NORTH AMERICA FEED ADDITIVES MARKET FORECAST 2021-2028

North America Market by Additive ( Antibiotics, Vitamins, Antioxidants, Amino Acids, Enzymes, Mycotoxin Detoxifiers, Prebiotics, Probiotics, Flavors and Sweeteners, Pigments, Binders, Minerals, Acidifiers ) Market by Animal Type ( Ruminants, Poultry, Swine, Other Animal Type ) by Geography.

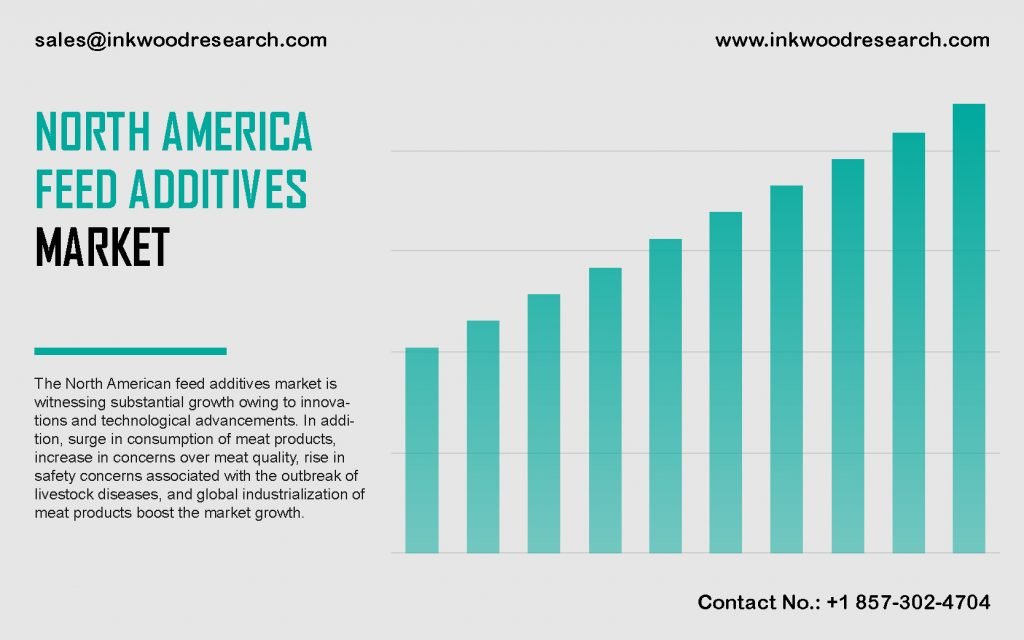

The North America feed additives market is expected to grow with a CAGR of 5.10% in terms of revenue, and 4.27% in terms of volume, over the forecast years of 2021 to 2028. The region’s market growth is majorly accredited to key factors, including, innovations and technological advancements, the rising consumption of meat as a source of protein, the growing livestock production, and the increased preference for processed food.

To learn more about this report, request a free sample copy

The North America feed additives market growth analysis includes the assessment of the United States and Canada. As per the report released by the Food and Drug Administration (FDA), nearly 80% of antibiotics used in the United States are fed to farm animals. Moreover, according to the Veterinary Feed Directive (VFD) regulations, the use of VFD drugs in farm animal feed must be authorized by a licensed veterinarian. However, the ban on using antibiotics, not including therapeutic uses, across the United States, inhibits the country’s market growth.

On the other hand, the Canadian Animal Health Institute controls Canada’s feed regulations, under schedule V or IV. Besides, the country regulates livestock feed under a single ‘ingredient feed.’ Aligning with the regulation, pre-market approval is mandatory, in order to assess complete efficacy and safety. As a result, this aspect has also influenced feed products manufactured and introduced into the Canadian market. Hence, these factors are set to propel the feed additives market growth in North America, during the forecast period.

Dupont De Nemours Inc, headquartered in the United States, is a diversified chemical company providing products and services for several markets, such as, nutrition, agriculture, safety and protection, and electronics and communications. The company is operational across North America, Europe, Latin America, the Middle East & Africa, and the Asia Pacific.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- RISE IN INDUSTRIAL LIVESTOCK PRODUCTION

- HIGH DEMAND FOR COMPOUND FEED

- RISING DEMAND FOR A PROTEIN-RICH DIET

- GROWING DEMAND FOR PHOSPHATES IN ANIMAL FEEDS

- KEY RESTRAINTS

- STRUGGLE FOR RAW MATERIAL WITH OTHER INDUSTRIES

- STRINGENT REGULATIONS

- RISING DEMAND FOR PLANT PROTEINS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON FEED ADDITIVES MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY ADDITIVE (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- ANTIBIOTICS

