ASIA PACIFIC BLOOD MARKET FORECAST 2019-2028

Asia Pacific Blood Market by Product (Whole Blood Collection (Whole Blood Collection Systems, Whole Blood Collection Reagents), Source Plasma Collection (Source Plasma Collection Systems, Source Plasma Collection Reagents), Blood Therapeutics (Intravenous Immunoglobulin (Ivig),albumin, Hyperimmune, Factor Viii, Factor Ix, Other Blood Therapeutics), Blood Typing (Blood Typing Systems, Blood Typing Reagents), Blood Screening (Blood Screening Systems, Blood Screening Reagents), Blood Processing Equipment (Blood Processing Equipment Systems, Blood Processing Equipment Reagents)) by End-user (Blood & Blood Component Banks, Diagnostic Laboratories, Ambulatory Surgical Centers, Hospitals, Other End-users) and by Geography.

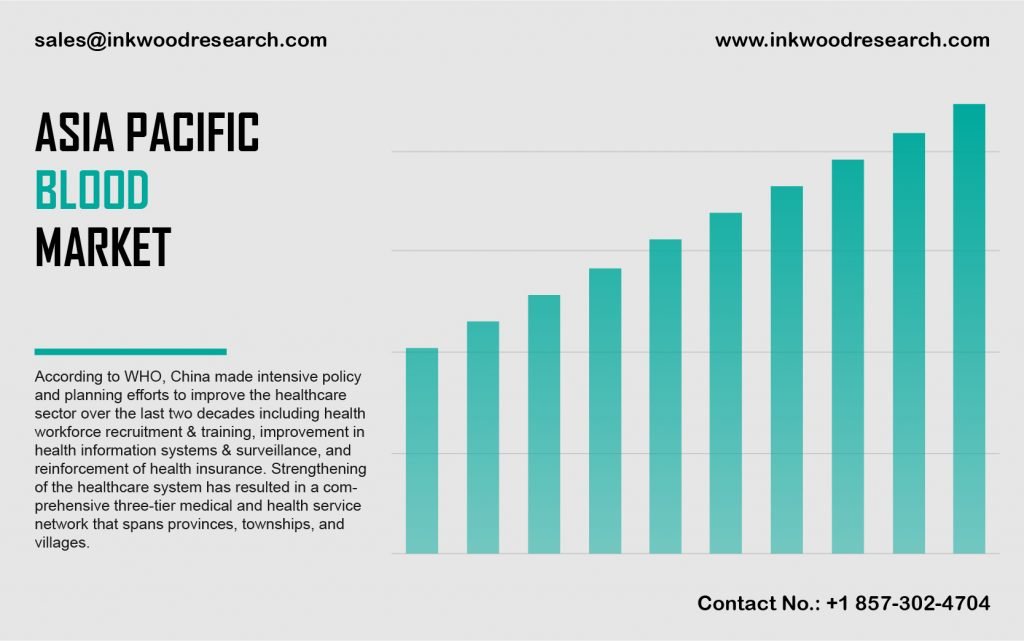

The Asia Pacific blood market is expected to record a CAGR of 4.71%, during the forecast period of 2019 to 2028. The key factors promoting the market growth include, increased lucrative opportunities for blood collection equipment industries, due to the growing number of individuals prone to chronic diseases, as well as the improving quality of healthcare facilities in the region.

To know more about this report, request a free sample copy

The Asia Pacific blood market growth is evaluated across India, China, Japan, Australia & New Zealand, Vietnam, Thailand, South Korea, Indonesia, and the rest of the Asia Pacific. The market in China is mainly propagated by the rising number of organ transplants. The average amount of blood and platelets required for organ transplantation fuels the country’s need for blood donation. However, blood shortage, due to insufficient blood donations, challenges China’s blood market.

The scarcity of blood is a serious threat to public health and blood supply. According to China’s Ministry of Health, more than 9% of the country’s eligible population donated blood in 2014, which is relatively lower than the recommended rate by the World Health Organization (WHO). Besides, the Blood Donation Law, 1998, has prohibited all kinds of paid blood donations for medical use, and instead, encourages regional residents to donate blood voluntarily. The law also provides volunteers a nutrition allowance, leaves of absence, and priority access to blood transfusion, especially during emergencies, to encourage donations. These initiatives are also estimated to bolster the region’s market growth.

