GLOBAL BARIATRIC SURGERY MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

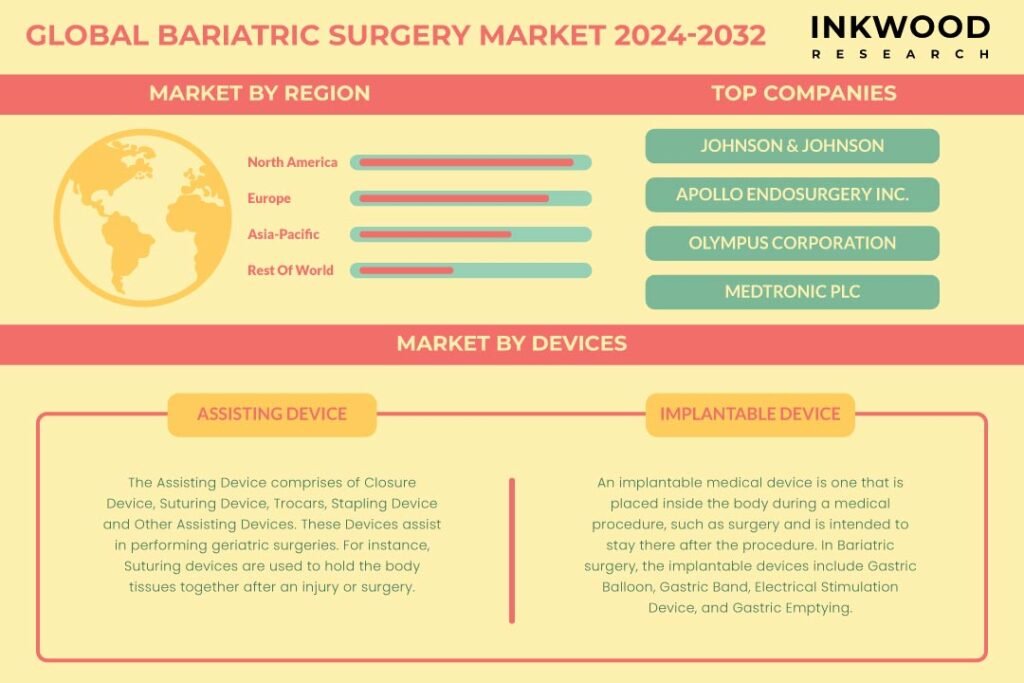

Global Bariatric Surgery Market by Device (Assisting Devices, Implantable Devices) Market by Procedure (Gastric Sleeve Surgery, Biliopancreatic Diversion With Duodenal Switch, Adjustable Gastric Band, Gastric Bypass) Market by End-user (Hospitals, Ambulatory Surgical Centers, Bariatric Surgery Clinics) by Geography

REPORTS » HEALTHCARE » MEDICAL DEVICES » GLOBAL BARIATRIC SURGERY MARKET FORECAST 2024-2032

MARKET OVERVIEW

According to Inkwood Research, the global bariatric surgery market is set to record a CAGR of 5.65% during the forecast period, 2024-2032.

Bariatric surgery refers to a variety of procedures performed on individuals with obesity to facilitate weight loss. It aims to treat comorbid conditions associated with obesity by bringing about changes to the gastrointestinal system that promote feelings of fullness and reduce capacity for food intake.

The procedures are performed by making changes to the anatomy of the digestive system using several techniques that reduce the size of the stomach. The types of surgeries differ based on the kind of modifications made and include restrictive procedures like gastric banding, predominantly malabsorptive procedures like biliopancreatic diversion, and combination procedures like Roux-en-Y gastric bypass.

Further, the procedures require an integrated approach by a multidisciplinary team before, during, and after to monitor progress and minimize nutrition deficiencies. Patient eligibility is determined based on BMI and obesity-related comorbidities. The procedures provide effective long-term weight loss along with improvement in obesity-associated conditions.

Read our latest blog on the Bariatric Surgery Market

GROWTH ENABLERS

Key growth enablers of the global bariatric surgery market are:

- Increasing availability and affordability of bariatric procedures

- Rising rates of obesity globally are expected to increase demand for bariatric procedures. Simultaneously, advancements in minimally invasive techniques have made bariatric surgery easier to perform, contributing to a higher volume of procedures across healthcare institutions.

