GLOBAL BIOABSORBABLE STENTS MARKET FORECAST 2017-2023

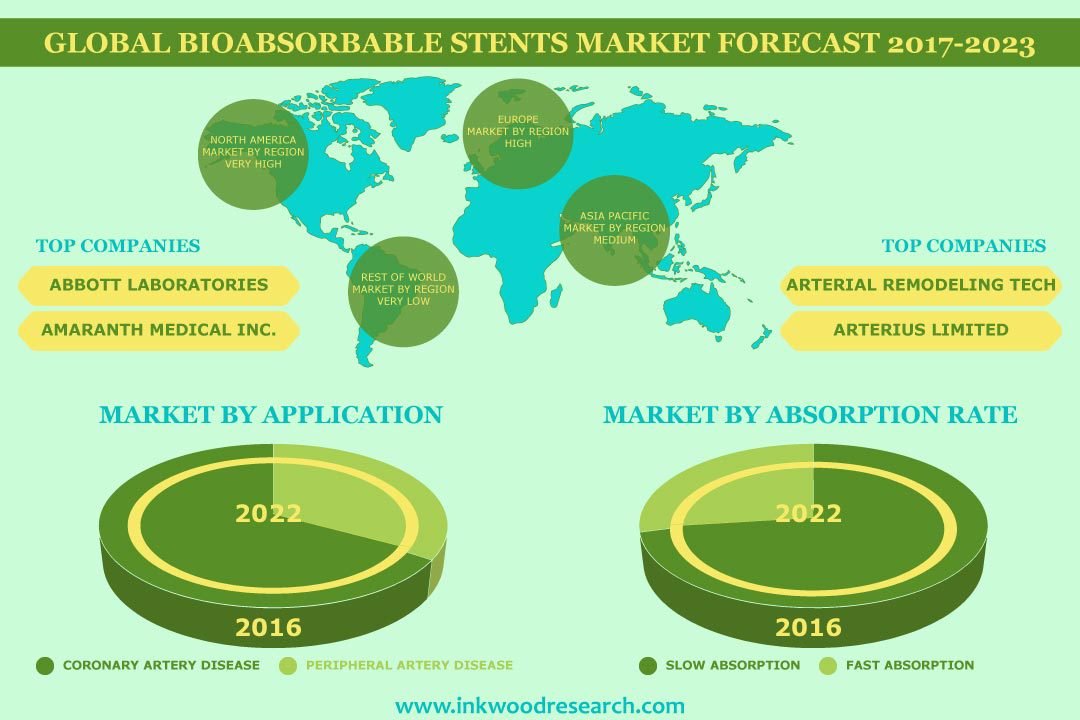

Bioabsorbable Stents Market by Absorption Rate (Slow Absorption Stents, Fast Absorption Stents) by Drugs (Paclitaxel, Limus Based Drugs) by Application (Coronary Artery Disease, Peripheral Artery Disease) by End Users (Hospitals, Cardiac Centers) by Materials (Polymeric Stents, Metallic Stents) & by Geography

The global bioabsorbable stent market is anticipated to grow from $ 251 million in 2016 to $689 million by 2025, at a CAGR of 11.86% between 2016 and 2025. The bioabsorbable stents are the devices inserted into the blood vessel or other internal duct that enlarges the vessel to check or alleviate a blockage. These stents are made up of materials may be absorbed or dissolved in the body. A large number of benefits provided by the bioabsorbable stents makes it beneficial over the earlier technologies present in the field. The bioabsorbable stent market is primarily driven by following factors:

- Rise in incidence of cardiac diseases

- Increasing risk of coronary artery & peripheral artery diseases in the elderly population

- Increasing number of heart failure and diabetes cases

- Strong product pipelines

- Rising technological advancements

- Increasing diabetic population

To learn more about this report, request a free sample copy

The important driver increasing growth in the global bioabsorbable stent market is the rising incidence of cardiac diseases worldwide, with cardiac arrests being the foremost reason of demise among entities aged 60 years and above. According to CDC, cardiac illnesses accounted for over 0.45 million death in the US each year. Hypertension is the most mutual motive for heart failure and is instigated due to an upsurge in the blood pressure in the arteries causes an imperative risk issue for various CVDs like stroke, CAD, heart failure, and PVD.