With its headquarters in Victoria, Australia, CSL Limited is a leading global distributor of biotherapies to prevent and treat rare medical disorders. The enterprise functions through its human health businesses, including CSL Plasma, CSL Behring, and Seqirus. In May 2020, the company announced the beginning of immediate onshore development of an anti-SARS-CoV-2 plasma product, with the potential to treat people with critical complications of COVID-19.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASING DEMAND FOR BLOOD AND OTHER BLOOD RELATED PRODUCTS ACROSS THE WORLD

- SURGE IN GERIATRIC POPULATION ACROSS THE GLOBE

- RISE IN BLOOD DONATIONS AND PLASMA DONATIONS

- PROMISING GOVERNMENT REGULATIONS FOR BLOOD SCREENING

- PROGRESSION IN BLOOD TRANSFUSION AND BLOOD SCREENING INSTRUMENTS

- KEY RESTRAINTS

- HIGH COST OF ADVANCED BLOOD COLLECTION DEVICES

- DEARTH OF SKILLED LABORATORY PROFESSIONALS

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- IMPACT OF COVID – BLOOD MARKET

- MARKET BY PRODUCT

- WHOLE BLOOD COLLECTION

- WHOLE BLOOD COLLECTION SYSTEMS

- WHOLE BLOOD COLLECTION REAGENTS

- SOURCE PLASMA COLLECTION

- SOURCE PLASMA COLLECTION SYSTEMS

- SOURCE PLASMA COLLECTION REAGENTS

- BLOOD THERAPEUTICS

- INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- ALBUMIN

- HYPERIMMUNE

- FACTOR VIII

- FACTOR IX

- OTHER BLOOD THERAPEUTICS

- BLOOD TYPING

- BLOOD TYPING SYSTEMS

- BLOOD TYPING REAGENTS

- BLOOD SCREENING

- BLOOD SCREENING SYSTEMS

- BLOOD SCREENING REAGENTS

- BLOOD PROCESSING EQUIPMENT

- BLOOD PROCESSING EQUIPMENT SYSTEMS

- BLOOD PROCESSING EQUIPMENT REAGENTS

- WHOLE BLOOD COLLECTION

- MARKET BY END-USER

- BLOOD & BLOOD COMPONENT BANKS

- DIAGNOSTIC LABORATORIES

- AMBULATORY SURGICAL CENTERS

- HOSPITALS

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILES

- ABBOTT LABORATORIES

- BIO-RAD LABORATORIES INC

- CSL LIMITED (CSL BEHRING)

- F HOFFMANN-LA ROCHE LTD

- GRIFOLS INTERNATIONAL SA

- HAEMONETICS CORPORATION

- MERCK & CO INC

- NOVO NORDISK A/S

- BAXTER INTERNATIONAL INC

- BECTON DICKINSON AND COMPANY

- FRESENIUS KABI AG

- ORTHO CLINICAL DIAGNOSTICS

- TERUMO CORPORATION (TERUMO BCT INC)

- IMMUCOR INC

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – BLOOD

TABLE 2: ASIA PACIFIC BLOOD MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: ASIA PACIFIC BLOOD MARKET, BY PRODUCT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC BLOOD MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: ASIA PACIFIC BLOOD MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC BLOOD MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: ASIA PACIFIC BLOOD MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2019

FIGURE 6: ASIA PACIFIC BLOOD MARKET, BY WHOLE BLOOD COLLECTION, 2019-2028 (IN $ MILLION)

FIGURE 7: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY WHOLE BLOOD COLLECTION, IN 2019

FIGURE 8: ASIA PACIFIC BLOOD MARKET, BY WHOLE BLOOD COLLECTION SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC BLOOD MARKET, BY WHOLE BLOOD COLLECTION REAGENTS, 2019-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC BLOOD MARKET, BY SOURCE PLASMA COLLECTION, 2019-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY SOURCE PLASMA COLLECTION, IN 2019

FIGURE 12: ASIA PACIFIC BLOOD MARKET, BY SOURCE PLASMA COLLECTION SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC BLOOD MARKET, BY SOURCE PLASMA COLLECTION REAGENTS, 2019-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC BLOOD MARKET, BY BLOOD THERAPEUTICS, 2019-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY BLOOD THERAPEUTICS, IN 2019

FIGURE 16: ASIA PACIFIC BLOOD MARKET, BY SOURCE PLASMA COLLECTION SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC BLOOD MARKET, BY ALBUMIN, 2019-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC BLOOD MARKET, BY HYPERIMMUNE, 2019-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC BLOOD MARKET, BY FACTOR VIII, 2019-2028 (IN $ MILLION)

