ASIA PACIFIC TRACTION MOTOR MARKET FORECAST 2021-2028

Asia Pacific Traction Motor Market by Type (Ac Traction Motor, Dc Traction Motor, Synchronous Motor) by Power Rating (Less Than 200kw, 200–400 Kw, More Than 400kw) by Application (Railways, Electric Vehicles, Industrial Vehicles, Others) and by Geography.

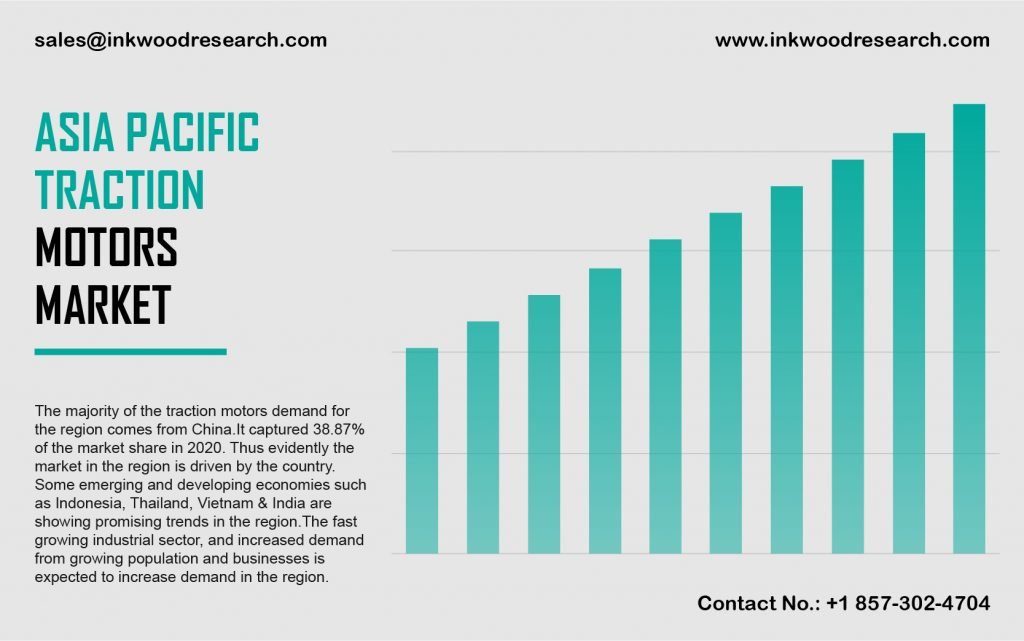

The Asia Pacific traction motor market is projected to register a CAGR of 14.99%, over the forecast period of 2021 to 2028. The market growth is facilitated by factors such as the growing trends observed in developing economies like India, Vietnam, Thailand, and Indonesia, the rapidly augmenting industrial sector, the rising demand from the surging population base, and the presence of established enterprises.

To learn more about this report, request a free sample copy

The Asia Pacific traction motor market growth is evaluated by analyzing Japan, China, South Korea, India, Indonesia, Vietnam, Thailand, Australia & New Zealand, and the rest of the Asia Pacific. China is set to dominate the electric vehicle industry, during the forecast period. While the California-based Tesla harbored popular traction for electric cars, Beijing’s national policy encouraged the introduction of numerous rivals in China, the largest auto market, globally. Besides, over the upcoming years, Chinese enterprises across the electric vehicle (EV) supply chain are anticipated to assertively enter the overseas market.

On the other hand, the government of Japan introduced the Top Runner Program based on the energy conservation law, affirming minimal efficiency needs for numerous industrial motors. As a result, the country’s energy-efficient motor players are primarily concentrating on developing next-generation energy-efficient products. Hence, these factors are projected to drive the Asia Pacific traction motor market growth, during the forecast period.

