ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET FORECAST 2019-2028

Asia Pacific Hyper-converged Infrastructure Market by Component (Hardware, Software) by End-user (Remote Office/ Branch Office, Virtualization Desktop Infrastructure, Data Center Consolidation, Backup Recovery/ Disaster Recovery, Virtualizing Critical Applications, Others) by Industry Vertical (Bfsi, It & Telecommunications, Government, Healthcare, Manufacturing, Education, Energy & Utilities, Others) and by Geography.

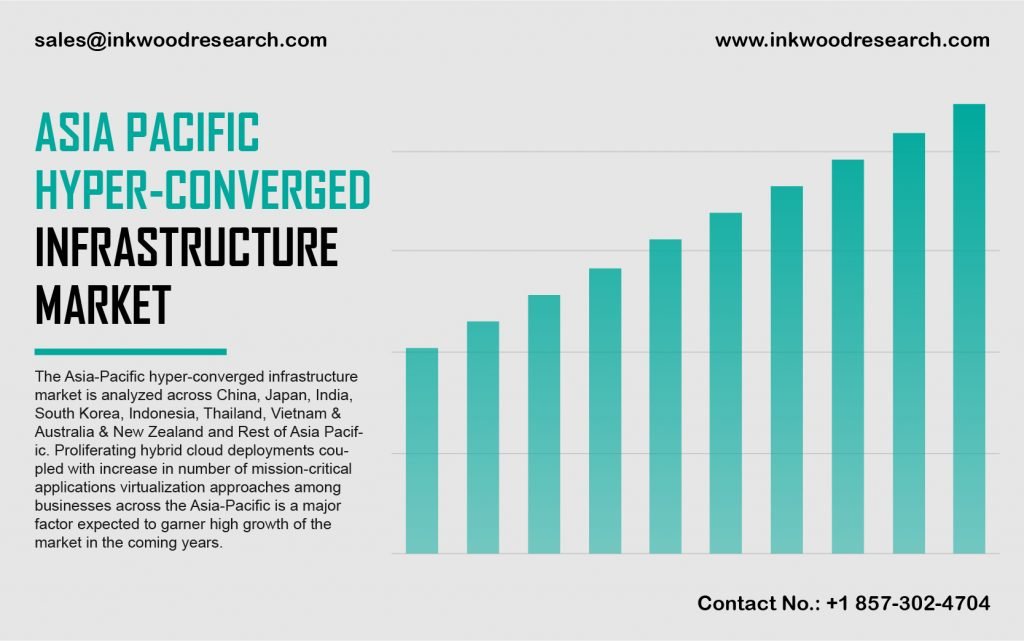

The Asia Pacific hyper-converged infrastructure market is expected to garner a CAGR of 28.96%, across the forecast years of 2019 to 2028. The increasing number of data centers and investments, proliferating hybrid cloud deployments, and the rise in digital innovation hubs, are accredited to the region’s market growth.

To know more about this report, request a free sample copy

The Asia Pacific hyper-converged infrastructure market growth is determined by analyzing India, Indonesia, China, Thailand, Australia & New Zealand, South Korea, Vietnam, Japan, and the rest of the Asia Pacific. China is a flourishing market for data center operations, mainly since data center investments are fuelled by distinguished cloud, internet, and telecommunication service providers. These include China Unicom, Alibaba, Tencent, China Telecom, China Mobile, CITIC Telecom, Princeton Digital Group, Amazon Web Services (AWS), Equinix, and Neo Telemedia, among numerous others.

In China, the data center demand is projected to exceed the supply, owing to the increasing need for cloud based services, the Internet of Things (IoT), and big data analytics. The country is also the world’s largest market for IoT, harboring over 60% of the 1.5 billion global cellular connections. China’s internet penetration rate is nearly 60%, with at least 90% of its internet population accessing the internet through their mobile devices. Similarly, around 60% of mobile users in China, have access to social networks. Thus, these factors are anticipated to drive the region’s market growth for hyper-converged infrastructure.

