ASIA PACIFIC ADHESIVES MARKET FORECAST 2021-2028

Asia Pacific Adhesives Market by Technology (Water-based, Solvent-based, Hot-melt, Reactive & Others) by Product Type (Acrylic, Polyvinyl Acetate (Pva),, Polyurethane, Styrenic Block, Epoxy, Ethylene Vinyl Acetate (Eva), Other Product Types) by Application (Pressure Sensitive, Packaging, Construction, Furniture, Footwear, Automotive, Other Applications) and by Geography.

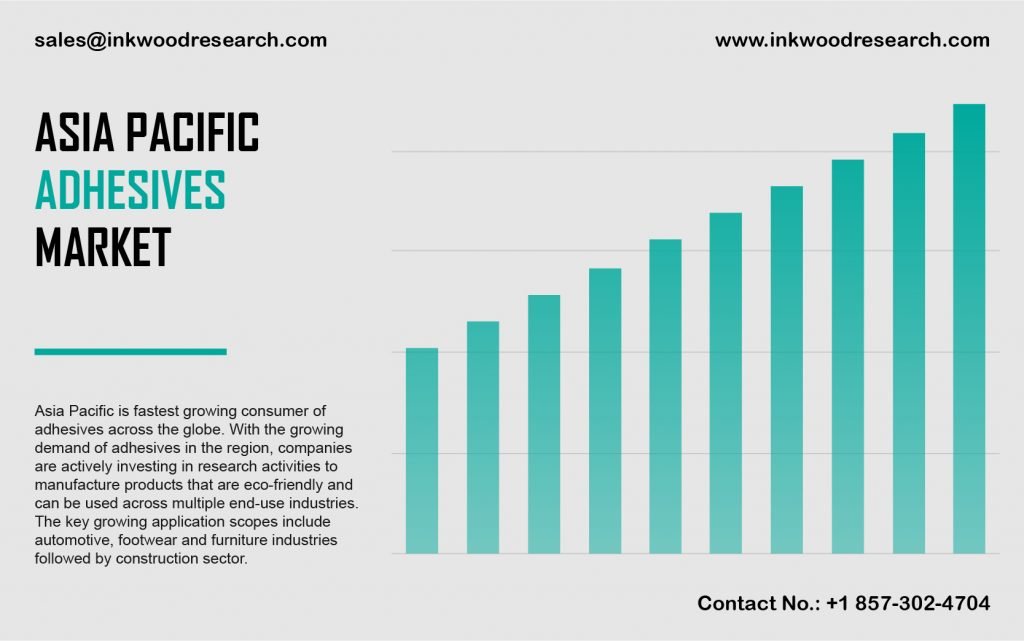

The Asia Pacific adhesives market is anticipated to grow with a CAGR of 6.93% in terms of revenue, and 5.61% in terms of volume, during the forecast period of 2021 to 2028. The region’s market growth is mainly driven by factors, such as, the increased demand for automotive adhesives, the active investments in research activities to manufacture eco-friendly products, and the growing demand for adhesives from aircraft manufacturing industries.

To learn more about this report, request a free sample copy

The Asia Pacific adhesives market growth is studied by assessing India, Indonesia, China, Japan, South Korea, Australia & New Zealand, Vietnam, Thailand, and the rest of the Asia Pacific. China has the second-largest packaging industry, worldwide, and is anticipated to observe consistent growth over the forecast period. The growth can be attributed to the increased need for packaged consumer goods across food segments, such as, snacks, and frozen foods, in addition to the rising customized packaging. The country also observes a growing trend, in terms of fast-moving consumer goods (FMCGs). The sector’s development is primarily fueled by the increased expenditure on healthier and premium products, especially by China’s middle-class customers.

Conversely, Japan’s packaging industry is anticipated to record positive growth, over the upcoming years, on account of the increasing popularity of flexible packaging. Presently, Japan also holds the highest per capita packaging materials consumption, globally. Moreover, the country has witnessed an increase in the sales and usage of motor vehicles, as well. Hence, these factors are set to drive market growth, during the forecast years.

Huntsman Corporation, headquartered in the United States, is an international manufacturer of differentiated inorganic and organic chemical products. Its products are used across various applications, such as aerospace, adhesives, automotive, construction products, durable and non-durable consumer products, power generation, personal care, hygiene, and medical, among others. The company operates across Asia, the Americas, Africa, the Middle East, and Europe.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- DEMAND FROM CONSTRUCTION INDUSTRY

- APPLICATIONS IN PACKAGING INDUSTRY

- DEMAND FOR MINIATURIZED AND LIGHTWEIGHT ELECTRONICS

- KEY RESTRAINTS

- STRICT REGULATIONS

- COMPLEXITIES IN DISASSEMBLY OF TWO ADHERED SUBSTRATES

- VOLATILITY IN RAW MATERIAL PRICES

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON ADHESIVES MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- MARKET BY TECHNOLOGY

- WATER-BASED

- SOLVENT-BASED

- HOT-MELT

- REACTIVE & OTHERS

- MARKET BY PRODUCT TYPE

- ACRYLIC

- POLYVINYL ACETATE (PVA)

- POLYURETHANE

- STYRENIC BLOCK

- EPOXY

- ETHYLENE VINYL ACETATE (EVA)

