ASIA PACIFIC TIRE REINFORCEMENT MATERIALS MARKET FORECAST 2021-2028

Asia Pacific Tire Reinforcement Market by Type (Tire Cord Fabric, Tire Bead Wire) Market by Material (Steel, Polyester, Rayon, Nylon, Others) Market by Tire Distribution Channel (OEM (Original Equipment Manufacturer) Market, Replacement Market) by Geography

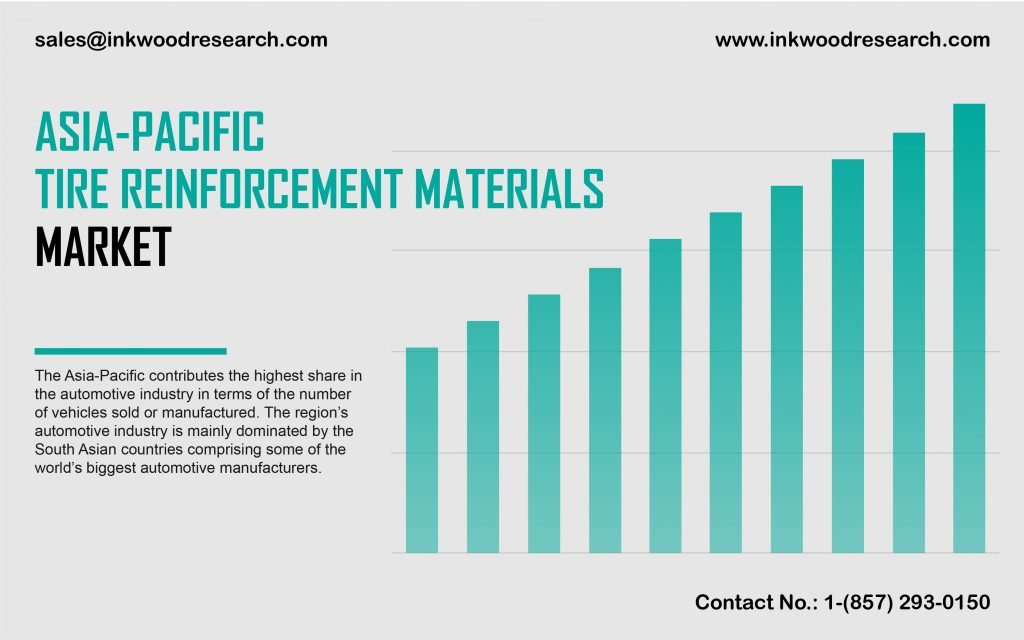

The Asia-Pacific tire reinforcement materials market is projected to register a CAGR of 5.79% during the forecast period, 2021-2028. The automotive industry of the region is dominated by some of the largest automotive manufacturers in the world. Also, there is a growing demand for next-generation high-performance tires, a current trend among automotive manufacturers and market players.

To learn more about this report, request a free sample copy

The Asia-Pacific tire reinforcement materials market growth assessment includes the analysis of Australia & New Zealand, Japan, Malaysia, China, India, Thailand, Indonesia, South Korea, and Rest of Asia-Pacific. Japan is one of the major automotive vehicles manufacturers worldwide. Also, the automotive industry is one of its crucial industrial sectors. In addition, it benefits from the presence of some of the biggest automotive OEMs, such as Mazda, Nissan, Mitsubishi, etc. Besides, the country is among the most technologically advanced in terms of integrating modern-day technologies in vehicles. Moreover, it has around 23 tire manufacturing facilities with more than 25 major tire brands. Such factors, along with the rising vehicle production, drive Japan’s market growth.

Indonesia exports 30% of its motorcycle tires to more than 70 countries, of which most are delivered to the US. With a large acreage of rubber, the country has a substantial competitive advantage over other countries. Additionally, there are 14 tire manufacturers in Indonesia in total. Such factors contribute to the country’s market prospects.