- Similarly, laparoscopic adjustable gastric banding and other stapling procedures do not require extended hospital stays, thereby reducing costs. Additionally, these procedures utilize standardized products such as surgical staplers and gastric bands, which have benefited from economies of scale, making them more affordable.

- Also, bariatric surgery is now available across many urban centers in developed countries, and availability is steadily rising in developing nations as well, leading to greater accessibility. Furthermore, the established safety profile and demonstrated efficacy of bariatric surgery in resolving comorbidities like diabetes have led more insurance providers to cover these procedures.

- Rising rates of obesity and associated health risks propel demand for weight loss procedures

- Technological advances enable safer and less invasive procedures

GROWTH RESTRAINTS

Key growth restraints of the global bariatric surgery market are:

- Complications and mortality risks requiring intensive follow-up care

- While advancements in minimally invasive techniques have made bariatric procedures much safer, risks of complications and mortality still remain. Complex anatomical changes to the gastrointestinal tract carry risks such as leaks, blood clots, infections, hernias, and gallstones that can lead to hospitalization or the need for revision surgery. Additionally, many patients experience side effects such as vomiting, dumping syndrome, and hypoglycemia. These procedures fundamentally change the digestive process, which can take time to adjust to, necessitating long-term dietary and lifestyle changes.

- The efficacy and safety profile varies across the types of bariatric procedures, with the more complicated combined restrictive and malabsorptive procedures considered higher risk. Due to the potential health implications, undergoing bariatric surgery involves stringent preoperative assessments and significant postoperative follow-up care, requiring a multidisciplinary approach.

- Navigating these complications often translates to patients having very limited provider options in some regions. The costs, complexity around the delivery of care, and concerns regarding complications and mortality can override the benefits expected from bariatric surgery for some patients.

- Limited insurance coverage in some healthcare markets

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Bariatric Surgery Market | Top Trends- Medical device companies are developing improved suturing instruments for gastrointestinal tissue approximation in bariatric procedures. These tools allow precise suturing and knot-tying in restricted spaces. Features such as ergonomic handles, various curve configurations, and jaw articulation aid laparoscopic suturing. Strong and flexible suture materials enable uniform distribution of tension across staple lines to prevent leaks. Barb sutures also offer better wound closure and healing.

- 3D modeling and printing technology are being leveraged to plan bariatric surgery more precisely for individual patients prior to procedures. CT or MRI scans are used to create 3D simulations of patient anatomy. This allows the assessment of parameters like stomach volume, shape, and wall thickness critical for surgery planning. Also, custom 3D models act as visual aids for improved pre-operative planning, intra-operative guidance, and device sizing. The models can also aid communication between surgical teams and patients regarding procedural details.

MARKET SEGMENTATION

Market Segmentation – Device, Procedure, and End-User –

Market by Device:

- Assisting Device

- Assisting devices play a vital role in enabling surgeons to safely and effectively perform bariatric procedures. Key functions provided by assisting devices include tissue dissection, retraction, suturing, stapling, and anastomosis. Laparoscopic adjustable gastric banding utilizes access ports and tubing sets to facilitate band implantation and adjustment. Similarly, circular stapling devices are crucial for gastric bypass and sleeve gastrectomy procedures to transect and seal tissue.

- With the shift towards minimally invasive approaches, demand for specialized assisting devices will rise significantly. Preference for advanced assisting devices that reduce surgery duration, minimize pain and scarring, and enable faster recovery continues to shape product development and adoption trends. Devices incorporating capabilities such as remote monitoring and adjustments will also grow in relevance.

- Implantable Device

Market by Procedure:

- Gastric Sleeve Surgery

- Gastric sleeve surgery, also known as sleeve gastrectomy, involves the surgical removal of a large portion of the stomach along the greater curvature, resulting in a sleeve- or tube-like structure. It induces weight loss by restricting food intake without any malabsorptive elements.

- The smaller stomach has fewer ghrelin-producing cells, which helps suppress hunger. As a standalone bariatric procedure, sleeve gastrectomy offers good weight loss outcomes while carrying a lower risk than gastric bypass or banding.