The Applications, materials and the drugs of bioabsorbable stent market are used extensively for various purposes. CAD is a cardiovascular condition in which a waxy substance called plaque builds up inside the coronary arteries. PAD is a disorder of blood circulation that causes the narrowing of blood vessels of the heart and the brain. Polymers have found wide applications in cardiology, specifically in coronary vascular intervention as scaffolds (stent platforms) and coating matrices for drug-eluting stents. Bioabsorbable metallic stents consist of either iron-based (Fe) or magnesium based alloys (Mg). Paclitaxel refers to a taxane derivative along with antiproliferative properties that makes it effective in treating coronary restenosis. Numerous members of litmus family are deployed as the drug component of eluting drug stents including zotarolimus, sirolimus, and everolimus.

Slow adoption rate and stringent government regulations are the major factors hindering the bioabsorbable stent market. Many stents under trial, slow approval from FDA and less commercial availability of the stent is impacting the recognition of the bioabsorbable stent market. Cost is also a major issue for the bioabsorbable stent market. Few complex issues associated with DES contain the length of clinical trials to define safety and the suitable dosage and period of attendant antiplatelet therapy. The FDA admits that DES are difficult products to produce and there are high safety issues in the stents.

The global bioabsorbable stent market segments include absorption rates, drugs, applications, end-users, and materials.

Absorption rates are segmented into:

- Slow absorption stents

- Fast absorption stents

Drugs are segmented into:

- Paclitaxel

- Limus based drugs

Applications are segmented into:

- Coronary artery disease

- Peripheral artery disease

End users are segmented into:

- Hospitals

- Cardiac centers

Materials are segmented into:

- Polymeric Stents

- Metallic Stents

This report covers the present market conditions and the growth prospects of the global bioabsorbable stent market for 2017-2025 and considered the revenue generated through the sales of the bioabsorbable stent for absorption rates, drugs, applications, end-users, and materials to calculate the market size considering 2016 as the base year.

Geographically, the global bioabsorbable stent market has been segmented on the basis of four major regions, which include:

- North America– Canada, United States & Mexico

- Asia-Pacific– India, Japan, China, South Korea & Rest of APAC

- Europe– UK, Spain, Germany, France, Italy & Rest of Europe

- Rest of World- the Middle East, Latin America, South Africa

The bioabsorbable stent market in Europe is expected to hold the largest share by 2025 possibilities of increased adoption of technologically advanced products. Also, the increase in coronary and peripheral procedures in Europe has increased the demand of bioabsorbable stents. Heart failure has affected 23 million people globally, and Europe accounts for 10 million of them. The market in the European countries is witnessing growth due to growing adoption of MI surgeries, which enables faster recovery. On the other hand, Asia-Pacific market is anticipated to the fastest-growing region for the bioabsorbable stent market. According to a survey by United Nation Population Fund, by 2050, one in four people in Asia Pacific will be over 60 years old. The population of the older people in the region will triple reaching 1.3 billion, with women constituting the majority of over 53%. Aging population will aid the growth of the market during the forecasted period.

The bioabsorbable stent market is segmented on the basis of absorption rates which is sub-divided into slow absorption stents and fast absorption stents. The end users segment is sub-divided into hospitals and cardiac centers. Slow absorption stents are designed to slowly release the drug to cure coronary diseases which require the long-term treatment. The fast absorption stents are being used to cure the coronary arterial diseases where the requirement of the stents is on the urgent basis, and the stents dissolve in less time. The sirolimus-eluting stents are made of stainless steel platform that is coated with a polymer, the 80% of the drug is out within the 30 days of the implants. Hospitals have the advanced medical infrastructure and trained professionals to cater to the needs of people. There is a rise in the use of bioabsorbable stents due to the increase in the number of cardiovascular procedures carried out at the hospitals. Cardiac centers refer to the specialized area where particularly cardiac disease patients are diagnosed & treated and cover all the aspects from imaging tests to the surgical procedures.

