ASIA PACIFIC CARBON NANOTUBES MARKET FORECAST 2019-2028

Asia Pacific Carbon Nanotubes Market by Type (Multi-walled Carbon Nanotubes, Single-walled Carbon Nanotubes, Other Type) by Application (Structural Polymer Composites, Conductive Polymer Composites, Conductive Adhesives, Fire Retardant Plastics, Metal Matrix Composites, Li-ion Battery Electrodes, Other Applications) by End-user (Electronics, Aerospace and Defense, Automotive, Textiles, Healthcare, Energy, Other End-user Industries) and by Geography.

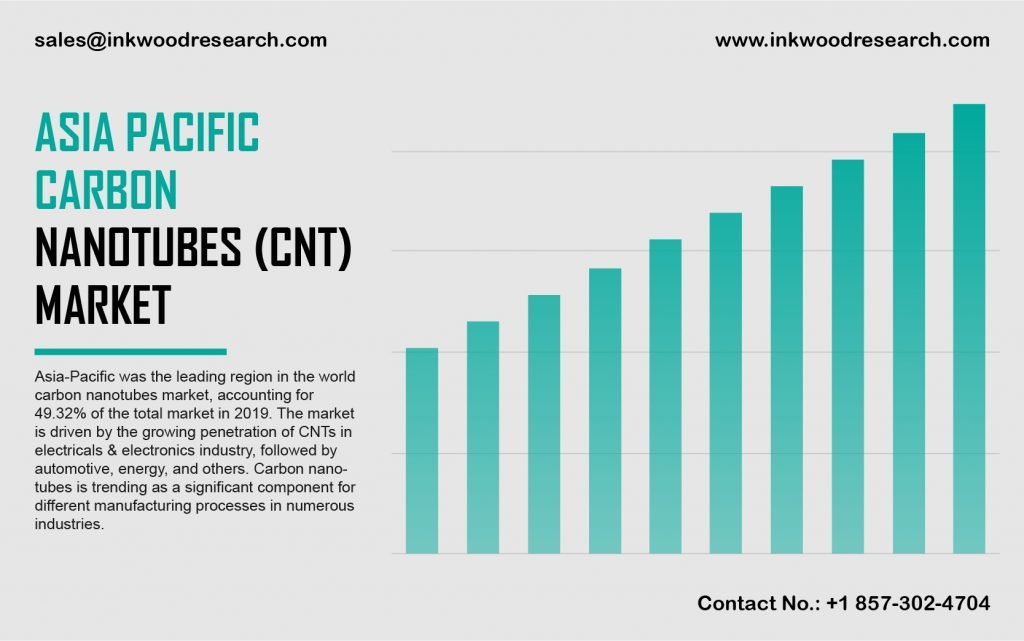

The Asia Pacific carbon nanotubes market is estimated to record a CAGR of 15.47% during the forecast period, 2019-2028. The application of carbon nanotubes as a significant component for various different manufacturing processes in several industries is one of the dominant factors propelling market growth in the region.

To learn more about this report, request a free sample copy

India, China, Japan, Thailand, South Korea, Vietnam, Australia & New Zealand, Indonesia, and the rest of Asia Pacific, are evaluated for the Asia Pacific carbon nanotubes market growth analysis. China boasts of the largest electronics production base in the world. The country is also the largest consumer and producer of carbon nanomaterials in the Asia Pacific. The aforementioned market standards are attributed to the abundant availability of raw materials and the low cost of production. China also dominates the global automotive production market, along with encompassing a rapidly growing aircraft parts and assembly manufacturing sector. The country requires around 8090 new planes by 2038, as per the Boeing forecast. Such demands are expected to result in an increasing need for carbon nanotubes, thereby driving its market growth.