Mitsubishi Electric Corporation, headquartered in Japan, is predominantly engaged in the manufacture, development, and commercialization of electronic and electric equipment, used in industrial automation, energy and electric systems, information and communication systems, home appliances, and electronic devices. The company operates across North America, Asia, and Europe.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- PARENT MARKET ANALYSIS: ELECTRIC MOTOR

- MARKET DEFINITION

- KEY DRIVERS

- GROWTH IN THE RAILWAY INDUSTRY

- INCREASED DEMAND FOR LOW EMISSION TECHNOLOGY

- GROWING DEMAND FROM ELECTRIC VEHICLES

- KEY RESTRAINTS

- INCREASED PRICES OF RAW MATERIALS

- HIGHER INVESTMENT COST FOR THE MARKET

- KEY ANALYTICS

- IMPACT OF COVID-19 ON TRACTION MOTOR MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY TYPE

- AC TRACTION MOTOR

- DC TRACTION MOTOR

- SYNCHRONOUS MOTOR

- MARKET BY POWER RATING

- LESS THAN 200KW

- 200–400 KW

- MORE THAN 400KW

- MARKET BY APPLICATION

- RAILWAYS

- ELECTRIC VEHICLES

- INDUSTRIAL VEHICLES

- OTHERS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- COMPANY PROFILES

- ABB LTD

- AMERICAN TRACTION SYSTEMS

- HITACHI LTD

- HYUNDAI ROTEM COMPANY

- CRRC

- MITSUBISHI ELECTRIC CORPORATION

- SIEMENS

- ŠKODA TRANSPORTATION

- TOSHIBA INTERNATIONAL CORPORATION

- WABTEC CORPORATION

- AMETEK

- EATON

- CG POWER AND INDUSTRIAL SOLUTIONS

- KAWASAKI

- ALSTOM

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – TRACTION MOTOR

TABLE 2: ASIA PACIFIC TRACTION MOTOR MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: ASIA PACIFIC TRACTION MOTOR MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC TRACTION MOTOR MARKET, BY POWER RATING, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA PACIFIC TRACTION MOTOR MARKET, BY POWER RATING, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC TRACTION MOTOR MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: ASIA PACIFIC TRACTION MOTOR MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: ASIA PACIFIC TRACTION MOTOR MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA PACIFIC TRACTION MOTOR MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA PACIFIC TRACTION MOTOR MARKET, GROWTH POTENTIAL, BY TYPE, IN 2020

FIGURE 6: ASIA PACIFIC TRACTION MOTOR MARKET, BY AC TRACTION MOTOR, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA PACIFIC TRACTION MOTOR MARKET, BY DC TRACTION MOTOR, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC TRACTION MOTOR MARKET, BY SYNCHRONOUS MOTOR, 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC TRACTION MOTOR MARKET, GROWTH POTENTIAL, BY POWER RATING, IN 2020

FIGURE 10: ASIA PACIFIC TRACTION MOTOR MARKET, BY LESS THAN 200KW, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC TRACTION MOTOR MARKET, BY 200–400 KW, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC TRACTION MOTOR MARKET, BY MORE THAN 400KW, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC TRACTION MOTOR MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 14: ASIA PACIFIC TRACTION MOTOR MARKET, BY RAILWAYS, 2021-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC TRACTION MOTOR MARKET, BY ELECTRIC VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC TRACTION MOTOR MARKET, BY INDUSTRIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC TRACTION MOTOR MARKET, BY OTHERS, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC TRACTION MOTOR MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 19: CHINA TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 20: JAPAN TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 21: INDIA TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 22: SOUTH KOREA TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 23: INDONESIA TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 24: THAILAND TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: VIETNAM TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 26: AUSTRALIA & NEW ZEALAND TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

FIGURE 27: REST OF ASIA PACIFIC TRACTION MOTOR MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY TYPE

- AC TRACTION MOTOR

- DC TRACTION MOTOR

- SYNCHRONOUS MOTOR

- MARKET BY POWER RATING

- LESS THAN 200KW

- 200–400 KW

- MORE THAN 400KW

- MARKET BY APPLICATION

- RAILWAYS

- ELECTRIC VEHICLES

- INDUSTRIAL VEHICLES

- OTHERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.