GLOBAL CARBON BLACK MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

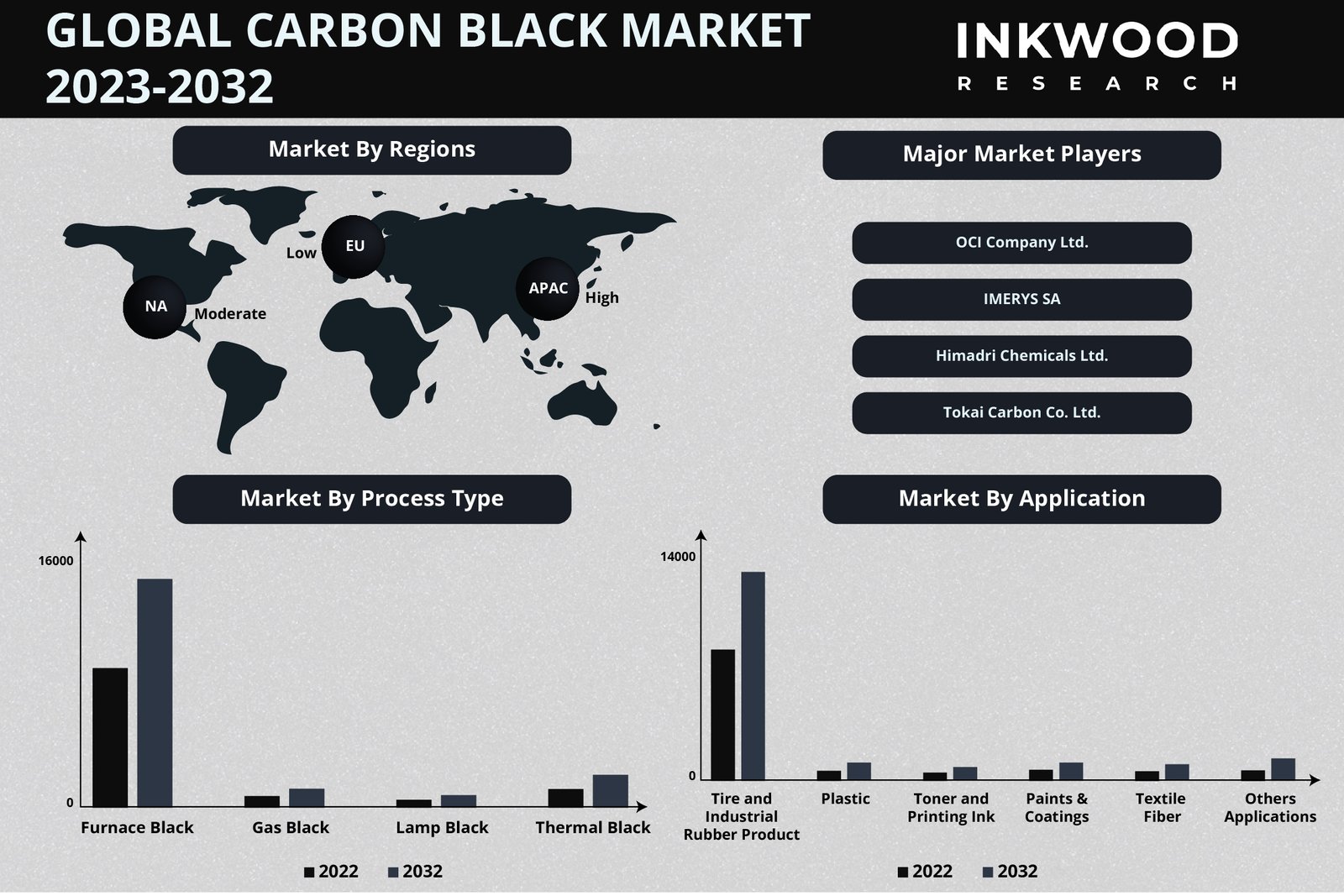

Global Carbon Black Market by Process Type (Furnace Black, Gas Black, Lamp Black, Thermal Black) Market by Application (Tires & Industrial Rubber Products, Plastics, Toners & Printing Inks, Paints & Coatings, Textile Fibers, Other Applications) by Geography

REPORTS » CHEMICALS AND MATERIALS » SPECIALTY MATERIALS » GLOBAL CARBON BLACK MARKET FORECAST 2023-2032

MARKET OVERVIEW

In terms of revenue, the global carbon black market was valued at $10874.67 million in 2022 and is expected to reach $17990.52 million by 2032, growing at a CAGR of 5.14% during the forecast years, 2023 to 2032.