The major market players in the global bioabsorbable stent market are:

- ABBOTT LABORATORIES

- ARTERIAL REMODELING TECHNOLOGIES

- BOSTON SCIENTIFIC CORP.

- JOHNSON & JOHNSON

- MEDTRONIC INC

Company Profiles covers analysis of important players.

Abbott Laboratories (Abbott) is a US based company and is headquartered in Illinois. The company develops, manufactures, discovers, and sells a broad and diversified line of healthcare products and services. The Company’s products include pharmaceuticals, nutritional, diagnostics, and vascular products. Abbott markets its products worldwide through affiliates and distributors. Medtronic, Inc. (Medtronic) a US-based medical technology company headquartered in Minnesota. The companies generated a US$ 20,261 million revenue in 2015 and have 85000 employees that aids to full fill the mission and goals of the company. The company develops, manufacture and market a wide range of medical devices, therapies, and services used in the treatment of chronic conditions such as diabetes, vascular disease, neurological disorders, spinal conditions and heart disease.

Key Findings of the Global Bioabsorbable stent market:

- Bioabsorbable stents are used in a wide range of applications

- Growing incidence of CVDS

- Polymeric stents market is anticipated to grow at a faster rate

- Coronary artery disease holds the largest market share

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- BIOABSORBABLE STENTS ARE USED IN A WIDE RANGE OF APPLICATIONS

- GROWING INCIDENCE OF CVDS

- POLYMERIC STENTS MARKET IS ANTICIPATED TO GROW AT A FASTER RATE

- CORONARY ARTERY DISEASE HOLDS THE LARGEST MARKET SHARE

- MARKET DETERMINANTS

- MARKET DRIVERS

- RISE IN INCIDENCE OF CARDIAC DISEASES

- INCREASING RISK OF CORONARY ARTERY & PERIPHERAL ARTERY DISEASES IN THE ELDERLY POPULATION

- INCREASING NUMBER OF HEART FAILURE AND DIABETES CASES

- STRONG PRODUCT PIPELINES

- RISING TECHNOLOGICAL ADVANCEMENTS

- INCREASING DIABETIC POPULATION

- MARKET RESTRAINTS

- SLOW ADOPTION RATE

- STRINGENT GOVERNMENT REGULATIONS

- HIGH COST OF DEVICES

- MARKET OPPORTUNITIES

- RISING DEMAND FROM EMERGING ECONOMIES

- TARGET HIGH-RISK PATIENTS

- RISING HEALTHCARE EXPENDITURE IN THE EMERGING COUNTRIES

- MARKET CHALLENGES

- AVAILABILITY OF SUBSTITUTE

- INCREASING R&D ACTIVITIES FOR THE CELL TRANSPLANTATION TO TREAT THE HEART

- STRINGENT GUIDELINE FOR AUTHORIZATION OF DEVICES

- GROWING COMPETITION AMONG VENDORS

- MARKET DRIVERS

- MARKET SEGMENTATION

- MARKET BY ABSORPTION RATE 2017-2025

- SLOW ABSORPTION STENTS

- FAST ABSORPTION STENTS

- MARKET BY DRUGS 2017-2025

- PACLITAXEL

- LIMUS BASED DRUGS

- MARKET BY APPLICATION 2017-2025

- CORONARY ARTERY DISEASE

- PERIPHERAL ARTERY DISEASE

- MARKET BY END USERS 2017-2025

- HOSPITALS

- CARDIAC CENTERS

- MARKET BY MATERIALS 2017-2025

- POLYMERIC STENTS

- METALLIC STENTS

- MARKET BY ABSORPTION RATE 2017-2025

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- BARGAINING POWER OF SUPPLIERS