Thailand is considered to be the largest production base for electrical appliances in ASEAN. The electronics & electrical component sector of the country was valued over $60 billion in 2017. The automotive industry in the country has an annual output of nearly two million vehicles, more than countries like the United Kingdom, Italy, Turkey, the Czech Republic, and Belgium. Thailand is also one of the biggest markets for pick-up trucks with more than 50% market share for one-ton trucks. Such factors are estimated to fuel the demand for carbon nanotubes in the country.

Jiangsu Cnano Technology Co Ltd is engaged in the production, research and development, and sale of carbon nanotube materials. The product portfolio of the company includes carbon nanotube conductive paste, carbon nanotube powder, graphene composite conductive paste, etc. The company supplies its products to structural, energy storage, and electronics industries. The company is based in Zhenjiang, China.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- GROWING DEMAND FOR ELECTRONICS & SEMICONDUCTORS

- USE OF CARBON NANOTUBES IN THE AEROSPACE INDUSTRY

- TECHNOLOGICAL INNOVATION & ADVANCEMENT TO TAP THE POTENTIAL APPLICATIONS OF CARBON NANOTUBES

- KEY RESTRAINTS

- HIGH PRODUCTION COSTS ASSOCIATED WITH CARBON NANOTUBES

- HARMFUL EFFECTS OF CARBON NANOTUBES ON THE ENVIRONMENT

- KEY ANALYTICS

- IMPACT OF COVID-19 ON CARBON NANOTUBES

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- MARKET BY TYPE

- MULTI-WALLED CARBON NANOTUBES

- SINGLE-WALLED CARBON NANOTUBES

- OTHER TYPE

- MARKET BY APPLICATION

- STRUCTURAL POLYMER COMPOSITES

- CONDUCTIVE POLYMER COMPOSITES

- CONDUCTIVE ADHESIVES

- FIRE RETARDANT PLASTICS

- METAL MATRIX COMPOSITES

- LI-ION BATTERY ELECTRODES

- OTHER APPLICATIONS

- MARKET BY END-USER

- ELECTRONICS

- AEROSPACE AND DEFENSE

- AUTOMOTIVE

- TEXTILES

- HEALTHCARE

- ENERGY

- OTHER END-USER INDUSTRIES

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILE

- ARKEMA SA

- CARBON SOLUTIONS INC

- CHASM ADVANCED MATERIALS INC

- CHEAP TUBES INC

- TIMESNANO (CHENGDU ORGANIC CHEMICALS CO LTD)

- HANWHA CORPORATION

- HYPERION CATALYSIS INTERNATIONAL INC

- JIANGSU CNANO TECHNOLOGY CO LTD

- KUMHO PETROCHEMICAL CO LTD

- MEIJO NANO CARBON CO LTD

- NANO-C

- NANOCYL SA

- NANOLAB INC

- NANOSHEL LLC

- OCSIAL

- RAYMOR INDUSTRIES INC

- SHOWA DENKO KK

- THOMAS SWAN & CO LTD

- TORAY INDUSTRIES INC

- ZEON CORPORATION

TABLE LIST

TABLE 1: MARKET SNAPSHOT – CARBON NANOTUBES

TABLE 2: SOME OF THE RECENT TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF CARBON NANOTUBES

TABLE 3: PATENT & PAPER FILED FOR CARBON NANOTUBES, 2000–2010

TABLE 4: KEY POTENTIAL APPLICATIONS OF MULTI-WALLED CARBON NANOTUBES ON THE SHORT-MID-AND-LONG-TERM

TABLE 5: ASIA PACIFIC CARBON NANOTUBES MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 6: ASIA PACIFIC CARBON NANOTUBES MARKET, BY TYPE, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 7: ASIA PACIFIC CARBON NANOTUBES MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 8: ASIA PACIFIC CARBON NANOTUBES MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 9: ASIA PACIFIC CARBON NANOTUBES MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 10: ASIA PACIFIC CARBON NANOTUBES MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 11: ASIA PACIFIC CARBON NANOTUBES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 12: ASIA PACIFIC CARBON NANOTUBES MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: REVENUE GENERATED BY SEMICONDUCTOR INDUSTRY IN TERMS OF PRODUCTION, 2016-2019 (IN $ 100 MILLION)

