ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET FORECAST 2019-2028

Asia Pacific Air Quality Control Systems Market by Application (Air Pollution Control, Automobiles, Tunnels, Public Transportation Stations, Underground Garages, Air Terminals, Other Applications) by Industry Vertical (Energy and Power, Powertrain Management, Mining, Commercial and Residential, Transportation, Agriculture, Medical and Pharma, Semiconductor, Other Industrial Vertical) by Pollutant (Gas, Voc, Dust, Other Pollutants) by Type of Product (Indoor, Ambient) and by Geography.

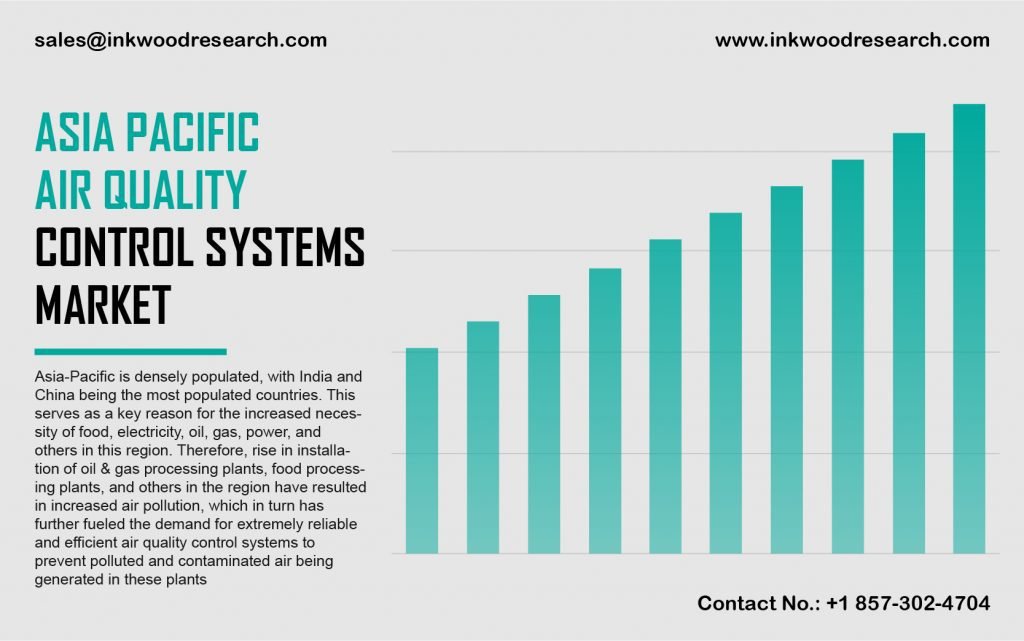

The Asia Pacific air quality control systems market is estimated to grow with a CAGR of 4.75%, across the forecast period of 2019 to 2028. Factors such as verification of real-time air quality index by governments, increased consumer awareness regarding air filters, and rising environment and health concerns, drive the region’s market growth.

To know more about this report, request a free sample copy

The Asia Pacific air quality control systems market growth is evaluated through, India, China, Thailand, Vietnam, Japan, Australia & New Zealand, South Korea, and Indonesia. The swift growth in China’s economy, especially within the industrial sectors, such as, power generation, chemical and metal processing, and cement manufacturing, has significantly increased air pollutant emissions in the country. As a result, the Chinese government has acknowledged the seriousness of air deterioration, owing to excessive energy consumption and the need to curb pollution. For instance, the State Council of China declared the Air Pollution Prevention and Control Action Plan, in September 2013, which establishes measurable goals to enhance the country’s air quality, within a particular time constraint.

Likewise, China’s 13th Five-Year (2016-2020) Plan for Economic and Social Development, strives to enhance air quality and manage emissions. This strategy also pledges to ensure maximum compliance with the standards of emissions. Additionally, aligning with the compliance strategy, new constructions, and existing power plants have been subjected to mercury radiation regulations. As a result, rising emissions due to growing economic endeavors, incorporated with strict government policies, positively influence the region’s market growth.

With its headquarters in Osaka, Japan, Daikin Industries, Ltd, manufactures and supplies air conditioners, chemicals, refrigerators, defense systems, electronics, and oil hydraulics. The company primarily operates through air conditioning and chemicals segments, across Asia, Europe, Oceania, the Middle East, and Africa.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES `

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- EFFECT OF POOR AIR QUALITY ON ECONOMY