- TETRACYCLINES

- PENICILLINS

- OTHER ANTIBIOTICS

- VITAMINS

- VITAMIN A

- VITAMIN B

- VITAMIN C

- VITAMIN E

- OTHER VITAMINS

- ANTIOXIDANTS

- BHA

- BHT

- ETHOXYQUIN

- OTHER ANTIOXIDANTS

- AMINO ACIDS

- TRYPTOPHAN

- LYSINE

- METHIONINE

- THREONINE

- OTHER AMINO ACIDS

- ENZYMES

- CARBOHYDRASES

- PHYTASES

- OTHER ENZYMES

- MYCOTOXIN DETOXIFIERS

- BINDERS

- BIOTRANSFORMERS

- PREBIOTICS

- INULIN

- FRUCTO OLIGOSACCHARIDES

- GALACTO OLIGOSACCHARIDE

- OTHER PREBIOTICS

- PROBIOTICS

- LACTOBACILLI

- BIFIDOBACTERIA

- OTHER PROBIOTICS

- FLAVORS AND SWEETENERS

- FLAVORS

- SWEETENERS

- PIGMENTS

- CAROTENOIDS

- CURCUMIN & SPIRULINA

- BINDERS

- NATURAL BINDERS

- SYNTHETIC BINDERS

- MINERALS

- MICRO MINERALS

- MACRO MINERALS

- ACIDIFIERS

- LACTIC ACID

- PROPIONIC ACID

- FUMARIC ACID

- OTHER ACIDIFIERS

- ANTIBIOTICS

- MARKET BY ANIMAL TYPE (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- RUMINANTS

- POULTRY

- SWINE

- OTHER ANIMAL TYPE

- GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS, CONTRACTS/AGREEMENTS & COLLABORATIONS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- BLUESTAR ADISSEO CO LTD

- BASF SE

- DUPONT DE NEMOURS INC (DANISCO ANIMAL NUTRITION)

