ASIA PACIFIC UV LED MARKET FORECAST 2019-2028

Asia Pacific Uv Led Market by Technology (Uv – A, Uv – B, Uv – C) by Application (Uv Curing, Medical Light Therapy, Sterilization, Optical Sensors and Instrumentation, Counterfeit Detection, Other Applications) and by Geography.

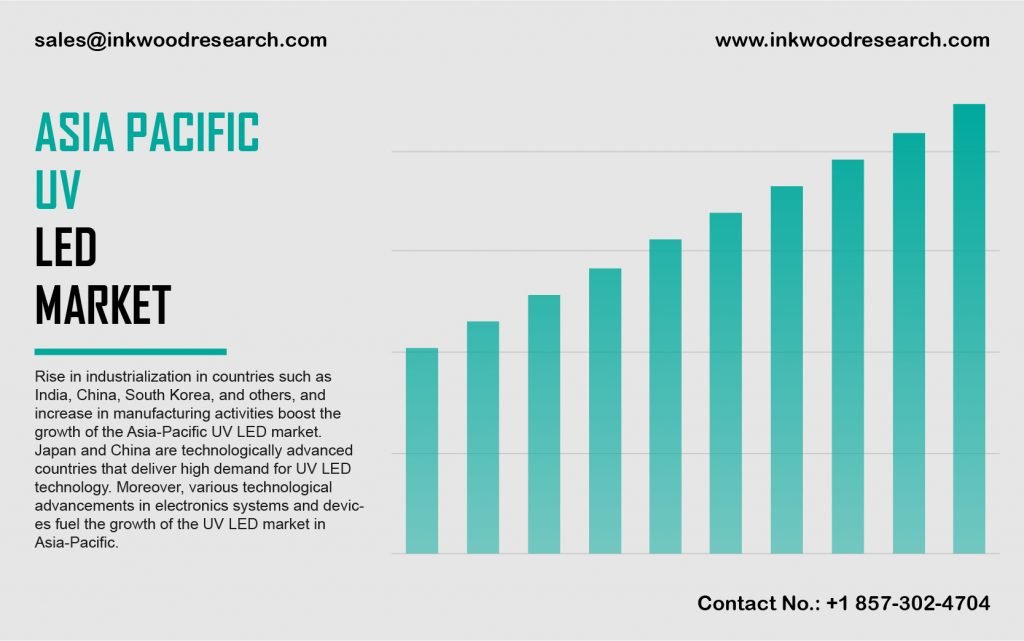

The Asia Pacific UV LED market is projected to grow with a CAGR of 21.79%, across the forecast period of 2019 to 2028. Implementing regulations for energy-efficient lighting, including numerous technological advancements in the electronics system and devices, promote market growth.

To know more about this report, request a free sample copy

The Asia Pacific UV LED market growth is determined by analyzing India, China, Vietnam, Thailand, Japan, Australia & New Zealand, Indonesia, South Korea, and the rest of Asia Pacific. Vendors in Japan are making significant investments, aligning with the expanding applications of UV LEDs. For instance, in January 2017, Formosa Petrochemical Corporation (FPCC), a petroleum refining company and Nikkiso, a Japan based enterprise, declared a UV LED joint venture. This partnership primarily concentrated on water and air purification, texture analysis of resins, and curing.

Japan is an epicenter for technological advancements and provides a comprehensive R&D platform for innovative and efficient UV-curable adhesives. As a result, new UV-curable adhesive products establish their applications within the packaging, automotive, and electrical sectors. Moreover, Japan’s automotive industry is one of the most prominent, worldwide. The country also harbors major automotive enterprises like Toyota and Honda, along with their service centers. Thus, the surging UV curing applications in the automotive division are expected to augment the region’s market growth.

Nichia Corporation, headquartered in Japan, is primarily involved in the industrial plant businesses, and the production and commercialization of industrial devices. The company’s product division entails the distribution of gasket packing, heat-insulating materials, filters, and fluorine resin products. In September 2019, the enterprise launched products, namely. 2-in-1 Turntable White and Single LES.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- PARENT MARKET ANALYSIS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASE IN INITIATIVES BY GOVERNMENT

- SURGING USAGE OF UV CURING IN NEW APPLICATIONS

- BAN ON MERCURY LAMPS PROPELLED THE NEED OF UV LEDs

- GROWING USAGE OF SAFE AND ECO-FRIENDLY PRODUCTS

- KEY RESTRAINTS

- HIGH COST OF UV LED DEVICES

- EXCESS THERMAL HEAT GENERATED BY THE UV LEDs

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- SUPPLY CHAIN ANALYSIS

- IMPACT OF COVID-19 ON UV-LED MARKET

- INNOVATIONS IN UV-LED PRODUCTS DUE TO COVID-19

- REGULATORY FRAMEWORK

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHT

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY TECHNOLOGY

- UV-A

- UV-B

- UV-C

- MARKET BY APPLICATION

- UV CURING

- MEDICAL LIGHT THERAPY

- STERILIZATION

- OPTICAL SENSORS AND INSTRUMENTATION

- COUNTERFEIT DETECTION

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILES

- CRYSTAL IS INC (ASAHI KASEI)

- EPIGAP OPTRONIC GMBH

- HERAEUS HOLDING GMBH

- HONLE UV AMERICA INC

- KONINKLIJKE PHILIPS NV

- LG INNOTEK CO LTD

- LUMILEDS HOLDING BV

- NICHIA CORPORATION

- NITRIDE SEMICONDUCTORS CO LTD

- NORDSON CORPORATION

- OSRAM

- PHOSEON TECHNOLOGY

- SEMILEDS CORPORATION

- SENSOR ELECTRONIC TECHNOLOGY

- SEOULVIOSYS CO LTD

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – UV LED

TABLE 2: ASIA PACIFIC UV LED MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: ASIA PACIFIC UV LED MARKET, BY TECHNOLOGY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC UV LED MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: ASIA PACIFIC UV LED MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC UV LED MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: ASIA PACIFIC UV LED MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: SUPPLY CHAIN ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA PACIFIC UV LED MARKET, BY TECHNOLOGY, IN 2019

FIGURE 6: ASIA PACIFIC UV LED MARKET, BY UV-A, 2019-2028 (IN $ MILLION)

FIGURE 7: ASIA PACIFIC UV LED MARKET, BY UV-B, 2019-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC UV LED MARKET, BY UV-C, 2019-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC UV LED MARKET, BY APPLICATION, IN 2019

FIGURE 10: ASIA PACIFIC UV LED MARKET, BY UV CURING, 2019-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC UV LED MARKET, BY MEDICAL LIGHT THERAPY, 2019-2028 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC UV LED MARKET, BY STERILIZATION, 2019-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC UV LED MARKET, BY OPTICAL SENSORS AND INSTRUMENTATION, 2019-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC UV LED MARKET, BY COUNTERFEIT DETECTION, 2019-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC UV LED MARKET, BY OTHER APPLICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC UV LED MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 17: JAPAN UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 18: CHINA UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 19: INDIA UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 20: AUSTRALIA & NEW ZEALAND UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 21: SOUTH KOREA UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 22: THAILAND UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 23: INDONESIA UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 24: VIETNAM UV LED MARKET, 2019-2028 (IN $ MILLION)

FIGURE 25: REST OF ASIA PACIFIC UV LED MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY TECHNOLOGY

- UV-A

- UV-B

- UV-C

- MARKET BY APPLICATION

- UV CURING

- MEDICAL LIGHT THERAPY

- STERILIZATION

- OPTICAL SENSORS AND INSTRUMENTATION

- COUNTERFEIT DETECTION

OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.