A commercial form of solid carbon, known as carbon black, is produced using tightly regulated methods to create specially engineered aggregates of carbon particles. They differ in shape, size, porosity, and surface chemistry. With only trace amounts of oxygen, hydrogen, and nitrogen, carbon black usually contains more than 95% pure carbon. Carbon black is produced as particles with sizes ranging from 10 nm to roughly 500 nm during the production process. These combine to form chain-like aggregates that determine the structure of individual carbon black grades.

A wide range of compounds utilizes carbon black to improve their optical, electrical, and physical characteristics. In addition to providing reinforcement, carbon black enhances conductivity, resilience, and other physical qualities. In tire components, such as treads, inner liners, and mechanical rubber goods, including industrial rubber goods, automotive rubber parts, membrane roofing, and general rubber goods, carbon black is the most commonly used and economically advantageous rubber reinforcing agent.

Read our latest blog on the Carbon Black Market

GROWTH ENABLERS

Key growth enablers propelling the global carbon black market:

- Growing application of carbon black in the fiber & textile industry and other non-rubber applications

- As a coloring agent, carbon black is used in the production of synthetic textiles. For instance, it is used to color clothing and textiles made from denier polyester and nylon fibers since these materials require robust color performance.

- Additionally, carbon black is utilized in the production of coarse staple fibers, predominantly used to make woven blankets, floor coverings, and other textiles. The floor-covering market is also likely to gain from a large number of consumers looking for high-quality products.

- The global carbon black market is projected to expand as a result of the rise in disposable income, a booming housing sector, and the growing demand for luxury flooring solutions.

- Increasing market penetration of specialty carbon black

- Rising demand for wire & cable, pressure pipes, and construction materials

GROWTH RESTRAINTS

Key growth restraining factors:

- Increased usage of green tires

- Availability of substitutes

- Alternative solutions have emerged for carbon black in several applications. For example, carbon black being substituted by precipitated, shapeless silica as a reinforcing additive is becoming popular in the tire industry, especially in terms of formulating the compound for passenger and truck tire treads.

- Silica’s particular surface, as compared to that of carbon black, results in different dynamic properties when it reacts with elastomers.

- Silica’s application also plays a crucial role in enhancing the viscosity of the compound. Hence, the use of silica as a filler has continually been favored, coupled with using fluidity factors to augment process-ability and reinforcing properties.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Carbon Black Market | Key Market Trends

- Recovered carbon black (rCB) is a prominent element in correlation with the specialty carbon black market. The main objective of rCB is to transform rubber waste into valuable commercial products. Due to innovations and technological improvements, the pyrolysis process has become more efficient and environmentally friendly. Hence, such developments are set to boost the specialty carbon black market over the upcoming years.

- Specialty carbon black has been a frequently-used component in the production of black printing inks. Specialty carbon black surpasses other coloring and tinting elements in terms of effectiveness as well as resistance to light, temperature, and numerous chemical compounds. It also offers distinct functionality and dependability. Moreover, specialty carbon black for inks has been designed to fulfill application-specific needs and is produced to high specifications, as well.

MARKET SEGMENTATION

Market Segmentation – Process Type and Application – Market by Process Type:- Furnace Black

- The furnace type segment under the process type category is expected to grow with the highest CAGR during the forecasted period.

- The furnace black process is the most used technology in terms of producing carbon black, with more than 90% of the manufacturers using the same.