- ARCHER DANIELS MIDLAND COMPANY

- CARGILL INC

- KEMIN INDUSTRIES INC

- SHV HOLDINGS NV

- NOVOZYMES A/S

- SUMIMOTO CORPORATION

- EVONIK INDUSTRIES

- PHIBRO ANIMAL HEALTH CORP

- LALLEMAND LLC

- ALLTECH INC

- ELANCO ANIMAL HEALTH

- ALPHIOS BELGIUM SA

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – FEED ADDITIVES

TABLE 2: NORTH AMERICA FEED ADDITIVES MARKET, BY ADDITIVE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: NORTH AMERICA FEED ADDITIVES MARKET, BY ADDITIVE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA FEED ADDITIVES MARKET, BY ADDITIVE, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 5: NORTH AMERICA FEED ADDITIVES MARKET, BY ADDITIVE, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 6: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIBIOTICS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIBIOTICS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIBIOTICS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 9: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIBIOTICS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 10: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMINS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMINS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 12: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMINS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 13: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMINS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 14: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIOXIDANTS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIOXIDANTS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 16: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIOXIDANTS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 17: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIOXIDANTS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 18: NORTH AMERICA FEED ADDITIVES MARKET, BY AMINO ACIDS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 19: NORTH AMERICA FEED ADDITIVES MARKET, BY AMINO ACIDS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 20: NORTH AMERICA FEED ADDITIVES MARKET, BY AMINO ACIDS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 21: NORTH AMERICA FEED ADDITIVES MARKET, BY AMINO ACIDS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 22: NORTH AMERICA FEED ADDITIVES MARKET, BY ENZYMES, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 23: NORTH AMERICA FEED ADDITIVES MARKET, BY ENZYMES, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 24: NORTH AMERICA FEED ADDITIVES MARKET, BY ENZYMES, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 25: NORTH AMERICA FEED ADDITIVES MARKET, BY ENZYMES, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 26: NORTH AMERICA FEED ADDITIVES MARKET, BY MYCOTOXIN DETOXIFIERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 27: NORTH AMERICA FEED ADDITIVES MARKET, BY MYCOTOXIN DETOXIFIERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 28: NORTH AMERICA FEED ADDITIVES MARKET, BY MYCOTOXIN DETOXIFIERS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 29: NORTH AMERICA FEED ADDITIVES MARKET, BY MYCOTOXIN DETOXIFIERS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 30: NORTH AMERICA FEED ADDITIVES MARKET, BY PREBIOTICS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 31: NORTH AMERICA FEED ADDITIVES MARKET, BY PREBIOTICS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 32: NORTH AMERICA FEED ADDITIVES MARKET, BY PREBIOTICS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 33: NORTH AMERICA FEED ADDITIVES MARKET, BY PREBIOTICS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 34: NORTH AMERICA FEED ADDITIVES MARKET, BY PROBIOTICS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 35: NORTH AMERICA FEED ADDITIVES MARKET, BY PROBIOTICS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 36: NORTH AMERICA FEED ADDITIVES MARKET, BY PROBIOTICS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 37: NORTH AMERICA FEED ADDITIVES MARKET, BY PROBIOTICS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 38: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS AND SWEETENERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 39: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS AND SWEETENERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 40: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS AND SWEETENERS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 41: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS AND SWEETENERS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 42: NORTH AMERICA FEED ADDITIVES MARKET, BY PIGMENTS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 43: NORTH AMERICA FEED ADDITIVES MARKET, BY PIGMENTS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 44: NORTH AMERICA FEED ADDITIVES MARKET, BY PIGMENTS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 45: NORTH AMERICA FEED ADDITIVES MARKET, BY PIGMENTS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 46: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 47: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 48: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 49: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 50: NORTH AMERICA FEED ADDITIVES MARKET, BY MINERALS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 51: NORTH AMERICA FEED ADDITIVES MARKET, BY MINERALS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 52: NORTH AMERICA FEED ADDITIVES MARKET, BY MINERALS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 53: NORTH AMERICA FEED ADDITIVES MARKET, BY MINERALS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 54: NORTH AMERICA FEED ADDITIVES MARKET, BY ACIDIFIERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 55: NORTH AMERICA FEED ADDITIVES MARKET, BY ACIDIFIERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 56: NORTH AMERICA FEED ADDITIVES MARKET, BY ACIDIFIERS, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 57: NORTH AMERICA FEED ADDITIVES MARKET, BY ACIDIFIERS, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 58: NORTH AMERICA FEED ADDITIVES MARKET, BY ANIMAL TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 59: NORTH AMERICA FEED ADDITIVES MARKET, BY ANIMAL TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 60: NORTH AMERICA FEED ADDITIVES MARKET, BY ANIMAL TYPE, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 61: NORTH AMERICA FEED ADDITIVES MARKET, BY ANIMAL TYPE, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 62: NORTH AMERICA FEED ADDITIVES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 63: NORTH AMERICA FEED ADDITIVES MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 64: NORTH AMERICA FEED ADDITIVES MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN THOUSAND METRIC TONS)

TABLE 65: NORTH AMERICA FEED ADDITIVES MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN THOUSAND METRIC TONS)

TABLE 66: LEADING PLAYERS OPERATING IN NORTH AMERICA FEED ADDITIVES MARKET

TABLE 67: LIST OF MERGERS & ACQUISITIONS

TABLE 68: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 69: LIST OF PARTNERSHIPS, CONTRACTS/AGREEMENTS & COLLABORATIONS

TABLE 70: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ADDITIVE, IN 2020

FIGURE 6: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 7: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ANTIBIOTICS, IN 2020

FIGURE 8: NORTH AMERICA FEED ADDITIVES MARKET, BY TETRACYCLINES, 2021-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA FEED ADDITIVES MARKET, BY PENICILLINS, 2021-2028 (IN $ MILLION)

FIGURE 10: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER ADDITIVES, 2021-2028 (IN $ MILLION)

FIGURE 11: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMINS, 2021-2028 (IN $ MILLION)

FIGURE 12: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY VITAMINS, IN 2020

FIGURE 13: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMIN A, 2021-2028 (IN $ MILLION)

FIGURE 14: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMIN B, 2021-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMIN C, 2021-2028 (IN $ MILLION)

FIGURE 16: NORTH AMERICA FEED ADDITIVES MARKET, BY VITAMIN E, 2021-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER VITAMINS, 2021-2028 (IN $ MILLION)

FIGURE 18: NORTH AMERICA FEED ADDITIVES MARKET, BY ANTIOXIDANTS, 2021-2028 (IN $ MILLION)

FIGURE 19: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ANTIOXIDANTS, IN 2020

FIGURE 20: NORTH AMERICA FEED ADDITIVES MARKET, BY BHA, 2021-2028 (IN $ MILLION)

FIGURE 21: NORTH AMERICA FEED ADDITIVES MARKET, BY BHT, 2021-2028 (IN $ MILLION)

