ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET FORECAST 2022-2028

Asia-Pacific Industrial Alcohols Market by Processing (Fermentation, Synthetic) Market by Source (Molasses, Sugarcane, Grains, Other Sources) Market by Product Type (Isopropyl Alcohol, Methyl Alcohol, Ethyl Alcohol, Isobutyl Alcohol, Benzyl Alcohol, Other Product Types) Market by End-user (Fuel, Chemical Intermediates & Solvent, Pharmaceuticals, Personal Care Products, Food & Beverages, Other End-users) and by Geography

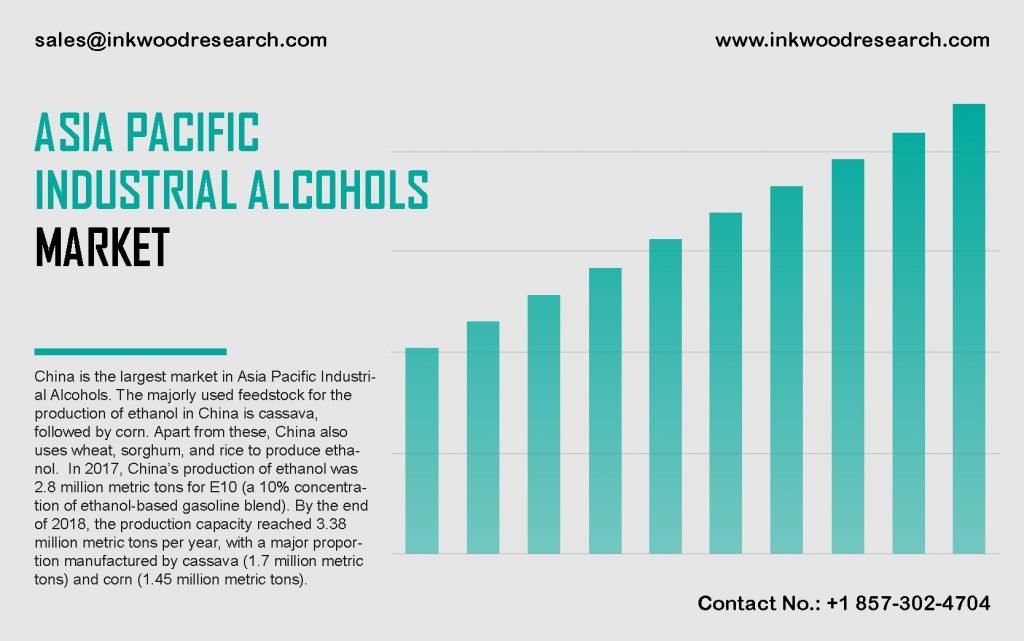

The Asia-Pacific industrial alcohols market is projected to record a CAGR of 9.17% in terms of revenue and 10.85% in terms of volume during the forecast period, 2022-2028. The use of industrial alcohol in biofuel, technological advancements, and increased awareness of carbon emissions drive market growth.

To learn more about this report, request a free sample copy

The Asia-Pacific industrial alcohols market growth analysis includes the assessment of Japan, China, Vietnam, India, Indonesia, Thailand, Australia & New Zealand, South Korea, and Rest of Asia-Pacific. Cassava is the majorly used feedstock in ethanol production in China. Besides, rice, sorghum, and wheat are also used to produce ethanol. However, in 2017, the government introduced the legislation that proposed using ethanol in fuel by 2020. This is per the Paris Accord, for regulating global carbon levels, minimizing fossil fuel usage, and reducing carbon emissions. Also, the production of ethanol increased by 2018. Such factors enable market growth in China.

In countries like Thailand, feedstock for ethanol production is cassava roots, molasses, and sugarcane. Cassava has a very prominent role in ethanol production in Thailand. This has led to its growing usage as a raw material for ethanol production. Moreover, there has been a rise in ethanol production in recent years. Sugarcane-based ethanol production has been operating at maximum capacity, accounting for 5% of the total ethanol production. With the increasing State Oil Fund’s price incentives and market incentives to retailers, ethanol consumption is set to rise. Such factors are estimated to facilitate market growth in South Korea.