- Given its effectiveness and safety profile, gastric sleeve surgery is growing considerably as a first-step surgery before considering more complex gastrointestinal changes. It only requires the use of stapling devices laparoscopically, making it easier to perform and more widely available. The procedure is applicable across a wider range of patients with different body compositions.

- Biliopancreatic Diversion with Duodenal Switch

- Adjustable Gastric Band

- Gastric Bypass

Market by End-User:

- Hospital

- Ambulatory Surgical Center

- Bariatric Surgery Clinic

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Indonesia, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is expected to exhibit the highest CAGR in the global bariatric surgery market over the forecast period. This growth will be fueled by rising obesity rates in highly populous countries like China and India, as a result of sedentary lifestyles and changing food habits. Whereas the increasing ability to spend on elective procedures due to growing middle-class disposable incomes, especially in China, Japan, and Australia, will drive strong demand.

- Currently, local and regional players lead the Asia-Pacific bariatric surgery market. Key players include Recoat Medical, Medical Excellence Jakarta, and Sun Surgical in Indonesia, as well as New Life and Fortis Healthcare in India. These providers are focused on tying up with international organizations and medical tourism agencies to attract more patients. Strategic collaborations with global innovators in bariatric technologies will further support procedure volumes.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

The major players in the global bariatric surgery market are:

- USGI Medical Inc

- Johnson & Johnson

- Apollo Endosurgery Inc

- Olympus Corporation

- Medtronic PLC

- Intuitive Surgical Inc

Key strategies adopted by some of these companies:

- Intuitive Surgical launched the da Vinci Xi+ surgical system in August 2023, featuring enhanced ergonomics and visualization tailored for bariatric procedures. In October 2023, the company announced favorable findings from a study examining the utilization of the da Vinci Xi in sleeve gastrectomy, highlighting its influence on weight loss and remission of diabetes.

- Medtronic obtained FDA approval for its MiniBand adjustable gastric band system in November 2023. Additionally, the company collaborated with Verb Surgical in May 2023 to advance the development and commercialization of the H-Pylori SCOPE system.

- Apollo Endosurgery expanded the availability of its Orbera intragastric balloon system into new markets in April 2023. Additionally, the company entered into a strategic partnership with the American Society for Metabolic and Bariatric Surgery (ASMBS) in June 2023.

- Intuitive Surgical has been expanding its sales and marketing initiatives in Europe and Asia-Pacific since October 2023. Also, in September 2023, the company initiated partnerships with hospitals and clinics to provide financing options.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Device, Procedure, and End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | USGI Medical Inc, Johnson & Johnson, Apollo Endosurgery Inc, Olympus Corporation, Medtronic PLC, Intuitive Surgical Inc, Allergan Inc, B. Braun Melsungen AG, ConMed Corporation, Mediflex Surgical Procedures, GI Dynamics Inc, Asensus Surgical US Inc, Cousin Surgery, Spatz Figa Inc, Abbott Laboratories, Richard Wolf GmbH |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT ANALYSIS OF COVID-19

- MAJOR MARKET FINDINGS

- INCREASING PREVALENCE OF OBESITY GLOBALLY

- GROWING ADOPTION OF MINIMALLY INVASIVE PROCEDURES DUE TO SHORTER HOSPITAL STAYS

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING AVAILABILITY AND AFFORDABILITY OF BARIATRIC PROCEDURES

- RISING RATES OF OBESITY AND ASSOCIATED HEALTH RISKS PROPEL DEMAND FOR WEIGHT LOSS PROCEDURES

- TECHNOLOGICAL ADVANCES ENABLE SAFER AND LESS INVASIVE PROCEDURES

- GROWING MEDICAL TOURISM FOR BARIATRIC SURGERIES

- KEY RESTRAINTS

- COMPLICATIONS AND MORTALITY RISKS REQUIRING INTENSIVE FOLLOW-UP CARE

- LIMITED INSURANCE COVERAGE IN SOME HEALTHCARE MARKETS

- KEY DRIVERS

KEY ANALYTICS

- KEY TECHNOLOGY TRENDS

- SHIFT TOWARDS LESS INVASIVE LAPAROSCOPIC PROCEDURES OVER OPEN SURGERIES

- DEVELOPMENT OF GASTROINTESTINAL SUTURE DEVICES FOR IMPROVED TISSUE APPROXIMATION

- USE OF PREOPERATIVE 3D MODELING TO PLAN PROCEDURES MORE PRECISELY

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR GERMANY

- GROWTH PROSPECT MAPPING FOR CHINA

- GROWTH PROSPECT MAPPING FOR UNITED ARAB EMIRATES

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- SUPPLY CHAIN MANAGEMENT AND INTEGRATION

