ASIA PACIFIC ANTI-RHEUMATIC MARKET FORECAST 2020-2028

Asia Pacific Anti-rheumatics Market by Type (Prescription-based Drugs, Over-the-counter Drugs) by Drug Class (Disease Modifying Anti-rheumatic Drugs, Nonsteroidal Anti-inflammatory Drugs, Corticosteroids, Uric Acid Drugs, Other Drug Class) and by Geography.

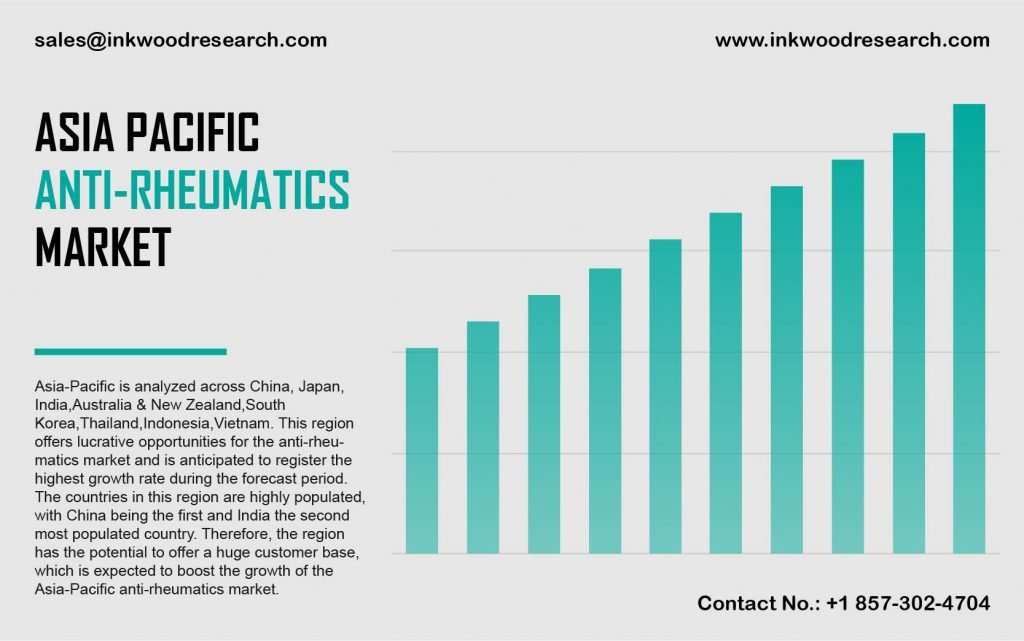

The Asia Pacific anti-rheumatics market is anticipated to register a CAGR of 2.38% over the projected period of 2020-2028. The region is highly populated due to the presence of most populated countries like India and China. Hence, the region has the potential to offer a huge customer base, which will augment market growth.

In order to analyze the Asia Pacific anti-rheumatics market further, the region is segmented into India, Australia & New Zealand, China, Indonesia, Japan, Vietnam, South Korea, Thailand, and the rest of Asia Pacific. China, follows the ACR 2012 and 2013 EULAR recommendations for the treatment and management of RA. The tests commonly used in China by rheumatologists are ESR, RF, CRP, X-ray, MRI, and other blood tests. In Japan, rheumatologists follow three different guidelines for the diagnosis and management of RA, and somewhat different trends in terms of the line of therapy which is driving the market.

In countries like India, the number of rheumatologists to treat RA patients all over the country is not sufficient. So these patients are managed by an orthopedic surgeon, GP, or a rheumatologist, if available. The market is expected to grow at a moderate rate due to the insufficient numbers of rheumatologists in the country. In countries like Australia, approximately 1.9% of the total population had rheumatoid arthritis in 2017-2018. In Australia, viral screenings and serology tests are used to dismiss other forms of arthritis, as viral arthritis is a common alternative diagnosis to RA. In New Zealand, RA affects 40,000 people and is the second most common form of arthritis. Women and smokers have a higher rate of RA.

