ASIA PACIFIC ANTICOAGULANTS MARKET FORECAST 2021-2028

Asia Pacific Anticoagulants Market by Application (Atrial Fibrillation & Heart Attack, Pulmonary Embolism (Pe), Deep Vein Thrombosis (Dvt), Stroke, Other Applications) by Route of Administration (Oral Anticoagulants, Injectable Anticoagulants) by Drug Class (Noacs (Xarelto, Eliquis, Pradaxa, Savaysa & Lixiana, Bevyxxa), Heparins & Low-molecular-weight Heparins (Lmwhs), Vitamin K Antagonists, Other Drug Class) and by Geography.

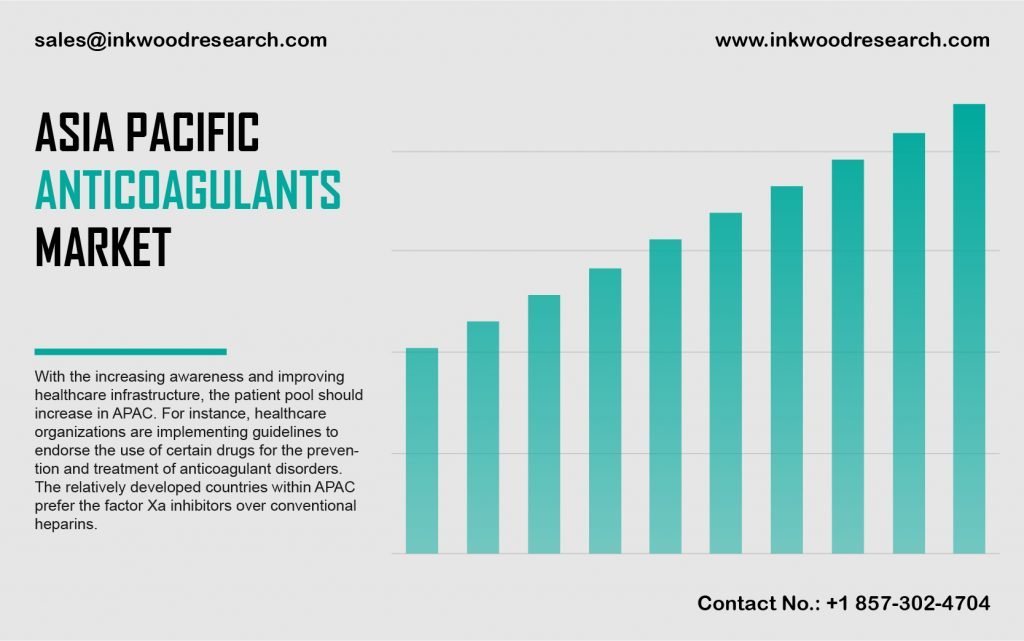

The Asia Pacific anticoagulants market is expected to grow with a CAGR of 8.83%, during the forecast period of 2021 to 2028. The region’s market growth is attributed to factors such as the improving healthcare infrastructure, increased awareness, the lucrative opportunities across developing economies, and the increasing research and development activities for developing newer therapeutics.

To learn more about this report, request a free sample copy

The Asia Pacific anticoagulants market growth is assessed by evaluating Japan, South Korea, Vietnam, Indonesia, India, China, Thailand, Australia & New Zealand, and the rest of the Asia Pacific. In China, the prevalence of cardiovascular diseases (CVDs) is increasing at an alarming rate. For instance, according to the Li-Yuan Ma report in 2018, out of nearly 290 million patients with CVDs, at least 2 in 5 fatalities in China are accredited to cardiovascular conditions. Besides, this figure is higher than the death-rate caused by cancer and other serious ailments. CVDs have also continued to remain the leading cause of death in China, representing over 45% of all the deaths in rural areas and 43.16% in urban areas.

On the other hand, as per the report by Kimi Sawada et al., published in the BMC Public Health Journal, CVDs are among the primary contributors to Japan’s disease burden. These conditions account for more than 20% of the country’s overall medical expenditure. As a result, such factors are expected to drive the anticoagulants market in the Asia Pacific, over the forecast period.

Daiichi Sankyo, headquartered in Tokyo, Japan, provides therapies for thrombotic disorders, hypertension, diabetes, and IV iron therapy, among others. Moreover, the company’s research and development department is predominantly focused on introducing new therapies in oncology, including immune-oncology, in addition to an increased focus on pain management and other rare conditions.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- SURGING PREVALENCE OF CHRONIC DISEASE

- ADVANCEMENTS IN TECHNOLOGY

- RISING APPROVAL OF NOVEL ORAL ANTICOAGULANTS (NOACS)

- KEY RESTRAINTS

- SIDE EFFECTS ASSOCIATED WITH ANTICOAGULANTS TREATMENT

- HIGH PRICE OF NOACS

- KEY DRIVERS

- KEY ANALYTICS

- PORTER’S FIVE FORCES ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- IMPACT OF COVID-19 ON ANTICOAGULANTS MARKET

