GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET FORECAST 2022-2030

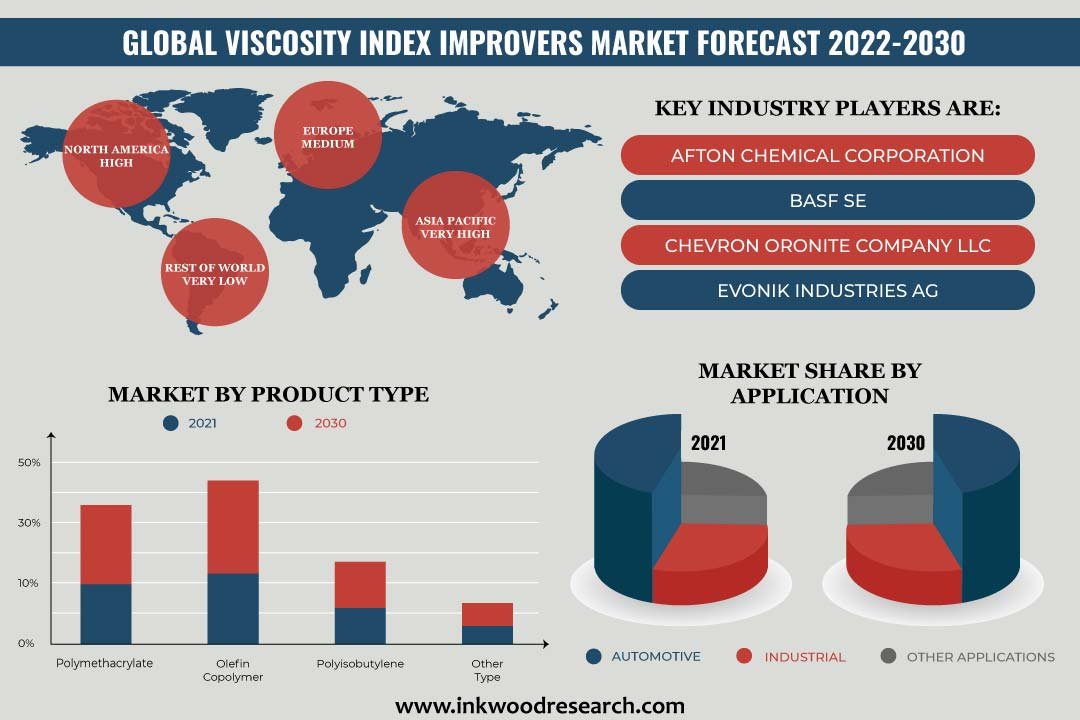

Global Viscosity Index (VI) Improvers Market by Type (Polymethacrylate, Olefin Copolymer, Polyisobutylene, Other Type) Market by Application (Automotive, Industrial, Other Applications) by Geography

In terms of revenue, the global viscosity index (VI) improvers market was valued at $xx million in 2021 and is expected to reach $5688.10 million by 2030, growing at a CAGR of 2.90% during the forecast period. The base year considered for the studied market is 2021, and the estimated years are from 2022 to 2030.

To know more about this report, request a free sample copy

Key market enablers propelling the global viscosity index (VI) improvers market:

- Demand for high-performance engine oils

- Engine oil, which is used to lubricate internal combustion engines, is the most commonly used lubricant for automotive. Viscosity index modifiers are extensively used in gear oils, automatic transmission fluids, hydraulic fluids, greases, multi-grade engine oils, and power steering fluids.

- Viscosity affects several important factors, including wear, energy consumption, and tolerance to contamination. The usage of viscosity index improvers enables the development of multi-grade engine oils that exhibits reduced temperature dependence.

- Thus, the growing need for high-performance engine oils is predicted to supplement the demand for viscosity index improvers.

- Increased consumption and production of lubricants

Key growth restraining factors:

- Longer oil change intervals due to advancements in lubricant technology

- Additional associated costs

- The production of viscosity index improvers involves the use of raw materials such as copolymers as well as monomers mined from petrochemical feedstock and refinery operations. However, unpredictability in crude oil prices limits the production of petrochemical feedstock, which consequently results in high raw material prices.

- Further, the technology involved in developing a new range of high-performance lubricants is becoming more complex with the rising intricacies of modern engines and machinery.

- Research and development investment further increases additional costs, negatively affecting the market over the upcoming years.

The report on the global viscosity index (VI) improvers market includes segmentation analysis on the basis of type and application.

Market by Type:

- Polymethacrylate

- Polymethacrylate is anticipated to be the fastest-growing type with a CAGR of 3.05%. Polymethacrylate (PMA) boosts the shear stability performance and viscosity index of industrial lubricants.

- Compared to other viscosity index improvers, PMAs possess improved low-temperature performance, thus prompting their extensive use in automotive engine oils, gear oils, automatic transmission fluids, hydraulic fluids, and industrial oils.