- The method generates carbon black by blowing coal oil or petroleum as raw material into high-temperature gases in order to partially combust them.

- It is available in various particle sizes and structures and widely used in industrial rubber production as a filler and pigment in plastics, inks, paints, and coatings.

- Gas Black

- Lamp Black

- Thermal Black

- Tires & Industrial Rubber Products

-

- The tires & industrial rubber products segment is set to dominate the application category over the projection period.

-

- Carbon black is used in the tires of vehicles as a filler and as a strengthening reinforcing agent.

-

- Carbon black is one of the reinforcements that is frequently used in the tire industry, owing to its effect on the mechanical and dynamic properties of tires.

-

- It is also used in various formulations with different rubber types to customize the performance properties of tires. In this regard, carbon black is mainly required in the inner liners, carcasses, and sidewalls.

-

- Furthermore, with a heat-dissipation potential when added to rubber compounds, it also enhances handling, fuel mileage, and tread wear, in addition to providing abrasion resistance.

- Plastics

- Toners & Printing Inks

- Textile Fibers

- Other Applications

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- The Asia-Pacific carbon black market is projected to grow with the highest CAGR over the forecasting years.

- Since China accounts for a greater share of the carbon black production and capacity globally, demand-supply imbalances in the nation can affect domestic players’ market share and performance.

- On the other hand, China generates carbon black predominantly through the Carbon Black Oil (CBO)/Coal Tar pathway, characterized by higher pricing than CBFS.

- Furthermore, carbon black costs have risen in China due to plant closures resulting from the country’s government’s aggressive environmental protection program.

- In addition to contributing to nearly 33% of the global carbon black production capacity, China is also the largest global exporter of carbon black. While the primary carbon black feedstock includes coal tar, other carbon black feedstock includes slurry oil and ethylene tar.

- The prices of carbon black in China surged in 2018 and 2019 due to a shortage of supply amidst large-scale plant shutdowns. This was mainly accredited to the Chinese government’s intensifying campaign for environmental protection. Furthermore, the prices of carbon black in China reached their peak in May 2021.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players operating in the global carbon black market:

- Aditya Birla Group

- Cabot Corporation

- Tokai Carbon Co Ltd

- Imersys Graphite & Carbon

- Mitsubishi Chemical Corporation

- OCI Company Ltd

Key strategies adopted by some of these companies:

- In November 2022, Cabot Corporation launched its new LITX® 93 series of conductive carbon additives (CCA) used in lithium-ion batteries for energy storage applications, electric vehicles, as well as consumer electronics.

- Klean Industries Inc, in November 2022, partnered with City Circle Group to construct a fully-integrated, continuous tire pyrolysis plant for the recovery of carbon black as well as biofuel in Melbourne, Australia.

- Orion Engineered Carbons introduced ECORAX® Nature – the first renewable carbon black for the tire industry in June 2021, made from industrial-grade renewable plant-based oils.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Process Type and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Aditya Birla Group, Cabot Corporation, Tokai Carbon Co Ltd, Imerys Graphite & Carbon, Mitsubishi Chemical Corporation, OCI Company Ltd, Epsilon Carbon Private Limited, International CSRC Investments Holdings Co Ltd, OMSK Carbon Group, Orion Engineered Carbons SA |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- FURNACE BLACK IS THE MOST USED TECHNOLOGY