Lupin Ltd, headquartered in Mumbai, India, sells drugs and products in over 100 countries of the world. Its product, Etanercept, treats certain autoimmune diseases, including psoriatic arthritis, rheumatoid arthritis, among others.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- RISING GERIATRIC POPULATION

- INCREASING OPPORTUNITIES IN THE DEVELOPING ECONOMIES

- SURGE IN THE PREVALENCE OF RHEUMATOID ARTHRITIS DISEASE

- GROWING HEALTHCARE EXPENDITURE

- KEY RESTRAINTS

- PATENT EXPIRATIONS

- LACK OF REGULATORY GUIDELINES FOR BIOSIMILARS WILL DELAY THEIR AVAILABILITY IN SOME REGIONS

- LESS EXPENSIVE ALTERNATIVES

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- ETIOLOGY OF RHEUMATOID ARTHRITIS (RA)

- SYMPTOMS OF RHEUMATOID ARTHRITIS

- RISK FACTORS ASSOCIATED WITH RHEUMATOID ARTHRITIS

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY TYPE

- PRESCRIPTION-BASED DRUGS

- OVER-THE-COUNTER DRUGS

- MARKET BY DRUG CLASS

- DISEASE MODIFYING ANTI-RHEUMATIC DRUGS

- NONSTEROIDAL ANTI-INFLAMMATORY DRUGS

- CORTICOSTEROIDS

- URIC ACID DRUGS

- OTHER DRUG CLASS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILES

- ABBOTT LABORATORIES

- ABBVIE INC

- AMGEN INC

- BECTON, DICKINSON & COMPANY (BD)

- BIO-RAD LABORATORIES INC

- BRISTOL-MYERS SQUIBB COMPANY

- ELI LILLY & COMPANY

- LUPIN LIMITED

- HOFFMANN-LA ROCHE

- JOHNSON & JOHNSON

- MERCK & CO INC

- NOVARTIS AG

- PERKINELMER

- PFIZER INC

- UCB

TABLE LIST

TABLE 1: MARKET SNAPSHOT – ANTI-RHEUMATICS

TABLE 2: COMMON SYMPTOMS OF RHEUMATOID ARTHRITIS

TABLE 3: RISK FACTORS FOR RHEUMATOID ARTHRITIS

TABLE 4: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC PRESCRIPTION-BASED DRUGS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: ASIA PACIFIC PRESCRIPTION-BASED DRUGS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 8: ASIA PACIFIC OVER-THE-COUNTER DRUGS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: ASIA PACIFIC OVER-THE-COUNTER DRUGS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 10: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY DRUG CLASS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY DRUG CLASS, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 12: ASIA PACIFIC DISEASE MODIFYING ANTI-RHEUMATIC DRUGS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: ASIA PACIFIC DISEASE MODIFYING ANTI-RHEUMATIC DRUGS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 14: ASIA PACIFIC NONSTEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: ASIA PACIFIC NONSTEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 16: ASIA PACIFIC CORTICOSTEROIDS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: ASIA PACIFIC CORTICOSTEROIDS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 18: ASIA PACIFIC URIC ACID DRUGS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: ASIA PACIFIC URIC ACID DRUGS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 20: ASIA PACIFIC OTHER DRUG CLASS MARKET, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: ASIA PACIFIC OTHER DRUG CLASS MARKET, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 22: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

FIGURES LIST

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: OPPORTUNITY MATRIX

FIGURE 3: VENDOR LANDSCAPE

FIGURE 4: KEY INVESTMENT INSIGHTS

FIGURE 5: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY TYPE, IN 2019

FIGURE 6: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY PRESCRIPTION-BASED DRUGS, 2020-2028 (IN $ MILLION)

FIGURE 7: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY OVER-THE-COUNTER DRUGS, 2020-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY DRUG CLASS, IN 2019

FIGURE 9: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY DISEASE MODIFYING ANTI-RHEUMATIC DRUGS, 2020-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, 2020-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY CORTICOSTEROIDS, 2020-2028 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY URIC ACID DRUGS, 2020-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC ANTI-RHEUMATICS MARKET, BY OTHER DRUG CLASS, 2020-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC ANTI-RHEUMATICS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 15: CHINA ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 16: JAPAN ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 17: INDIA ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 18: AUSTRALIA & NEW ZEALAND ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 19: SOUTH KOREA ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 20: THAILAND ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 21: INDONESIA ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 22: VIETNAM ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

FIGURE 23: REST OF ASIA PACIFIC ANTI-RHEUMATICS MARKET, 2020-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY TYPE

- PRESCRIPTION-BASED DRUGS

- OVER-THE-COUNTER DRUGS

- MARKET BY DRUG CLASS

- DISEASE MODIFYING ANTI-RHEUMATIC DRUGS

- NONSTEROIDAL ANTI-INFLAMMATORY DRUGS

- CORTICOSTEROIDS

- URIC ACID DRUGS

- OTHER DRUG CLASS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.