- DISTRIBUTION STRATEGIES AND RETAIL NETWORKS

- TECHNOLOGICAL ADVANCEMENTS AND RESEARCH & DEVELOPMENT

- POST-OPERATIVE CARE AND PATIENT SUPPORT

- KEY PROCURING FACTORS

- SURGICAL EFFICACY AND OUTCOMES

- INNOVATIVE PROCEDURAL TECHNIQUES

- SURGEON PROFICIENCY AND EXPERTISE

- COMPLIANCE WITH MEDICAL GUIDELINES AND SAFETY STANDARDS

- KEY TECHNOLOGY TRENDS

MARKET BY DEVICE

- ASSISTING DEVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- IMPLANTABLE DEVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ASSISTING DEVICES

MARKET BY PROCEDURE

- GASTRIC SLEEVE SURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ADJUSTABLE GASTRIC BAND

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GASTRIC BYPASS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GASTRIC SLEEVE SURGERY

MARKET BY END-USER

- HOSPITALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AMBULATORY SURGICAL CENTERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BARIATRIC SURGERY CLINICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOSPITALS

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA BARIATRIC SURGERY MARKET DRIVERS

- NORTH AMERICA BARIATRIC SURGERY MARKET CHALLENGES

- NORTH AMERICA BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA BARIATRIC SURGERY MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE BARIATRIC SURGERY MARKET DRIVERS

- EUROPE BARIATRIC SURGERY MARKET CHALLENGES

- EUROPE BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE BARIATRIC SURGERY MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC BARIATRIC SURGERY MARKET DRIVERS

- ASIA-PACIFIC BARIATRIC SURGERY MARKET CHALLENGES

- ASIA-PACIFIC BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC BARIATRIC SURGERY MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA THAILAND BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD BARIATRIC SURGERY MARKET DRIVERS

- REST OF WORLD BARIATRIC SURGERY MARKET CHALLENGES

- REST OF WORLD BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD BARIATRIC SURGERY MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA BARIATRIC SURGERY MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIP & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- USGI MEDICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- JOHNSON & JOHNSON

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- APOLLO ENDOSURGERY INC.

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- OLYMPUS CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEDTRONIC PLC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- INTUITIVE SURGICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ALLERGAN INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- B. BRAUN MELSUNGEN AG

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- CONMED CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEDIFLEX SURGICAL PROCEDURES

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- GI DYNAMICS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ASENSUS SURGICAL US INC

- COMPANY OVERVIEW

- PRODUCTS LIST

- STRENGTHS & CHALLENGES

- COUSIN SURGERY

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SPATZ FIGA INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ABBOTT LABORATORIES

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- RICHARD WOLF GMBH

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- USGI MEDICAL INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – BARIATRIC SURGERY MARKET

TABLE 2: GLOBAL BARIATRIC SURGERY MARKET, BY DEVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL BARIATRIC SURGERY MARKET, BY DEVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL ASSISTING DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL ASSISTING DEVICES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL IMPLANTABLE DEVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL IMPLANTABLE DEVICES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL BARIATRIC SURGERY MARKET, BY PROCEDURE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL BARIATRIC SURGERY MARKET, BY PROCEDURE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL GASTRIC SLEEVE SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL GASTRIC SLEEVE SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL ADJUSTABLE GASTRIC BAND MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL ADJUSTABLE GASTRIC BAND MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL GASTRIC BYPASS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL GASTRIC BYPASS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL BARIATRIC SURGERY MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL BARIATRIC SURGERY MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL HOSPITALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL HOSPITALS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL AMBULATORY SURGICAL CENTERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL AMBULATORY SURGICAL CENTERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL BARIATRIC SURGERY CLINICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL BARIATRIC SURGERY CLINICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL BARIATRIC SURGERY MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL BARIATRIC SURGERY MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: NORTH AMERICA BARIATRIC SURGERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: NORTH AMERICA BARIATRIC SURGERY MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: NORTH AMERICA BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

