CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

Canada Enterprise Resource Planning (ERP) Market by Deployment (On-premise, Cloud, Hybrid) Market by Enterprise Size (Large Enterprises, Medium Enterprises, Small Enterprises) Market by Business Function (Finance, Human Resource, Supply Chain, Customer Management, Inventory Management, Manufacturing Module, Other Business Functions) Market by End-user (Automotive, Retail, Manufacturing, BFSI, Government, IT and Telecom, Healthcare, Military and Defense, Other End-users)

REPORTS » INFORMATION TECHNOLOGY » ENTERPRISE SOLUTION » CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET FORECAST 2024-2032

MARKET OVERVIEW

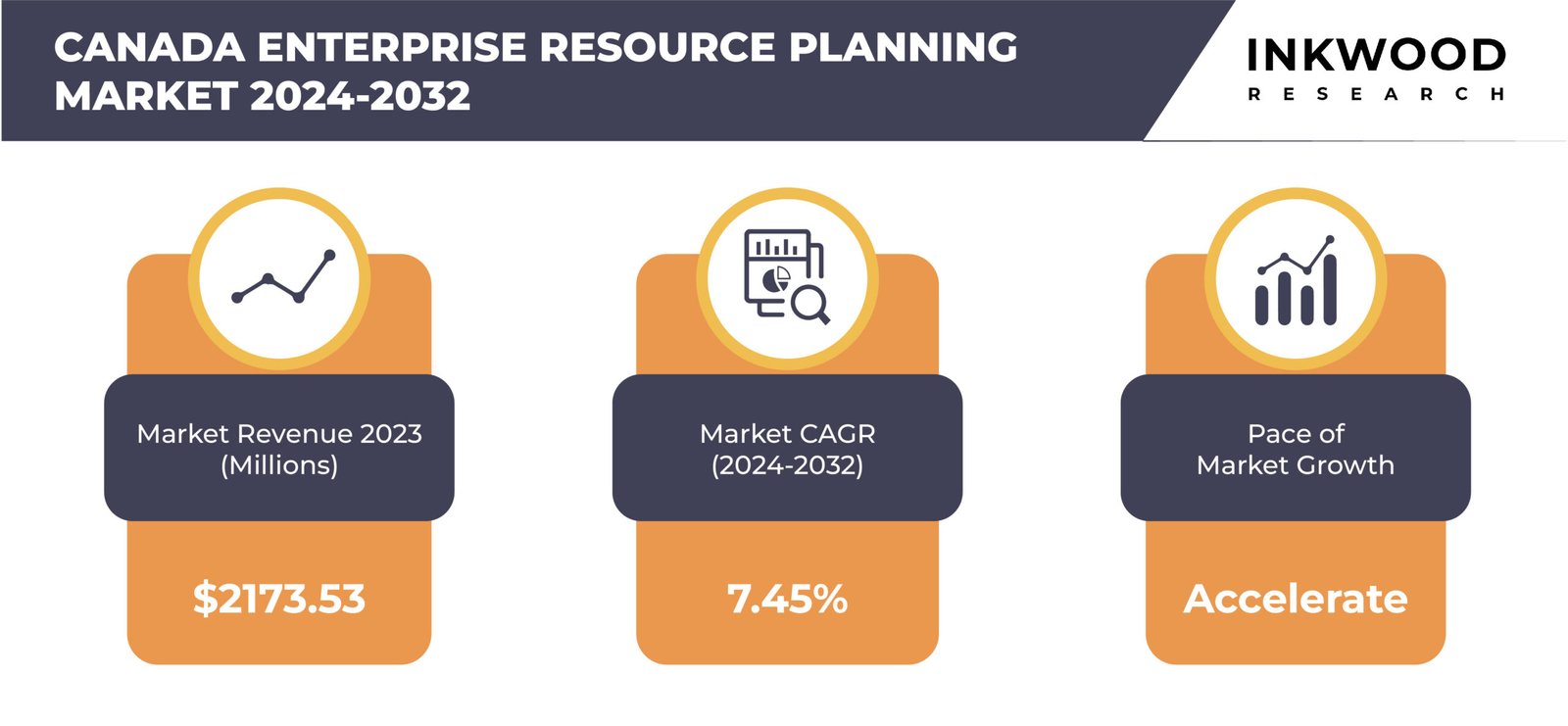

The Canada enterprise resource planning (ERP) market is predicted to rise with a CAGR of 7.45% during the forecasted period. The base year considered for the studied market is 2023, and the projection years are from 2024 to 2032.

Canada’s enterprise resource planning (ERP) market is witnessing substantial growth driven by the increasing need for continuous improvement and operational efficiency across companies. The integration of ERP systems allows for real-time monitoring and management of various business functions, reducing redundancies, minimizing errors, and improving overall efficiency.

Another key driver propelling the Canadian ERP market is the rising emphasis on competitive strategies and real-time decision-making. In an increasingly dynamic and competitive business environment, organizations require accurate and timely information to make informed decisions. ERP systems, in this regard, provide a unified platform that consolidates data from different departments, enabling managers to access critical insights and analytics.