FIGURE 20: ASIA PACIFIC BLOOD MARKET, BY FACTOR IX, 2019-2028 (IN $ MILLION)

FIGURE 21: ASIA PACIFIC BLOOD MARKET, BY OTHER BLOOD THERAPEUTICS, 2019-2028 (IN $ MILLION)

FIGURE 22: ASIA PACIFIC BLOOD MARKET, BY BLOOD TYPING, 2019-2028 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY BLOOD TYPING, IN 2019

FIGURE 24: ASIA PACIFIC BLOOD MARKET, BY BLOOD TYPING SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 25: ASIA PACIFIC BLOOD MARKET, BY BLOOD TYPING REAGENTS, 2019-2028 (IN $ MILLION)

FIGURE 26: ASIA PACIFIC BLOOD MARKET, BY BLOOD SCREENING, 2019-2028 (IN $ MILLION)

FIGURE 27: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY BLOOD SCREENING, IN 2019

FIGURE 28: ASIA PACIFIC BLOOD MARKET, BY BLOOD SCREENING SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 29: ASIA PACIFIC BLOOD MARKET, BY BLOOD SCREENING REAGENTS, 2019-2028 (IN $ MILLION)

FIGURE 30: ASIA PACIFIC BLOOD MARKET, BY BLOOD PROCESSING EQUIPMENT, 2019-2028 (IN $ MILLION)

FIGURE 31: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY BLOOD PROCESSING EQUIPMENT, IN 2019

FIGURE 32: ASIA PACIFIC BLOOD MARKET, BY BLOOD PROCESSING EQUIPMENT SYSTEMS, 2019-2028 (IN $ MILLION)

FIGURE 33: ASIA PACIFIC BLOOD MARKET, BY BLOOD PROCESSING EQUIPMENT REAGENTS, 2019-2028 (IN $ MILLION)

FIGURE 34: ASIA PACIFIC BLOOD MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 35: ASIA PACIFIC BLOOD MARKET, BY BLOOD & BLOOD COMPONENT BANKS, 2019-2028 (IN $ MILLION)

FIGURE 36: ASIA PACIFIC BLOOD MARKET, BY DIAGNOSTIC LABORATORIES, 2019-2028 (IN $ MILLION)

FIGURE 37: ASIA PACIFIC BLOOD MARKET, BY AMBULATORY SURGICAL CENTERS, 2019-2028 (IN $ MILLION)

FIGURE 38: ASIA PACIFIC BLOOD MARKET, BY HOSPITALS, 2019-2028 (IN $ MILLION)

FIGURE 39: ASIA PACIFIC BLOOD MARKET, BY OTHER END-USERS, 2019-2028 (IN $ MILLION)

FIGURE 40: ASIA PACIFIC BLOOD MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 41: ASIA PACIFIC BLOOD MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 42: CHINA BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 43: JAPAN BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 44: INDIA BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 45: SOUTH KOREA BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 46: INDONESIA BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 47: THAILAND BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 48: VIETNAM BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 49: AUSTRALIA & NEW ZEALAND BLOOD MARKET, 2019-2028 (IN $ MILLION)

FIGURE 50: REST OF ASIA PACIFIC BLOOD MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY PRODUCT

- WHOLE BLOOD COLLECTION

- WHOLE BLOOD COLLECTION SYSTEMS

- WHOLE BLOOD COLLECTION REAGENTS

- SOURCE PLASMA COLLECTION

- SOURCE PLASMA COLLECTION SYSTEMS

- SOURCE PLASMA COLLECTION REAGENTS

- BLOOD THERAPEUTICS

- INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- ALBUMIN

- HYPERIMMUNE

- FACTOR VIII

- FACTOR IX

- OTHER BLOOD THERAPEUTICS

- BLOOD TYPING

- BLOOD TYPING SYSTEMS

- BLOOD TYPING REAGENTS

- BLOOD SCREENING

- BLOOD SCREENING SYSTEMS

- BLOOD SCREENING REAGENTS

- BLOOD PROCESSING EQUIPMENT

- BLOOD PROCESSING EQUIPMENT SYSTEMS

- BLOOD PROCESSING EQUIPMENT REAGENTS

- WHOLE BLOOD COLLECTION

- MARKET BY END-USER

- BLOOD & BLOOD COMPONENT BANKS

- DIAGNOSTIC LABORATORIES

- AMBULATORY SURGICAL CENTERS

- HOSPITALS

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.