With its headquarters in China, Huawei Technologies Co Ltd, a Huawei Investment & Holding Co Ltd subsidiary, is an information and communication technology company. Its product offerings include broadband, mobile, core network, data communication products, transmission network, and value-added services. In June 2020, the company launched Fusion Server Pro V6 Intelligent Server, based on the 3rd Gen Intel Xeon Scalable Processor.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- GROWTH IN THE NUMBER OF DATA CENTRES

- RISE IN THE DEMAND FOR VIRTUAL DESKTOP INFRASTRUCTURE

- REDUCTION IN COSTS

- KEY RESTRAINTS

- CLOUD COMPATIBILITY ISSUES

- SCALABILITY ISSUES

- ADDED COSTS OF REDESIGNING OF POWER DISTRIBUTION WITHIN EXISTING FACILITY

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- COMPARATIVE STUDY OF TOP TEN COMPANIES IN TERMS OF PRODUCT OFFERING & GEOGRAPHIC REACH

- IMPACT OF COVID 19 PANDEMIC ON HYPERCONVERGED INFRASTRUCTURE MARKET

- MARKET BY COMPONENT

- HARDWARE

- SOFTWARE

- MARKET BY END-USER

- REMOTE OFFICE/ BRANCH OFFICE

- VIRTUALIZATION DESKTOP INFRASTRUCTURE

- DATA CENTER CONSOLIDATION

- BACKUP RECOVERY/ DISASTER RECOVERY

- VIRTUALIZING CRITICAL APPLICATIONS

- OTHERS

- MARKET BY INDUSTRY VERTICAL

- BFSI

- IT & TELECOMMUNICATIONS

- GOVERNMENT

- HEALTHCARE

- MANUFACTURING

- EDUCATION

- ENERGY & UTILITIES

- OTHERS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILES

- CISCO

- DELL TECHNOLOGIES INC

- FUJITSU

- HEWLETT PACKARD ENTERPRISE

- HITACHI VANTARA

- HIVEIO

- HUAWEI TECHNOLOGIES

- IBM

- MICROSOFT CORPORATION

- NEC

- NETAPP INC

- NUTANIX INC

- PIVOT3

- SCALE COMPUTING

- VMWARE INC

- DATACORE

- RED HAT

TABLE LIST

TABLE 1: MARKET SNAPSHOT – HYPER-CONVERGED INFRASTRUCTURE

TABLE 2: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY INDUSTRY VERTICAL, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY INDUSTRY VERTICAL, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

FIGURES LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: COMPARATIVE STUDY OF TOP TEN COMPANIES IN TERMS OF PRODUCT OFFERING & GEOGRAPHIC REACH

FIGURE 6: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2019

FIGURE 7: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY HARDWARE, 2019-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY SOFTWARE, 2019-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 10: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REMOTE OFFICE/ BRANCH OFFICE, 2019-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY VIRTUALIZATION DESKTOP INFRASTRUCTURE, 2019-2028 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY DATA CENTER CONSOLIDATION, 2019-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY BACKUP RECOVERY/ DISASTER RECOVERY, 2019-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY VIRTUALIZING CRITICAL APPLICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, GROWTH POTENTIAL, BY INDUSTRY VERTICAL, IN 2019

FIGURE 17: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY BFSI, 2019-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY IT & TELECOMMUNICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY GOVERNMENT, 2019-2028 (IN $ MILLION)

FIGURE 20: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY HEALTHCARE, 2019-2028 (IN $ MILLION)

FIGURE 21: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY MANUFACTURING, 2019-2028 (IN $ MILLION)

FIGURE 22: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY EDUCATION, 2019-2028 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ENERGY & UTILITIES, 2019-2028 (IN $ MILLION)

FIGURE 24: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 25: ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 26: CHINA HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 27: JAPAN HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 28: INDIA HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 29: SOUTH KOREA HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 30: INDONESIA HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 31: THAILAND HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: VIETNAM HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: AUSTRALIA & NEW ZEALAND HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: REST OF ASIA PACIFIC HYPER-CONVERGED INFRASTRUCTURE MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY COMPONENT

- HARDWARE

- SOFTWARE

- MARKET BY END-USER

- REMOTE OFFICE/ BRANCH OFFICE

- VIRTUALIZATION DESKTOP INFRASTRUCTURE

- DATA CENTER CONSOLIDATION

- BACKUP RECOVERY/ DISASTER RECOVERY

- VIRTUALIZING CRITICAL APPLICATIONS

- OTHERS

- MARKET BY INDUSTRY VERTICAL

- BFSI

- IT & TELECOMMUNICATIONS

- GOVERNMENT

- HEALTHCARE

- MANUFACTURING

- EDUCATION

- ENERGY & UTILITIES

- OTHERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.