- TIRES & INDUSTRIAL RUBBER PRODUCTS IS THE LARGEST APPLICATION

- CHINA ACCOUNTS FOR THE HIGHEST MARKET SHARE IN THE WORLD’S CARBON BLACK CAPACITY AND PRODUCTION

MARKET DYNAMICS

- KEY DRIVERS

- GROWING APPLICATION OF CARBON BLACK IN THE FIBER & TEXTILE INDUSTRY AND OTHER NON-RUBBER APPLICATIONS

- SPECIALTY CARBON BLACK’S INCREASING MARKET PENETRATION

- RISING DEMAND FOR WIRE & CABLE, PRESSURE PIPES, AND CONSTRUCTION MATERIALS

- KEY RESTRAINTS

- INCREASED USAGE OF GREEN TIRES

- AVAILABILITY OF SUBSTITUTES

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- TRADE ANALYSIS

- CARBON BLACK IMPORT, BY TOP 5 COUNTRIES, 2016-2021

- CARBON BLACK EXPORT, BY TOP 5 COUNTRIES, 2016-2021

MARKET BY PROCESS TYPE

- FURNACE BLACK

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GAS BLACK

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- LAMP BLACK

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- THERMAL BLACK

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FURNACE BLACK

MARKET BY APPLICATION

- TIRES & INDUSTRIAL RUBBER PRODUCTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PLASTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TONERS & PRINTING INKS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PAINTS & COATINGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TEXTILE FIBERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TIRES & INDUSTRIAL RUBBER PRODUCTS

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA CARBON BLACK MARKET DRIVERS

- NORTH AMERICA CARBON BLACK MARKET CHALLENGES

- NORTH AMERICA CARBON BLACK MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA CARBON BLACK MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES CARBON BLACK MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE CARBON BLACK MARKET DRIVERS

- EUROPE CARBON BLACK MARKET CHALLENGES

- EUROPE CARBON BLACK MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE CARBON BLACK MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM CARBON BLACK MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY CARBON BLACK MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE CARBON BLACK MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY CARBON BLACK MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN CARBON BLACK MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM CARBON BLACK MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND CARBON BLACK MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE CARBON BLACK MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET ESTIMATES & SIZES

- ASIA-PACIFIC CARBON BLACK MARKET DRIVERS

- ASIA-PACIFIC CARBON BLACK MARKET CHALLENGES

- ASIA-PACIFIC CARBON BLACK MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC CARBON BLACK MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN CARBON BLACK MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND CARBON BLACK MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM CARBON BLACK MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND CARBON BLACK MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC CARBON BLACK MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET ESTIMATES & SIZES

- REST OF WORLD CARBON BLACK MARKET DRIVERS

- REST OF WORLD CARBON BLACK MARKET CHALLENGES

- REST OF WORLD CARBON BLACK MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD CARBON BLACK MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA CARBON BLACK MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ADITYA BIRLA GROUP

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- CABOT CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- EPSILON CARBON PRIVATE LIMITED

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- IMERYS GRAPHITE & CARBON

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- INTERNATIONAL CSRC INVESTMENTS HOLDINGS CO LTD

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- MITSUBISHI CHEMICAL CORPORATION

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- OCI COMPANY LTD

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- OMSK CARBON GROUP

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ORION ENGINEERED CARBONS SA

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- TOKAI CARBON CO LTD

- COMPANY OVERVIEW

- PRODUCTS / SERVICES LIST

- STRENGTHS & CHALLENGES

- ADITYA BIRLA GROUP

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – CARBON BLACK

TABLE 2: CARBON BLACK MANUFACTURING METHOD AND RAW MATERIAL REQUIRED

TABLE 3: GLOBAL CARBON BLACK MARKET, BY PROCESS TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL CARBON BLACK MARKET, BY PROCESS TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 5: GLOBAL FURNACE BLACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL FURNACE BLACK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 7: GLOBAL GAS BLACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL GAS BLACK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 9: GLOBAL LAMP BLACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL LAMP BLACK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 11: GLOBAL THERMAL BLACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL THERMAL BLACK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 13: GLOBAL CARBON BLACK MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL CARBON BLACK MARKET, BY APPLICATION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 15: GLOBAL TIRES & INDUSTRIAL RUBBER PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 16: GLOBAL TIRES & INDUSTRIAL RUBBER PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 17: GLOBAL PLASTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL PLASTICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 19: GLOBAL TONERS & PRINTING INKS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL TONERS & PRINTING INKS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 21: GLOBAL PAINTS & COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL PAINTS & COATINGS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 23: GLOBAL TEXTILE FIBERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL TEXTILE FIBERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 25: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 27: GLOBAL CARBON BLACK MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL CARBON BLACK MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 29: NORTH AMERICA CARBON BLACK MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: NORTH AMERICA CARBON BLACK MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 31: NORTH AMERICA CARBON BLACK MARKET REGULATORY FRAMEWORK