- Olefin Copolymer

- Polyisobutylene

- Other Types

Geographically, the global viscosity index (VI) improvers market has been segmented on the basis of four major regions, which includes:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific emerged as the dominating region, with its share estimated at 46.06% in 2021.

- The Asia-Pacific is presently a major hub in terms of manufacturing, led by China. Other Asian countries leading the production sector include Indonesia, Thailand, the Philippines, Vietnam, and Singapore.

- China is one of the largest lubricant markets across the region and is expected to continue a similar trend over the upcoming years. The country’s government is focusing on replacing obsolete equipment, set to increase the demand for improved and high-performance lubricants

- India is the second-largest lubricant consumer in the Asia-Pacific and the third-largest globally, following the United States and China. The Indian market comprises 20 organized players, including Castrol, Shell, Gulf Oil, Valvoline, Veedol, Total, etc. Besides, the public sector oil marketing companies dominate the country’s market. Over recent years, private players have also begun growing rapidly, owing to their expanding reach and highly innovative products and services.

- Rest of World: Latin America, the Middle East & Africa

Major players in the global viscosity index (VI) improvers market:

- Asian Oil Company

- BASF SE

- Lubrizol Corporation

- Chevron Oronite Company LLC

- Croda International PLC

Key strategies adopted by some of these companies:

Infineum signed a contract in August 2021 to acquire ISCA UK’s emulsifiers business unit. Chevron Oronite started commercial production at its Ningbo, China manufacturing plant in December 2020. Evonik and Umongo Petroleum (PTY) Ltd signed a distribution agreement in October 2021 in South Africa.

Key trends of the global viscosity index (VI) improvers market:

- The consumption of viscosity index improvers is directly proportional to the production of lubricants. Thus, the increasing need for lubricants is likely to drive the global viscosity index (VI) improvers market during the forecast period.

- A proactive outlook for the manufacturing sector in the Asia-Pacific is anticipated to boost the demand for viscosity index improvers.

- The fourth industrial revolution, commonly referred to as 4IR in the Middle East, is likely to hold great potential for the lubricants market in the manufacturing sector. This is likely to boost the demand for lubricant additives, including viscosity index improvers over the forecast period.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- DEMAND FOR HIGH-PERFORMANCE ENGINE OILS

- INCREASED CONSUMPTION AND PRODUCTION OF LUBRICANTS

- KEY RESTRAINTS

- LONGER OIL CHANGE INTERVALS DUE TO ADVANCEMENTS IN LUBRICANT TECHNOLOGY

- ADDITIONAL ASSOCIATED COSTS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON VISCOSITY INDEX (VI) IMPROVERS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY TYPE

- POLYMETHACRYLATE

- OLEFIN COPOLYMER

- POLYISOBUTYLENE

- OTHER TYPE

- MARKET BY APPLICATION

- AUTOMOTIVE

- PASSENGER VEHICLES

- HEAVY DUTY VEHICLES

- OTHER VEHICLES

- INDUSTRIAL

- OTHER APPLICATIONS

- AUTOMOTIVE

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AFTON CHEMICAL CORPORATION

- ASIAN OIL COMPANY

- BASF SE

- BPT CHEMICAL CO LTD

- BRB INTERNATIONAL BV

- CHEVRON ORONITE COMPANY LLC

- CRODA INTERNATIONAL PLC

- ENI SPA

- EVONIK INDUSTRIES AG

- EXXON MOBIL CORPORATION

- INFINEUM INTERNATIONAL LIMITED

- JILIN XINGYUN CHEMICAL CO LTD

- JINZHOU KANGTAI LUBRICANT ADDITIVES CO LTD

- LUBRIZOL CORPORATION

- SANYO CHEMICAL INDUSTRIES LTD

- SHANGHAI MINGLAN CHEMICAL CO LTD

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – VISCOSITY INDEX (VI) IMPROVERS

TABLE 2: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY TYPE, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 3: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY TYPE, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 4: GLOBAL POLYMETHACRYLATE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 5: GLOBAL POLYMETHACRYLATE MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 6: GLOBAL OLEFIN COPOLYMER MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 7: GLOBAL OLEFIN COPOLYMER MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 8: GLOBAL POLYISOBUTYLENE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 9: GLOBAL POLYISOBUTYLENE MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 10: GLOBAL OTHER TYPE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 11: GLOBAL OTHER TYPE MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 12: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 13: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY APPLICATION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 14: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 15: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 16: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY AUTOMOTIVE APPLICATION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 17: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY AUTOMOTIVE APPLICATION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 18: GLOBAL PASSENGER VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 19: GLOBAL PASSENGER VEHICLES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 20: GLOBAL HEAVY DUTY VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 21: GLOBAL HEAVY DUTY VEHICLES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 22: GLOBAL OTHER VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 23: GLOBAL OTHER VEHICLES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 24: GLOBAL INDUSTRIAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 25: GLOBAL INDUSTRIAL MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 26: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 27: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 28: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 29: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 30: NORTH AMERICA VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 31: NORTH AMERICA VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 32: LEADING PLAYERS OPERATING IN NORTH AMERICA VISCOSITY INDEX (VI) IMPROVERS MARKET