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCES ANALYSIS

- MARKET BY APPLICATION

- ATRIAL FIBRILLATION & HEART ATTACK

- PULMONARY EMBOLISM (PE)

- DEEP VEIN THROMBOSIS (DVT)

- STROKE

- OTHER APPLICATIONS

- MARKET BY ROUTE OF ADMINISTRATION

- ORAL ANTICOAGULANTS

- INJECTABLE ANTICOAGULANTS

- MARKET BY DRUG CLASS

- NOACS

- HEPARINS & LOW-MOLECULAR-WEIGHT HEPARINS (LMWHS)

- VITAMIN K ANTAGONISTS

- OTHER DRUG CLASS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- AUSTRALIA & NEW ZEALAND

- INDIA

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- BUSINESS EXPANSION/ APPROVAL/ ANNOUNCEMENT

- COMPANY PROFILE

- ABBOTT LABORATORIES

- ALEXION PHARMACEUTICAL INC

- ASPEN PHARMACARE HOLDINGS LIMITED

- BAYER AG

- BOEHRINGER INGELHEIM GMBH

- BRISTOL-MYERS SQUIBB COMPANY

- DAIICHI SANKYO

- REDDY’S LABORATORIES

- GLAXOSMITHKLINE PLC

- JOHNSON & JOHNSON

- LEO PHARMA AS

- MERCK & CO

- NOVARTIS AG

- PFIZER INC

- SANOFI

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ANTICOAGULANTS

TABLE 2: ASIA PACIFIC ANTICOAGULANTS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: ASIA PACIFIC ANTICOAGULANTS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC ANTICOAGULANTS MARKET, BY ROUTE OF ADMINISTRATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA PACIFIC ANTICOAGULANTS MARKET, BY ROUTE OF ADMINISTRATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC ANTICOAGULANTS MARKET, BY DRUG CLASS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: ASIA PACIFIC ANTICOAGULANTS MARKET, BY DRUG CLASS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: ASIA PACIFIC ANTICOAGULANTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA PACIFIC ANTICOAGULANTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE10: LEADING PLAYERS OPERATING IN ASIA PACIFIC ANTICOAGULANTS MARKET

LIST OF FIGURES

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: OPPORTUNITY MATRIX

FIGURE 3: VENDOR LANDSCAPE

FIGURE 4: KEY INVESTMENT INSIGHTS

FIGURE 5: ASIA PACIFIC ANTICOAGULANTS MARKET, BY APPLICATION, IN 2020

FIGURE 6: ASIA PACIFIC ANTICOAGULANTS MARKET, BY ATRIAL FIBRILLATION & HEART ATTACK, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA PACIFIC ANTICOAGULANTS MARKET, BY PULMONARY EMBOLISM (PE), 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC ANTICOAGULANTS MARKET, BY DEEP VEIN THROMBOSIS (DVT), 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC ANTICOAGULANTS MARKET, BY STROKE, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC ANTICOAGULANTS MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC ANTICOAGULANTS MARKET, BY ROUTE OF ADMINISTRATION, IN 2020

FIGURE 12: ASIA PACIFIC ANTICOAGULANTS MARKET, BY ORAL ANTICOAGULANTS, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC ANTICOAGULANTS MARKET, BY INJECTABLE ANTICOAGULANTS, 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC ANTICOAGULANTS MARKET, BY DRUG CLASS, IN 2020

FIGURE 15: ASIA PACIFIC ANTICOAGULANTS MARKET, BY NOACS, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC ANTICOAGULANTS MARKET, BY HEPARINS & LOW-MOLECULAR-WEIGHT HEPARINS (LMWHS), 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC ANTICOAGULANTS MARKET, BY VITAMIN K ANTAGONISTS, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC ANTICOAGULANTS MARKET, BY OTHER DRUG CLASS, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC ANTICOAGULANTS MARKET, COUNTRY OUTLOOK, 2020 & 2028 (IN %)

FIGURE 20: CHINA ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 21: JAPAN ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 22: AUSTRALIA & NEW ZEALAND ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 23: INDIA ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 24: SOUTH KOREA ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 25: THAILAND ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 26: INDONESIA ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 27: VIETNAM ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 28: REST OF ASIA PACIFIC ANTICOAGULANTS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- AUSTRALIA & NEW ZEALAND

- INDIA

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY APPLICATION

- ATRIAL FIBRILLATION & HEART ATTACK

- PULMONARY EMBOLISM (PE)

- DEEP VEIN THROMBOSIS (DVT)

- STROKE

- OTHER APPLICATIONS

- MARKET BY ROUTE OF ADMINISTRATION

- ORAL ANTICOAGULANTS

- INJECTABLE ANTICOAGULANTS

- MARKET BY DRUG CLASS

- NOACS

- HEPARINS & LOW-MOLECULAR-WEIGHT HEPARINS (LMWHS)

- VITAMIN K ANTAGONISTS

- OTHER DRUG CLASS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.