ASIA PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET FORECAST 2021-2028

Asia Pacific Automotive Paints & Coatings Market by Product Type (Solvent-borne, Water-borne, Other Coatings (Powder Coatings, ETC)) Market by Vehicle Type (Passenger Vehicles, Commercial Vehicles) Market by Texture Type (Solid, Metallic, Pearlescent, Other Texture Type) Market by Coat Type (Base Coat, Electro Coat, Clear Coat, Primer) Market by End-users (Original Equipment Manufacturers (OEM), Automotive Refinish) by Gepgraphy.

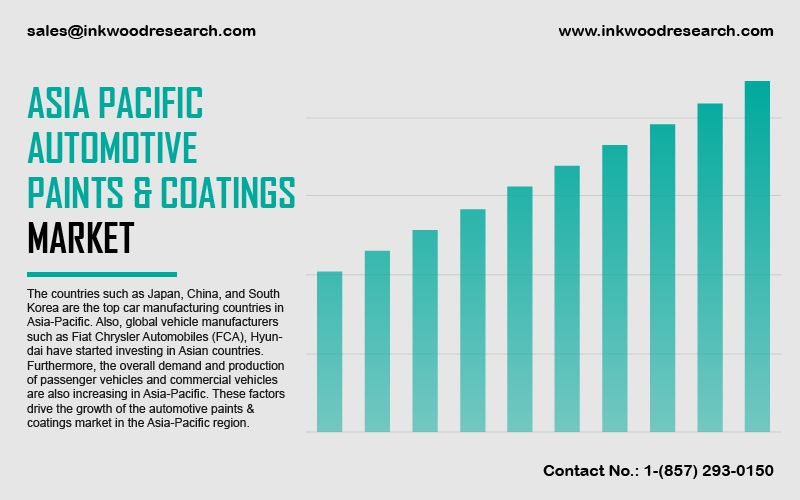

The Asia-Pacific automotive paints & coatings market is expected to record a CAGR of 4.08% across the forecasting years of 2021 to 2028. Key factors such as the presence of leading automobile manufacturers, the increasing demand and production of passenger vehicles as well as commercial vehicles, and governmental support through incentives are set to strengthen the regional market’s growth.

To know more about this report, request a free sample copy.

The Asia-Pacific automotive paints & coatings market growth analysis comprises the assessment of South Korea, China, Thailand, India, Japan, and the rest of the Asia-Pacific. Virtually all of China’s top-selling automobiles are the product of joint ventures with global automakers. Since the country’s legislation mandates the formation of joint ventures with Chinese brands, General Motors, for instance, possesses a long-standing partnership with the Shanghai Automotive Industry Corporation. Similarly, South Korea-based automobile manufacturer Hyundai formed a joint venture with the Shanghai Automotive Industry Corporation, as well.

Over the years, India has advanced to become a notable player across the global automobile sector, ranking fourth in the Asia-Pacific in 2020. Moreover, as per the statistics issued by the Department for Promotion of Industry and Internal Trade (DPIIT), India’s automobile industry acquired more than $25 billion in foreign direct investment (FDI) from April 2020 to December 2020. Besides, the gross value added by the Indian road transportation industry in the financial year 2020 was approximately $58.26 billion. As a result, these factors are projected to augment the automotive paints & coatings market in the Asia-Pacific over the forecast period.

Berger Paints Ltd is a multinational plant manufacturing company. Its product portfolio includes wood paints, interior, and exterior wall coatings, external thermal insulation and composite systems (ETICS), metal primers, and wall putties. It primarily caters to the general industry as well as automotive sectors. The firm is headquartered in India and is operational in the Asia-Pacific and North America.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND FOR PASSENGER VEHICLES

- PROACTIVE GOVERNMENT SUPPORT FOR AUTOMOTIVE INDUSTRY

- RISING DEMAND FOR HYGIENIC AUTOMOTIVE INTERIORS

- KEY RESTRAINTS

- INCREASING REGULATION THREATS AND MEETING NUMEROUS FORMULATORS’ REGISTRATION REQUIREMENTS

- HIGH COSTS AND SHORTAGES OF RAW MATERIALS FOR COATINGS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON AUTOMOTIVE PAINTS & COATINGS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PRODUCT TYPE

- SOLVENT-BORNE

- WATER-BORNE

- OTHER COATINGS (POWDER COATINGS, ETC)