FIGURE 22: NORTH AMERICA FEED ADDITIVES MARKET, BY ETHOXYQUIN, 2021-2028 (IN $ MILLION)

FIGURE 23: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER ANTIOXIDANTS, 2021-2028 (IN $ MILLION)

FIGURE 24: NORTH AMERICA FEED ADDITIVES MARKET, BY AMINO ACIDS, 2021-2028 (IN $ MILLION)

FIGURE 25: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY AMINO ACIDS, IN 2020

FIGURE 26: NORTH AMERICA FEED ADDITIVES MARKET, BY TRYPTOPHAN, 2021-2028 (IN $ MILLION)

FIGURE 27: NORTH AMERICA FEED ADDITIVES MARKET, BY LYSINE, 2021-2028 (IN $ MILLION)

FIGURE 28: NORTH AMERICA FEED ADDITIVES MARKET, BY METHIONINE, 2021-2028 (IN $ MILLION)

FIGURE 29: NORTH AMERICA FEED ADDITIVES MARKET, BY THREONINE, 2021-2028 (IN $ MILLION)

FIGURE 30: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER AMINO ACIDS, 2021-2028 (IN $ MILLION)

FIGURE 31: NORTH AMERICA FEED ADDITIVES MARKET, BY ENZYMES, 2021-2028 (IN $ MILLION)

FIGURE 32: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ENZYMES, IN 2020

FIGURE 33: NORTH AMERICA FEED ADDITIVES MARKET, BY CARBOHYDRASES, 2021-2028 (IN $ MILLION)

FIGURE 34: NORTH AMERICA FEED ADDITIVES MARKET, BY PHYTASES, 2021-2028 (IN $ MILLION)

FIGURE 35: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER ENZYMES, 2021-2028 (IN $ MILLION)

FIGURE 36: NORTH AMERICA FEED ADDITIVES MARKET, BY MYCOTOXIN DETOXIFIERS, 2021-2028 (IN $ MILLION)

FIGURE 37: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY MYCOTOXIN DETOXIFIERS, IN 2020

FIGURE 38: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, 2021-2028 (IN $ MILLION)

FIGURE 39: NORTH AMERICA FEED ADDITIVES MARKET, BY BIOTRANSFORMERS, 2021-2028 (IN $ MILLION)

FIGURE 40: NORTH AMERICA FEED ADDITIVES MARKET, BY PREBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 41: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY PREBIOTICS, IN 2020

FIGURE 42: NORTH AMERICA FEED ADDITIVES MARKET, BY INULIN, 2021-2028 (IN $ MILLION)

FIGURE 43: NORTH AMERICA FEED ADDITIVES MARKET, BY FRUCTO OLIGOSACCHARIDES, 2021-2028 (IN $ MILLION)

FIGURE 44: NORTH AMERICA FEED ADDITIVES MARKET, BY GALACTO OLIGOSACCHARIDE, 2021-2028 (IN $ MILLION)

FIGURE 45: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER PREBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 46: NORTH AMERICA FEED ADDITIVES MARKET, BY PROBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 47: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY PROBIOTICS, IN 2020

FIGURE 48: NORTH AMERICA FEED ADDITIVES MARKET, BY LACTOBACILLI, 2021-2028 (IN $ MILLION)

FIGURE 49: NORTH AMERICA FEED ADDITIVES MARKET, BY BIFIDOBACTERIA, 2021-2028 (IN $ MILLION)

FIGURE 50: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER PROBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 51: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS AND SWEETENERS, 2021-2028 (IN $ MILLION)

FIGURE 52: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY FLAVORS AND SWEETENERS, IN 2020

FIGURE 53: NORTH AMERICA FEED ADDITIVES MARKET, BY FLAVORS, 2021-2028 (IN $ MILLION)

FIGURE 54: NORTH AMERICA FEED ADDITIVES MARKET, BY SWEETENERS, 2021-2028 (IN $ MILLION)

FIGURE 55: NORTH AMERICA FEED ADDITIVES MARKET, BY PIGMENTS, 2021-2028 (IN $ MILLION)

FIGURE 56: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY PIGMENTS, IN 2020

FIGURE 57: NORTH AMERICA FEED ADDITIVES MARKET, BY CAROTENOIDS, 2021-2028 (IN $ MILLION)

FIGURE 58: NORTH AMERICA FEED ADDITIVES MARKET, BY CURCUMIN & SPIRULINA, 2021-2028 (IN $ MILLION)

FIGURE 59: NORTH AMERICA FEED ADDITIVES MARKET, BY BINDERS, 2021-2028 (IN $ MILLION)