- OTHER PRODUCT TYPES

- MARKET BY APPLICATION

- PRESSURE SENSITIVE

- PACKAGING

- CONSTRUCTION

- FURNITURE

- FOOTWEAR

- AUTOMOTIVE

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- BUSINESS EXPANSION

- COMPANY PROFILES

- 3M COMPANY

- ARKEMA SA

- ASHLAND ASIA PACIFIC SPECIALTY CHEMICALS INC

- AVERY DENNISON CORPORATION

- BASF SE

- EASTMAN CHEMICAL COMPANY

- HENKEL AG & CO KGAA

- MOMENTIVE PERFORMANCE MATERIALS INC (MPM)

- BEARDOW & ADAMS (ADHESIVES) LIMITED

- HB FULLER COMPANY

- SIKA AG

- DOW CHEMICAL COMPANY

- UNISEAL INC

- RPM INTERNATIONAL INC

- HEXCEL CORPORATION

- HUNTSMAN CORPORATION

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ADHESIVES

TABLE 2: RAW MATERIALS – ADHESIVES

TABLE 3: ASIA PACIFIC ADHESIVES MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 4: ASIA PACIFIC ADHESIVES MARKET, BY TECHNOLOGY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 5: ASIA PACIFIC ADHESIVES MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 6: ASIA PACIFIC ADHESIVES MARKET, BY TECHNOLOGY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 7: ASIA PACIFIC ADHESIVES MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 8: ASIA PACIFIC ADHESIVES MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 9: ASIA PACIFIC ADHESIVES MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 10: ASIA PACIFIC ADHESIVES MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 11: ASIA PACIFIC ADHESIVES MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 12: ASIA PACIFIC ADHESIVES MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 13: ASIA PACIFIC ADHESIVES MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 14: ASIA PACIFIC ADHESIVES MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 15: ASIA PACIFIC ADHESIVES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 16: ASIA PACIFIC ADHESIVES MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 17: ASIA PACIFIC ADHESIVES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 18: ASIA PACIFIC ADHESIVES MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 19: LEADING PLAYERS OPERATING IN ASIA PACIFIC ADHESIVES MARKET

FIGURES LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: VALUE CHAIN ANALYSIS

FIGURE 6: ASIA PACIFIC ADHESIVES MARKET, GROWTH POTENTIAL, BY TECHNOLOGY, IN 2020

FIGURE 7: ASIA PACIFIC ADHESIVES MARKET, BY WATER-BASED, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA PACIFIC ADHESIVES MARKET, BY SOLVENT-BASED, 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA PACIFIC ADHESIVES MARKET, BY HOT-MELT, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC ADHESIVES MARKET, BY REACTIVE & OTHERS, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC ADHESIVES MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 12: ASIA PACIFIC ADHESIVES MARKET, BY ACRYLIC, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC ADHESIVES MARKET, BY POLYVINYL ACETATE (PVA), 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC ADHESIVES MARKET, BY POLYURETHANE, 2021-2028 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC ADHESIVES MARKET, BY STYRENIC BLOCK, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC ADHESIVES MARKET, BY EPOXY, 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC ADHESIVES MARKET, BY ETHYLENE VINYL ACETATE (EVA), 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA PACIFIC ADHESIVES MARKET, BY OTHER PRODUCT TYPES, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA PACIFIC ADHESIVES MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 20: ASIA PACIFIC ADHESIVES MARKET, BY PRESSURE SENSITIVE, 2021-2028 (IN $ MILLION)

FIGURE 21: ASIA PACIFIC ADHESIVES MARKET, BY PACKAGING, 2021-2028 (IN $ MILLION)

FIGURE 22: ASIA PACIFIC ADHESIVES MARKET, BY CONSTRUCTION, 2021-2028 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC ADHESIVES MARKET, BY FURNITURE, 2021-2028 (IN $ MILLION)

FIGURE 24: ASIA PACIFIC ADHESIVES MARKET, BY FOOTWEAR, 2021-2028 (IN $ MILLION)

FIGURE 25: ASIA PACIFIC ADHESIVES MARKET, BY AUTOMOTIVE, 2021-2028 (IN $ MILLION)

FIGURE 26: ASIA PACIFIC ADHESIVES MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 27: ASIA PACIFIC ADHESIVES MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 28: CHINA ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 29: JAPAN ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 30: INDIA ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 31: SOUTH KOREA ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: INDONESIA ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: THAILAND ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 34: VIETNAM ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: AUSTRALIA & NEW ZEALAND ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 36: REST OF ASIA PACIFIC ADHESIVES MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- ASIA PACIFIC

- MARKET BY TECHNOLOGY

- WATER-BASED

- SOLVENT-BASED

- HOT-MELT

- REACTIVE & OTHERS

- MARKET BY PRODUCT TYPE

- ACRYLIC

- POLYVINYL ACETATE (PVA)

- POLYURETHANE

- STYRENIC BLOCK

- EPOXY

- ETHYLENE VINYL ACETATE (EVA)

- OTHER PRODUCT TYPES

- MARKET BY APPLICATION

- PRESSURE SENSITIVE

- PACKAGING

- CONSTRUCTION

- FURNITURE

- FOOTWEAR

- AUTOMOTIVE

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.