Teijin Limited is engaged in a vast range of businesses that include electronic materials, performance polymer products, advanced fibers & composites, etc. In addition, the company increasingly prioritizes research & development to expand its product portfolio. It operates in the Americas, Europe, Asia, etc., with headquarters in Osaka, Japan.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- PARENT MARKET ANALYSIS: TIRE INDUSTRY

- KEY DRIVERS

- DEMAND FROM THE AUTOMOTIVE INDUSTRY

- GROWTH OF THE AUTOMOTIVE INDUSTRY IN THE ASIA-PACIFIC REGION

- ENHANCED PROPERTIES OF REINFORCED TIRES

- USE OF ADVANCED TECHNOLOGY IN THE MANUFACTURING PROCESS

- KEY RESTRAINTS

- SLOWDOWN DUE TO THE GROWTH IN THE RETREADING OF TIRES

- EFFECTS OF VOLATILE PRICES OF RAW MATERIALS ON TIRE INDUSTRY

- KEY ANALYTICS

- IMPACT OF COVID-19 ON TIRE REINFORCEMENT MATERIALS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY TYPE

- TIRE CORD FABRIC

- TIRE BEAD WIRE

- MARKET BY MATERIAL

- STEEL

- POLYESTER

- RAYON

- NYLON

- OTHERS

- MARKET BY TIRE DISTRIBUTION CHANNEL

- OEM (ORIGINAL EQUIPMENT MANUFACTURER) MARKET

- REPLACEMENT MARKET

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- MALAYSIA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BEKAERT SA

- CENTURY ENKA LIMITED

- CORDENKA GMBH & CO KG

- DUPONT

- FORMOSA TAFFETA CO LTD

- HBT RUBBER INDUSTRIAL CO LTD

- HYOSUNG CORPORATION

- JIANGSU XINGDA STEEL TIRE CORD CO LTD

- KOLON INDUSTRIES INC

- KORDSA TEKNIK TEKSTIL AS

- MICHELIN

- SHENMA INDUSTRIAL CO LTD

- SHINKONG SYNTHETIC FIBERS CORPORATION

- SRF LIMITED

- TATA STEEL

- TEIJIN LIMITED

- TORAY INDUSTRIES INC

- TOYOBO CO LTD

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – TIRE REINFORCEMENT MATERIALS

TABLE 2: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY MATERIAL, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY MATERIAL, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: STEEL CORD FILAMENTS AND THEIR TENSILE STRENGTHS

TABLE 7: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TIRE DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TIRE DISTRIBUTION CHANNEL, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 11: LIST OF MERGERS & ACQUISITIONS

TABLE 12: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 13: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

FIGURE LIST

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2020

FIGURE 6: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TIRE CORD FABRIC, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY TIRE BEAD WIRE, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, GROWTH POTENTIAL, BY MATERIAL, IN 2020

FIGURE 9: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY STEEL, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY POLYESTER, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY RAYON, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY NYLON, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY OTHERS, 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, GROWTH POTENTIAL, BY TIRE DISTRIBUTION CHANNEL, IN 2020

FIGURE 15: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY OEM MARKET, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, BY REPLACEMENT MARKET, 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC TIRE REINFORCEMENT MATERIALS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 18: CHINA TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 19: JAPAN TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 20: INDIA TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 21: SOUTH KOREA TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 22: INDONESIA TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 23: THAILAND TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 24: MALAYSIA TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: AUSTRALIA & NEW ZEALAND TIRE REINFORCEMENT MATERIALS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- MALAYSIA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- MARKET BY TYPE

- TIRE CORD FABRIC

- TIRE BEAD WIRE

- MARKET BY MATERIAL

- STEEL

- POLYESTER

- RAYON

- NYLON

- OTHERS

- MARKET BY TIRE DISTRIBUTION CHANNEL

- OEM (ORIGINAL EQUIPMENT MANUFACTURER) MARKET

- REPLACEMENT MARKET

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.