CANADA SURGICAL SITE INFECTION CONTROL MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

Canada Surgical Site Infection Control Market by Procedure (Laparoscopy, Orthopedic Surgery, Cardiovascular, Obstetrics and Gynecology, Wound Closure, Plastic & Reconstructive Surgery, Thoracic Surgery, Microvascular, Urology, Neurosurgery, Other Procedures) Market by Type of Infection (Superficial Incisional SSI, Deep Incisional SSI, Organ or Space SSI) Market by End-user (Hospitals, Ambulatory Surgical Centers) Market by Product (Disinfectants, Manual Reprocessors Solutions, Surgical Drapes, Surgical Gloves, Skin Preparation Solutions, Surgical Irrigation, Surgical Scrubs, Hair Clippers, Medical Nonwovens, Other Products)

REPORTS » HEALTHCARE » MEDICAL DEVICES » CANADA SURGICAL SITE INFECTION CONTROL MARKET FORECAST 2024-2032

MARKET OVERVIEW

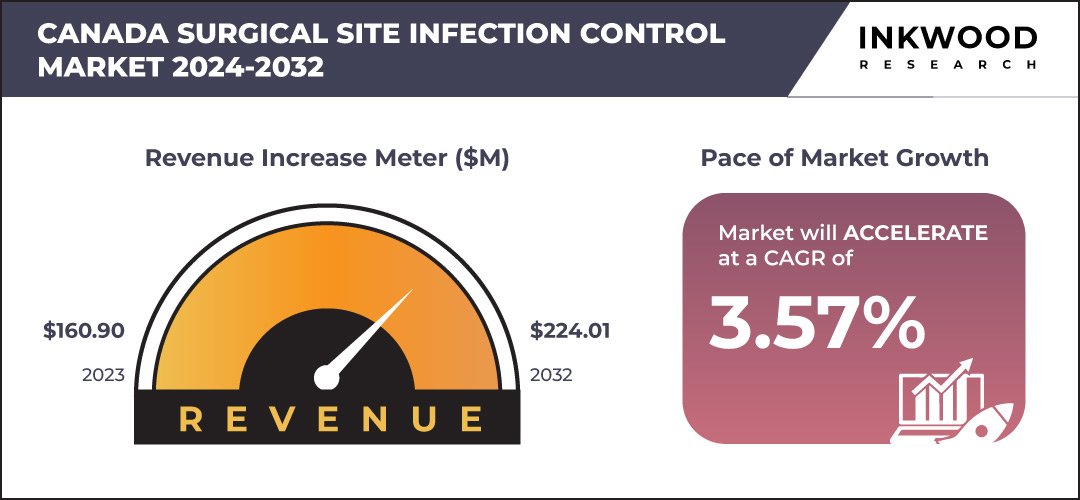

The Canada surgical site infection control market is estimated to rise with a CAGR of 3.57% during the forecasting period of 2024-2032. The Canada surgical site infection control market is driven by the increasing prevalence of surgical site infections (SSIs) and the resulting emphasis on patient safety and infection prevention.

Key factors include advancements in aseptic techniques, government initiatives, and the implementation of standardized SSI surveillance systems to monitor and reduce infection rates. Additionally, the rising number of surgeries, particularly among the aging population, and the focus on improving healthcare outcomes are boosting the demand for SSI control products and solutions in Canada.

The Canadian healthcare system continues to face significant challenges associated with surgical site infections (SSIs). In fact, according to the Canadian Patient Safety Institute (CPSI), SSIs are the most common type of healthcare-associated infection among surgical patients, with infections linked to 77% of patient deaths in this group. Despite advancements in aseptic techniques, antibiotic prophylaxis, and minimally invasive surgical procedures, healthcare-associated infections (HAIs) remain a persistent issue, complicating the recovery of many surgical patients.

To Know More About This Report, Request a Free Sample Copy

The Centers for Disease Control (CDC) highlights that while there have been improvements in infection control practices, including enhanced operating room ventilation and sterilization methods, SSIs still contribute substantially to morbidity, prolonged hospital stays, and mortality in Canada. In response to these challenges, the ‘Safer Healthcare Now!’ initiative introduced the SSI Getting Started Kit in 2005, aimed at promoting standardized SSI prevention processes across healthcare facilities.

Since its introduction, 145 healthcare organizations throughout Canada have self-reported data on SSI prevention measures. This initiative has played a key role in improving surgical care safety, leading to a notable decline in SSI rates for clean and clean-contaminated surgeries from 2005 to 2021. These ongoing prevention efforts are a major driver of the SSI control market in Canada, as healthcare providers continue to prioritize infection prevention and patient safety to achieve better surgical outcomes.