- COMPETITIVE RIVALRY BETWEEN EXISTING PLAYERS

- MERGERS AND ACQUISITIONS

- OPPORTUNITY MATRIX

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- UNITED KINGDOM

- FRANCE

- GERMANY

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- REST OF ASIA PACIFIC

- REST OF THE WORLD

- LATIN AMERICA

- MIDDLE EAST

- SOUTH AFRICA

- NORTH AMERICA

- COMPANY PROFILE

- ABBOTT LABORATORIES

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- AMARANTH MEDICAL INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- ARTERIAL REMODELING TECHNOLOGIES

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- ARTERIUS LIMITED

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- BOSTON SCIENTIFIC CORP.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- ELIXIR MEDICAL CORPORATION

- OVERVIEW

- . PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- JOHNSON & JOHNSON

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- KYOTO MEDICAL PLANNING CO. LTD

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- MEDTRONIC INC

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- MERIL LIFE SCIENCES

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- SAHAJAN AND MEDICAL TECHNOLOGY

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- TEPHA INC

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- XENOGENICS CORPORATION (A SUBSIDIARY OF MULTICELL TECHNOLOGIES INC.)

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- STENTYS S.A.S.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC ANALYSIS

- SWOT ANALYSIS

- BIOABSORBABLE THERAPEUTICS, INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- SWOT ANALYSIS

- ABBOTT LABORATORIES

LIST OF TABLES

TABLE 1 FACTS FOR THE HEART FAILURE

TABLE 2 FACT FOR THE DIABETES CASES

TABLE 3 LIST OF SOME OF THE BIOABSORBABLE STENTS THAT ARE CURRENTLY UNDER TRIALS

TABLE 4 FEW FACT RELATED TO DEVELOPING COUNTRIES

TABLE 5 AVAILABLE BIORESORBABLE SCAFFOLDS

TABLE 6 GLOBAL BIOABSORBABLE STENTS MARKET, BY ABSORPTION RATE 2017-2025 ($ MILLION)

TABLE 7 GLOBAL BIOABSORBABLE STENTS MARKET IN SLOW ABSORPTION RATE, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 8 GLOBAL BIOABSORBABLE STENTS MARKET IN FAST ABSORPTION RATE, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 9 GLOBAL BIOABSORBABLE STENTS MARKET IN DRUGS, 2017-2025 ($ MILLION)

TABLE 10 GLOBAL BIOABSORBABLE STENTS MARKET IN PACLITAXEL, 2017-2025 ($ MILLION)

TABLE 11 GLOBAL BIOABSORBABLE STENTS MARKET SHARE IN LIMUS BASED DRUGS, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 12 GLOBAL BIOABSORBABLE STENTS MARKET, BY APPLICATIONS 2017-2025 ($ MILLION)

TABLE 13 GLOBAL BIOABSORBABLE STENTS MARKET IN CORONARY ARTERY DISEASE, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 14 GLOBAL BIOABSORBABLE STENTS MARKET IN PERIPHERAL ARTERY DISEASE, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 15 LIST OF COUNTRIES BY ANNUAL PER CAPITA CONSUMPTION OF TOBACCO CIGARETTES IN 2015

TABLE 16 GLOBAL BIOABSORBABLE STENTS MARKET, BY END USERS 2017-2025 ($ MILLION)

TABLE 17 GLOBAL BIOABSORBABLE STENTS MARKET IN HOSPITALS, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 18 GLOBAL BIOABSORBABLE STENTS MARKET IN CARDIAC CENTERS, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 19 GLOBAL BIOABSORBABLE STENTS MARKET, BY MATERIALS 2017-2025 ($ MILLION)

TABLE 20 GLOBAL BIOABSORBABLE STENTS MARKET IN POLYMERIC STENTS, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 21 GLOBAL BIOABSORBABLE STENTS MARKET SHARE IN METALLIC STENTS, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 22 GLOBAL BIOABSORBABLE STENTS MARKET, BY GEOGRAPHY 2017-2025 ($ MILLION)