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLES

- COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- 2-WHEELERS

- MARKET BY TEXTURE TYPE

- SOLID

- METALLIC

- PEARLESCENT

- OTHER TEXTURE TYPE

- MARKET BY COAT TYPE

- BASE COAT

- ELECTRO COAT

- CLEAR COAT

- PRIMER

- MARKET BY END-USERS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- AUTOMOTIVE REFINISH

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- THAILAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AKZO NOBEL NV

- AXALTA COATING SYSTEMS

- BASF SE

- BERGER PAINTS LTD

- CONCEPT PAINTS

- HMG PAINTS LTD

- KANSAI PAINT CO LTD

- KAPCI COATINGS

- KCC CORPORATION

- NATIONAL PAINTS FACTORIES CO LTD

- PPG INDUSTRIES INC

- RED SPOT PAINT

- RPM INTERNATIONAL INC

- SHERWIN-WILLIAMS

- VALSPAR CORPORATION

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – AUTOMOTIVE PAINTS & COATINGS

TABLE 2: NEW PASSENGER CAR REGISTRATIONS IN TOP COUNTRIES IN 2020

TABLE 3: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY VEHICLE TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY VEHICLE TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 7: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY TEXTURE TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY TEXTURE TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 11: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COAT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 12: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COAT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 13: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY END-USERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 14: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY END-USERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 15: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 16: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 17: KEY PLAYERS IN ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET

TABLE 18: PRODUCTION & SALES OF AUTOMOBILES IN CHINA (2016-2020)

TABLE 19: PRODUCTION & SALES OF AUTOMOBILES IN JAPAN (2016-2020)

TABLE 20: PRODUCTION & SALES OF AUTOMOBILES IN INDIA (2016-2020)

TABLE 21: PRODUCTION & SALES OF AUTOMOBILES IN SOUTH KOREA (2016-2020)

TABLE 22: PRODUCTION & SALES OF AUTOMOBILES IN THAILAND (2016-2020)

TABLE 23: PRODUCTION & SALES OF AUTOMOBILES IN PHILIPPINES (2016-2020)

TABLE 24: PRODUCTION & SALES OF AUTOMOBILES IN TAIWAN (2016-2020)

TABLE 25: PRODUCTION & SALES OF AUTOMOBILES IN MALAYSIA (2016-2020)

TABLE 26: PRODUCTION & SALES OF AUTOMOBILES IN SINGAPORE (2016-2020)

TABLE 27: LIST OF MERGERS & ACQUISITIONS

TABLE 28: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 29: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

FIGURE LIST

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 6: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY SOLVENT-BORNE, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY WATER-BORNE, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY OTHER COATINGS (POWDER COATINGS, ETC), 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY VEHICLE TYPE, IN 2020

FIGURE 10: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY PASSENGER VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY COMMERCIAL VEHICLES, IN 2020

FIGURE 13: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY HEAVY COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY LIGHT COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY 2-WHEELERS, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY TEXTURE TYPE, IN 2020

FIGURE 17: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY SOLID, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY METALLIC, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY PEARLESCENT, 2021-2028 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY OTHER TEXTURE TYPE, 2021-2028 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY COAT TYPE, IN 2020

FIGURE 22: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY BASE COAT, 2021-2028 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY ELECTRO COAT, 2021-2028 (IN $ MILLION)

FIGURE 24: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY CLEAR COAT, 2021-2028 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRIMER, 2021-2028 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY END-USERS, IN 2020

FIGURE 27: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY ORIGINAL EQUIPMENT MANUFACTURERS (OEM), 2021-2028 (IN $ MILLION)

FIGURE 28: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY AUTOMOTIVE REFINISH, 2021-2028 (IN $ MILLION)

FIGURE 29: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 30: CHINA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 31: JAPAN AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: INDIA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: SOUTH KOREA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 34: THAILAND AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: REST OF ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- THAILAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- MARKET BY PRODUCT TYPE

- SOLVENT-BORNE

- WATER-BORNE

- OTHER COATINGS (POWDER COATINGS, ETC)

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLES

- COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- 2-WHEELERS

- MARKET BY TEXTURE TYPE

- SOLID

- METALLIC

- PEARLESCENT

- OTHER TEXTURE TYPE

- MARKET BY COAT TYPE

- BASE COAT

- ELECTRO COAT

- CLEAR COAT

- PRIMER

- MARKET BY END-USERS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- AUTOMOTIVE REFINISH

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.