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: PORTER’S FIVE FORCE ANALYSIS

FIGURE 4: OPPORTUNITY MATRIX

FIGURE 5: VENDOR LANDSCAPE

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: ASIA PACIFIC CARBON NANOTUBES MARKET, GROWTH POTENTIAL, BY TYPE, IN 2019

FIGURE 8: ASIA PACIFIC CARBON NANOTUBES MARKET, BY MULTI-WALLED CARBON NANOTUBES, 2019-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC CARBON NANOTUBES MARKET, BY SINGLE-WALLED CARBON NANOTUBES, 2019-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC CARBON NANOTUBES MARKET, BY OTHER TYPE, 2019-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC CARBON NANOTUBES MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2019

FIGURE 12: ASIA PACIFIC CARBON NANOTUBES MARKET, BY STRUCTURAL POLYMER COMPOSITES, 2019-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC CARBON NANOTUBES MARKET, BY CONDUCTIVE POLYMER COMPOSITES, 2019-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC CARBON NANOTUBES MARKET, BY CONDUCTIVE ADHESIVES, 2019-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC CARBON NANOTUBES MARKET, BY FIRE RETARDANT PLASTICS, 2019-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC CARBON NANOTUBES MARKET, BY METAL MATRIX COMPOSITES, 2019-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC CARBON NANOTUBES MARKET, BY LI-ION BATTERY ELECTRODES, 2019-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC CARBON NANOTUBES MARKET, BY OTHER APPLICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC CARBON NANOTUBES MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 20: ASIA PACIFIC CARBON NANOTUBES MARKET, BY ELECTRONICS, 2019-2028 (IN $ MILLION)

FIGURE 21: ASIA PACIFIC CARBON NANOTUBES MARKET, BY AEROSPACE AND DEFENSE, 2019-2028 (IN $ MILLION)

FIGURE 22: ASIA PACIFIC CARBON NANOTUBES MARKET, BY AUTOMOTIVE, 2019-2028 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC CARBON NANOTUBES MARKET, BY TEXTILES, 2019-2028 (IN $ MILLION)

FIGURE 24: ASIA PACIFIC CARBON NANOTUBES MARKET, BY HEALTHCARE, 2019-2028 (IN $ MILLION)

FIGURE 25: ASIA PACIFIC CARBON NANOTUBES MARKET, BY ENERGY, 2019-2028 (IN $ MILLION)

FIGURE 26: ASIA PACIFIC CARBON NANOTUBES MARKET, BY OTHER END-USER INDUSTRIES, 2019-2028 (IN $ MILLION)

FIGURE 27: ASIA PACIFIC CARBON NANOTUBES MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 28: CHINA CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 29: JAPAN CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 30: INDIA CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 31: SOUTH KOREA CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: INDONESIA CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: THAILAND CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: VIETNAM CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: AUSTRALIA & NEW ZEALAND CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: REST OF ASIA PACIFIC CARBON NANOTUBES MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY TYPE

- MULTI-WALLED CARBON NANOTUBES

- SINGLE-WALLED CARBON NANOTUBES

- OTHER TYPE

- MARKET BY APPLICATION

- STRUCTURAL POLYMER COMPOSITES

- CONDUCTIVE POLYMER COMPOSITES

- CONDUCTIVE ADHESIVES

- FIRE RETARDANT PLASTICS

- METAL MATRIX COMPOSITES

- LI-ION BATTERY ELECTRODES

- OTHER APPLICATIONS

- MARKET BY END-USER

- ELECTRONICS

- AEROSPACE AND DEFENSE

- AUTOMOTIVE

- TEXTILES

- HEALTHCARE

- ENERGY

- OTHER END-USER INDUSTRIES

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.