINERY, 2024-2032 (IN $ MILLION)

FIGURE 20: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY HEALTHCARE, 2024-2032 (IN $ MILLION)

FIGURE 21: CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET, BY OTHER END-USERS, 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

BRAZIL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032