The Canada Surgical Site Infection Control Market: 3.57% CAGR (2024-2032)

Need a custom report or have specific data requirements? Let us know!

Need a custom report or have specific data requirements? Let us know!

The Canada surgical site infection control market segmentation includes procedure, type of infection, end-user, and product. The end-user segment is further classified into hospitals and ambulatory surgical centers. Surgical site infections (SSIs) account for approximately 15% of all hospital-acquired infections and are the most prevalent type of nosocomial infection among surgical patients. These infections significantly impact patient outcomes, leading to extended postoperative hospital stays, increased healthcare costs, higher rates of hospital readmission, and compromised health outcomes.

Hospitals play a crucial role as a key end-user segment in the surgical site infection control market, given their responsibility for patient care and infection prevention. As primary centers for surgical procedures, hospitals are heavily invested in implementing comprehensive infection control measures, including the adoption of advanced antiseptics, wound care products, and infection monitoring systems. The increasing focus on patient safety, adherence to stringent healthcare regulations, and the rising number of surgeries performed are driving hospitals to prioritize effective SSI prevention strategies, thereby fueling the demand for SSI control products and solutions in this segment.

Some of the prominent companies operating in the Canada surgical site infection control market are 3M Company, Ansell Ltd, Becton, Dickinson and Company (BD), etc.

Ansell is a leading global provider of protection solutions, specializing in the design, development, and manufacturing of a wide range of products, including surgical and examination gloves, industrial and household gloves, protective clothing, and condoms. The company operates through four key business segments: industrial, medical, single-use, and sexual wellness.

With a primary focus on safety, Ansell aims to deliver advanced solutions and technologies to address the challenges faced by industrial workers and healthcare professionals, ensuring their safety and protection in both professional and personal settings. Ansell has established a strong global presence, with offices and manufacturing facilities in 52 countries worldwide. The company provides protection solutions to both industrial and healthcare sectors, emphasizing innovation and value-added services to enhance its offerings.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Procedure, Type of Infection, End-User, and Product |

| Countries Analyzed | Canada |

| Companies Analyzed | 3M Company, Ansell Ltd, Becton, Dickinson and Company (BD), Johnson & Johnson, Kimberly-Clark |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- HIGH EMPHASIS ON ENVIRONMENTAL HYGIENE BOOSTS THE SSI CONTROL MARKET

- DISPOSABLE AND SINGLE-USE PRODUCTS ARE SHAPING THE SURGICAL INFECTION CONTROL LANDSCAPE

MARKET DYNAMICS

- KEY DRIVERS

- SURGE IN GERIATRIC POPULATION

- INCREASED INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS

- IMPLEMENTATION OF REGULATORY GUIDELINES FOR THE PREVENTION OF HOSPITAL-ACQUIRED INFECTIONS

- KEY RESTRAINTS

- LACK OF AWARENESS ASSOCIATED WITH HOSPITAL-ACQUIRED INFECTIONS

- SURGING MEDICAL WASTE DUE TO THE USE OF MEDICAL DISPOSABLE ITEMS

- RISING USE OF OUTPATIENT TREATMENTS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- RISING RATE OF SURGICAL PROCEDURES