FIGURE 60: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY BINDERS, IN 2020

FIGURE 61: NORTH AMERICA FEED ADDITIVES MARKET, BY NATURAL BINDERS, 2021-2028 (IN $ MILLION)

FIGURE 62: NORTH AMERICA FEED ADDITIVES MARKET, BY SYNTHETIC BINDERS, 2021-2028 (IN $ MILLION)

FIGURE 63: NORTH AMERICA FEED ADDITIVES MARKET, BY MINERALS, 2021-2028 (IN $ MILLION)

FIGURE 64: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY MINERALS, IN 2020

FIGURE 65: NORTH AMERICA FEED ADDITIVES MARKET, BY MICRO MINERALS, 2021-2028 (IN $ MILLION)

FIGURE 66: NORTH AMERICA FEED ADDITIVES MARKET, BY MACRO MINERALS, 2021-2028 (IN $ MILLION)

FIGURE 67: NORTH AMERICA FEED ADDITIVES MARKET, BY ACIDIFIERS, 2021-2028 (IN $ MILLION)

FIGURE 68: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ACIDIFIERS, IN 2020

FIGURE 69: NORTH AMERICA FEED ADDITIVES MARKET, BY LACTIC ACID, 2021-2028 (IN $ MILLION)

FIGURE 70: NORTH AMERICA FEED ADDITIVES MARKET, BY PROPIONIC ACID, 2021-2028 (IN $ MILLION)

FIGURE 71: NORTH AMERICA FEED ADDITIVES MARKET, BY FUMARIC ACID, 2021-2028 (IN $ MILLION)

FIGURE 72: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER ACIDIFIERS, 2021-2028 (IN $ MILLION)

FIGURE 73: NORTH AMERICA FEED ADDITIVES MARKET, GROWTH POTENTIAL, BY ANIMAL TYPE, IN 2020

FIGURE 74: NORTH AMERICA FEED ADDITIVES MARKET, BY RUMINANTS, 2021-2028 (IN $ MILLION)

FIGURE 75: NORTH AMERICA FEED ADDITIVES MARKET, BY POULTRY, 2021-2028 (IN $ MILLION)

FIGURE 76: NORTH AMERICA FEED ADDITIVES MARKET, BY SWINE, 2021-2028 (IN $ MILLION)

FIGURE 77: NORTH AMERICA FEED ADDITIVES MARKET, BY OTHER ANIMAL TYPE, 2021-2028 (IN $ MILLION)

FIGURE 78: NORTH AMERICA FEED ADDITIVES MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 79: UNITED STATES FEED ADDITIVES MARKET, 2021-2028 (IN $ MILLION)

FIGURE 80: CANADA FEED ADDITIVES MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY ADDITIVE (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- ANTIBIOTICS

- TETRACYCLINES

- PENICILLINS

- OTHER ANTIBIOTICS

- VITAMINS

- VITAMIN A

- VITAMIN B

- VITAMIN C

- VITAMIN E

- OTHER VITAMINS

- ANTIOXIDANTS

- BHA

- BHT

- ETHOXYQUIN

- OTHER ANTIOXIDANTS

- AMINO ACIDS

- TRYPTOPHAN

- LYSINE

- METHIONINE

- THREONINE

- OTHER AMINO ACIDS

- ENZYMES

- CARBOHYDRASES

- PHYTASES

- OTHER ENZYMES

- MYCOTOXIN DETOXIFIERS

- BINDERS

- BIOTRANSFORMERS

- PREBIOTICS

- INULIN

- FRUCTO OLIGOSACCHARIDES

- GALACTO OLIGOSACCHARIDE

- OTHER PREBIOTICS

- PROBIOTICS

- LACTOBACILLI

- BIFIDOBACTERIA

- OTHER PROBIOTICS

- FLAVORS AND SWEETENERS

- FLAVORS

- SWEETENERS

- PIGMENTS

- CAROTENOIDS

- CURCUMIN & SPIRULINA

- BINDERS

- NATURAL BINDERS

- SYNTHETIC BINDERS

- MINERALS

- MICRO MINERALS

- MACRO MINERALS

- ACIDIFIERS

- LACTIC ACID

- PROPIONIC ACID

- FUMARIC ACID

- OTHER ACIDIFIERS

- ANTIBIOTICS

- MARKET BY ANIMAL TYPE (IN TERMS OF REVENUE: $ MILLION & IN TERMS OF VOLUME: THOUSAND METRIC TONS)

- RUMINANTS

- POULTRY

- SWINE

- OTHER ANIMAL TYPE

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.