To Know More About This Report, Request a Free Sample Copy

This capability supports strategic planning, resource allocation, and performance tracking, empowering businesses to implement effective competitive strategies and respond swiftly to changing market conditions. Consequently, the ability to make data-driven decisions in real-time is becoming a pivotal factor for businesses seeking to achieve and sustain competitive advantage.

Furthermore, the rapid adoption of cloud-based ERP solutions is also significantly influencing the country’s market. Cloud-based ERP offers several advantages over traditional on-premises systems, including scalability, cost-efficiency, and accessibility. These solutions allow businesses to leverage ERP functionalities without the need for substantial upfront investments in hardware and infrastructure. Additionally, cloud-based ERP systems facilitate seamless updates and maintenance, ensuring that businesses always have access to the latest features and security enhancements. The flexibility and scalability of cloud-based solutions make them particularly attractive to small and medium-sized enterprises (SMEs) in Canada seeking to expand their capabilities without incurring significant costs.

Canada Enterprise Resource Planning (ERP) Market: 7.45% CAGR (2024-2032)

Need a custom report or have specific data requirements? Let us know!

Need a custom report or have specific data requirements? Let us know!

The Canada enterprise resource planning (ERP) market is segmented into deployment, enterprise size, business function, and end-user. The business function segment is further categorized into finance, human resource (HR), supply chain, customer management, inventory management, manufacturing module, and other business functions.

Accounting modules within ERP systems offer essential functionalities such as accounts payable, accounts receivable, general ledger, bank reconciliation, fixed asset tracking, and expense management. In many organizations, the finance department has adopted ERP software to maintain precision and reliability. Integrating financial functions like payment management and accounting is crucial to prevent communication gaps. The finance module, in this regard, aids organizations in making critical financial decisions by managing cash inflows and outflows.

Moreover, ERP systems integrated in fiscal systems facilitate uniform data tracking, allowing multiple users to work on different entries simultaneously within the same accounting package. Implementing financial ERP modules helps organizations reduce complexity in economic functions and achieve overall business efficiency. Additionally, these modules enhance the transparency of financial systems, a significant driver for their adoption.

The top players operating in the Canada enterprise resource planning (ERP) market include SAP SE, Syspro (PTY) Ltd, The Sage Group PLC, Unit4, Workday Inc, etc.

Industrial and Financial Systems (IFS) AB, headquartered in Sweden, is a multinational enterprise software company specializing in developing and supplying component-based business applications and software support services. The company’s offerings include IFS Applications, enterprise service management (ESM), enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), IFS Maintenix, governance, enterprise asset management (EAM), and risk and compliance (GRC).

The company serves a diverse range of industries, including aviation and defense, engineering, construction and infrastructure, energy and utilities, oil and gas, retail, service providers, automotive, and process manufacturing. Its global operations span Canada, Africa, Brazil, India, Indonesia, Malaysia, Argentina, Australia, Austria, Denmark, Finland, France, Germany, and other countries.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Deployment, Enterprise Size, Business Function, and End-User |

| Countries Analyzed | Canada |

| Companies Analyzed | Epicor Software Corporation, Industrial and Financial Systems (IFS) AB, Infor Inc, International Business Machines Corporation (IBM), Microsoft Corporation, Oracle Corporation, Ramco Systems Ltd (RSL), SAP SE, Syspro (PTY) Ltd, The Sage Group PLC, Unit4, Workday Inc |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT- CANADA

- COUNTRY ANALYSIS- CANADA

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON THE ENTERPRISE RESOURCE PLANNING (ERP) MARKET

- MAJOR MARKET FINDINGS

- RAPID ADOPTION OF ERP SOLUTIONS ACROSS SEVERAL INDUSTRIES

- FOCUS ON DIGITAL TRANSFORMATION AND AUTOMATION

- MARKET IS CHARACTERISED BY VENDOR COMPETITIVENESS AND DIVERSE OFFERINGS

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING NEED FOR CONTINUOUS IMPROVEMENT AND OPERATIONAL EFFICIENCY IN BUSINESSES

- RISING EMPHASIS ON COMPETITIVE STRATEGIES AND REAL-TIME DECISION MAKING

- RAPID ADOPTION OF CLOUD-BASED ERP SOLUTIONS

- KEY RESTRAINTS

- HIGH COST OF ERP SOLUTIONS

- SURGE IN OPEN-SOURCE ERP VENDORS

- VULNERABILITIES IN ERP APPLICATIONS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- INTEGRATION OF ERP WITH ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING IS GAINING TRACTION

- SHIFT TOWARDS SUBSCRIPTION-BASED PRICING MODELS

- GROWING POPULARITY OF MOBILE ERP APPLICATIONS AND PLATFORMS

- SURGE IN DEMAND FOR INDUSTRY-SPECIFIC SOLUTIONS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING – CANADA

- KEY BUYING CRITERIA

- COMPATIBILITY

- COST-EFFECTIVENESS

- EASE OF USE

- SECURITY

- KEY MARKET TRENDS

MARKET BY DEPLOYMENT

- ON-PREMISE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- CLOUD

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- HYBRID

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- ON-PREMISE

MARKET BY ENTERPRISE SIZE

- LARGE ENTERPRISES

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- MEDIUM ENTERPRISES

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- SMALL ENTERPRISES

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- LARGE ENTERPRISES

MARKET BY BUSINESS FUNCTION

- FINANCE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- HUMAN RESOURCE (HR)