Royal Dutch Shell Plc recovers and explores natural gas, crude pol, natural gas liquids (NGLs), and transport oil & gas. The company also refines and markets oil products, gas power, and chemicals. It offers petroleum products supply and distribution services and gas service stations. It operates in Asia, Africa, Oceania, the Americas, and Europe, with headquarters in The Hague, Netherlands.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASED ADOPTION OF BIOFUELS AS AN ALTERNATIVE TO PETROLEUM

- WIDE UTILIZATION OF ALCOHOLS IN MULTIPLE END-USER APPLICATIONS

- RISING DEMAND FOR METHANOL

- KEY RESTRAINTS

- RISING PRICES OF RAW MATERIAL

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON INDUSTRIAL ALCOHOLS MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PROCESSING (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FERMENTATION

- SYNTHETIC

- MARKET BY SOURCE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- MOLASSES

- SUGARCANE

- GRAINS

- OTHER SOURCES

- MARKET BY PRODUCT TYPE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- ISOPROPYL ALCOHOL

- METHYL ALCOHOL

- ETHYL ALCOHOL

- ISOBUTYL ALCOHOL

- BENZYL ALCOHOL

- OTHER PRODUCT TYPES

- MARKET BY END-USER (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FUEL

- CHEMICAL INTERMEDIATES & SOLVENT

- PHARMACEUTICALS

- PERSONAL CARE PRODUCTS

- FOOD & BEVERAGES

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BASF SE

- CARGILL INCORPORATED

- CRISTALCO

- DOW CHEMICAL COMPANY

- EASTMAN CHEMICAL COMPANY

- ECOLAB

- EXXON MOBIL CORPORATION

- GREEN PLAINS INC

- GREENFIELD ASIA-PACIFIC INC

- LINDE AG

- LYONDELLBASELL INDUSTRIES NV

- MGP INGREDIENTS INC

- RAÍZEN ENERGIA

- ROYAL DUCTH SHELL

- SIGMA ALDRICH CORPORATION

- THE ANDERSONS INC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – INDUSTRIAL ALCOHOLS

TABLE 2: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 3: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 4: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PROCESSING, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 7: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 8: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SOURCE, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 11: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 12: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 13: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 14: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 15: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY END-USER, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 16: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 17: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY END-USER, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 18: WORLDWIDE PRODUCTION OF FUEL ETHANOL, 2014-2018 (IN MILLION GALLONS)

TABLE 19: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 20: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN KILOTONS)

TABLE 21: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 22: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2028 (IN $ MILLION)

TABLE 23: LIST OF MERGERS & ACQUISITIONS

TABLE 24: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 25: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 26: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: COUNTRY-WISE FUEL ETHANOL PRODUCTION, 2019 (IN MILLION GALLONS)

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: PORTER’S FIVE FORCES ANALYSIS

FIGURE 4: OPPORTUNITY MATRIX

FIGURE 5: VENDOR LANDSCAPE

FIGURE 6: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY PROCESSING, IN 2020

FIGURE 7: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY FERMENTATION, 2022-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SYNTHETIC, 2022-2028 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY SOURCE, IN 2020

FIGURE 10: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY MOLASSES, 2022-2028 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY SUGARCANE, 2022-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY GRAINS, 2022-2028 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY OTHER SOURCES, 2022-2028 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 15: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY ISOPROPYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY METHYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY ETHYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY ISOBUTYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY BENZYL ALCOHOL, 2022-2028 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY OTHER PRODUCT TYPES, 2022-2028 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2020

FIGURE 22: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY FUEL, 2022-2028 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY CHEMICAL INTERMEDIATES & SOLVENT, 2022-2028 (IN $ MILLION)

FIGURE 24: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PHARMACEUTICALS, 2022-2028 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY PERSONAL CARE PRODUCTS, 2022-2028 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY FOOD & BEVERAGES, 2022-2028 (IN $ MILLION)

FIGURE 27: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, BY OTHER END-USERS, 2022-2028 (IN $ MILLION)

FIGURE 28: ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 29: CHINA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 30: JAPAN INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 31: INDIA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 32: SOUTH KOREA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 33: INDONESIA INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 34: THAILAND INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 35: VIETNAM INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 36: AUSTRALIA & NEW ZEALAND INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

FIGURE 37: REST OF ASIA-PACIFIC INDUSTRIAL ALCOHOLS MARKET, 2022-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- MARKET BY PROCESSING (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FERMENTATION

- SYNTHETIC

- MARKET BY SOURCE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- MOLASSES

- SUGARCANE

- GRAINS

- OTHER SOURCES

- MARKET BY PRODUCT TYPE (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- ISOPROPYL ALCOHOL

- METHYL ALCOHOL

- ETHYL ALCOHOL

- ISOBUTYL ALCOHOL

- BENZYL ALCOHOL

- OTHER PRODUCT TYPES

- MARKET BY END-USER (IN TERMS OF REVENUE: $ MILLION & VOLUME: KILOTONS)

- FUEL

- CHEMICAL INTERMEDIATES & SOLVENT

- PHARMACEUTICALS

- PERSONAL CARE PRODUCTS

- FOOD & BEVERAGES

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.