- EXPANSION OF MINIMALLY INVASIVE AND OUTPATIENT SURGICAL PRACTICES

- ADVANCEMENTS IN TECHNOLOGY FOR PREVENTING SURGICAL SITE INFECTIONS

- PESTLE ANALYSIS

- POLITICAL

- ECONOMICAL

- SOCIAL

- TECHNOLOGICAL

- LEGAL

- ENVIRONMENTAL

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTIONS

- NEW ENTRANTS

- INDUSTRY RIVALRY

- MARKET CONCENTRATION ANALYSIS

- KEY MARKET TRENDS

MARKET BY PROCEDURE

- LAPAROSCOPY

- ORTHOPEDIC SURGERY

- CARDIOVASCULAR

- OBSTETRICS AND GYNECOLOGY

- WOUND CLOSURE

- PLASTIC & RECONSTRUCTIVE SURGERY

- THORACIC SURGERY

- MICROVASCULAR

- UROLOGY

- NEUROSURGERY

- OTHER PROCEDURES

MARKET BY TYPE OF INFECTION

- SUPERFICIAL INCISIONAL SSI

- DEEP INCISIONAL SSI

- ORGAN OR SPACE SSI

MARKET BY END-USER

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

MARKET BY PRODUCT

- DISINFECTANTS

- SKIN DISINFECTANTS

- HAND DISINFECTANTS

- MANUAL REPROCESSORS SOLUTIONS

- SURGICAL DRAPES

- SURGICAL GLOVES

- SKIN PREPARATION SOLUTIONS

- SURGICAL IRRIGATION

- SURGICAL SCRUBS

- HAIR CLIPPERS

- MEDICAL NONWOVENS

- OTHER PRODUCTS

- DISINFECTANTS

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- 3M COMPANY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ANSELL LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- BECTON, DICKINSON AND COMPANY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- JOHNSON & JOHNSON

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KIMBERLY-CLARK

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- 3M COMPANY

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SURGICAL SITE INFECTION CONTROL

TABLE 2: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY PROCEDURE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY PROCEDURE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY TYPE OF INFECTION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY TYPE OF INFECTION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY PRODUCT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: LIST OF MERGERS & ACQUISITIONS

TABLE 11: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 12: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: MARKET CONCENTRATION ANALYSIS

FIGURE 4: CANADA SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY PROCEDURE, IN 2023

FIGURE 5: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY LAPAROSCOPY, 2024-2032 (IN $ MILLION)

FIGURE 6: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY ORTHOPEDIC SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 7: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY CARDIOVASCULAR, 2024-2032 (IN $ MILLION)

FIGURE 8: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY OBSTETRICS AND GYNECOLOGY, 2024-2032 (IN $ MILLION)

FIGURE 9: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY WOUND CLOSURE, 2024-2032 (IN $ MILLION)

FIGURE 10: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY PLASTIC & RECONSTRUCTIVE SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 11: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY THORACIC SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 12: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY MICROVASCULAR, 2024-2032 (IN $ MILLION)

FIGURE 13: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY UROLOGY, 2024-2032 (IN $ MILLION)

FIGURE 14: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY NEUROSURGERY, 2024-2032 (IN $ MILLION)

FIGURE 15: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY OTHER PROCEDURES, 2024-2032 (IN $ MILLION)

FIGURE 16: CANADA SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY TYPE OF INFECTION, IN 2023

FIGURE 17: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SUPERFICIAL INCISIONAL SSI, 2024-2032 (IN $ MILLION)

FIGURE 18: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY DEEP INCISIONAL SSI, 2024-2032 (IN $ MILLION)

FIGURE 19: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY ORGAN OR SPACE SSI, 2024-2032 (IN $ MILLION)

FIGURE 20: CANADA SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 21: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY HOSPITALS, 2024-2032 (IN $ MILLION)

FIGURE 22: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY AMBULATORY SURGICAL CENTERS, 2024-2032 (IN $ MILLION)

FIGURE 23: CANADA SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2023

FIGURE 24: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 25: CANADA SURGICAL SITE INFECTION CONTROL MARKET, GROWTH POTENTIAL, BY DISINFECTANTS, IN 2023

FIGURE 26: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SKIN DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 27: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY HAND DISINFECTANTS, 2024-2032 (IN $ MILLION)

FIGURE 28: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY MANUAL REPROCESSORS SOLUTION, 2024-2032 (IN $ MILLION)

FIGURE 29: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL DRAPES, 2024-2032 (IN $ MILLION)

FIGURE 30: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL GLOVES, 2024-2032 (IN $ MILLION)

FIGURE 31: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SKIN PREPARATION SOLUTIONS, 2024-2032 (IN $ MILLION)

FIGURE 32: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL IRRIGATION, 2024-2032 (IN $ MILLION)

FIGURE 33: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY SURGICAL SCRUBS, 2024-2032 (IN $ MILLION)

FIGURE 34: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY HAIR CLIPPERS, 2024-2032 (IN $ MILLION)

FIGURE 35: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY MEDICAL NONWOVENS, 2024-2032 (IN $ MILLION)

FIGURE 36: CANADA SURGICAL SITE INFECTION CONTROL MARKET, BY OTHER PRODUCTS, 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

INDIA WIND ENERGY MARKET FORECAST 2025-2032

-

INDIA SOLAR ENERGY MARKET FORECAST 2025-2032

-

INDIA GREEN HYDROGEN MARKET FORECAST 2025-2032

-

INDIA GREEN BUILDING MATERIAL MARKET FORECAST 2025-2032

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

BRAZIL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032