TABLE 32: KEY PLAYERS OPERATING IN NORTH AMERICA CARBON BLACK MARKET

TABLE 33: EUROPE CARBON BLACK MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 34: EUROPE CARBON BLACK MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 35: EUROPE CARBON BLACK MARKET REGULATORY FRAMEWORK

TABLE 36: KEY PLAYERS OPERATING IN EUROPE CARBON BLACK MARKET

TABLE 37: ASIA-PACIFIC CARBON BLACK MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 38: ASIA-PACIFIC CARBON BLACK MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 39: ASIA-PACIFIC CARBON BLACK MARKET REGULATORY FRAMEWORK

TABLE 40: KEY PLAYERS OPERATING IN ASIA-PACIFIC CARBON BLACK MARKET

TABLE 41: REST OF WORLD CARBON BLACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 42: REST OF WORLD CARBON BLACK MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 43: REST OF WORLD CARBON BLACK MARKET REGULATORY FRAMEWORK

TABLE 44: KEY PLAYERS OPERATING IN REST OF WORLD CARBON BLACK MARKET

TABLE 45: LIST OF MERGERS & ACQUISITIONS

TABLE 46: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 47: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 48: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: CARBON BLACK IMPORT, BY TOP 5 COUNTRIES, 2016-2021 (IN KILO METRIC TONS)

FIGURE 11: CARBON BLACK EXPORT, BY TOP 5 COUNTRIES, 2016-2021 (IN KILO METRIC TONS)

FIGURE 12: GLOBAL CARBON BLACK MARKET, GROWTH POTENTIAL, BY PROCESS TYPE, IN 2022

FIGURE 13: GLOBAL CARBON BLACK MARKET, BY FURNACE BLACK, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL CARBON BLACK MARKET, BY GAS BLACK, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL CARBON BLACK MARKET, BY LAMP BLACK, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL CARBON BLACK MARKET, BY THERMAL BLACK, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL CARBON BLACK MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2022

FIGURE 18: GLOBAL CARBON BLACK MARKET, BY TIRES & INDUSTRIAL RUBBER PRODUCTS, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL CARBON BLACK MARKET, BY PLASTICS, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL CARBON BLACK MARKET, BY TONERS & PRINTING INKS, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL CARBON BLACK MARKET, BY PAINTS & COATINGS, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL CARBON BLACK MARKET, BY TEXTILE FIBERS, 2023-2032 (IN $ MILLION)

FIGURE 23: GLOBAL CARBON BLACK MARKET, BY OTHER APPLICATIONS, 2023-2032 (IN $ MILLION)

FIGURE 24: NORTH AMERICA CARBON BLACK MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 25: UNITED STATES CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 26: CANADA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: EUROPE CARBON BLACK MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 28: UNITED KINGDOM CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: GERMANY CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: FRANCE CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: ITALY CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: SPAIN CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: BELGIUM CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: POLAND CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: REST OF EUROPE CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: ASIA-PACIFIC CARBON BLACK MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 37: CHINA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: JAPAN CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: INDIA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: SOUTH KOREA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: INDONESIA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: THAILAND CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: VIETNAM CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: AUSTRALIA & NEW ZEALAND CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: REST OF ASIA-PACIFIC CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: REST OF WORLD CARBON BLACK MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 47: LATIN AMERICA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FIGURE 48: MIDDLE EAST & AFRICA CARBON BLACK MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

The furnace black segment under the process type category dominated the global carbon black market with a revenue share of nearly 78% and a value of $8577.13 million in 2022.

Rising research activities for the improvement of dispersibility as well as higher viscosity of specialty carbon black, recovered carbon black’s emergence, and the growing demand for carbon black for packaging and printing inks are the key market trends set to drive the global carbon black market growth during the forecast period.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032