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- SUPPLY CHAIN

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- CUSTOMER MANAGEMENT

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- INVENTORY MANAGEMENT

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- MANUFACTURING MODULE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- OTHER BUSINESS FUNCTIONS

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- FINANCE

MARKET BY END-USER

- AUTOMOTIVE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- RETAIL

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- MANUFACTURING

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- GOVERNMENT

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- IT AND TELECOM

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- HEALTHCARE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- MILITARY AND DEFENSE

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENTATION ANALYSIS

- AUTOMOTIVE

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- EPICOR SOFTWARE CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- INDUSTRIAL AND FINANCIAL SYSTEMS (IFS) AB

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- INFOR INC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM)

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- MICROSOFT CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ORACLE CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- RAMCO SYSTEMS LIMITED (RSL)

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SAP SE

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SYSPRO (PTY) LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- THE SAGE GROUP PLC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- UNIT4

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- WORKDAY INC

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- EPICOR SOFTWARE CORPORATION

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ENTERPRISE RESOURCE PLANNING (ERP)

TABLE 2: DEVELOPMENT OF ENTERPRISE RESOURCE PLANNING (ERP)

TABLE 3: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY DEPLOYMENT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY DEPLOYMENT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 5: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY ENTERPRISE SIZE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY ENTERPRISE SIZE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 7: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY BUSINESS FUNCTION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY BUSINESS FUNCTION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 9: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 11: LIST OF MERGERS & ACQUISITIONS

TABLE 12: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 13: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 14: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING- CANADA

FIGURE 4: KEY BUYING CRITERIA

FIGURE 5: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, GROWTH POTENTIAL, BY DEPLOYMENT, IN 2023

FIGURE 6: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY ON-PREMISE, 2024-2032 (IN $ MILLION)

FIGURE 7: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY CLOUD, 2024-2032 (IN $ MILLION)

FIGURE 8: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY HYBRID, 2024-2032 (IN $ MILLION)

FIGURE 9: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, GROWTH POTENTIAL, BY ENTERPRISE SIZE, IN 2023

FIGURE 10: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY LARGE ENTERPRISES, 2024-2032 (IN $ MILLION)

FIGURE 11: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY MEDIUM ENTERPRISES, 2024-2032 (IN $ MILLION)

FIGURE 12: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY SMALL ENTERPRISES, 2024-2032 (IN $ MILLION)

FIGURE 13: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, GROWTH POTENTIAL, BY BUSINESS FUNCTION, IN 2023

FIGURE 14: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY FINANCE, 2024-2032 (IN $ MILLION)

FIGURE 15: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY HUMAN RESOURCE (HR), 2024-2032 (IN $ MILLION)

FIGURE 16: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY SUPPLY CHAIN, 2024-2032 (IN $ MILLION)

FIGURE 17: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY CUSTOMER MANAGEMENT, 2024-2032 (IN $ MILLION)

FIGURE 18: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY INVENTORY MANAGEMENT, 2024-2032 (IN $ MILLION)

FIGURE 19: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY MANUFACTURING MODULE, 2024-2032 (IN $ MILLION)

FIGURE 20: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY OTHER BUSINESS FUNCTIONS, 2024-2032 (IN $ MILLION)

FIGURE 21: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 22: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY AUTOMOTIVE, 2024-2032 (IN $ MILLION)

FIGURE 23: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY RETAIL, 2024-2032 (IN $ MILLION)

FIGURE 24: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY MANUFACTURING, 2024-2032 (IN $ MILLION)

FIGURE 25: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY BANKING, FINANCIAL SERVICES & INSURANCE (BFSI), 2024-2032 (IN $ MILLION)

FIGURE 26: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY GOVERNMENT, 2024-2032 (IN $ MILLION)

FIGURE 27: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY IT AND TELECOM, 2024-2032 (IN $ MILLION)

FIGURE 28: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY HEALTHCARE, 2024-2032 (IN $ MILLION)

FIGURE 29: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY MILITARY AND DEFENSE, 2024-2032 (IN $ MILLION)

FIGURE 30: CANADA ENTERPRISE RESOURCE PLANNING (ERP) MARKET, BY OTHER END-USERS, 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032

-

TAIWAN BABY DIAPER MARKET FORECAST 2025-2032

-

SOUTH AFRICA BABY DIAPER MARKET FORECAST 2025-2032

-

INDONESIA BABY DIAPER MARKET FORECAST 2025-2032

-

INDIA BABY DIAPER MARKET FORECAST 2025-2032

-

BRAZIL BABY DIAPER MARKET FORECAST 2025-2032

-

AUSTRALIA & NEW ZEALAND BABY DIAPER MARKET FORECAST 2025-2032

-

ALGERIA BABY DIAPER MARKET FORECAST 2025-2032