TABLE 23 NORTH AMERICA BIOABSORBABLE STENTS MARKET SHARE 2017-2025 ($ MILLION)

TABLE 24 EUROPE BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

TABLE 25 ASIA PACIFIC BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

TABLE 26 REST OF THE WORLD BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

LIST OF FIGURES

FIGURE 1 GLOBAL BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 2 PREVALENCE OF PAD (%) BY AGE GROUP (YEARS)

FIGURE 3 GLOBAL HEALTHCARE EXPENDITURE BY DEVELOPED AND EMERGING ECONOMIES (%)

FIGURE 4 GLOBAL BIOABSORBABLE STENTS MARKET IN SLOW ABSORPTION RATE, 2017-2025($ MILLION)

FIGURE 5 GLOBAL BIOABSORBABLE STENTS MARKET IN FAST ABSORPTION RATE, 2017-2025($ MILLION)

FIGURE 6 GLOBAL BIOABSORBABLE STENTS MARKET IN PACLITAXEL, 2017-2025 ($ MILLION)

FIGURE 7 GLOBAL BIOABSORBABLE STENTS MARKET IN LIMUS BASED DRUGS 2017-2025 ($ MILLION)

FIGURE 8 GLOBAL BIOABSORBABLE STENTS MARKET IN CORONARY ARTERY DISEASE, 2017-2025 ($ MILLION)

FIGURE 9 GLOBAL BIOABSORBABLE STENTS MARKET IN PERIPHERAL ARTERY DISEASE, 2017-2025

FIGURE 10 GLOBAL BIOABSORBABLE STENTS MARKET IN HOSPITALS 2017-2025 ($ MILLION)

FIGURE 11 GLOBAL BIOABSORBABLE STENTS MARKET SHARE IN CARDIAC CENTERS 2017-2025 ($ MILLION)

FIGURE 12 GLOBAL BIOABSORBABLE STENTS MARKET IN POLYMERIC STENTS 2017-2025 ($ MILLION)

FIGURE 13 GLOBAL BIOABSORBABLE STENTS MARKET SHARE IN METALLIC STENTS 2017-2025 ($ MILLION)

FIGURE 14 NORTH AMERICA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 15 UNITED STATES BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 16 CANADA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 17 MEXICO BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 18 EUROPE BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 19 UNITED KINGDOM BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 20 FRANCE BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 21 GERMANY BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 22 SPAIN BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 23 ITALY BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 24 REST OF EUROPE BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 25 ASIA PACIFIC BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 26 CHINA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 27 JAPAN BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 28 INDIA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 29 SOUTH KOREA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 30 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 31 REST OF THE WORLD BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 32 LATIN AMERICA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 33 MIDDLE EAST BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

FIGURE 34 SOUTH AFRICA BIOABSORBABLE STENTS MARKET 2017-2025 ($ MILLION)

- MARKET SEGMENTATION

- MARKET BY ABSORPTION RATE 2017-2025

- SLOW ABSORPTION STENTS

- FAST ABSORPTION STENTS

- MARKET BY DRUGS 2017-2025

- PACLITAXEL

- LIMUS BASED DRUGS

- MARKET BY APPLICATION 2017-2025

- CORONARY ARTERY DISEASE

- PERIPHERAL ARTERY DISEASE

- MARKET BY END USERS 2017-2025

- HOSPITALS

- CARDIAC CENTERS

- MARKET BY MATERIALS 2017-2025

- POLYMERIC STENTS

- METALLIC STENTS

- MARKET BY ABSORPTION RATE 2017-2025

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- UNITED KINGDOM

- FRANCE

- GERMANY

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- REST OF ASIA PACIFIC

- REST OF THE WORLD

- LATIN AMERICA

- MIDDLE EAST

- SOUTH AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.