TABLE 33: EUROPE VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 34: EUROPE VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 35: LEADING PLAYERS OPERATING IN EUROPE VISCOSITY INDEX (VI) IMPROVERS MARKET

TABLE 36: ASIA-PACIFIC VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 37: ASIA-PACIFIC VISCOSITY INDEX (VI) IMPROVERS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 38: LEADING PLAYERS OPERATING IN ASIA-PACIFIC VISCOSITY INDEX (VI) IMPROVERS MARKET

TABLE 39: REST OF WORLD VISCOSITY INDEX (VI) IMPROVERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 40: REST OF WORLD VISCOSITY INDEX (VI) IMPROVERS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 41: LEADING PLAYERS OPERATING IN REST OF WORLD VISCOSITY INDEX (VI) IMPROVERS MARKET

TABLE 42: LIST OF MERGERS & ACQUISITIONS

TABLE 43: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 44: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 45: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2021

FIGURE 6: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY POLYMETHACRYLATE, 2022-2030 (IN $ MILLION)

FIGURE 7: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY OLEFIN COPOLYMER, 2022-2030 (IN $ MILLION)

FIGURE 8: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY POLYISOBUTYLENE, 2022-2030 (IN $ MILLION)

FIGURE 9: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY OTHER TYPE, 2022-2030 (IN $ MILLION)

FIGURE 10: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2021

FIGURE 11: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY AUTOMOTIVE, 2022-2030 (IN $ MILLION)

FIGURE 12: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, GROWTH POTENTIAL, BY AUTOMOTIVE APPLICATION, IN 2021

FIGURE 13: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY PASSENGER VEHICLES, 2022-2030 (IN $ MILLION)

FIGURE 14: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY HEAVY DUTY VEHICLES, 2022-2030 (IN $ MILLION)

FIGURE 15: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY OTHER VEHICLES, 2022-2030 (IN $ MILLION)

FIGURE 16: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY INDUSTRIAL, 2022-2030 (IN $ MILLION)

FIGURE 17: GLOBAL VISCOSITY INDEX (VI) IMPROVERS MARKET, BY OTHER APPLICATIONS, 2022-2030 (IN $ MILLION)

FIGURE 18: NORTH AMERICA VISCOSITY INDEX (VI) IMPROVERS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 19: UNITED STATES VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 20: CANADA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 21: EUROPE VISCOSITY INDEX (VI) IMPROVERS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 22: UNITED KINGDOM VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 23: GERMANY VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 24: FRANCE VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 25: ITALY VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 26: RUSSIA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 27: BELGIUM VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 28: POLAND VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 29: REST OF EUROPE VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 30: ASIA-PACIFIC VISCOSITY INDEX (VI) IMPROVERS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 31: CHINA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 32: JAPAN VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 33: INDIA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 34: SOUTH KOREA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 35: INDONESIA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 36: THAILAND VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 37: VIETNAM VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 38: AUSTRALIA & NEW ZEALAND VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 39: REST OF ASIA-PACIFIC VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 40: REST OF WORLD VISCOSITY INDEX (VI) IMPROVERS MARKET, REGIONAL OUTLOOK, 2021 & 2030 (IN %)

FIGURE 41: LATIN AMERICA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

FIGURE 42: MIDDLE EAST & AFRICA VISCOSITY INDEX (VI) IMPROVERS MARKET, 2022-2030 (IN $ MILLION)

- MARKET BY TYPE

- POLYMETHACRYLATE

- OLEFIN COPOLYMER

- POLYISOBUTYLENE

- OTHER TYPE

- MARKET BY APPLICATION

- AUTOMOTIVE

- PASSENGER VEHICLES

- HEAVY DUTY VEHICLES

- OTHER VEHICLES

- INDUSTRIAL

- OTHER APPLICATIONS

- AUTOMOTIVE

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

Frequently Asked Questions (FAQs):

Which end-use categories of viscosity index improvers are covered in the global viscosity index (VI) improvers market report?

Passenger vehicles, heavy duty vehicles, and industrial applications such as construction, mining, oil & gas, and agriculture are covered in the global viscosity index (VI) improvers market report.

Which are the key regional markets for viscosity index improvers?

Emerging economies in the Asia-Pacific are the most dynamic regional markets for viscosity index improvers.

Does this report cover the impact of COVID-19 on the global viscosity index (VI) improvers market?

Yes, the market study has also analyzed the impact of COVID-19 on the global viscosity index (VI) improvers market qualitatively as well as quantitatively.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.