- GROWING INDUSTRIAL ACTIVITIES

- GROWING DEMAND FOR AIR FILTERS

- GOVERNMENT SUPPORT

- KEY RESTRAINTS

- DECLINE IN THE USE OF NON-RENEWABLE RESOURCES IN POWER SECTOR

- INITIAL SETUP & OPERATING COST

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- SUPPLY CHAIN ANALYSIS

- IMPACT OF COVID 19

- MARKET BY APPLICATION

- AIR POLLUTION CONTROL

- AUTOMOBILES

- TUNNELS

- PUBLIC TRANSPORTATION STATIONS

- UNDERGROUND GARAGES

- AIR TERMINALS

- OTHER APPLICATIONS

- MARKET BY INDUSTRY VERTICAL

- ENERGY AND POWER

- POWERTRAIN MANAGEMENT

- MINING

- COMMERCIAL AND RESIDENTIAL

- TRANSPORTATION

- AGRICULTURE

- MEDICAL AND PHARMA

- SEMICONDUCTOR

- OTHER INDUSTRIAL VERTICAL

- MARKET BY POLLUTANT

- GAS

- VOC

- DUST

- OTHER POLLUTANTS

- MARKET BY TYPE OF PRODUCT

- INDOOR

- AMBIENT

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPANY PROFILES

- DAIKIN INDUSTRIES LTD

- ELEX AG

- GENERAL ELECTRIC COMPANY

- MANN+HUMMEL INTERN GMBH

- THERMAX LTD

- MITSUBISHI HITACHI POWER SYSTEMS LTD

- HAMON GROUP

- GEA GROUP AKTIENGESELLSCHAFT

- BABCOCK WILCOX ENTERPRISES INC

- DONALDSON COMPANY INC

- JOHN WOOD GROUP PLC

- DUCON TECHNOLOGIES

- FUJAN LONGKING CO LTD

- ESCO INTERNATIONAL

- HORIBA LTD

TABLE LIST

TABLE 1: MARKET SNAPSHOT – AIR QUALITY CONTROL SYSTEMS

TABLE 2: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY INDUSTRY VERTICAL, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY INDUSTRY VERTICAL, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY POLLUTANT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY POLLUTANT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY TYPE OF PRODUCT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY TYPE OF PRODUCT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: ECONOMIC COST OF AIR POLLUTION FROM FOSSIL FUELS AS A COST OF GDP 2018

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: PORTER’S FIVE FORCE ANALYSIS

FIGURE 4: OPPORTUNITY MATRIX

FIGURE 5: VENDOR LANDSCAPE

FIGURE 6: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2019

FIGURE 7: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY AIR POLLUTION CONTROL, 2019-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY AUTOMOBILES, 2019-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY TUNNELS, 2019-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY PUBLIC TRANSPORTATION STATIONS, 2019-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY UNDERGROUND GARAGES, 2019-2028 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY AIR TERMINALS, 2019-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY OTHER APPLICATIONS, 2019-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 15: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY ENERGY AND POWER, 2019-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY POWERTRAIN MANAGEMENT, 2019-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY MINING, 2019-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY COMMERCIAL AND RESIDENTIAL, 2019-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY TRANSPORTATION, 2019-2028 (IN $ MILLION)

FIGURE 20: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY AGRICULTURE, 2019-2028 (IN $ MILLION)

FIGURE 21: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY MEDICAL AND PHARMA, 2019-2028 (IN $ MILLION)

FIGURE 22: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY SEMICONDUCTOR, 2019-2028 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY OTHER INDUSTRIAL VERTICAL, 2019-2028 (IN $ MILLION)

FIGURE 24: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, GROWTH POTENTIAL, BY POLLUTANT, IN 2019

FIGURE 25: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY GAS, 2019-2028 (IN $ MILLION)

FIGURE 26 ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY VOC, 2019-2028 (IN $ MILLION)

FIGURE 27 ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY DUST, 2019-2028 (IN $ MILLION)

FIGURE 28 ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY OTHER POLLUTANTS, 2019-2028 (IN $ MILLION)

FIGURE 29: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, GROWTH POTENTIAL, BY TYPE OF PRODUCT, IN 2019

FIGURE 30: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY INDOOR, 2019-2028 (IN $ MILLION)

FIGURE 31: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, BY AMBIENT, 2019-2028 (IN $ MILLION)

FIGURE 32: ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 33: CHINA AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: JAPAN AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: INDIA AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: SOUTH KOREA AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 37: INDONESIA AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 38: THAILAND AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 39: VIETNAM AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 40: AUSTRALIA & NEW ZEALAND AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 41: REST OF ASIA PACIFIC AIR QUALITY CONTROL SYSTEMS MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY APPLICATION

- AIR POLLUTION CONTROL

- AUTOMOBILES

- TUNNELS

- PUBLIC TRANSPORTATION STATIONS

- UNDERGROUND GARAGES

- AIR TERMINALS

- OTHER APPLICATIONS

- MARKET BY INDUSTRY VERTICAL

- ENERGY AND POWER

- POWERTRAIN MANAGEMENT

- MINING

- COMMERCIAL AND RESIDENTIAL

- TRANSPORTATION

- AGRICULTURE

- MEDICAL AND PHARMA

- SEMICONDUCTOR

- OTHER INDUSTRIAL VERTICAL

- MARKET BY POLLUTANT

- GAS

- VOC

- DUST

- OTHER POLLUTANTS

- MARKET BY TYPE OF PRODUCT

- INDOOR

- AMBIENT

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.