TABLE 31: KEY PLAYERS OPERATING IN NORTH AMERICA BARIATRIC SURGERY MARKET

TABLE 32: EUROPE BARIATRIC SURGERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: EUROPE BARIATRIC SURGERY MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: EUROPE BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

TABLE 35: KEY PLAYERS OPERATING IN EUROPE BARIATRIC SURGERY MARKET

TABLE 36: ASIA-PACIFIC BARIATRIC SURGERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: ASIA-PACIFIC BARIATRIC SURGERY MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 38: ASIA-PACIFIC BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

TABLE 39: KEY PLAYERS OPERATING IN ASIA-PACIFIC BARIATRIC SURGERY MARKET

TABLE 40: REST OF WORLD BARIATRIC SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: REST OF WORLD BARIATRIC SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: REST OF WORLD BARIATRIC SURGERY MARKET REGULATORY FRAMEWORK

TABLE 43: KEY PLAYERS OPERATING IN REST OF WORLD BARIATRIC SURGERY MARKET

TABLE 44: LIST OF MERGERS & ACQUISITIONS

TABLE 45: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 46: LIST OF PARTNERSHIP & AGREEMENTS

TABLE 47: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY TECHNOLOGY TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR UNITED ARAB EMIRATES

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL BARIATRIC SURGERY MARKET, GROWTH POTENTIAL, BY DEVICE, IN 2023

FIGURE 10: GLOBAL BARIATRIC SURGERY MARKET, BY ASSISTING DEVICES, 2024-2032 (IN $ MILLION)

FIGURE 11: GLOBAL BARIATRIC SURGERY MARKET, BY IMPLANTABLE DEVICES, 2024-2032 (IN $ MILLION)

FIGURE 12: GLOBAL BARIATRIC SURGERY MARKET, GROWTH POTENTIAL, BY PROCEDURE, IN 2023

FIGURE 13: GLOBAL BARIATRIC SURGERY MARKET, BY GASTRIC SLEEVE SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL BARIATRIC SURGERY MARKET, BY BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL BARIATRIC SURGERY MARKET, BY ADJUSTABLE GASTRIC BAND, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL BARIATRIC SURGERY MARKET, BY GASTRIC BYPASS, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL BARIATRIC SURGERY MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 18: GLOBAL BARIATRIC SURGERY MARKET, BY HOSPITALS, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL BARIATRIC SURGERY MARKET, BY AMBULATORY SURGICAL CENTERS, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL BARIATRIC SURGERY MARKET, BY BARIATRIC SURGERY CLINICS, 2024-2032 (IN $ MILLION)

FIGURE 21: NORTH AMERICA BARIATRIC SURGERY MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 22: UNITED STATES BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 23: CANADA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 24: EUROPE BARIATRIC SURGERY MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 25: UNITED KINGDOM BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 26: GERMANY BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 27: FRANCE BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 28: ITALY BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 29: SPAIN BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 30: BELGIUM BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 31: POLAND BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 32: REST OF EUROPE BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: ASIA-PACIFIC BARIATRIC SURGERY MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 34: CHINA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 35: JAPAN BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: INDIA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: SOUTH KOREA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: THAILAND BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: AUSTRALIA & NEW ZEALAND BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: REST OF ASIA-PACIFIC BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: REST OF WORLD BARIATRIC SURGERY MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 42: LATIN AMERICA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: MIDDLE EAST & AFRICA BARIATRIC SURGERY MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

Bariatric surgery promotes weight loss by restricting food intake, reducing the size of the stomach, or altering the digestive process.

Common types include gastric bypass, sleeve gastrectomy, adjustable gastric banding, and biliopancreatic diversion with duodenal switch.

Some procedures can be reversed, while others are considered permanent. Reversal depends on the type of surgery and individual circumstances.

Lifestyle changes may include adopting a healthy diet, regular exercise, adequate hydration, and vitamin supplementation.

Yes, many bariatric procedures can be performed laparoscopically, resulting in smaller incisions, less pain, and quicker recovery compared to traditional open surgery.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032